Generalized Anxiety Disorder - Disease Overview:

Generalized Anxiety Disorder (GAD) is a chronic mental health condition characterized by excessive, uncontrollable worry and anxiety about a variety of everyday events or activities. Unlike normal anxiety, which is temporary and situation-specific, the concern in GAD is persistent, often lasting for six months or more, and occurs most days, even when there is little or no reason to worry.

Generalized Anxiety Disorder - Key Features of GAD:

Excessive anxiety about work, health, family, or routine life circumstances.

Difficult to control the worry.

Associated with physical symptoms, such as:

Restlessness or feeling on edge

Fatigue

Difficulty concentrating

Irritability

Muscle tension

Sleep disturbances

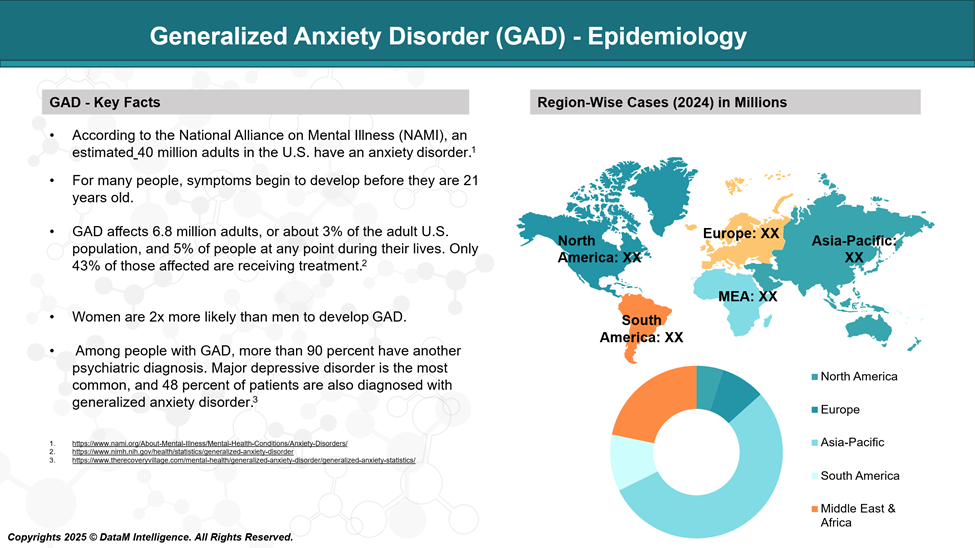

Generalized Anxiety Disorder - Epidemiology Analysis (Current & Forecast)

Global Prevalence

- Generalized Anxiety Disorder is one of the most common anxiety disorders globally, with lifetime prevalence estimates ranging from 3% to 6%. The 12-month prevalence globally is generally lower, around 1% to 3%, but it varies across regions and population demographics.

- According to the World Health Organization's World Mental Health Survey Initiative, the 12-month prevalence of GAD varies from 0.1% in Nigeria to over 6% in the United States.

- Developed countries tend to report higher rates of GAD, likely due to greater awareness, diagnostic tools, and cultural differences in reporting psychological symptoms.

Prevalence in the United States

The National Comorbidity Survey Replication (NCS-R) provides the most comprehensive data on psychiatric disorders in the U.S.:

- Lifetime prevalence: ~5.7% of U.S. adults will experience GAD at some point.

- 12-month prevalence: ~3.1% of adults suffer from GAD in any given year.

Gender Differences

GAD disproportionately affects women, who are about twice as likely to be diagnosed as men.

- This may be due to hormonal factors, societal pressures, and greater willingness among women to seek help or report symptoms.

- The gender disparity is consistent across countries and cultures.

Age of Onset

The median age of onset for GAD is 31 years, though it can begin in adolescence or even childhood.

- Early onset is associated with greater severity, longer duration, and higher comorbidity.

- Onset tends to be gradual, with many individuals experiencing subclinical symptoms for years before meeting full diagnostic criteria.

Comorbidities

GAD frequently co-occurs with other mental health conditions:

- Major Depressive Disorder (MDD) – up to 70% of individuals with GAD may also meet criteria for depression.

- Panic Disorder, social anxiety disorder, and PTSD are also commonly comorbid.

- High rates of substance use disorders are reported among GAD patients, possibly as a maladaptive coping mechanism.

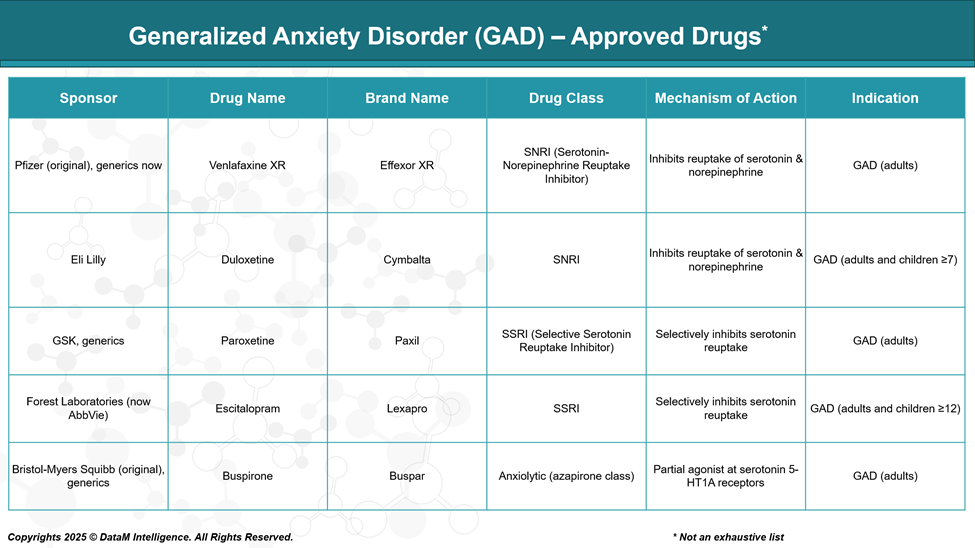

Generalized Anxiety Disorder Approved Drugs - Sales & Forecast

GAD is treated primarily with antidepressants (SSRIs and SNRIs) and the anxiolytic buspirone. These medications are selected based on their efficacy, safety, tolerability, and long-term outcomes in managing excessive and persistent worry, the hallmark of GAD.

Duloxetine (Cymbalta)

- Class: SNRI (Serotonin-Norepinephrine Reuptake Inhibitor)

- Mechanism: Inhibits the reuptake of both serotonin (5-HT) and norepinephrine (NE), increasing their availability in the synaptic cleft.

- FDA Approval: For adults and children (≥7 years) with GAD

- Dosing: 30–120 mg/day (once daily)

- Sponsor: Eli Lilly

- Benefits:

- Also approved for chronic pain, making it suitable for patients with comorbid pain disorders.

- Fast onset and well-tolerated.

- Risks: Nausea, dry mouth, increased blood pressure, withdrawal symptoms on discontinuation.

Venlafaxine XR (Effexor XR)

- Class: SNRI

- Mechanism: Blocks serotonin reuptake at low doses; blocks norepinephrine reuptake at higher doses.

- FDA Approval: GAD in adults

- Dosing: 75–225 mg/day

- Sponsor: Pfizer (original), now also available as a generic

- Benefits:

- Effective for GAD, panic disorder, and social anxiety.

- Risks:

- Notable discontinuation syndrome (tapering required).

- Elevated blood pressure at higher doses.

- Side effects: insomnia, sweating, nausea.

Paroxetine (Paxil)

- Class: SSRI

- Mechanism: Selectively inhibits reuptake of serotonin.

- FDA Approval: GAD in adults

- Dosing: 20–60 mg/day

- Sponsor: GSK, now generic

- Benefits:

- One of the first SSRIs approved for GAD.

- Sedating profile may help patients with insomnia.

- Risks:

- Anticholinergic side effects (dry mouth, constipation).

- Sexual dysfunction, weight gain.

- Significant withdrawal symptoms.

Escitalopram (Lexapro)

- Class: SSRI

- Mechanism: Selective serotonin reuptake inhibition.

- FDA Approval: For adults and adolescents (≥12 years) with GAD

- Dosing: 10–20 mg/day

- Sponsor: AbbVie

- Benefits:

- Highly selective; lower side effect profile than other SSRIs.

- Also used for depression and other anxiety disorders.

- Risks:

- Sexual side effects, possible QT prolongation at higher doses.

