Global Wind Blade Market Size Overview

The global wind blade market reached US$23.9 billion in 2023, rising to US$25.7 billion in 2024 and is expected to reach US$45.2 billion by 2032, growing at a CAGR of 7.2% from 2025 to 2032.

The global wind blade market is witnessing steady growth, driven by the accelerating shift toward renewable energy and the rising demand for sustainable power generation. Wind blades are essential components of wind turbines, designed to maximize energy conversion efficiency and reliability.

Continuous advancements in composite materials, aerodynamic designs, and automated manufacturing processes are improving blade performance and lifespan. Moreover, growing investments in both onshore and offshore wind farms, supported by favorable government policies and clean energy initiatives, are further boosting market expansion. With the increasing deployment of high-capacity turbines and innovative lightweight blade technologies, the wind blade market is set to experience strong growth in the years ahead.

Wind Blade Market Industry Trends and Strategic Insights

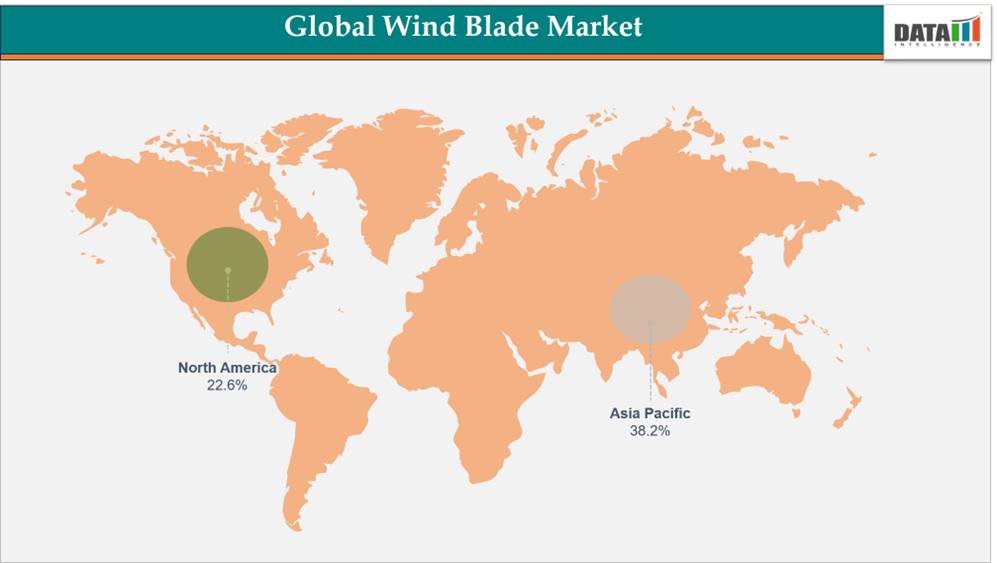

- Asia-Pacific leads the global wind blade market, capturing the largest revenue share of 38.2% in 2024.

- By material type segment, glass fiber-based leads the global wind blade market, capturing the largest revenue share of 41.4% in 2024.

Global Wind Blade Market Size and Future Outlook

- 2024 Market Size: US$25.7 billion

- 2032 Projected Market Size: US$45.2 billion

- CAGR (2025–2032): 7.2%

- Dominating Market: Asia-Pacific

- Fastest Growing Market: North America

Market Scope

| Metrics | Details |

| By Material Type | Glass Fiber, Carbon Fiber, Hybrid Composites, Other material types |

| By Blade Size | Up to 45 meters, 46-70 meters, above 70 meters |

| By Turbine Capacity | Up to 3 MW, 3 MW - 5 MW, above 5 MW |

| By Deployment | Onshore, Offshore |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rapid Expansion of Offshore Wind Projects

The accelerating development of offshore wind projects is a major factor driving growth in the global wind blade market. Offshore wind farms benefit from stronger and more consistent wind resources than onshore sites, resulting in higher energy yields and greater efficiency. As nations intensify their efforts toward carbon neutrality and renewable energy adoption, global investments in offshore wind infrastructure are expanding rapidly.

For instance, in October 2023, RES, GEV Wind Power, Outreach Offshore, and Rix Renewables formed the Offshore Wind O&M Partnership (OWOP) in the United Kingdom. This alliance unites specialized service providers to deliver comprehensive, long-term operations and maintenance (O&M) solutions for offshore wind assets. Such collaborations reflect the growing industrial maturity and coordinated approach within the offshore wind sector, which in turn fuels demand for durable, high-performance wind blades.

Offshore turbines typically require larger, stronger, and more advanced blades to harness greater wind energy and withstand harsh marine conditions. As a result, manufacturers are focusing on innovative aerodynamic designs, composite material advancements, and automated blade production. The global push for offshore capacity expansion, supported by strategic partnerships like OWOP, is propelling continuous innovation and market growth in the wind blade industry.

Moreover, several governments are launching favorable policies and financial incentives to accelerate offshore wind deployment, boosting private sector participation. The rising installation of floating wind farms in deep-water regions is also opening new opportunities for advanced blade designs. Collectively, these developments are solidifying offshore wind as a cornerstone of the renewable energy transition, significantly amplifying demand for efficient and reliable wind blades.

Segment Analysis

The global wind blade market is segmented based on material type, blade size, turbine capacity, deployment and region.

Glass Fiber Segment Dominates the Market with Cost Efficiency and Proven Reliability

The glass fiber segment holds a significant share of the global wind blade market, primarily due to its excellent balance of cost-effectiveness, mechanical strength, and resistance to environmental degradation. Glass fiber remains the material of choice for most onshore and offshore wind turbine blades, offering a superior strength-to-weight ratio and fatigue resistance essential for long-term turbine performance.

In 2024, several leading manufacturers, including LM Wind Power and Vestas, continued to advance glass fiber composite technologies to meet the structural demands of next-generation wind turbines. Notably, DecomBlades partners, in collaboration with 3B-Fibreglass, have established a sustainable recycling pathway for glass fiber recovered from decommissioned wind blades marking a significant move toward circularity in the wind energy sector. This initiative underscores the industry's commitment to reducing composite waste and integrating recycled materials into new blade production.

Further, innovations in glass fiber reinforced polymers (GFRP) and production methods such as resin transfer molding (RTM) and vacuum-assisted infusion have improved blade strength, consistency, and manufacturing efficiency. These advancements enable the production of longer, lighter blades capable of capturing more energy at lower wind speeds.

Overall, the glass fiber segment continues to anchor the wind blade market, supported by its affordability, structural dependability, and increasing alignment with sustainability goals. As the global wind industry scales up to meet renewable energy targets, glass fiber composites will remain an indispensable material for high-performance, eco-efficient wind blade manufacturing.

Carbon Fiber Segment Grows Rapidly with Focus on Lightweight and High-Performance Blades

The carbon fiber segment is expanding quickly in the global wind blade market, driven by the need for stronger, lighter, and more efficient turbine designs. Its superior strength-to-weight ratio and stiffness make it ideal for manufacturing longer blades that boost energy capture while reducing structural stress.

Leading OEMs such as Siemens Gamesa, GE Vernova, and Vestas are increasingly using carbon fiber, particularly in offshore and high-capacity turbines. Advances in automated fiber placement (AFP), pultrusion, and hybrid composites combining carbon and glass fibers are helping lower costs and improve scalability.

Overall, carbon fiber is emerging as a key material for next-generation wind blades, supporting the industry’s push toward larger turbines, improved efficiency, and sustainable energy generation.

Geographical Penetration

Dominating Market : Asia-Pacific Leads the Global Wind Blade Market Driven by Renewable Energy Expansion and Technological Advancements

The global wind blade market is growing rapidly, with Asia-Pacific leading due to strong renewable energy adoption, supportive policies, and advances in composite manufacturing. In 2024, China, India, Japan, and South Korea dominated regional growth through large-scale onshore and offshore wind installations and technology collaborations. A key highlight in 2024 was Vestas’ order to supply 21 V236-15.0 MW turbines for the 315 MW Oga Katagami Akita Offshore Wind Project in Japan, reflecting the country’s growing focus on offshore wind energy.

Innovation in glass and carbon fiber composites, automation, and recycling initiatives continues to enhance turbine efficiency and sustainability. Overall, Asia-Pacific is expected to remain the largest and fastest-growing market through 2025, supported by strong policies and renewable energy investments.

India Wind Blade Market Insights

India represents one of the most dynamic markets in the Asia-Pacific region, supported by an expanding renewable energy portfolio and the government’s focus on achieving ambitious wind power capacity targets. Policies under the National Wind-Solar Hybrid Policy and Make in India initiative are encouraging domestic manufacturing and technology localization. Ongoing investments in wind farms across Tamil Nadu, Gujarat, and Karnataka are boosting demand for durable and high-performance wind blades. Furthermore, collaborations with global OEMs and local suppliers are enhancing production efficiency and promoting sustainable industry growth.

China Wind Blade Market Growth

China remains the largest producer and consumer in the regional wind blade market, driven by extensive wind energy deployment and strong government backing for carbon neutrality goals. The country continues to invest heavily in offshore wind projects and next-generation turbine technology, increasing demand for lightweight and ultra-long carbon fiber blades. Domestic leaders such as Goldwind, MingYang Smart Energy, and Envision Energy are spearheading innovation through advanced blade designs and recycling initiatives. With continuous R&D investment and a focus on cost optimization, China is expected to maintain its dominance in the Asia-Pacific wind blade market.

Fastest Growing Market : North America Emerges as the Fastest-Growing Region Fueled by Renewable Energy Expansion and Advanced Wind Technologies

The global wind blade market is expanding rapidly, with North America emerging as the fastest-growing region, driven by strong renewable energy commitments, favorable policies, and continuous advancements in turbine design and materials. The region’s focus on carbon reduction, energy security, and large-scale wind farm development is accelerating demand for high-efficiency and durable wind blades

US Wind Blade Market Outlook

The US leads regional growth, supported by major investments in onshore and offshore wind projects, robust manufacturing infrastructure, and government incentives for clean energy deployment. Expanding offshore developments along the East Coast and the introduction of larger, more efficient turbine models are boosting demand for advanced glass and carbon fiber blades. Strategic collaborations between OEMs, material suppliers, and energy companies are fostering innovation and scaling up production capacity nationwide.

Canada Wind Blade Market Trends

Canada’s wind blade market is growing steadily, driven by expanding renewable energy initiatives and supportive government programs. Increased installation of onshore wind projects in provinces such as Alberta, Ontario, and Saskatchewan is creating strong demand for lightweight, weather-resistant blades. Partnerships between manufacturers, research institutes, and energy developers are further advancing local expertise and promoting sustainable production practices.

Overall, North America is set to remain the fastest-growing region in the global wind blade market, underpinned by strong policy support, rapid technological progress, and rising investment in renewable energy infrastructure.

Sustainability and ESG Analysis

Sustainability and ESG factors are becoming key drivers of transformation in the global wind blade market, shaping production processes, investment strategies, and corporate responsibility initiatives. Companies are increasingly prioritizing low-carbon manufacturing, circular economy principles, and responsible material sourcing to align with global climate and sustainability goals.

Vestas is a leader in this space, committed to achieving carbon neutrality by 2030 without the use of offsets. The company has set a long-term goal of producing zero-waste turbines by 2040, reflecting its dedication to circular design and waste minimization.

Vestas operates entirely on 100% renewable electricity, continuously improving material efficiency through higher recycling rates and sustainable manufacturing practices. It is also reducing emissions from its service operations by introducing hydrogen-powered vessels and low-emission vehicles.

These efforts highlight the wind industry’s growing alignment with ESG principles, emphasizing transparency, resource efficiency, and environmental stewardship. By embedding sustainability across the entire value chain, the global wind blade sector is advancing toward a more circular, carbon-free, and resilient future.

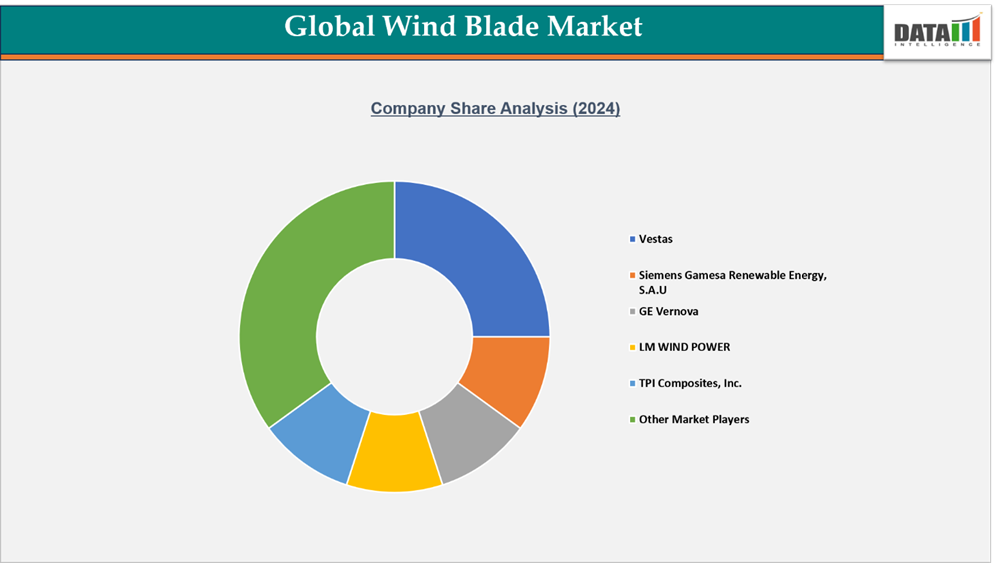

Competitive Landscape

- The global wind blade market is highly competitive, with participation from major international corporations and strong regional players. Key companies such as Vestas, Siemens Gamesa Renewable Energy S.A.U., GE Vernova, LM Wind Power, TPI Composites, and Nordex SE lead the market through advanced manufacturing capabilities, cutting-edge blade technologies, and sustained investments in R&D and composite innovation.

- Many companies are strengthening their global footprint by forming strategic partnerships, joint ventures, and establishing local production facilities in emerging wind power markets. Collaborations with digital and engineering solution providers are improving efficiency, performance monitoring, and maintenance optimization.

- Competition is increasingly shaped by sustainability commitments, advancements in recyclable and lightweight materials, and digitalization across design and production. Strong compliance with global standards, growing focus on circular economy practices, and innovation in offshore wind applications continue to define leadership and long-term competitiveness in the global wind blade industry.

Key Developments

- In August 2025: Envision Energy, a global leader in green technology, has achieved a major milestone in wind power innovation with its next-generation two-blade onshore smart turbine prototype. The turbine has successfully operated for over 500 days with an impressive 99.3% availability rate, a mean time between trips (MTBT) of 2,444 hours, and equivalent full-load hours of 3,048 per year. Field tests demonstrate that the two-blade turbine performs on par with conventional three-blade models operating under similar conditions.

Investment & Funding Landscape

The global wind blade market is experiencing notable investment momentum and strategic collaborations, underscoring growing confidence in sustainable and high-efficiency renewable energy technologies.

In 2025, Noida-based wind energy solutions provider Inox Wind announced an investment of approximately ₹4 billion (~$45 million) to establish a wind turbine blade manufacturing facility in Kushtagi, Koppal district, Karnataka. The project involves an initial investment of ₹3 billion (~$34 million), marking a significant step toward strengthening India’s domestic wind energy manufacturing ecosystem.

This initiative aligns with the country’s broader renewable energy goals and supports the global transition toward clean power generation. Such strategic investments reflect the industry’s focus on scaling production capacity, enhancing blade performance, and fostering regional manufacturing capabilities to meet rising global demand for sustainable wind energy solutions.

| Company | Investment/Funding | Year | Details | |

| Inox Wind | Investment | 2025 | Noida-based wind energy solutions provider Inox Wind announced an investment of approximately ₹4 billion (~$45 million) to establish a wind turbine blade manufacturing facility in Kushtagi, Koppal district, Karnataka. The project involves an initial investment of ₹3 billion (~$34 million), marking a significant step toward strengthening India’s domestic wind energy manufacturing ecosystem. | |

What Sets This Global Wind Blade Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by material type, blade size, turbine size, and deployment segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect wind blade commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.