Global Vehicle Subscription Market is Segmented By Type (Single Brand Subscription, Multi Brand Subscription), By Service Provider (OEM/Captives, Third Party Providers), By Subscription Period (1 to 6 Months, 6 to 12 Months, More than 12 Months), By Vehicle Type (IC Engine Vehicle, Electric Vehicle, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Market Size

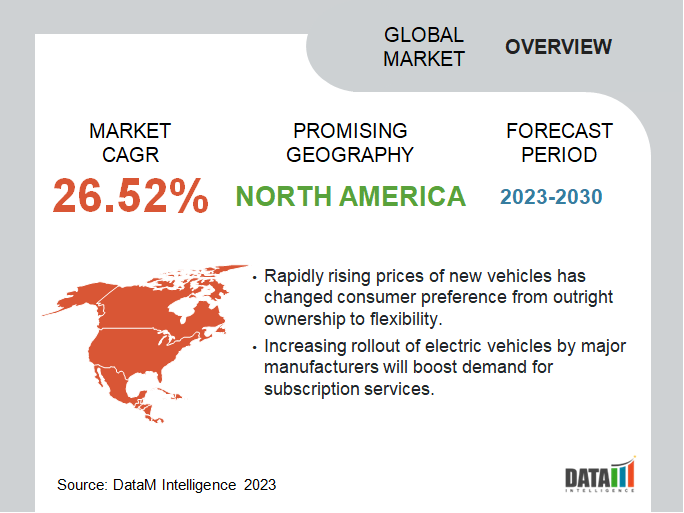

Global Vehicle Subscription Market reached USD 3.2 billion in 2022 and is expected to reach USD 18.2 billion by 2030, growing with a CAGR of 24.2% during the forecast period 2023-2030. Over the forecast period, changing consumer preferences will be a key factor in driving global vehicle subscription market growth.

Consumer mentality has shifted from outright vehicle ownership to increased demand for flexibility and convenience. Recognizing this shift, companies are expanding their subscription offerings to various price points in order to appeal to a wider range of customers.

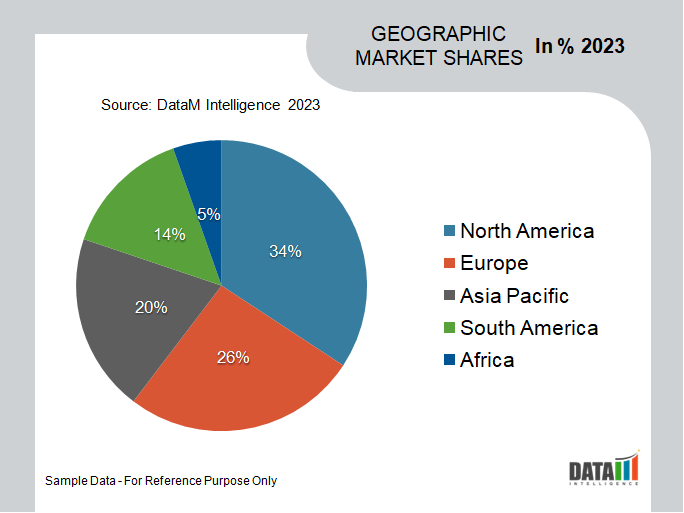

Emerging regions such as Asia-Pacific are also poised for major growth in vehicle subscription services. Relatively low incomes and high taxes on new vehicles makes car ownership difficult for a vast majority of the people in these regions. To increase vehicle penetration, automotive companies are rolling out affordable subscription services in these regions. For instance, in February 2023, Hyundai launched its ‘No Commitment’ electric vehicle subscription service for the Indian market.

Report Scope

|

Metrics |

Details |

|

CAGR |

24.2% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Type, Service Provider, Subscription Period, Vehicle Type and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics

Rising Costs of Vehicle Ownership

As modern cars have become increasingly sophisticated, their ownership costs have increased. According to a recent analysis by the American Automobile Association (AAA), the average annual cost of ownership for a brand new passenger car in 2022 was USD 10,738 representing an 11% increase from the previous year. Insurance, fuel, fluids and other consumables and maintenance are some of the biggest expenses in car ownership.

The increasing costs of vehicle ownership have led consumers to explore alternative vehicle usage models. It has led to a surge in the popularity of vehicle leasing and vehicle subscription services. Vehicle subscription is more short-term as compared to vehicle leasing and offers greater flexibility to consumers. The monthly payments are inclusive of maintenance and insurance and are often lower when compared to monthly auto loan payments on new car purchases.

Increasing Rollout of Electric Vehicles

With growing environmental consciousness and increasing demand for zero emission vehicles, automotive manufacturers are gradually expanding their lineup of electric vehicles (EVs). On average, electric vehicles are atleast USD 10,000 more expensive than comparable conventional vehicles. Although new innovations have brought down EV operating costs significantly, the high upfront costs still dissuades consumers from EV adoption.

As a result, automotive companies are rolling out subscription services to increase EV adoption. Subscriptions allow consumers to experience the benefits of electric vehicles without the associated high upfront purchase costs. It also provides an opportunity for consumers to try out different electric models without committing to long-term ownership.

Legal and Regulatory Barriers

Vehicle subscription services require various licenses and permits to ensure the legality of their operations. However, obtaining all licenses can be a complex process due to bureaucratic procedures. Countries can have different taxation policies for vehicle purchase, leasing and subscription, creating further complications for vehicle subscription companies.

