Veterinary Orthopedics Market Size and Growth

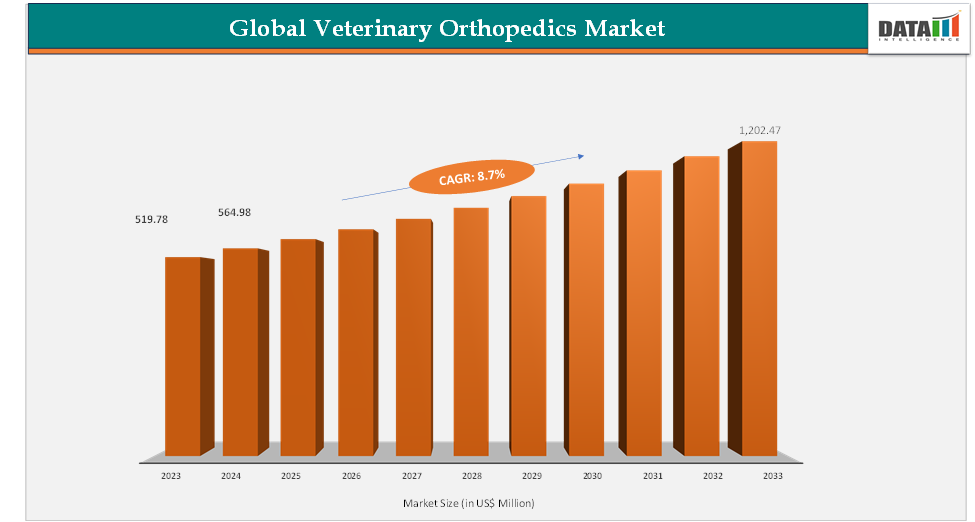

The global veterinary orthopedics market size reached US$ 519.78 million in 2023, with a rise to US$ 564.98 million in 2024, and is expected to reach US$ 1,202.47 million by 2033, growing at a CAGR of 8.7% during the forecast period 2025–2033. The veterinary orthopedics market is witnessing steady growth, fueled by increasing pet ownership, rising awareness of animal health, and a growing demand for advanced surgical care for musculoskeletal conditions. Technological advancements, including 3D-printed implants, minimally invasive procedures, and biologic therapies, are enhancing treatment outcomes and expanding clinical capabilities. The market is further supported by a surge in veterinary training, improved diagnostic tools, and greater investment from key players in developing precision instruments and customizable implant solutions. As pet owners increasingly prioritize long-term mobility and quality of life for their animals, the market is positioned for sustained expansion across both developed and emerging regions.

Key Market Trends & Insights

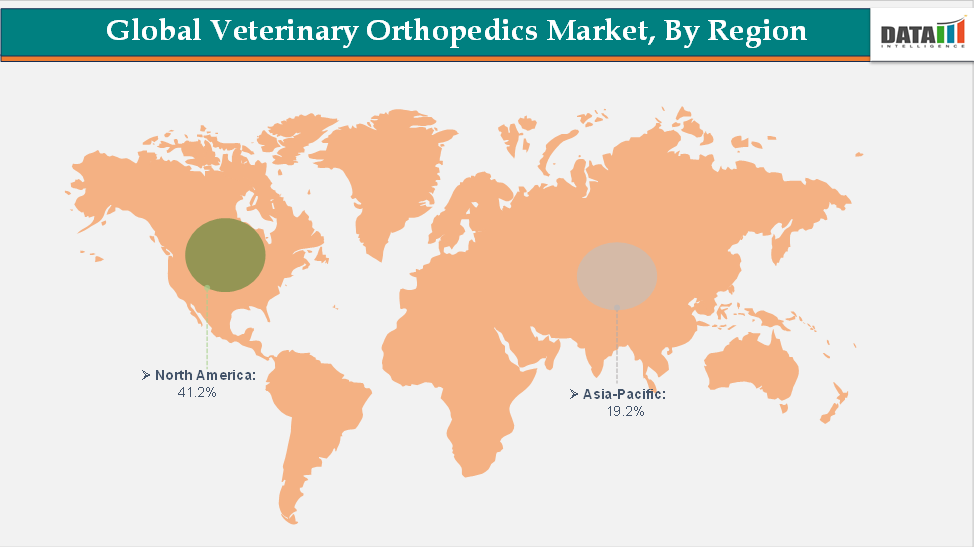

North America accounted for approximately 41.2% of the Veterinary Orthopedics market in 2024 and is expected to maintain its leading position throughout the forecast period. This dominance is supported by a well-established veterinary healthcare system, high pet ownership rates, and strong consumer willingness to invest in advanced surgical care.

Asia-Pacific is projected to be the fastest-growing region, driven by rising pet adoption, growing awareness of animal health, expanding access to veterinary care, and increasing investments in veterinary infrastructure across emerging economies like China, India, and Southeast Asia. Rapid urbanization, improved disposable incomes, and the expansion of animal health insurance are further boosting demand for high-quality orthopedic treatments in the region.

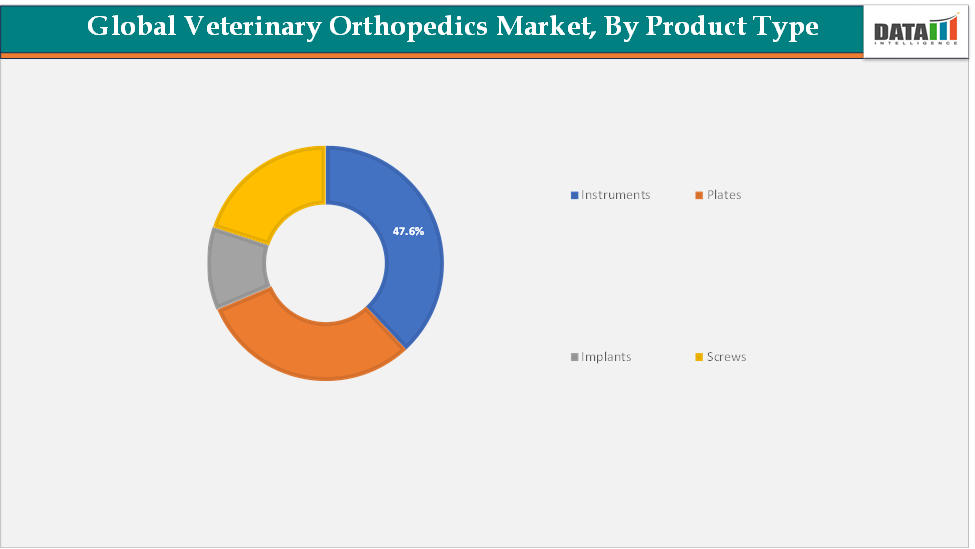

Orthopedic instruments remain the dominant product segment, owing to their essential role in surgical procedures such as fracture fixation, joint stabilization, and ligament repair. Their high usage rate in both routine and complex surgeries, combined with continuous innovation in materials and design, makes instruments a critical and recurring revenue stream for manufacturers.

Market Size & Forecast

2024 Market Size: US$ 564.98 Million

2033 Projected Market Size: US$ 1,202.47 Million

CAGR (2025–2033): 8.7%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Rising Pet Ownership & Companion Animal Spending

Rising pet ownership and growing spending on companion animal healthcare are major drivers of the veterinary orthopedics market, as more households treat pets like family members and willingly invest in advanced treatments such as TPLO surgeries, joint replacements, and trauma repair; coupled with longer pet lifespans and the higher prevalence of age-related conditions like arthritis and hip dysplasia, this has fueled demand for orthopedic care. For instance, according to the American Veterinary Medical Association, in 2024, dogs were owned by 45.5% of U.S. households, totaling about 59.8 million, while cats were present in 32.1% of households, accounting for roughly 42.2 million. On average, annual veterinary spending reached $580 for dogs and $433 for cats. This reflects the expanding companion animal base that sustains long-term demand for veterinary orthopedic solutions.

Moreover, advancements in surgical technologies are making orthopedic treatments more precise and accessible, encouraging wider adoption across veterinary clinics and hospitals. Increasing awareness of pet health and the emotional value attached to companion animals are also influencing owners to opt for specialized care, even at higher costs. Collectively, these factors are positioning veterinary orthopedics as one of the most dynamic and rapidly expanding segments within the broader veterinary healthcare industry.

Restraint: Post-Surgical Complications and Long Recovery Periods

Post-surgical complications and long recovery periods could hamper the growth of the veterinary orthopedics market because many advanced orthopedic procedures, such as joint replacements or ligament repairs, carry risks of infections, implant failures, or poor healing outcomes, which may discourage pet owners from opting for them despite their benefits; additionally, extended recovery timelines requiring strict rest, rehabilitation, and frequent follow-ups can be difficult for both pets and owners to manage, leading to higher overall costs and emotional strain, thereby reducing the willingness of some owners to pursue surgical solutions and limiting the market’s expansion potential.

For more details on this report, Request for Sample

Market Segmentation Analysis

The veterinary orthopedics market is segmented by product type, application, end-user, and region.

Product Type-The instruments segment is estimated to have 47.6% of the veterinary orthopedics market share.

The instruments segment is expected to dominate the veterinary orthopedics market because surgical procedures for pets, such as fracture fixation, joint replacement, and ligament repair, require a wide variety of specialized tools, including bone plates, screws, drills, forceps, and saws, which are indispensable in nearly every operation. Unlike implants, which are patient-specific and replaced after each use, instruments are reusable, high in demand across clinics and hospitals, and critical for enabling precision and safety in orthopedic surgeries.

Additionally, continuous advancements in surgical instrument design, durability, and ergonomics, along with the rising number of orthopedic procedures due to increasing pet ownership and age-related conditions, reinforce the instruments segment’s dominance in driving market revenue.

Market Geographical Share

The North America veterinary orthopedics market was valued at 37.20% market share in 2024

North America is expected to dominate the veterinary orthopedics market due to its high rate of pet ownership, substantial spending on companion animal healthcare, and well-established veterinary infrastructure. The region has a large base of pets suffering from age-related orthopedic conditions, such as arthritis and hip dysplasia, creating a strong demand for advanced treatments. In America, adoption rates for both dogs (57%) and cats (64%) increased.

Additionally, the widespread availability of skilled veterinary professionals, the adoption of cutting-edge technologies such as 3D-printed implants and minimally invasive surgical techniques, and the presence of leading market players contribute to the region’s leadership. Favorable insurance coverage for pet healthcare and a culture of treating pets as family further drive willingness to invest in costly orthopedic procedures, solidifying North America’s dominance in this market.

The Asia-Pacific veterinary orthopedics market was valued at 18.60% market share in 2024

The Asia Pacific is the fastest-growing region in the veterinary orthopedics market, driven by rapidly increasing pet ownership, rising disposable incomes, and growing awareness of advanced veterinary care across countries such as China, India, and Japan. Urbanization and the humanization of pets are driving higher spending on companion animal health, including specialized orthopedic treatments for fractures, joint disorders, and age-related conditions.

The expansion of veterinary clinics and hospitals, coupled with improving access to advanced surgical instruments and implants, is further accelerating market growth. Additionally, rising investments by global veterinary companies and local manufacturers in emerging economies, along with increasing adoption of pet insurance, are enhancing affordability and accessibility, positioning the Asia Pacific as the fastest-growing region in this market.

Market Competitive Landscape

The major players in the veterinary orthopedics market include BioMedtrix, LLC, Integra LifeSciences Corporation, Fusion Implants, Arthrex, Inc., KYON AG, Narang Medical Limited, Cencora, Inc., GerMedUSA, Orthomed (UK) Ltd, among others.

BioMedtrix, LLC: BioMedtrix, LLC is a key player in the veterinary orthopedics market, specializing in advanced implants and surgical solutions for companion animals. The company is particularly recognized for its Total Hip Replacement (THR) systems, widely used in dogs with severe hip dysplasia and arthritis. With a strong reputation for innovation and quality, BioMedtrix supports veterinarians worldwide by providing reliable orthopedic products that enhance mobility and improve the quality of life in pets, thereby reinforcing its leadership in the sector.

Key Developments:

- In August 2022, Vimian Group’s Movora acquired New Generation Devices (NGD), a New Jersey–based veterinary orthopedic implant company. The acquisition enhanced Movora’s portfolio by adding products such as TPLO and fracture plates, while also broadening its customer base and strengthening its presence in the U.S. veterinary orthopedics market.

Market Scope

Metrics | Details | |

CAGR | 8.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Instruments, Plates, Implants, Screws |

Application | Total Knee Replacement, Total Elbow Replacement, Total Hip Replacement, Trauma, Others | |

End-User | Veterinary Hospitals, Clinics, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The veterinary orthopedics market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more veterinary health-related reports, please click here