Buspirone (BuSpar)

- Class: Anxiolytic (azapirone class)

- Mechanism: Partial agonist at 5-HT1A receptors; has dopaminergic effects as well.

- FDA Approval: GAD in adults

- Dosing: 15–60 mg/day in divided doses

- Sponsor: Originally Bristol-Myers Squibb, now available generically

- Benefits:

- Non-sedating, non-addictive alternative to benzodiazepines.

- No withdrawal symptoms.

- Risks:

- Delayed onset (2–4 weeks), dizziness, nausea, headache.

- Less effective in patients previously treated with benzodiazepines.

Important Considerations for All Approved Drugs:

- All medications require several weeks for full therapeutic effects.

- May cause an initial increase in anxiety or agitation.

- Must be tapered to avoid withdrawal effects.

- Long-term safety is generally established, but careful monitoring is needed for:

- Suicidality (especially in young adults)

- Sexual dysfunction

- Weight changes

- Sleep disturbances

Frequently Used Off-Label Drugs for GAD (Not FDA-Approved for GAD)

Drug Name | Class | Use Case |

Sertraline (Zoloft) | SSRI | Often used off-label; strong evidence base |

Fluoxetine (Prozac) | SSRI | Used off-label; preferred for comorbid depression |

Pregabalin (Lyrica) | GABA analog | FDA-approved in Europe for GAD; not approved in U.S. |

Hydroxyzine | Antihistamine | Used for acute anxiety; non-addictive and sedating |

Benzodiazepines | Sedative-hypnotic | Effective for short-term use only; risk of dependence |

Strategic Insights & Clinical Use

- SSRIs and SNRIs dominate the first-line treatment landscape for GAD.

- Buspirone remains underused despite its unique safety profile.

- Generic availability of these agents limits commercial opportunity for branded products.

- Future drugs must show:

- Faster onset

- Improved tolerability

- Non-sedating, non-habit-forming profiles

- Efficacy in treatment-resistant or comorbid cases

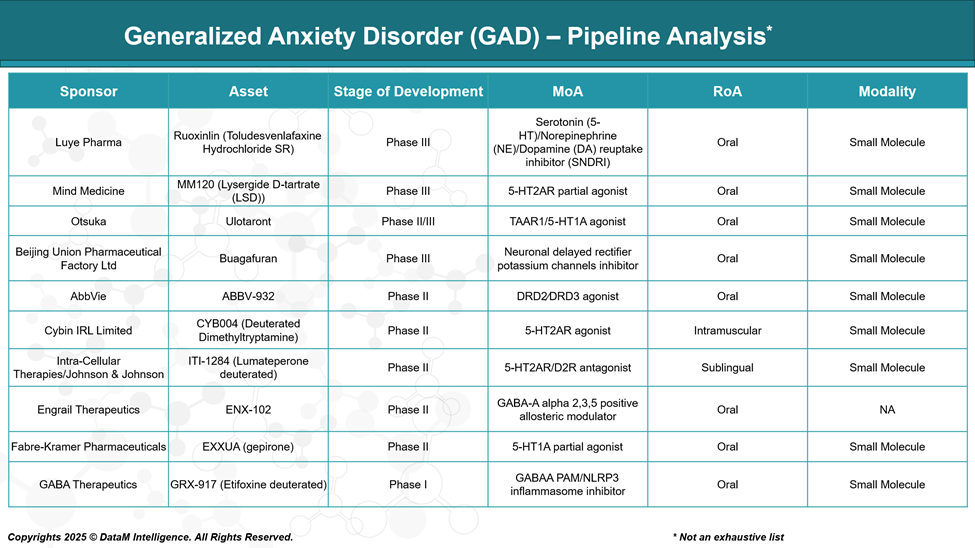

Pipeline Analysis and Expected Approval Timelines

The diabetic retinopathy (DR) pipeline is evolving beyond traditional anti-VEGF therapies, with innovations targeting multiple pathways, including Ang-Tie2 and inflammation. Emerging treatments focus on extended durability, non-invasive delivery, and early intervention, reflecting strong momentum in addressing unmet needs across all DR stages.

Ruoxinlin (Toludesvenlafaxine SR)

Sponsor: Luye Pharma

Stage: Phase III

MoA: Serotonin (5-HT)/Norepinephrine (NE)/Dopamine (DA) reuptake inhibitor (SNDRI)

RoA: Oral

Modality: Small Molecule

Profile:

Ruoxinlin is a next-generation antidepressant that targets all three major monoamine systems, offering potential advantages in treating patients with partial or non-response to SSRIs/SNRIs. By enhancing dopamine activity as well, it may also address anhedonia and fatigue, which are often associated with GAD.Differentiator: First-in-class SNDRI in the GAD pipeline; broader spectrum neurotransmitter engagement.

Potential Limitation: Requires monitoring for side effects such as insomnia, agitation, or CV effects related to dopaminergic action.

MM120 (Lysergide D-tartrate / LSD)

Sponsor: Mind Medicine, Inc.

Stage: Phase III

MoA: 5-HT2AR partial agonist

RoA: Oral

Modality: Small Molecule

Profile:

MM120 is a psychedelic compound designed for intermittent use in treatment-resistant GAD. Early trials have shown rapid and sustained anxiety reduction after a single dose, suggesting major therapeutic shifts.Differentiator: Single-dose, durable benefit; addresses refractory anxiety with transformative neuroplastic effects.

Potential Limitation: Requires psychotherapeutic support, faces regulatory complexity, and may raise safety concerns in vulnerable populations.

Ulotaront (SEP-363856)

Sponsor: Otsuka Pharmaceutical

Stage: Phase II/III

MoA: TAAR1/5-HT1A agonist

RoA: Oral

Modality: Small Molecule

Profile:

Ulotaront offers a non-D2 receptor mechanism, originally developed for schizophrenia. It exhibits broad-spectrum CNS activity, showing promise in anxiety due to its dopamine-sparing, serotonergic modulation.Differentiator: Reduced risk of extrapyramidal side effects, weight gain, or sexual dysfunction.

Potential Limitation: Must prove efficacy distinct from antipsychotic indications and maintain safety in long-term use.

Buagafuran

Sponsor: Beijing Union Pharmaceutical Factory Ltd

Stage: Phase III

MoA: Neuronal delayed rectifier potassium channels inhibitor

RoA: Oral

Modality: Small Molecule

Profile:

Buagafuran acts through a novel non-GABAergic mechanism, offering anxiolytic effects without sedation or cognitive blunting. It's a compelling candidate for patients needing long-term, non-habit-forming treatment.Differentiator: Unique MoA; no benzodiazepine-like sedation or dependence.

Potential Limitation: Needs robust global trials for acceptance beyond China; limited real-world exposure.

ABBV-932

Sponsor: AbbVie

Stage: Phase II

MoA: Dopamine D2/D3 receptor agonist

RoA: Oral

Modality: Small Molecule

Profile:

This asset is pursuing a dopaminergic approach, which is rare in anxiety pipelines. It may improve motivation, drive, and emotional flattening in certain GAD subtypes, especially those overlapping with depression.Differentiator: Addresses motivational and reward deficits often seen in chronic anxiety or comorbid depression.

Potential Limitation: Risk of side effects like agitation, impulsivity, or insomnia.

Competitive Landscape and Market Positioning

Here is the Strategic Competitive Landscape and Market Positioning analysis for Generalized Anxiety Disorder (GAD) treatments, focusing on approved and pipeline drugs, and now refined with strategic insights by removing the RoA and Class columns and enriching the positioning context:

Generalized Anxiety Disorder (GAD) Competitive Landscape

I. FDA-Approved Therapies

Drug | Sponsor | MoA | Key Strategic Insights |

Escitalopram (Lexapro) | AbbVie | SSRI | Market leader; generic erosion, but widely prescribed first-line option. Slow onset and sexual side effects limit use. |

Paroxetine (Paxil) | GSK | SSRI | Older agent, sedating—preferred in anxious insomnia but associated with weight gain and withdrawal. |

Duloxetine (Cymbalta) | Eli Lilly | SNRI | Strong positioning due to dual action (anxiety + pain). Competitive in comorbid fibromyalgia/neuropathy. |

Venlafaxine ER (Effexor XR) | Pfizer | SNRI | Widely used in GAD, but the risk of discontinuation syndrome affects compliance. |

Buspirone | Generic | 5-HT1A Partial Agonist | Unique mechanism, low side effect burden. Underutilized due to mild efficacy and slow onset. |

Hydroxyzine | Generic | H1-Antihistamine | Fast-acting but limited to short-term use. Useful in patients avoiding benzodiazepines. |

Alprazolam, Diazepam, Lorazepam | Various | GABA-A PAM | Powerful but declining due to addiction concerns. Still dominates acute anxiety management. |

Strategic Summary:

Approved drugs form the core of first-line therapy, but are increasingly criticized for delayed onset, addiction risk, and modest long-term efficacy, opening the door for novel, non-sedating, fast-acting alternatives.

II. GAD Pipeline Therapies

Sponsor | Asset | Stage | MoA | Key Strategic Insights |

Mind Medicine | MM120 (LSD) | Phase III | 5-HT2AR Partial Agonist | Psychedelic renaissance candidate. Single or few-dose regimen + therapy could redefine chronic anxiety treatment. Strong IP, but requires care model adaptation. |

Luye Pharma | Ruoxinlin | Phase III | SNDRI | Triple reuptake inhibition addresses a broader neurotransmitter profile. Differentiation lies in efficacy vs current SNRIs. Targets treatment-resistant population. |

Beijing Union | Buagafuran | Phase III | Potassium Channel Inhibitor | Novel MoA offering non-sedating anxiolysis. Strategic edge in populations avoiding benzos. Potential to replace sedating agents. |

Otsuka | Ulotaront | Phase II/III | TAAR1/5-HT1A Agonist | Non-dopaminergic approach with promising tolerability. Strategic alignment with CNS innovation in schizophrenia and anxiety. |

Cybin IRL Limited | CYB004 | Phase II | 5-HT2AR Agonist | Deuterated DMT variant allowing controlled psychedelic exposure. Emerging as short-acting, rapid-acting therapy—if payer access & care delivery model align. |

Intra-Cellular Therapies / J&J | ITI-1284 | Phase II | 5-HT2AR/D2R Antagonist | Positioned as a rapid-acting sublingual, potentially useful in geriatric anxiety. A dual-receptor profile may provide mood-anxiety overlap benefits. |

Engrail Therapeutics | ENX-102 | Phase II | GABA-A α2/3/5 PAM | Non-sedating, non-addictive alternative to benzos. If it avoids dependence, this could replace BZDs as a first-line for acute anxiety. |

AbbVie | ABBV-932 | Phase II | D2/D3 Agonist | Strategic bet on reward/anhedonia modulation. May overlap anxiety with depression/apathy markets. |

Fabre-Kramer | EXXUA (gepirone ER) | Phase II | 5-HT1A Partial Agonist | Modified buspirone for sustained action. Positioned to capture patients with sexual dysfunction from SSRIs. |

GABA Therapeutics | GRX-917 | Phase I | GABAA PAM + NLRP3 Inhibitor | Dual mechanism combining anxiolytic and anti-inflammatory activity. Innovative approach targeting neuroinflammation-linked anxiety. |

Strategic Summary:

The pipeline is characterized by MoA innovation, especially targeting:

- Psychedelics and fast-acting 5-HT2AR modulators (MM120, CYB004)

- Non-GABA sedative options (Buagafuran, ENX-102)

- Neuroinflammation (GRX-917)

- Multi-neurotransmitter modulation (Ruoxinlin, Ulotaront)

These candidates are poised to displace first-generation SSRIs/SNRIs and fill therapeutic gaps like rapid onset, refractory cases, and benzo avoidance.

Competitive Market Positioning

Segment | Leaders | Strategic Positioning |

First-line (SSRI/SNRI) | Escitalopram, Duloxetine | Heavily genericized; high volume, low innovation; vulnerable to novel MoAs |

Fast-acting / Acute Relief | Hydroxyzine, Alprazolam | Needs non-addictive replacements—MM120, CYB004, ENX-102 are challengers |

Non-sedating / Non-addictive options | Buspirone, ENX-102, GRX-917 | Strong strategic fit for long-term anxiety without BZD risks |

Novel CNS pathways (TAAR1, Potassium channels) | Ulotaront, Buagafuran | High unmet need alignment; well-positioned for resistant patients |

Next-gen Anxiolytics | MM120, CYB004 | Disruptive potential; requires a supportive regulatory and commercial ecosystem |

Key Companies:

Target Opportunity Profile (TOP)

Here is a Target Opportunity Profile (TOP) for emerging therapies in Generalized Anxiety Disorder (GAD), benchmarking the key attributes that new drugs must demonstrate to outperform existing FDA-approved options and establish a competitive advantage:

Target Opportunity Profile (TOP): Generalized Anxiety Disorder (GAD)

Category | Current Standard (Approved Drugs) | Target Profile for Emerging Drugs | Strategic Rationale |

Efficacy | Moderate; onset typically takes 2–6 weeks | Rapid onset (≤7 days), durable response (≥12 weeks); remission > response | Patients demand fast relief; long lag time limits the utility of SSRIs/SNRIs |

Safety / Tolerability | Weight gain, sexual dysfunction, withdrawal, sedation (BZDs) | Minimal side effects; no sexual dysfunction or sedation; no withdrawal | Side effects are the leading cause of non-compliance and switching |

Mechanism of Action (MoA) | Primarily SSRI/SNRI, BZD, 5-HT1A partial agonist | Novel pathways: 5-HT2AR, TAAR1, GABA-A subtype selective, neuroinflammation, SNDRI | Innovation is needed to address treatment resistance and side effect burden |

Route of Administration (RoA) | Oral (daily), some as-needed (BZDs) | Flexible: oral, rapid-onset sublingual, IM, or intermittent psychedelic dosing | Alternate delivery (e.g., IM DMT or LSD microdosing) can enhance adherence |

Dosing Frequency | Daily (often chronic) | Intermittent or short-course dosing with long-lasting effects (e.g., 1–2/month) | Intermittent dosing (e.g., MM120, CYB004) reduces pill fatigue and improves QoL |

Onset of Action | 2–6 weeks (SSRIs), 30–60 mins (BZDs) | <1 week (preferably <3 days) | Rapid onset is crucial for acute anxiety and real-world utility |

Addiction / Abuse Risk | High (BZDs), Low (SSRIs/SNRIs) | Non-addictive, no physical dependency | Avoidance of controlled substances is a top payer and prescriber concern |

Modality | Small molecules (oral tablets/capsules) | Precision-targeted small molecules, psychedelics, neurosteroids | Diverse modalities offer differentiated outcomes and IP protection |

Innovation Differentiators | Generic erosion, lack of MoA diversity | First-in-class or best-in-class agents with unique receptor targets | Novelty helps in pricing, positioning, and BD&L interest |

Treatment-Resistant GAD | Very limited options (only dose escalation) | Proven efficacy in TR-GAD subgroups; overlap with MDD, PTSD, OCD | Pipeline agents must target underserved patients who failed SSRIs/SNRIs |

Comorbidity Management | Some overlap with depression or pain (e.g., duloxetine) | Efficacy in GAD with comorbid depression, PTSD, and substance use | Multi-indication strategy expands commercial potential |

Payer Acceptability | High for generics; restricted for benzos | Clear cost-benefit case, with low risk of misuse | Favorable health economics help with formulary inclusion |

Real-World Evidence Potential | Modest, mostly from SSRIs/SNRIs | Strong PROs (e.g., reduced ER visits, workplace productivity) | Data beyond clinical endpoints (QoL, function) will aid adoption |

Summary: What Emerging GAD Drugs Must Offer to Win

- Rapid and Sustained Efficacy

Must outperform SSRIs/SNRIs in onset and durability, potentially via 5-HT2A, TAAR1, or GABA-A α2/3 modulators.

- Superior Safety / Tolerability

No sedation, sexual dysfunction, or withdrawal risk this is key to real-world success and regulatory differentiation.

- Novel and Differentiated MoA

First-in-class agents (e.g., ENX-102, MM120, Ulotaront) are strategically superior in BD&L value and market entry.

- Flexible Dosing & Administration

Psychedelics (e.g., MM120, CYB004) offer intermittent dosing with lasting benefit, a disruptive model vs daily pills.

- No Abuse Liability

Must replace benzodiazepines without triggering addiction concerns a space where non-GABA addictive alternatives will dominate.

- Positioning in TR-GAD & Comorbid Populations

Ideal candidates should target patients with partial response or comorbid MDD, PTSD, or insomnia, creating expansion options.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: