Weight Management Supplements Market Size & Industry Outlook

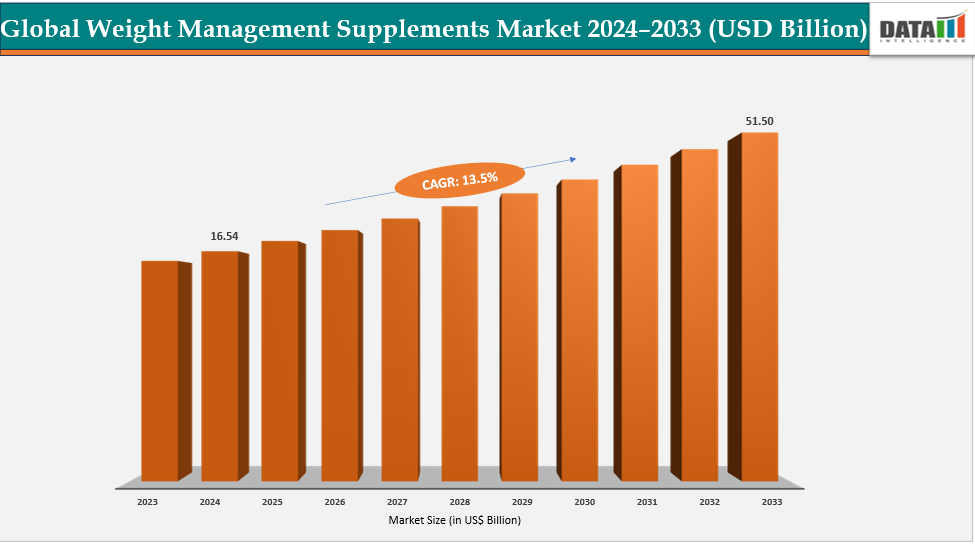

The global weight management supplements market size reached US$ 14.70 Billion in 2023 with a rise of US$ 16.54 Billion in 2024 and is expected to reach US$ 51.50 Billion by 2033, growing at a CAGR of 13.5% during the forecast period 2025-2033.

The market for weight-management supplements is increasing rapidly due to a trend toward preventative care and increased health awareness. Nowadays, consumers place a higher value on preserving wellness through a healthy diet and way of life. Because they are thought to be safer, cleaner, and devoid of dangerous chemicals, natural and plant-based products are strongly preferred. The growing popularity of botanical extracts, herbal mixes, and organic formulations is in line with the global trend toward eco-friendly living and sustainability. Moreover, influencers and social media are accelerating the movement toward natural wellness remedies.

Key Highlights

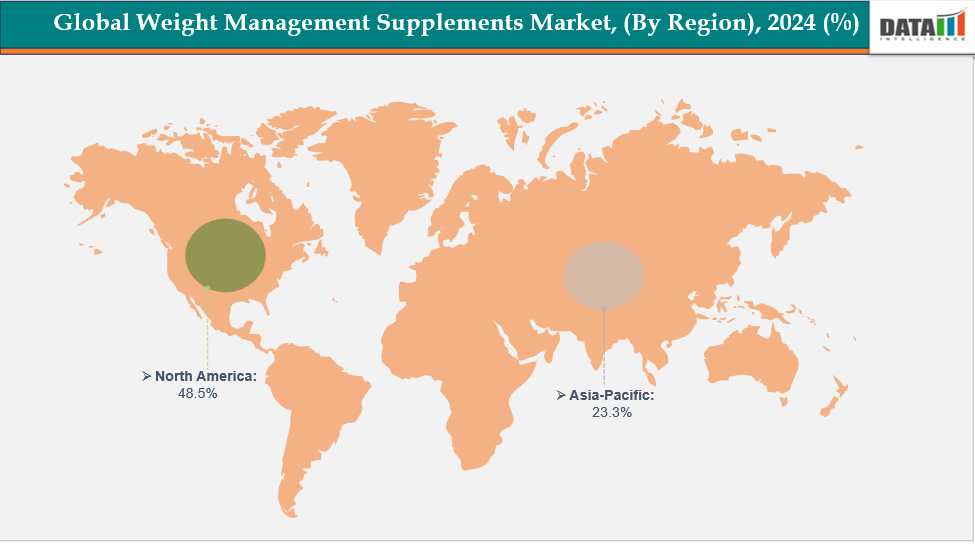

- North America is dominating the global weight management supplements market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global weight management supplements market, with a CAGR of 7.7% in 2024

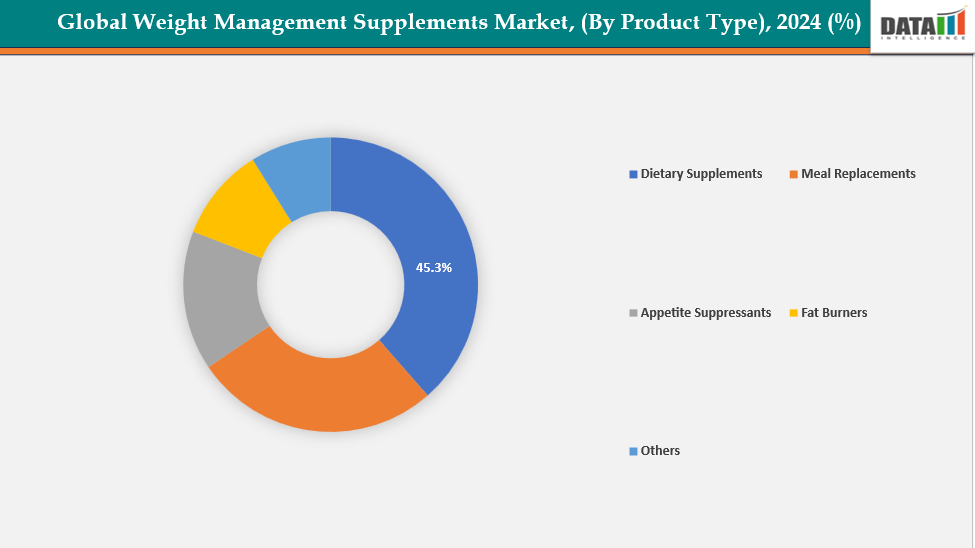

- The dietary supplements segment from product type is dominating the weight management supplements market with a 45.3% share in 2024

- The powders segment form is dominating the weight management supplements market with a 41.3% share in 2024

- Top companies in the weight management supplements market include Abbott Nutrition, Glanbia plc, Herbalife International, Inc., NOW Foods, Himalaya Wellness Company, Atkins Nutritionals Inc., Nestlé Health Science, MuscleTech, Nutrafy Wellness Private Limited, Amway, and Oriflame Cosmetics AG, among others.

Market Dynamics

Drivers: Rising obesity and metabolic disease prevalence are accelerating the growth of the weight management supplements market

The market for weight management supplements is mostly driven by the rise in metabolic diseases and obesity. Worldwide, people are gaining weight quickly as a result of more sedentary lifestyles and poor nutrition. The dangers of obesity for heart disease and diabetes are becoming more widely known. For instance, according to WHO data published in 2024, overweight and obesity were among the leading causes of disability and death in the European Region, affecting around 60% of adults, one-third of school-aged children, and 8% of children under five.

Additionally, customers favor simple, natural solutions over rigid diets or surgery. Supplements for weight management aid in regulating hunger, boosting fat burning, and improving metabolism. Companies are being encouraged to experiment with herbal and clinically proved compounds due to the rising number of overweight people in the world.

Restraints: Efficacy skepticism and weak clinical evidence for many ingredients are hampering the growth ofthe weight management supplements market

Weak clinical data and skepticism about efficacy are main reasons impeding the market's expansion for weight management products. Many products make quick weight loss claims without solid scientific evidence. Customers are growing warier of unsubstantiated ingredients and overstated advertising promises. A lack of standardized clinical trials erodes consumer confidence in the efficacy of products.

Furthermore, regulatory agencies frequently doubt the legitimacy and safety of specific synthetic or botanical substances. Health care providers are also hesitant to suggest such supplements in the absence of evidence of their effectiveness. Customers consequently turn to prescription or clinically verified substitutes.

For more details on this report, see Request for Sample

Segmentation Analysis

The global weight management supplements market is segmented based on product type, form, distribution channel and region

By Product Type: The dietary supplements segment from product type is dominating the weight management supplements market with a 45.3% share in 2024

The market for weight-management supplements is dominated by the dietary supplement category. Vitamins, minerals, herbal extracts, and protein-based products that aid in fat loss and metabolism are included in this category. Dietary supplements are preferred by consumers due to their accessibility and ease of use. Their adoption is being fueled by rising knowledge of preventive healthcare. These vitamins support better digestion, increased energy, and hunger control.

Moreover, companies are introducing innovative and natural formulations and ingredients to attract health-conscious consumers. For instance, in March 2025, the FDA published 75 new 75-day Premarket Notifications for New Dietary Ingredients. Several NDINs were reviewed and acknowledged, including those for Omega-3 Fish Oil, Deep Sea Minerals, and Chios Mastic Gum Powder, reflecting strong supplement innovation.

By Form: The powders segment form is dominating the weight management supplements market with a 41.3% share in 2024

The market for weight-management supplements is dominated by the powders category. Powders are simple to eat and can be added to smoothies, milk, or water. In contrast to tablets or capsules, they provide higher rates of absorption. Powders are preferred by customers due to their rapid outcomes and adjustable dosage. Powder supplements are frequently used by sportsmen and fitness enthusiasts for energy and recuperation. Meal replacement shakes' rising appeal contributes to the segment's expansion.

Additionally, producers are introducing plant-based and flavored powders to appeal to consumers who are health-conscious. Protein, fiber, and thermogenic components that promote fat burning and weight management are frequently included in these goods. For instance, in June 2024, 1440 Foods launched the Pure Protein All-in-One Powder for weight management. The formula combined 25 g whey protein, 10 g collagen, 6 g fiber, and 14 essential vitamins and minerals per serving, supporting balanced nutrition and wellness.

Geographical Analysis

North America is dominating the global weight management supplements market with a 48.5% in 2024

North America dominates the global market for weight management supplements because of its high obesity prevalence, sophisticated product innovation, and high customer awareness. Active lifestyle habits, broad retail availability, and ongoing introductions of clinically supported meal replacement, fat-burning, and dietary items all contribute to the region's dominance.

In the USA, market growth is driven by rising obesity rates, strong consumer awareness, innovative product formulations, expanding e-commerce channels, high adoption of dietary and protein-based supplements. Moreover, the recent launch of new products for companion combos to support weight management. For instance, in February 2024, Herbalife launched its GLP-1 Nutrition Companion Product Combos in the United States and Puerto Rico. The products were designed to support individuals on weight-loss medications by providing balanced nutrition for sustained and healthy weight management.

Europe is the second region after North America which is expected to dominate the global weight management supplements market with a 34.5% in 2024

In Europe the market for weight management supplements is growing due to rising obesity rates, increasing health awareness, and demand for natural ingredients. Market expansion and innovation throughout the region are being propelled by ongoing product introductions, favorable EU laws, growing e-commerce, and consumers' strong preference for plant-based and meal replacement goods.

Owing to factors like new product launches, for instance, in August 2025, Leanova launched its evidence-based, plant-based weight loss supplement in the UK market. The once-daily vegan capsule was formulated to support sustainable wellness by enhancing metabolism, controlling appetite, and promoting gradual, healthy fat reduction.

Germany’s weight management supplements market is driven by high health awareness, strong regulatory standards, and demand for scientifically proven formulations. Rising obesity rates, expanding fitness culture, and growing preference for natural, plant-based, and protein-enriched products are fueling consistent market growth and consumer adoption.

The Asia Pacific region is the fastest-growing region in the global weight management supplements market, with a CAGR of 7.7% in 2024

The market for weight management supplements in Asia-Pacific, including China, India, South Korea, and Japan, is expanding rapidly due to rising obesity rates, growing health awareness, and increasing disposable income. Urbanization, fitness trends, e-commerce expansion, and strong demand for natural, herbal, and protein-based supplements further drive regional market growth.

China’s weight management supplements market is expanding rapidly, driven by rising obesity rates, increasing disposable income, and growing health consciousness among consumers. The market benefits from continuous innovation, local brand expansion, and strong demand for natural and functional ingredients, supported by favorable regulatory approvals and launches growth across the nation. For instance, in August 2023, Germany’s Mom’s Garden GmbH expanded its presence in China by launching the Princess Luna weight management supplement. The formulation combined postbiotics and botanical extracts functioning as AMPK activators to naturally support metabolism and healthy weight regulation.

Competitive Landscape

Top companies in the weight management supplements market include Abbott Nutrition, Glanbia plc, Herbalife International, Inc., NOW Foods, Himalaya Wellness Company, Atkins Nutritionals Inc., Nestlé Health Science, MuscleTech, Nutrafy Wellness Private Limited, Amway, and Oriflame Cosmetics AG, among others.

Abbott Nutrition: Abbott Nutrition is a global leader in science-based nutrition, offering a range of products that support weight management and overall wellness. Through brands like Ensure, Glucerna, and Protality Nutrition Shake, Abbott provides clinically formulated meal replacements and protein supplements designed to promote muscle health, manage calorie intake, and support balanced nutrition for effective and sustainable weight management.

Key Developments:

- In July 2025, Herbalife Ltd. launched MultiBurn, a next-generation, science-backed dietary supplement formulated with clinically studied botanical extracts to support metabolic health. Developed by Herbalife’s global scientific team, MultiBurn is vegan, gluten-free, and free from synthetic colors or dyes.

- In April 2025, UK-based wellness brand Elénzia expanded its supplement portfolio by launching a science-backed GLP-1 booster, designed to support appetite control and blood sugar regulation through clinically studied ingredients and advanced nutritional formulation.

- In December 2024, SUANNUTRA, S.L., launched SuanBlend, an innovative digital platform designed to help dietary supplement companies create novel, science-based products using botanical extracts and advanced ingredient combinations, supported by SUANNUTRA’s extensive expertise and formulation capabilities.

Market Scope

| Metrics | Details | |

| CAGR | 13.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Dietary Supplements, Meal Replacements, Appetite Suppressants, Fat Burners and Others |

| By Form | Powders, Capsules, Tablets, Gummies and Others | |

| By Distribution Channel | Online Pharmacies, Retail Pharmacies, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global weight management supplements market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Women's and men's health-related reports, please click here