Insuring a fleet of vehicles for subscription services creates unique and complex challenges. Determining liability in the event of accidents or damages can be complicated, especially when multiple parties are involved, such as the subscription provider, vehicle manufacturer and insurance companies. Insurance providers can be hesitant to offer competitive pricing due to the nature of the vehicle subscription model, resulting in higher costs for subscription providers.

Similarly some countries have zoning restrictions, which restricts parking for commercial vehicles. Such laws also include clauses classifying subscription vehicles as commercial vehicles, thus creating further complications. Legal and regulatory barriers present operational difficulties for vehicle subscription companies and constraint the growth of the global market.

Segmentation Analysis

The global vehicle subscription market is segmented based on type, service provider, subscription period, vehicle type and region.

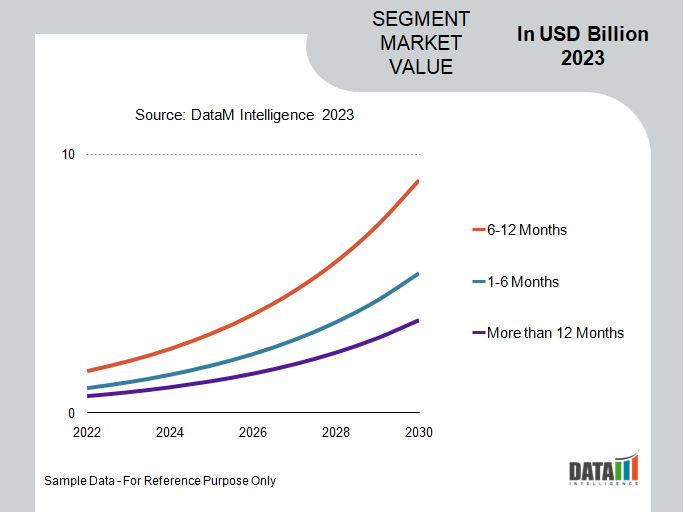

6-12 Month Subscription Period is Mostly Preferred by Consumers

6-12 months is the most popular period of vehicle subscription by consumers. It is favored by customers since it entails lower costs than the 1-6 month period plans and is more flexible than 12 month+ subscription plans. The plan offers the optimum balance between the convenience of long term vehicle access along with the potential flexibility to change transportation options, if the need arises.

Subscriptions lasting more than 12 months typically have higher costs and it is much more economical to consider long-term vehicle leasing. Similarly 1-6 month subscription period is more suitable for tourists and short-term business travellers, who require flexible transportation options.

Geographical Shares

Electric Vehicle Launches to Boost Vehicle Subscription Services in North America

North America is expected to account for more than a third of the global market over the forecast period. Vehicle subscription services are increasing in popularity across North America, especially in U.S., mainly on account of steep rises in new vehicle prices. Owing to semiconductors and other component shortages, new car prices rose dramatically in 2022, with vehicles of some brands selling for 6-8% more than their MSRP (maximum suggested retail price).

Vehicle subscription is becoming highly popular in U.S., with automotive manufacturers and third party providers launching various services. The market is expected to receive a further boost with the ongoing introduction of electric vehicle (EVs). Many automakers are launching subscription services to increase the adoption of electric vehicles. For instance, in February 2023, Hyundai, the South Korean automotive manufacturer, launched its Evolve+ vehicle subscription service for its range of electric vehicles.

Key Players

The major global players include Sixt, Avis Budget Group, Lyft, Inc., Arval BNP Paribas Group, The Hertz Corporation, ORIX Auto Corporation, Volvo Car Corporation, ALD Automotive, Carvolution and Mercedes Benz.

COVID-19 Impact on Vehicle Subscription Market

The COVID-19 pandemic created major challenges for the global vehicle subscription market. With stringent lockdowns and other movement restrictions, many people cancelled their existing subscriptions. Furthermore, the enrolment of new subscribers also declined drastically over the course of the pandemic.

As COVID-19 cases reduced with mass vaccination campaigns, governments started gradually easing restrictions. It led to a gradual recovery in demand for vehicle subscriptions. Supply chain disruptions in the pandemic’s aftermath constrained automotive production. It presented an opportunity for vehicle subscription companies to step in and offer their services to potential customers.

AI Impact Analysis

AI-based technologies will likely have an outsized impact on the global market. For instance, using big data analytics and sophisticated machine learning algorithms, subscription companies can identify vehicle usage patterns with variables such as type of car used, average distance travelled and average subscription period. It will allow companies to formulate new subscription plans better tailored to consumer needs.

AI-enabled technologies can also help companies to streamline their operations, thereby improving customer experience. AI algorithms can be used by companies to significantly improve app-based subscription services. It will simplify various operations such as subscription payments, renewals, insurance and thus greatly improve customer convenience.

Key Developments

- In October 2022, Stellantis, a major European automotive conglomerate, announced a partnership with Casi, to offer car subscription services to European consumers.

- In February 2023, Maruti Suzuki, an Indian automotive manufacturer, announced a partnership with SMAS Auto Leasing to launch a vehicle subscription program for the Indian market.

- In July 2023, Volkswagen, one of Germany’s biggest automotive manufacturer announced plans to grow by 40% in South America through the expansion of its electric vehicle subscription program in key markets such as Brazil and Argentina.

Why Purchase the Report?

- To visualize the global vehicle subscription market segmentation based on type, service provider, subscription period, vehicle type and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of vehicle subscription market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global vehicle subscription market report would provide approximately 64 tables, 64 figures and 195 Pages.

Target Audience 2023

- Automotive Manufacturers

- Vehicle Subscription Companies

- Automotive Insurance Companies

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies