Global Vehicle Scrapping Market: Industry Outlook

The global vehicle scrapping market reached US$ 75.05 billion in 2023, with a rise to US$ 81.08 billion in 2024, and is expected to reach US$ 182.00 billion by 2033, growing at a CAGR of 9.40% during the forecast period 2025–2033. The global vehicle scrapping market is experiencing consistent growth, driven by mounting environmental concerns, tightening emission standards, and government-supported recycling programs. The increasing number of end-of-life vehicles (ELVs), along with the worldwide emphasis on sustainable resource utilization, is creating strong demand for organized scrapping and recycling services. Rising vehicle ownership, coupled with shorter automotive lifecycles brought on by rapid technological innovation and electrification, is accelerating the replacement of aging, high-emission vehicles with cleaner, more fuel-efficient, or electric alternatives.

In the U.S., federal and state-level initiatives aimed at cutting carbon emissions and encouraging circular economy practices are shaping market dynamics. One of the most significant milestones was the Car Allowance Rebate System (CARS Act), widely known as the “Cash for Clunkers” program, introduced in 2009. Such scrappage schemes, along with new incentives for electric vehicle adoption, have bolstered structured recycling processes. Additionally, increasing recovery rates for steel, aluminum, and other materials are enhancing the sector’s overall economic value.

Japan’s market is largely influenced by stringent inspection requirements under the shaken system, which often prompts consumers to retire vehicles earlier than in many other countries to avoid steep compliance costs. This has fostered a highly advanced recycling ecosystem, where recycling rates exceed 90% for ELVs. The country’s adoption of cutting-edge dismantling technologies and efficient material recovery methods further strengthens its position as a global leader in vehicle recycling.

Overall, a combination of regulatory enforcement, financial incentives, and evolving consumer behavior is positioning the global vehicle scrapping market as a vital contributor to sustainability and resource efficiency across the automotive industry.

Key Market Trends & Insights

North America represented around 42.04% of the global vehicle scrapping market in 2024 and is anticipated to retain its leading position over the forecast period. This dominance is underpinned by robust emission control policies, government-supported scrappage programs, and growing demand for recycled raw materials such as steel and aluminum.

Asia Pacific is expected to record the fastest growth, driven by rapid urban development, rising vehicle ownership, and tightening government norms for end-of-life vehicles (ELVs). Increasing awareness of sustainable practices, coupled with Japan’s recycling efficiency exceeding 90%, is further boosting the region’s momentum.

The passenger vehicle scrapping segment continues to hold the largest share, supported by high turnover of aging cars, stricter environmental regulations, and a growing consumer shift toward fuel-efficient and electric models.

Market Size & Forecast

2024 Market Size: US$ 81.08 Billion

2033 Projected Market Size: US$ 182.00 Billion

CAGR (2025–2033): 9.40%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Growing Environmental Priorities and Emission Control Measures

The increasing emphasis on environmental protection and the tightening of global emission standards are major factors fueling the growth of the vehicle scrapping market. Rising concerns over air pollution and the growing number of end-of-life vehicles (ELVs) have prompted governments to adopt structured recycling and scrappage initiatives. For example, the European Union’s End-of-Life Vehicle Directive requires that 95% of a vehicle’s weight must be reused or recovered, thereby creating significant opportunities for regulated scrapping businesses. In the U.S., initiatives such as the “Cash for Clunkers” program and recent state-level policies promoting electric vehicle adoption are accelerating the retirement of older, high-emission cars.

At the same time, global vehicle ownership is rising, while rapid innovation in automotive technologies and the electrification trend are shortening vehicle lifecycles. These dynamics are encouraging the replacement of outdated models with fuel-efficient and electric alternatives. Growing awareness of climate change and the benefits of circular economy practices is further boosting the adoption of organized scrapping solutions, positioning the market for steady expansion in the years ahead.

Restraint: Significant Capital Needs and Regulatory Burden

While the vehicle scrapping market is expanding, its growth is constrained by high upfront investment requirements and complex regulatory environments. Setting up modern dismantling and recycling facilities demands substantial capital for land, equipment, and compliance with strict environmental and safety rules. Smaller and unorganized players often face difficulties meeting these standards, which limits scalability and leads to fragmented market operations.

In addition, regulations governing ELV recycling vary significantly across regions, creating operational challenges for global companies. In certain markets, the absence of uniform collection and dismantling guidelines slows the development of efficient recycling ecosystems, while in others, lengthy bureaucratic processes create further barriers. Market players also face profitability pressures due to fluctuating prices of recovered metals like steel, aluminum, and copper.

With governments pushing for higher environmental performance, recyclers are compelled to continuously upgrade technologies and implement more advanced systems, further driving up costs. These factors collectively act as restraints, particularly in developing economies where informal scrapping practices continue to dominate.

For more details on this report, Request for Sample

Segmentation Analysis

The global vehicle scrapping market is segmented based on vehicle type, material recovered, scrapping method,application, and region.

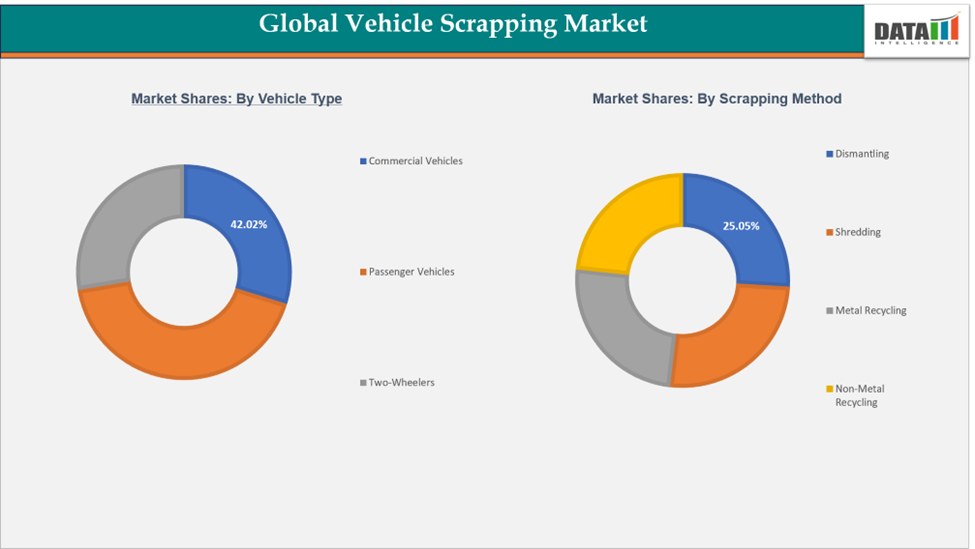

Vehicle Type:The passenger vehicles segment is estimated to have 42.02% of the vehicle scrapping market share.

The Passenger Vehicle Scrapping segment accounts for the largest share of the global market. This dominance is largely driven by the faster replacement cycle of passenger cars, spurred by stricter emission norms, evolving fuel efficiency standards, and growing adoption of hybrid and electric vehicles. Passenger cars also represent the majority of ELVs worldwide, making them the central focus of organized scrapping and recycling operations.

Additionally, dismantling passenger vehicles provides access to high-value recyclable materials, including steel, aluminum, plastics, and batteries, further boosting the segment’s economic importance. Their relatively shorter lifecycle compared to heavy-duty commercial vehicles, coupled with frequent technology upgrades and government incentives for new vehicle purchases, ensures that passenger vehicles remain the largest contributor to the scrapping market.

Geographical Analysis

The North America vehicle scrapping market was valued at 40.04% market share in 2024

North America remains the dominant region in the global vehicle scrapping market, supported by robust regulatory frameworks, growing environmental consciousness, and a well-developed recycling ecosystem. In the United States, landmark initiatives such as the CARS Act (“Cash for Clunkers”) significantly accelerated the removal of older, high-emission vehicles from circulation. More recently, federal and state-level policies aimed at reducing carbon emissions and encouraging the adoption of electric vehicles have further strengthened organized scrapping and recycling practices.

High vehicle ownership levels, combined with shorter replacement cycles driven by rapid technological upgrades and electrification, ensure a steady supply of end-of-life vehicles (ELVs) for dismantling. Rising recovery rates of steel, aluminum, and copper continue to enhance the economic value of recycling activities. Furthermore, the presence of advanced dismantling operators and structured recycling programs, along with policy-driven support for circular economy initiatives, reinforces North America’s leading role in the global market.

The Asia-Pacific vehicle scrapping market was valued at 32.05% market share in 2024

Asia-Pacific is positioned as the fastest-expanding region in the vehicle scrapping market, fueled by surging automotive ownership, stricter emission regulations, and rapid advancements in recycling infrastructure. Key markets such as China, India, and Japan are taking the lead with structured scrappage frameworks to handle the increasing flow of ELVs.

Japan’s rigorous shaken inspection system often makes it costly for consumers to keep aging vehicles, leading to earlier scrappage compared to global standards. As a result, Japan has built a highly efficient recycling industry, achieving ELV recycling rates of over 90%, powered by cutting-edge dismantling technologies and material recovery systems. China, on the other hand, has strengthened its ELV regulations and invested in large-scale recycling facilities to curb pollution and reclaim raw materials. Similarly, India’s 2021 Vehicle Scrappage Policy is designed to phase out polluting vehicles while incentivizing newer, fuel-efficient, and electric models.

The combination of a massive vehicle base, environmental priorities, and proactive government policies positions Asia-Pacific as a critical growth engine for the global vehicle scrapping market in the forecast period.

Competitive Landscape

The major players in the vehicle scrapping market include LKQ Corporation, Inc, Sims Limited., Covanta Holding Corporation and among others.

LKQ Corporation: LKQ Corporation, Inc. is a leading player in the global vehicle scrapping market, recognized for its comprehensive vehicle recycling and parts recovery operations. The company specializes in dismantling end-of-life vehicles (ELVs) and maximizing material recovery through advanced recycling systems. LKQ’s extensive network of facilities enables the efficient extraction and resale of reusable auto parts, metals, and other materials, supporting both environmental sustainability and economic value creation.

Market Scope

Metrics | Details | |

CAGR | 9.40% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Vehicle Type | Commercial Vehicles (Light Commercial Vehicles Heavy Commercial Vehicles), Passenger Vehicles, Two-Wheelers |

Material Recovered | Ferrous Metals, Non-Ferrous Metals, Plastics & Polymers, Rubber & Tires, Glass, Other Materials (electronics, fluids, rare earths from EV batteries) | |

Scrapping Method | Dismantling, Shredding, Metal Recycling, Non-Metal Recycling | |

| Application | New Product Manufacturer, Reusable Parts, OEMs, Aftermarket |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global vehicle scrapping market report delivers a detailed analysis with 42 key tables, more than 36 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more vehicle scrapping-related reports, please click here