Disease Overview:

- Friedreich’s ataxia (FA), often referred to as 'Friedreich,' is a rare inherited disorder that affects the nervous system and is marked by a progressive loss of coordination.

- Individuals with Friedreich’s ataxia gradually experience worsening coordination, which can result in an unsteady walk and slurred speech.

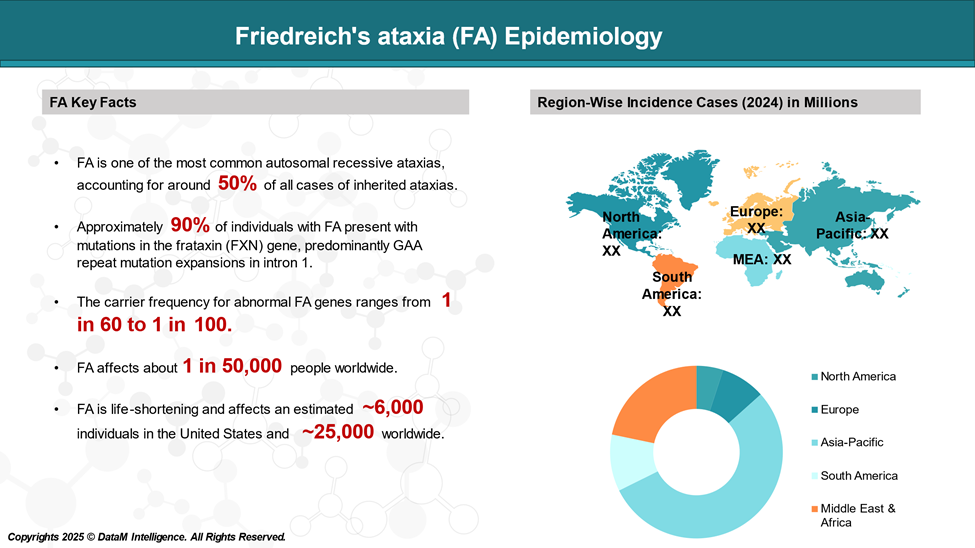

Epidemiology Analysis (Current & Forecast)

Friedreich's ataxia (FA) is a rare, progressive, neurogenetic disorder that affects about 1 in 50,000 people worldwide. Although uncommon, FA is the most prevalent inherited form of ataxia in children. It is occasionally mistaken for spinocerebellar ataxia, a separate group of inherited ataxias.

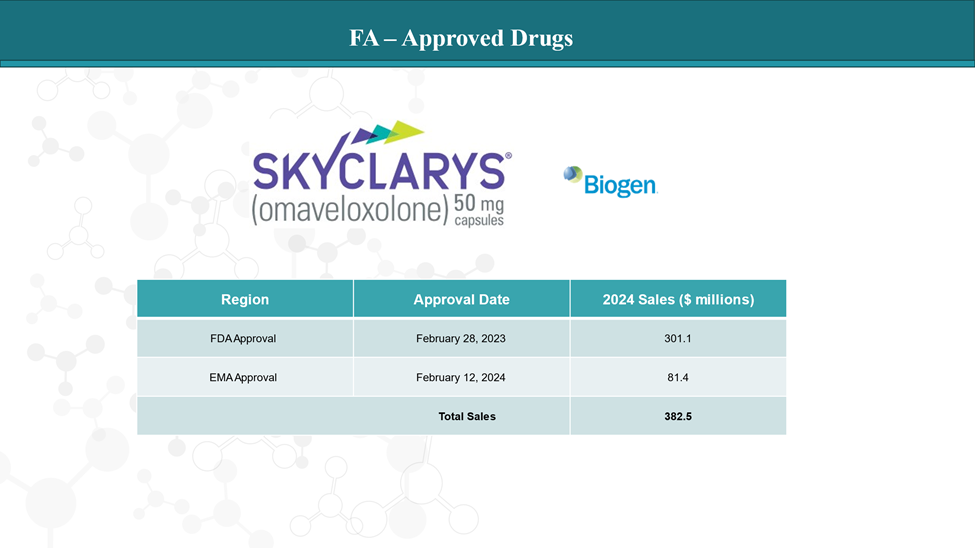

Approved Drugs (Current SoC) - Sales & Forecast

Currently, Skyclarys ™ (omaveloxolone; Biogen) is the only approved treatment for Friedreich’s ataxia (FA) in people age 16 and older.

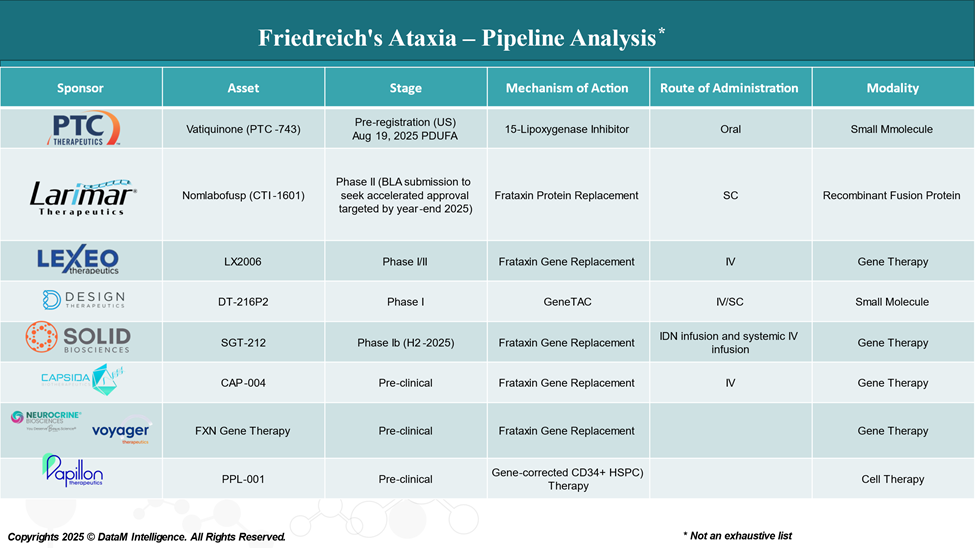

Pipeline Analysis and Expected Approval Timelines

The therapeutic pipeline for Friedreich's ataxia is rapidly evolving, with a growing focus on disease-modifying treatments aimed at correcting the underlying genetic defect, enhancing muscle repair, and improving quality of life.

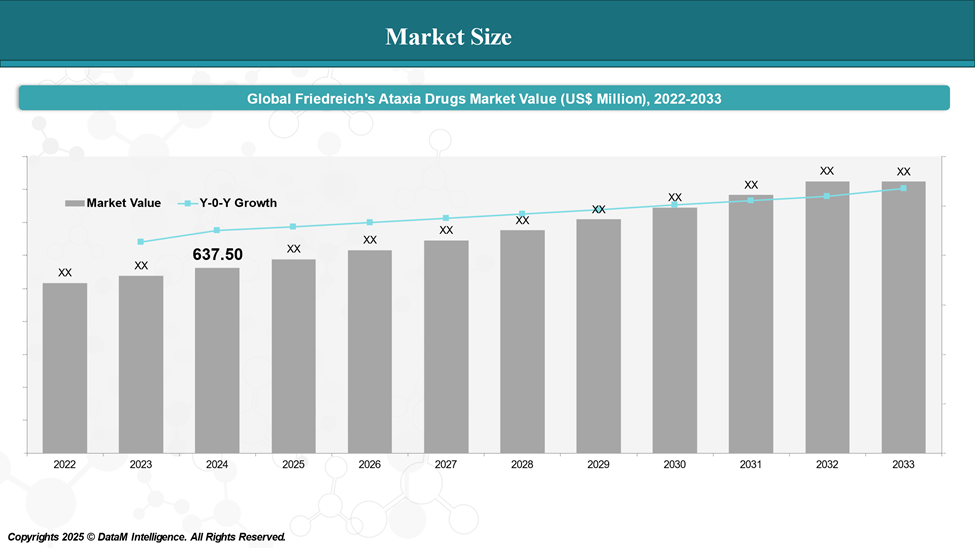

Market Size & Forecasting

In 2024, the global Friedreich's ataxia Drugs market was valued at approximately US$ 637.50 million, with a rise to US$ XX billion in 2033, reflecting a compound annual growth rate of XX%.

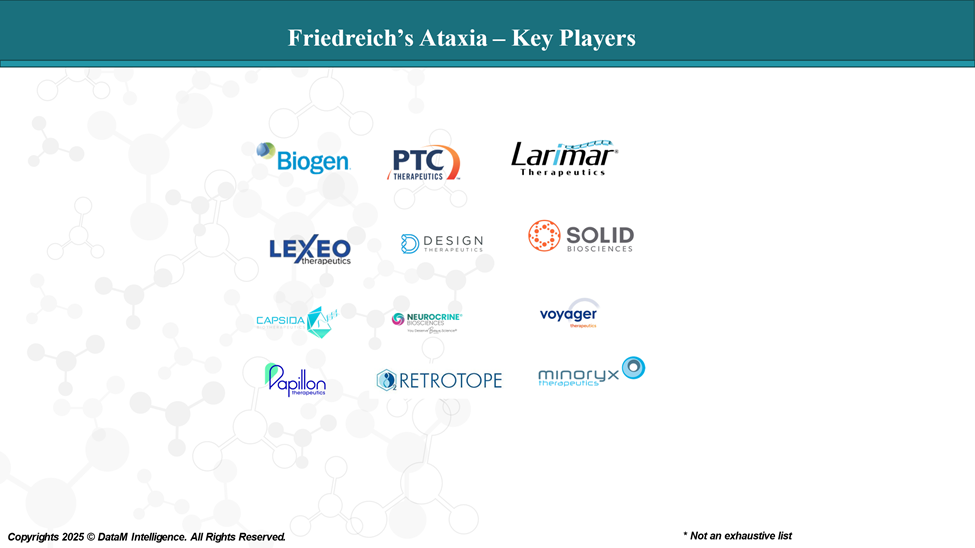

Competitive Landscape and Market Positioning

The FA therapeutic landscape is rapidly expanding, with both established pharmaceutical companies and innovative biotech startups competing to deliver life-changing treatments.

Market Positioning Highlights

| Company | Drug Candidate | Stage | Mechanism | Strategic Insight |

| Biogen (Reata) | Skyclarys (omaveloxolone) | Approved | Nrf2 activator, antioxidant, mitochondrial enhancer | First-mover advantage; high pricing ($370K) sets benchmark. Limited to the U.S. for now; faces pressure from follow-on therapies with better safety/access. |

| PTC Therapeutics | Vatiquinone (PTC-743) | Pre-registration (US) | Modulates mitochondrial function & oxidative stress | Lead challenger to Skyclarys. May position on global accessibility, tolerability, or pediatric use. Strong track record in rare neuro disorders. |

| Retrotope | RT001 | Phase II | Deuterated linoleic acid → protects lipid membranes | Could serve as an adjunct to Skyclarys. Unique antioxidant strategy. Potential use in early disease or as a combination therapy. |

| Lexeo Therapeutics | LX2006 (Gene Therapy) | Phase I/II | AAVrh.10-mediated FXN gene delivery (cardiac focus) | Targets FA cardiomyopathy, the main cause of death in FA. Could complement systemic drugs. Positioned as a long-term disease-modifying strategy. |

| Larimar Therapeutics | Nomlabofusp (CTI-1601) | Phase II Planning for Accelerated Approval | Frataxin Protein Replacement | Recombinant fusion protein intended to deliver human frataxin into the mitochondria of patients with Friedreich's ataxia (FA). |

Key Companies:

Target Opportunity Profile (TOP)

Given the current landscape, where only one drug (Skyclarys) is approved, and patients face chronic progression, high costs, and limited global access

| Domain | Current Landscape | Target Opportunity | SoC Benchmark (Skyclarys) | What Emerging Drugs Must Show |

| Diagnosis | Delayed diagnosis, genetic testing required; no screening or biomarkers | Early detection using non-invasive biomarkers or screening programs | No diagnostic tool — used after diagnosis | Combine drug development with biomarker validation or companion diagnostics |

| Safety | Some tolerability concerns (e.g., liver enzymes); pediatric safety not well studied | Safe in all age groups, low side effects, minimal monitoring | Elevated ALT/AST in some patients; black-box-like caution for liver | Show a cleaner safety profile, especially in pediatrics and long-term use |

| Efficacy | Skyclarys slows functional decline (mFARS), with no reversal | Functional improvement or stabilization over 12–24 months | +2.4-point improvement in mFARS over placebo at 48 weeks | Show ≥ 3-point improvement in mFARS or impact on multiple systems (e.g., cardiac, fatigue, QoL) |

| Clinical Endpoints | - mFARS (motor function) - ADL (activities of daily living) - 9-HPT (fine motor) - T25FW (gait) - NT-proBNP (cardiac) - FXN expression (exploratory) | Integrate validated biomarkers + multi-domain functional scores | Only mFARS and some cardiac markers used | Use composite endpoints (e.g., mFARS + NT-proBNP + PROs) and show durable benefit |

| Price | High (~$370K/year in the U.S.); limited payer support in some cases | Value-based pricing, global affordability model | High-cost oral daily therapy | Offer comparable or superior efficacy at lower cost or less frequent dosing |

| Treatment Format | Daily oral capsule; chronic use | Long-acting or one-time therapy (e.g., gene therapy); pediatric-compatible | Daily oral pill | Offer simpler, less frequent dosing or longer duration of effect |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.