1. Introduction:

Antibody-drug conjugates (ADCs) represent a specialized form of targeted cancer therapy, combining the specificity of monoclonal antibodies with the potency of cytotoxic agents. This approach enables the direct delivery of chemotherapy to cancer cells while minimizing systemic toxicity.

Key Components of ADC

| Component | Function | Example |

| Monoclonal Antibody (mAb) | Recognizes and binds to cancer-specific antigens. | Trastuzumab (HER2) |

| Linker | Attaches the drug to the antibody and controls release. | Cleavable (pH-sensitive, enzyme-sensitive) and non-cleavable linkers |

| Cytotoxic Payload | A potent chemotherapy drug that induces cell death. | MMAE (microtubule inhibitor), SN-38 (topoisomerase inhibitor) |

ADC Mechanism of Action

- Target Binding – The ADC selectively binds to a specific antigen on the cancer cell surface.

- Internalization – The cancer cell engulfs the ADC through receptor-mediated endocytosis.

- Drug Release – The linker is cleaved inside the cell, releasing the chemotherapy payload.

- Cell Death – The cytotoxic agent disrupts key cellular functions, leading to apoptosis.

2. Key Trends & Advancements in ADC

Antibody-drug conjugates (ADCs) are evolving rapidly, with innovations aimed at improving efficacy, reducing toxicity, and expanding their use across different cancer types. Below are key trends and advancements shaping the future of ADCs.

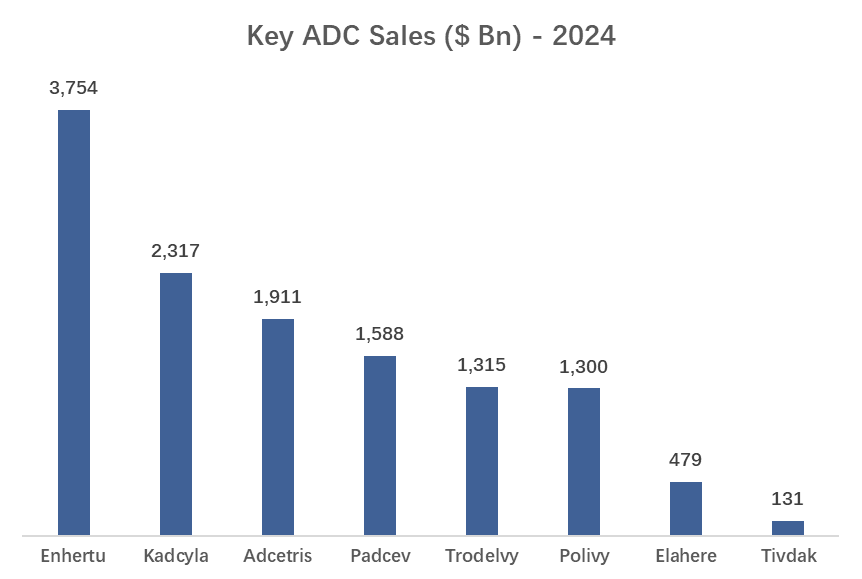

3. Approved ADCs - Sales & Forecast

As of March 2025, several antibody- drug conjugates (ADCs) have received approval from the U.S. Food and Drug Administration (FDA) for various cancer treatments.

4. Pipeline Analysis and Expected Approval Timelines

Antibody-drug conjugates (ADCs) continue to be a focal point in oncology drug development, with several candidates progressing through clinical trials and anticipated to receive regulatory approvals in the coming years.

5. Market Size & Forecasting

The global antibody-drug conjugates market was valued at $13.81 billion in 2024 and is anticipated to be valued at US$ XX million by 2033, registering a CAGR of 15-17% over the forecast period.

Unmet Needs

| Unmet Need | Challenges | Potential Solutions |

| Tumor Heterogeneity | Some tumors lack uniform antigen expression, reducing ADC efficacy. | - Development of bispecific or multi-target ADCs. - Use of biomarkers for better patient selection. |

| Drug Resistance | Tumors develop resistance by downregulating antigen expression or increasing drug efflux. | - Combination therapies (e.g., ADCs + checkpoint inhibitors). - Use of alternative cytotoxic payloads to bypass resistance. |

| Toxicity Management | Off-target effects and systemic toxicity limit therapeutic windows. | - Develop more stable linkers and tumor-specific payload release mechanisms. - Optimized dosing strategies. |

| Limited Penetration in Solid Tumors | ADCs face challenges in penetrating dense tumor tissues, reducing efficacy. | - Engineering smaller ADC formats (e.g., nanobody-drug conjugates). - Modifying antibody affinity to enhance tumor uptake. |

| Expansion Beyond Oncology | ADCs are primarily focused on cancer treatment, with limited applications in other diseases. | - Research into ADCs for autoimmune and infectious diseases. - Development of ADCs targeting immune cells. |

| Manufacturing Complexity | ADC production requires precise conjugation and high purity, increasing costs. | - Improving site-specific conjugation technologies. - Streamlining large-scale production processes. |

| Cost & Accessibility | High development costs make ADCs expensive, limiting patient access. | - Exploring biosimilar ADCs. - Partnering with healthcare systems for cost-effective treatment strategies. |

6. Competitive Landscape and Market Positioning

The competitive landscape of the ADC market is dynamic, with established pharmaceutical companies and emerging biotech firms striving for market share through innovation and strategic alliances. As the market continues to grow, companies that effectively navigate technological advancements and collaborative opportunities are well-positioned to lead in the evolving ADC sector.

Key Players and Market Positioning

| Company | Key ADC Products | Market Position & Strategy | Recent Developments |

| Seagen (Pfizer) | Adcetris®, Padcev®, Tivdak® | Market leader in ADC technology, acquired by Pfizer for $43B. | Pfizer completed Seagen acquisition in 2024 to expand the ADC pipeline. |

| Daiichi Sankyo | Enhertu®, Datopotamab Deruxtecan | Strong partnership with AstraZeneca; leading in HER2-targeting ADCs. | Enhertu generated $3.75B in 2024 sales. |

| AstraZeneca | Enhertu®, Datopotamab Deruxtecan | Focused on solid tumor ADCs with Daiichi Sankyo collaboration. | Expanding ADC portfolio beyond breast cancer. |

| Gilead Sciences | Trodelvy® | Entered ADC market through $21B Immunomedics acquisition. | Expanding Trodelvy into new cancer indications. |

| AbbVie | Teliso-V, Elahere® | Invested $10B in ImmunoGen, targeting solid tumors. | Developing next-gen ADCs for NSCLC. |

Key Companies:

7. Target Opportunity Profile (TOP) & Benchmarking

The Target Opportunity Profile (TOP) and Benchmarking framework help assess market potential, competitive positioning, and key differentiators in the ADC landscape.

Target Opportunity Profile (TOP)

| Criteria | Enhertu® (Daiichi Sankyo/AstraZeneca) | Trodelvy® (Gilead Sciences) | Adcetris® (Seagen/Pfizer) | Padcev® (Seagen/Pfizer) |

| Target Antigen | HER2 | Trop-2 | CD30 | Nectin-4 |

| Indications | Breast, gastric, lung cancers | TNBC, bladder cancer | Hodgkin lymphoma | Urothelial carcinoma |

| Approval Year | 2019 | 2020 | 2011 | 2019 |

| Efficacy (ORR% / mPFS) | 60% ORR / ~9.9 months | 31% ORR / ~5.6 months | 69% ORR / ~12 months | 40% ORR / ~4.4 months |

| Safety Profile | Moderate toxicity, ILD risk | Moderate toxicity, neutropenia | Manageable neuropathy risk | Manageable, rash risk |

| Sales (2024) | ~$3.75B | ~$1.32B | ~$1.9B | ~$1.6B |

| Market Differentiation | Best-in-class HER2 ADC | First-in-class Trop-2 ADC | Pioneer in lymphoma ADCs | First FDA-approved Nectin-4 ADC |

Key Takeaways:

- Enhertu® leads the HER2-ADC market but faces growing competition.

- Trodelvy® has a first-mover advantage in Trop-2 ADCs, but upcoming candidates may challenge its position.

- Adcetris® remains a strong player in hematologic malignancies, with competition from emerging CD30-targeting therapies.

- Padcev® dominates Nectin-4 ADCs, but newer candidates are emerging in urothelial cancer.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

2. Make Data-Driven Decisions

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

3. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

4. Optimize R&D and Clinical Development

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

5. Enhance Market Access & Pricing Strategy

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

- Ensure smooth market entry and optimize pricing strategies for better adoption. your needs!

6. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

7. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.