Disease Overview:

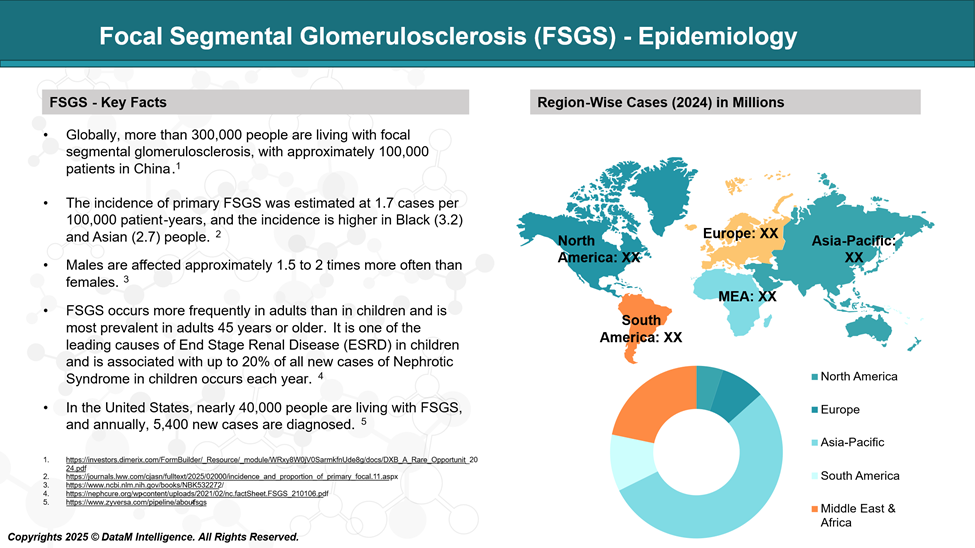

Focal segmental glomerulosclerosis (FSGS) is a kidney disorder characterized by scarring in segments of some glomeruli, the tiny blood vessels responsible for filtering waste and excess fluid from the bloodstream. It can affect both children and adults and arises from a variety of underlying causes. Over time, FSGS may impair kidney function and potentially progress to end-stage kidney disease (ESKD), commonly referred to as kidney failure.

Epidemiology Analysis (Current & Forecast)

FSGS is responsible for around 40% of nephrotic syndrome cases in adults and about 20% in children. While idiopathic FSGS can develop at any age, it is most frequently diagnosed in individuals between 18 and 45 years old. Among those who continue to have high levels of protein in their urine (nephrotic-range proteinuria), roughly half may progress to end-stage renal disease (ESRD) within 3 to 8 years following their initial diagnosis.

Approved Drugs - Sales & Forecast

FSGS is a challenging kidney disorder with limited treatment options, as there are currently no FDA-approved therapies specifically developed for this condition. The primary approach to managing FSGS involves supportive care aimed at controlling symptoms and slowing disease progression, rather than curing the disease.

Supportive Care as Mainstay: Treatment focuses on managing symptoms and slowing disease progression rather than curing the condition.

Common Supportive Therapies:

ACE inhibitors or ARBs: Used to lower blood pressure and reduce proteinuria.

Corticosteroids: Often prescribed, especially in primary or idiopathic FSGS, though not all patients respond.

Immunosuppressive agents, Such as calcineurin inhibitors (e.g., cyclosporine, tacrolimus) may be used in steroid-resistant cases.

Unmet Clinical Need:

The absence of targeted, disease-specific therapies highlights a major gap in care.

There is ongoing research and clinical trials exploring new treatments, but effective, approved options remain limited.

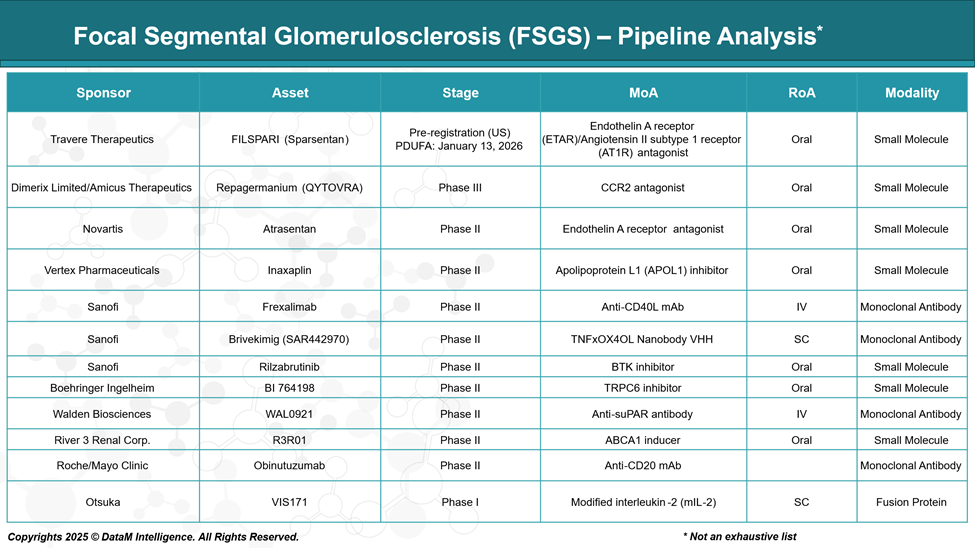

Pipeline Analysis and Expected Approval Timelines

As of May 2025, the therapeutic pipeline for focal segmental glomerulosclerosis (FSGS) is advancing, with several promising candidates in various stages of development.

Below is an overview of key therapies and their current statuses:

Competitive Landscape and Market Positioning

Here is a comparison of key emerging therapies for Focal Segmental Glomerulosclerosis (FSGS), focused on competitive positioning, clinical stage, and mechanism of action (MoA). This landscape is particularly competitive given the absence of an FDA-approved treatment, and several candidates are vying for first-to-market status and therapeutic dominance:

Sponsor | Asset | Key Milestones / Regulatory Status | Target Patient Population | Strategic Notes / Competitive Edge |

Travere Therapeutics | FILSPARI (sparsentan) | FDA sNDA accepted; PDUFA: Jan 13, 2026 | Broad FSGS population (including steroid-resistant) | Likely first FDA-approved drug for FSGS; strong Phase III data in PROTECT trial; has orphan designation |

Dimerix Limited/Amicus Therapeutics | DMX-200 | Expanding global Phase III; US licensing deal secured | Adults with proteinuric FSGS | Global commercialization strategy underway; fast-track designation; strong pharma partnerships |

Vertex Pharmaceuticals | Inaxaplin | Accelerating development in APOL1-positive FSGS | Patients with APOL1 genetic variants | Precision medicine model; APOL1 targeting may provide first-in-class, gene-specific solution |

Sanofi | Frexalimab, SAR442970, Rilzabrutinib | Multi-arm Phase IIa trial is ongoing | Primary FSGS & minimal change disease | Strong immunology pipeline integration; evaluating multiple biologics in parallel; platform synergy |

Roche / Genentech | Obinutuzumab | Clinical trial in steroid-resistant FSGS | Immunosuppression-dependent or refractory patients | Leverages known biologic with safety data; repurposing strategy may reduce time to market |

Walden Biosciences | WAL0921 | Phase II started | suPAR-driven FSGS subtype | Highly innovative biomarker-driven approach; strong academic support; first suPAR inhibitor in pipeline |

Boehringer Ingelheim | BI 764198 | Phase II | Broad CKD and proteinuric subgroups | Potential to apply to FSGS and beyond; portfolio-level strategic flexibility |

Key Takeaways:

- Travere’s FILSPARI leads the race and may define the treatment landscape if approved in early 2026.

- Dimerix’s Repagermanium is the closest competitor in Phase III with strong licensing activity in US with Amicus Therapeutics.

- Vertex’s Inaxaplin is uniquely positioned to dominate the APOL1 mutation-positive segment, a genetically defined subset of FSGS.

- Sanofi is building a diversified FSGS pipeline across multiple novel immunologic targets, offering strategic depth and potential combo therapies.

- Emerging therapies such as WAL0921 (anti-suPAR) and R3R01 (ABCA1 inducer) reflect highly innovative biological approaches, signaling a trend toward precision nephrology.

Key Companies:

Target Opportunity Profile (TOP)

Here's a comprehensive Target Opportunity Profile for emerging drugs aiming to successfully enter the FSGS (Focal Segmental Glomerulosclerosis) treatment market. This outlines the key clinical, mechanistic, and commercial characteristics that a drug should ideally demonstrate to be competitive and address current unmet needs:

Target Opportunity Profile for FSGS Therapeutics

Parameter | Optimal Profile | Rationale / Market Expectation |

Safety | - Well-tolerated over long-term use | FSGS often affects younger populations; safety is critical, especially with chronic therapy and possible combination use |

Efficacy | - Durable reduction in proteinuria | Proteinuria reduction is a key surrogate endpoint for regulatory approval and clinical adoption |

Mechanism of Action (MoA) | - Disease-modifying or precision-targeted (e.g., APOL1, suPAR) | Precision or pathway-specific drugs offer a differentiated approach and may avoid steroid-like toxicity |

Route of Administration (RoA) | - Oral preferred | Oral or at-home treatments increase adherence and reduce healthcare burden |

Dosing Frequency | - Once-daily or weekly | Convenience matters for chronic diseases; high dosing frequency can limit adoption |

Modality | - Small molecules | Modalities must balance innovation with manufacturability, safety, and payer acceptance |

Patient Segmentation | - Effective in steroid-resistant and steroid-dependent patients | Most urgent unmet needs lie in steroid-resistant and genetic subtypes |

Innovation / Differentiation | - First-in-class or best-in-class profile | High innovation value attracts investor, regulatory, and payer attention |

Time to Onset of Action | - Moderate (within 4–8 weeks) | Faster responses can help physicians monitor efficacy early and reduce reliance on steroids |

Combination Potential | - Compatible with ACEi/ARBs, SGLT2 inhibitors, or immunosuppressants | Real-world use likely involves polytherapy; combination safety and synergy are important |

Pediatric Use Potential | - Favorable PK/PD and safety data in children | FSGS affects both children and adults—pediatric-friendly profile expands market potential |

Reimbursement Outlook | - Cost-effective with long-term health economic benefit | High upfront costs must be justified by delayed progression to ESRD and reduced need for dialysis/transplant |

Strategic Implications

To successfully compete in the FSGS space, emerging therapies should aim for:

- Clinical superiority or clear differentiation over off-label immunosuppressants.

- Pathway specificity (e.g., APOL1, CCR2, CD40L) or innovative MOAs that offer more than just proteinuria reduction.

- A safety profile suitable for chronic and pediatric use.

- Oral delivery and simple dosing to enhance adherence and enable outpatient management.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: