Disease Overview:

Atypical hemolytic uremic syndrome (aHUS) is a rare disorder that often appears suddenly and can lead to serious complications. It frequently progresses into a chronic condition marked by relapses. aHUS arises when the complement system, a key part of the immune defense, becomes overactive, causing the body to mistakenly attack its own healthy cells. This imbalance in the complement system may result from genetic mutations, environmental triggers, or a combination of both.

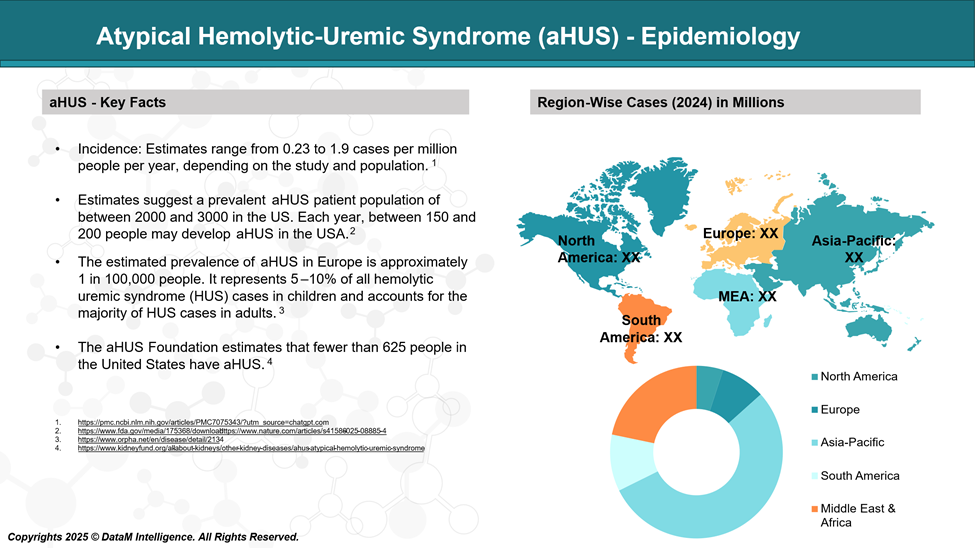

Epidemiology Analysis (Current & Forecast)

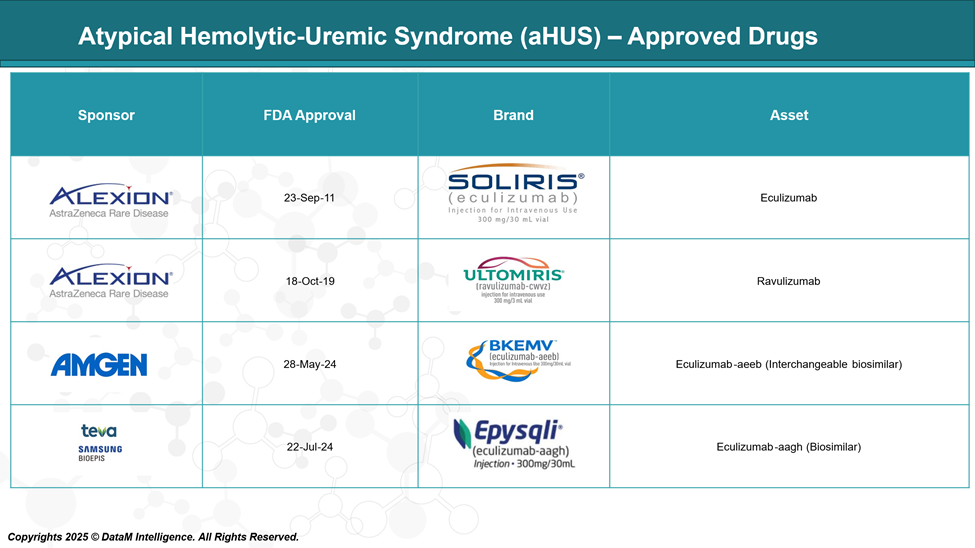

Approved Drugs - Sales & Forecast

Approved drugs for aHUS include Soliris (eculizumab) and Ultomiris (ravulizumab), which block the complement system to prevent blood vessel damage. Bkemv and EPYSQLI are biosimilars of Soliris, offering the same effect with potentially lower cost.

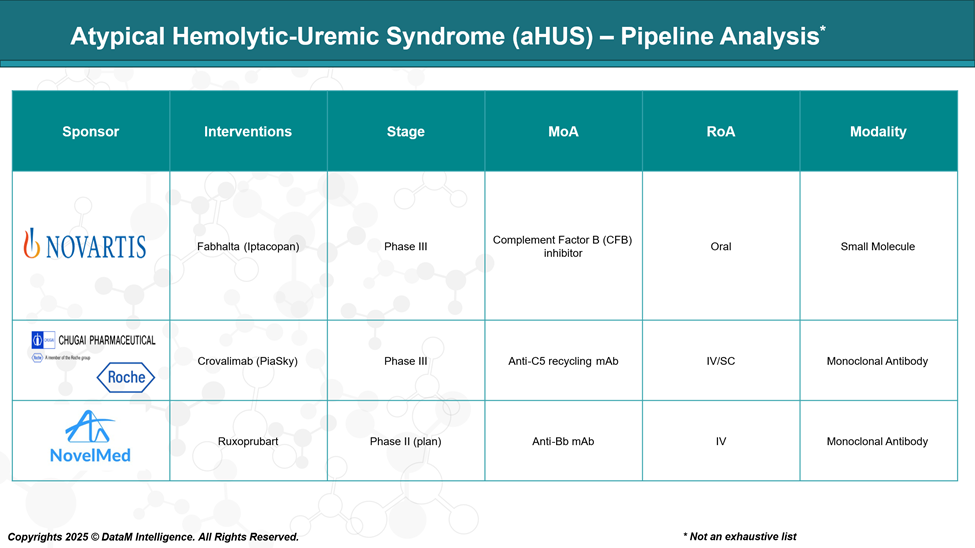

Pipeline Analysis and Expected Approval Timelines

The pipeline for Atypical Hemolytic-Uremic Syndrome (aHUS) has expanded significantly, with several promising therapies under development. Here's an overview of the current landscape:

Competitive Landscape and Market Positioning

The treatment landscape for atypical hemolytic uremic syndrome (aHUS) has evolved significantly over the past decade, largely driven by advances in complement inhibition therapy. The market is currently dominated by Soliris (eculizumab) and its long-acting successor, Ultomiris (ravulizumab), both of which target complement protein C5 to prevent blood vessel damage.

More recently, biosimilars like Bkemv and EPYSQLI have entered the market, offering cost-effective alternatives that increase patient access. Additionally, new entrants such as the oral complement factor B inhibitor Fabhalta (Iptacopan) and subcutaneous Crovalimab (Piasky) are poised to disrupt the market with improved convenience and potentially better patient adherence.

Drug | Type | Route & Dosing | Market Position | Key Notes |

Soliris | Anti-C5 monoclonal antibody | IV infusion, every 2 weeks | First approved and widely used; market leader | High efficacy, established safety profile |

Ultomiris | Long-acting anti-C5 antibody | IV infusion, every 8 weeks | Preferred for less frequent dosing; growing uptake | Extended half-life improves patient convenience |

Bkemv | Biosimilar to Soliris | IV infusion, every 2 weeks | Cost-effective alternative; approved biosimilar | Competes on price while maintaining Soliris efficacy |

EPYSQLI | Biosimilar to Soliris | IV infusion, every 2 weeks | Affordable alternative to Soliris | Expands access to complement inhibition therapy |

Fabhalta (Iptacopan) | Oral complement factor B inhibitor | Oral, daily | Novel oral agent; potential to disrupt IV therapies | Offers convenience and improved quality of life |

Crovalimab (Piasky) | Anti-C5 monoclonal antibody (subcutaneous) | SC injection, every 4 weeks | Emerging competitor; recently approved in multiple regions | Subcutaneous dosing offers a patient-friendly alternative |

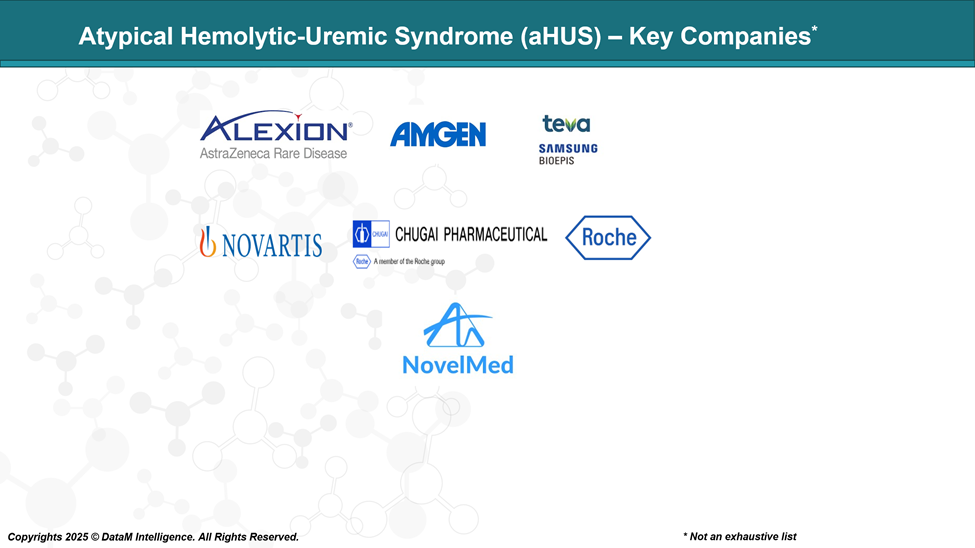

Key Companies:

Target Opportunity Profile (TOP)

As the treatment landscape for atypical hemolytic uremic syndrome (aHUS) matures, emerging therapies must demonstrate clear advantages over existing options to capture market share. Beyond matching the high efficacy and safety standards set by established drugs, new candidates need to address unmet needs such as improved convenience, novel mechanisms of action, and better affordability.

Criteria | Approved Drugs (Soliris, Ultomiris, Bkemv, EPYSQLI, Crovalimab) | Emerging Drugs (e.g., Fabhalta, Novel MOAs) |

Safety | Generally, well tolerated but risk of serious infections (meningococcal) due to complement inhibition; infusion reactions possible | Need to match or improve safety with fewer infections and less immunosuppression |

Efficacy | High efficacy in blocking complement C5, rapid and sustained control of aHUS | Should match or exceed efficacy, including effectiveness in resistant or breakthrough cases |

MOA | Target terminal complement component C5 (blocking membrane attack complex) | Potential to target upstream components (e.g., factor B, C3) for broader or more selective inhibition |

Route of Administration (ROA) | Mainly intravenous (IV) infusions every 2 to 8 weeks; Crovalimab offers subcutaneous dosing | Aim for oral or subcutaneous routes with easier self-administration to improve convenience |

Dosing Regimen | IV infusions every 2 weeks (Soliris) or every 8 weeks (Ultomiris, EPYSQLI); Crovalimab SC every 4 weeks | Prefer once daily oral or less frequent dosing to enhance adherence and reduce healthcare visits |

Modality | Monoclonal antibodies and biosimilars | Small molecules, RNA interference, gene therapy — novel modalities potentially offering improved pharmacokinetics and dynamics |

Innovation | Long-acting dosing (Ultomiris), biosimilars (Bkemv, EPYSQLI), subcutaneous injection (Crovalimab) | Oral factor B inhibitors (Fabhalta), RNAi therapies; potential to address unmet needs and improve quality of life |

Cost & Access | High-cost limits access in many regions; biosimilars offer some cost relief | Should be competitively priced or demonstrate cost-effectiveness to broaden market access |

Summary

- Approved drugs are highly effective but mainly rely on intravenous or subcutaneous dosing and target C5.

- Emerging drugs have the opportunity to differentiate by offering oral administration, novel mechanisms (upstream complement targets), improved safety, and better affordability.

- Success will depend on demonstrating non-inferior or superior efficacy and safety while providing greater patient convenience and lower treatment burden.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: