Disease Overview:

Eosinophilic esophagitis (EoE) is a chronic allergic condition characterized by inflammation in the esophagus, the muscular tube that links the mouth to the stomach. The disorder occurs when eosinophils, a specific type of white blood cell, accumulate in the esophageal lining. This accumulation leads to tissue irritation and damage, which can interfere with normal swallowing and cause discomfort during meals.

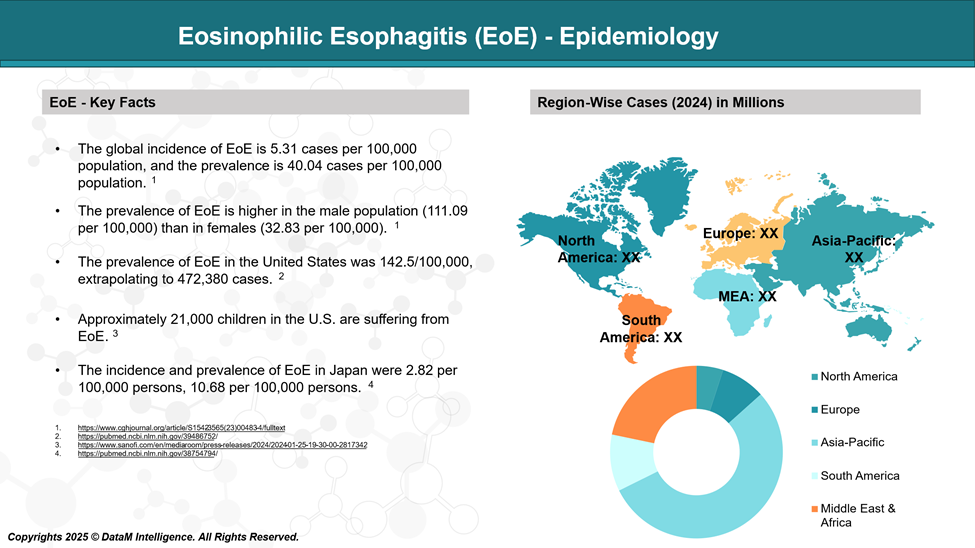

Epidemiology Analysis (Current & Forecast)

A 2025 epidemiological study reported that eosinophilic esophagitis (EoE) affects approximately 142.5 individuals per 100,000 in the United States, with an estimated 472,380 total cases nationwide. These findings indicate that EoE is no longer classified as a rare disease in the U.S. Similarly, EoE is also recognized as a relatively common condition across Europe.

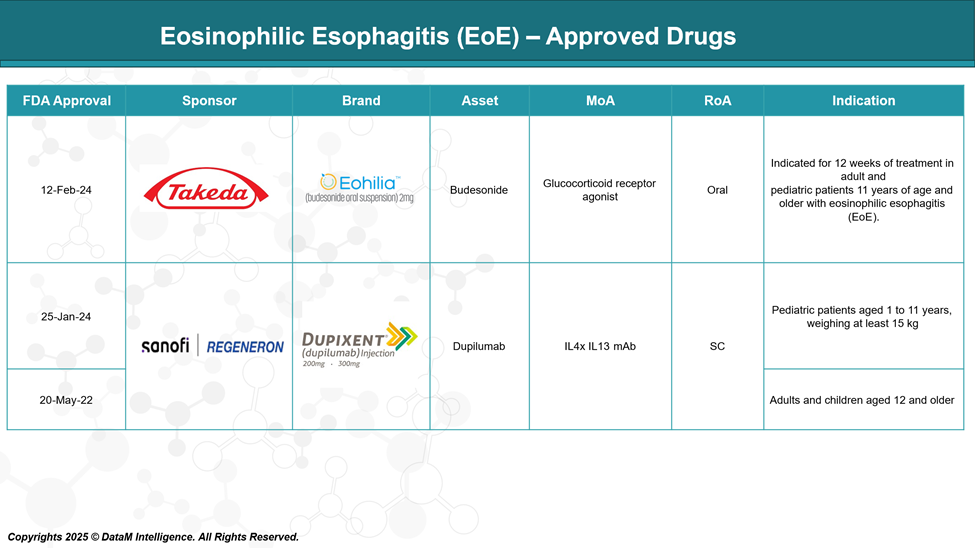

Approved Drugs - Sales & Forecast

Currently, EOHILIA is a liquid medication, and DUPIXENT is an injection; both are approved treatments for eosinophilic esophagitis (EoE). They help reduce swelling in the esophagus and relieve symptoms like difficulty swallowing.

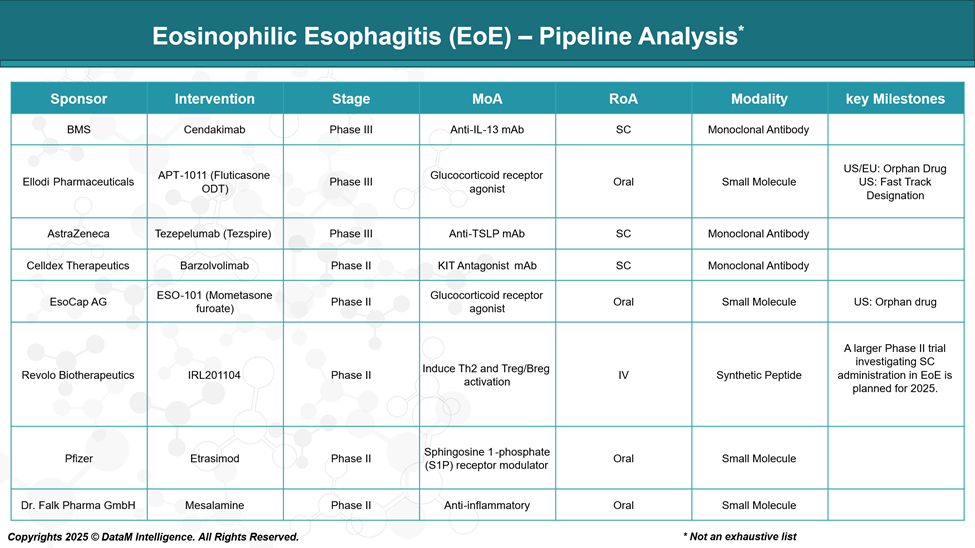

Pipeline Analysis and Expected Approval Timelines

As of May 2025, the treatment landscape for eosinophilic esophagitis (EoE) is rapidly evolving, with several promising therapies in various stages of development.

Here's an overview of notable candidates in the EoE pipeline:

Competitive Landscape and Market Positioning

The EoE treatment market is rapidly growing and competitive, led by approved drugs like Takeda’s EOHILIA and Sanofi/Regeneron’s DUPIXENT®. Several late-stage pipeline therapies from major pharma focus on targeted biologics and improved delivery, aiming to meet unmet patient needs and expand options.

Company | Drug | Mechanism / Class | Stage | Strategic Positioning | Differentiators |

Takeda | EOHILIA | Topical corticosteroid (budesonide) | Approved (2024) | First oral therapy, positioned as a front-line, accessible option | Oral liquid; non-biologic; favorable safety for broad use |

Sanofi / Regeneron | DUPIXENT® | IL-4Rα inhibitor (biologic) | Approved (2022) | Biologic leader in Type 2 inflammation; cross-indication leverage (asthma, AD, CRSwNP) | Strong brand equity, high efficacy, multi-indication synergy |

Bristol Myers Squibb | Cendakimab | Anti-IL-13 monoclonal antibody | Phase III | Direct biologic challenger to DUPIXENT targeting IL-13 pathway | Focused mechanism; potential for differentiated efficacy |

Ellodi Pharmaceuticals | APT-1011 | Fluticasone ODT (glucocorticoid) | Phase III | Enhanced esophageal delivery with oral disintegrating tablet | Targeted mucosal exposure; potential for fast-track adoption |

AstraZeneca | Tezepelumab (Tezspire) | Anti-TSLP monoclonal antibody | Phase III | Upstream cytokine targeting with broader potential across allergic diseases | TSLP inhibition may prevent multiple allergic pathways upstream |

Strategic Takeaways:

- Takeda and Sanofi/Regeneron currently anchor the market with differentiated modalities (oral vs. biologic), appealing to different patient segments (mild-to-moderate vs. moderate-to-severe).

