1. Disease Overview:

Bullous keratopathy results from permanent swelling of the cornea’s inner layers. The corneal endothelium dysfunction allows aqueous humor to enter and causes edema formation, which causes loss of corneal transparency and blurred vision.

2. Epidemiology Analysis (Current & Forecast)

- Bullous keratopathy is more prevalent in patients with ophthalmic surgical interventions, such as cataract surgery. Fuchs endothelial dystrophy is another primary cause.

3. Approved Drugs (Current SoC) - Sales & Forecast

The current treatment landscape includes medical management, surgical interventions, and emerging therapies.

Medical Management (Symptomatic relief)

| Treatment | Mechanism | Usage | Limitations |

| Hypertonic Saline (5%) Eye Drops/Ointment | Draws out excess fluid from the cornea | Temporary relief of edema | Short-term effect, requires frequent dosing |

| Bandage Contact Lenses (BCLs) | Protects the cornea, reduces pain | Used for pain relief | Doesn't treat underlying endothelial dysfunction |

| Topical Lubricants | Reduces discomfort from corneal irregularities | Symptom management | No effect on disease progression |

| Topical Steroids (low-dose) | Reduces inflammation, may control mild edema | Used for mild cases or after surgery | Prolonged use can cause increased IOP |

| Carbonic Anhydrase Inhibitors (Dorzolamide, Acetazolamide) | Reduces corneal hydration by decreasing fluid production | Used in select cases | It may worsen corneal decompensation in some patients |

4. Pipeline Analysis and Expected Approval Timelines

Bullous Keratopathy (BK) is a condition characterized by corneal endothelial dysfunction, leading to corneal edema, pain, and vision loss. While current treatments primarily involve symptomatic relief and surgical interventions, several emerging therapies are in development, aiming to provide less invasive and more effective solutions. Below is a pipeline analysis of these therapies, including their mechanisms, current development stages, and anticipated approval timelines.

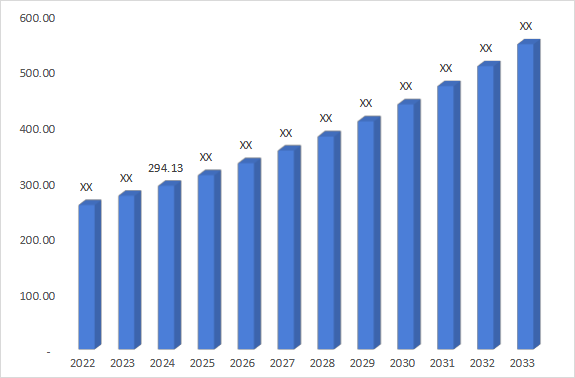

5. Market Size & Forecasting

The global bullous keratopathy market size is valued at USD 294.13 million in 2024 and is estimated to grow with a CAGR of 6% to 8% during the forecast period (2025-2033)

Unmet Needs

Despite advances in corneal transplantation and emerging regenerative therapies, significant gaps remain in the treatment landscape for Bullous Keratopathy (BK).

These include limited non-surgical options, donor shortages, long recovery times, and a lack of curative treatments.

| Unmet Need | Potential Solutions | Development Status |

| Non-surgical regenerative therapy | ROCK inhibitors (Ripasudil, Netarsudil), Endothelial cell injection therapy | Clinical trials (Japan, U.S., EU) |

| Reduced dependency on donor tissue | iPSC-derived corneal endothelial cell therapy | Preclinical to Phase I/II trials |

| Minimally invasive alternatives | Magnetic cell-based therapy (EO2002), Nanoparticle drug delivery | Early-stage research |

| Long-term disease modification | Gene therapy, Stem cell therapy | Preclinical stage |

| Improved affordability & access | Biosynthetic corneas, Scalable cell therapy manufacturing | In development |

6. Competitive Landscape and Market Positioning

The Bullous Keratopathy treatment market is evolving, with regenerative therapies, endothelial cell injections, and ROCK inhibitors poised to disrupt traditional corneal transplantation. Below is a competitive analysis of key players and their position in the market.

Leading Late-Stage Pipeline Candidates

| Company | Product/Candidate | Mechanism of Action | Stage | Market Differentiation |

| Aurion Biotech | VYZNOVA (Neltependocel) | Allogeneic corneal endothelial cell therapy | Approved (Japan), Pre-Phase III (U.S.) | First-in-class cell therapy for BK |

| Trefoil Therapeutics | TTHX1114 | Fibroblast growth factor-1 (FGF-1) protein for endothelial regeneration | Phase I/II | Injectable alternative to corneal transplant |

| Cellusion | CLS001 | iPSC-derived corneal endothelial cell therapy | Phase I | Potential donor-free solution |

| Emmecell | EO2002 | Magnetic cell-based therapy for targeted delivery | Phase I | Novel nanoparticle-based approach |

Market Positioning of Emerging Therapies

| Therapy Class | Key Players | Advantages | Challenges |

| Endothelial Cell Therapy | Aurion (VYZNOVA), Cellusion (CLS001) | Minimally invasive, avoids donor corneas | High cost, complex manufacturing |

| FGF-1 Therapy | Trefoil (TTHX1114) | Potential regenerative effects | Early-stage development |

| ROCK Inhibitors | Kowa, Aerie (Netarsudil, Ripasudil) | First pharmacologic option, non-invasive | Limited efficacy data for BK |

| Nanoparticle Delivery | Emmecell (EO2002) | Targeted therapy, less invasive | Early clinical stage |

7. Target Opportunity Profile (TOP) & Benchmarking

The Target Opportunity Profile (TOP) helps identify ideal treatment characteristics for Bullous Keratopathy (BK), while benchmarking evaluates how emerging therapies compare to the current standard of care (SoC).

| Attribute | Ideal Target Profile | Current Limitations |

| Efficacy | Full corneal endothelial function restoration | Current treatments (e.g., transplants) can fail over time |

| Safety | Non-invasive or minimally invasive, no rejection risk | Transplants carry the risk of graft rejection, inflammation |

| Durability | Long-term or permanent solution | Corneal grafts have a limited lifespan, require re-transplantation |

| Availability | Widely accessible, donor-free | Donor tissue shortages limit transplant accessibility |

| Recovery Time | Rapid recovery, minimal post-op care | Corneal transplant recovery can take months |

| Affordability | Cost-effective and scalable globally | Cell therapies are expensive, transplants need infrastructure |

Benchmarking – How Emerging Therapies Compare

| Therapy Class | Example | Efficacy | Safety | Durability | Availability | Recovery |

| Corneal Transplant (DMEK, DSAEK) | Standard care | ✅✅✅ | ⚠️ Risk of rejection | ⚠️ Limited lifespan | ⚠️ Donor-dependent | ❌ Long recovery |

| Endothelial Cell Therapy | Aurion Biotech (VYZNOVA), Cellusion (CLS001) | ✅✅✅ | ✅ No rejection | ✅ Long-term potential | ✅ Donor-free | ✅ Short recovery |

| FGF-1 Growth Factor Therapy | Trefoil (TTHX1114) | ✅ Regenerative potential | ✅ Safe, non-invasive | ⚠️ Needs long-term data | ✅ Scalable | ✅ Fast recovery |

| ROCK Inhibitors | Ripasudil, Netarsudil | ⚠️Modest benefit | ✅ Low risk | ❌ Not curative | ✅ Widely available | ✅ Easy to use |

| Magnetic Cell Therapy | Emmecell (EO2002) | ✅ Targeted therapy | ✅ Non-invasive | ⚠️ Early-stage data | ✅ Donor-free | ✅ Fast recovery |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.