- Sanofi/Regeneron is strategically positioned to extend its dominance in the type 2 inflammation space through ecosystem synergies (shared pathways with asthma, eczema, etc.).

- BMS and AstraZeneca are competing to carve out biologic market share, focusing on precision cytokine targeting that may provide advantages in efficacy or side-effect profiles.

- Ellodi offers a low-cost, patient-friendly delivery innovation that could be disruptive if long-term safety and efficacy are proven.

Key Companies:

Target Opportunity Profile (TOP)

Here’s a Target Opportunity Profile outlining the key attributes emerging eosinophilic esophagitis (EoE) drugs need to demonstrate to compete effectively against approved therapies like EOHILIA and DUPIXENT®:

Attribute | Current Standard of Care (EOHILIA & DUPIXENT®) | Emerging Drugs – Target Profile | Competitive Gap / Opportunity |

Safety | - EOHILIA: Generally well tolerated but corticosteroids can cause local candidiasis and potential systemic effects with long-term use. | - Aim for safer profiles with fewer infections, less systemic corticosteroid exposure. | Safer long-term use with fewer side effects can drive preference, especially for younger patients requiring chronic therapy. |

Efficacy | - Both provide significant symptom relief and histologic improvements. | - Equal or superior efficacy, including faster onset and durable response. | Enhanced or faster symptom control and disease modification would be key differentiators. |

Mechanism of Action | - EOHILIA: Topical corticosteroid reducing inflammation locally. | - Novel targets (e.g., IL-13, TSLP) or combination approaches. | Targeting upstream or complementary pathways could offer improved efficacy or reduced side effects. |

Route of Administration | - EOHILIA: Oral liquid suspension. | - Oral tablets, oral disintegrating forms, or less frequent injections preferred. | More convenient, less invasive, or better-targeted delivery may improve adherence and patient preference. |

Dosing Regimen | - EOHILIA: Twice daily. | - Once daily or less frequent dosing preferred. | Easier dosing can reduce treatment burden and enhance adherence. |

Modality | - EOHILIA: Small molecule corticosteroid. | - Small molecules, novel biologics, or combination therapies with reduced immunogenicity. | New modalities could address unmet needs like immunogenicity or localized delivery. |

Innovation | - Current therapies focus mainly on symptom and inflammation control. | - Disease modification potential, biomarker-driven personalized therapy, improved patient experience. | Innovation in disease progression prevention and personalization could drive market leadership. |

Onset of Action | - Symptom relief is typically within weeks. | - Faster onset (days) is desirable to enhance patient satisfaction. | Rapid relief can improve quality of life and compliance. |

Cost-effectiveness | - Generally high costs for biologics; oral corticosteroids are more affordable but with safety trade-offs. | - Competitive pricing with a clear value proposition through improved outcomes and safety. | Better value could improve payer access and patient affordability. |

Strategic Considerations:

- Differentiation Is Key: Emerging drugs must clearly show advantages over EOHILIA’s oral corticosteroid approach and DUPIXENT®’s biologic immunomodulation to capture market share.

- Balancing Efficacy and Safety: Offering strong efficacy with a better safety/tolerability profile will be critical, especially for chronic use in a mostly young population.

- Patient Convenience: Routes and dosing that improve adherence will drive real-world success.

- Innovation Beyond Symptom Control: Targeting disease mechanisms to prevent fibrosis and improve esophageal remodeling will create long-term value.

- Cost and Access: Ensuring affordability and reimbursement will be vital to achieving broad adoption.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: