Vehicle Analytics Market Overview

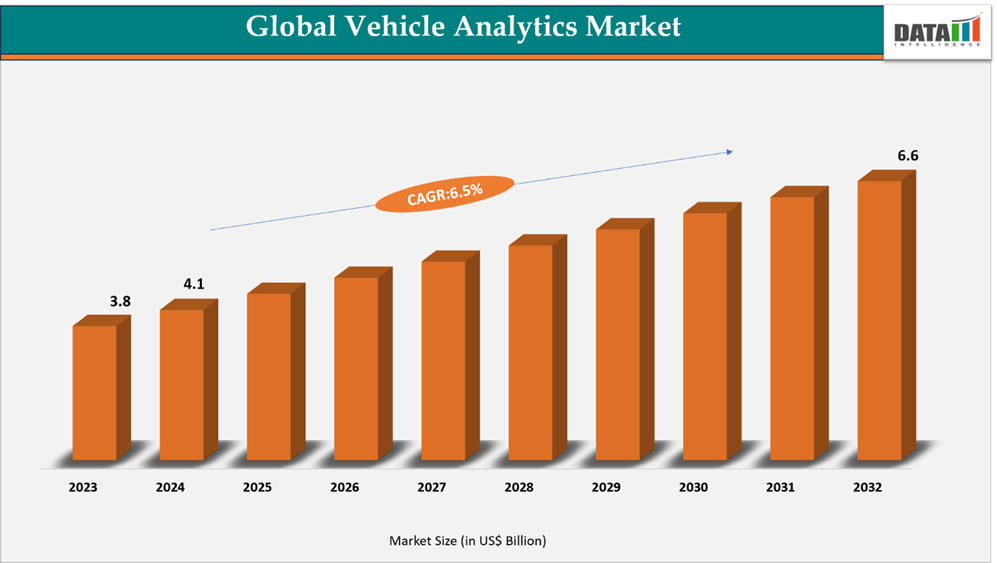

The global vehicle analytics market reached US$3.8 billion in 2023, rising to US$4.1 billion in 2024 and is expected to reach US$6.6 billion by 2032, growing at a CAGR of 6.5% from 2025 to 2032.

The global vehicle analytics market is witnessing steady growth, driven by the rising need for data-driven insights to improve vehicle safety, performance, and operational efficiency. Vehicle analytics solutions facilitate real-time monitoring, predictive maintenance, and intelligent decision-making, enabling fleet operators, automakers, and mobility providers to optimize performance and reduce operational costs.

Ongoing advancements in AI, IoT, and telematics, coupled with the rapid adoption of connected and autonomous vehicles, are accelerating market expansion. With growing utilization across logistics, transportation, insurance, and automotive manufacturing, the vehicle analytics market is poised for strong growth in the years ahead.

Vehicle Analytics Market Industry Trends and Strategic Insights

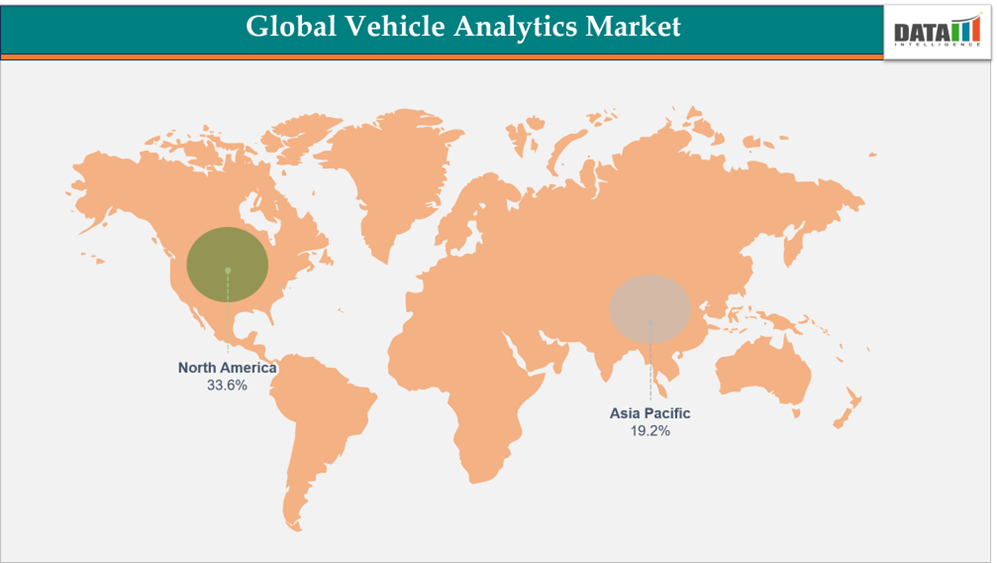

- North America leads the global vehicle analytics market, capturing the largest revenue share of 33.6% in 2024.

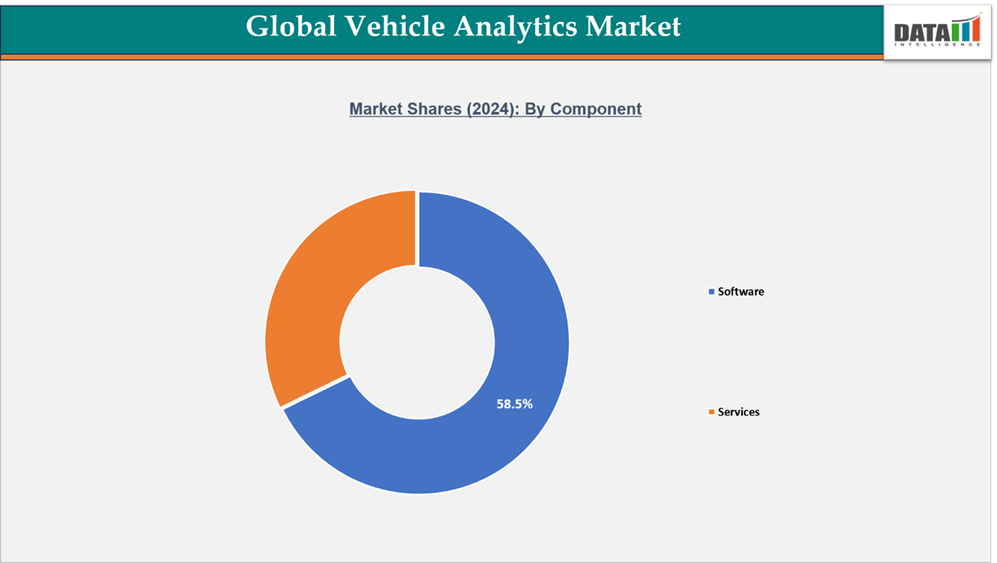

- By component segment, software leads the global vehicle analytics market, capturing the largest revenue share of 58.5% in 2024.

Global Vehicle Analytics Market Size and Future Outlook

- 2024 Market Size: US$4.1 billion

- 2032 Projected Market Size: US$6.6 billion

- CAGR (2025–2032): 6.5%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Component | Software, Services |

| By Deployment Mode | Cloud-Based, On-Premises |

| By Application | Predictive Maintenance, Safety and Security Management, Driver and User Behavior Analysis, Traffic Management and Optimization, Usage-Based Insurance (UBI), Warranty and Dealer Performance Analytics, Other Applications |

| By End-User | Automotive OEMs, Automotive Dealers, Fleet Operators, Insurance Companies, Government & Transport Authorities, Service Providers |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing adoption of connected vehicles

The rising adoption of connected vehicles is one of the key drivers fueling the growth of the global vehicle analytics market. Connected vehicles continuously generate large volumes of data through sensors, telematics systems, and communication networks, providing valuable insights into vehicle performance, driver patterns, and overall operational efficiency.

As the automotive industry increasingly embraces data-driven strategies, the demand for advanced analytics solutions to interpret and utilize this data effectively is accelerating.

Connected vehicle technology enables real-time monitoring of fuel consumption, predictive maintenance, and enhanced safety management. For instance, in 2023, Volvo Trucks North America introduced the Connected Vehicle Analytics (CVA) tool to help fleet customers improve both fuel efficiency and vehicle productivity.

The CVA tool collects and analyzes real-world data such as truck configurations, daily routes, average speed, and fuel economy, allowing dealers to recommend the most suitable configurations for each fleet’s specific operational needs.

Such innovations demonstrate how connected vehicle technologies are transforming fleet management and automotive operations. By leveraging analytics, companies can gain actionable insights, streamline operations, and reduce downtime. As more vehicles integrate IoT and 5G connectivity, vehicle analytics will play an increasingly critical role in enhancing performance, safety, and cost efficiency, driving the continued expansion of the global vehicle analytics market.

Segmentation Analysis

The global vehicle analytics market is segmented based on component, deployment mode, application, end-user and region.

Software Segment Leads the Global Vehicle Analytics Market with Focus on Connected Intelligence

The software segment dominates the global vehicle analytics market, driven by the growing adoption of connected and software-defined vehicles (SDVs). Advanced analytics software enables real-time monitoring of engine performance, fuel efficiency, driver behavior, and predictive maintenance, helping automakers and fleet operators improve performance, safety, and cost efficiency.

The integration of AI, ML, and cloud technologies is turning raw telematics data into actionable insights. A key example is the 2025 collaboration between Tata Technologies and Synopsys, which leverages electronic digital twins (eDTs) to accelerate SDV design and validation.

Rising use of cloud-based and edge analytics is further enhancing real-time decision-making and enabling features like ADAS and autonomous driving. Overall, the software segment remains the core growth engine of the vehicle analytics market, powering the shift toward intelligent, data-driven mobility.

Services Segment Gains Momentum with Rising Need for Integration and Analytics Support

The services segment of the global vehicle analytics market is growing rapidly, driven by rising demand for system integration, real-time monitoring, and ongoing technical support. As automakers and fleet operators adopt complex analytics platforms, professional and managed services are essential for smooth deployment, customization, and optimization.

Service providers now offer end-to-end solutions, including data integration, predictive maintenance consulting, and system upgrades—helping businesses turn telematics data into actionable insights. In 2025, Bosch Mobility expanded its connected mobility services to support predictive analytics and OTA updates, highlighting the shift toward service-based vehicle management.

The increasing adoption of cloud analytics, AI-driven insights, and subscription-based models like “analytics-as-a-service” is further fueling growth. Overall, the services segment is set for strong expansion as connected vehicles become more complex, making integration and continuous support vital to maximizing analytics value.

Geographical Penetration

DOMINATING MARKET:

North America Leads the Global Vehicle Analytics Market Driven by Connected Mobility and Data-Driven Innovations

The global vehicle analytics market is experiencing robust growth, led by North America, driven by advancements in connected vehicle infrastructure, the rise of software-defined vehicles (SDVs), and a strong focus on predictive maintenance, safety, and driver experience. The region’s mature automotive ecosystem, advanced data analytics capabilities, and government initiatives supporting intelligent transportation systems are accelerating widespread adoption among automakers, fleet operators, and mobility providers.

A notable development in 2024 was Salesforce’s launch of Connected Vehicle, a new Automotive Cloud application that enables automakers to deliver safer and more personalized driving experiences. Featuring a unified console and low-code/no-code tools, the platform supports bidirectional over-the-air (OTA) data sharing between vehicles and the cloud—allowing faster deployment of new features, software updates, and enhanced real-time connectivity. This reflects North America’s growing commitment to data-driven innovation and connected mobility solutions.

Ongoing progress in edge analytics, telematics integration, and OTA update capabilities continues to improve vehicle performance, uptime, and user experience. Furthermore, increasing investments in electric vehicles (EVs), autonomous driving technologies, and data security compliance are reinforcing North America’s dominance. Overall, the region is expected to remain the largest and most technologically advanced vehicle analytics market in the coming years.

US Vehicle Analytics Market Insights

The US represents the largest vehicle analytics market in North America, driven by rapid digital transformation across the automotive and mobility sectors. The country’s strong ecosystem of OEMs, tech firms, and analytics providers is fostering innovation in areas like predictive maintenance, driver behavior analysis, and fleet optimization. Government support for intelligent transport infrastructure and EV expansion further strengthens adoption. Partnerships between automakers and cloud service providers continue to enhance data integration, automation, and real-time decision-making.

Canada Vehicle Analytics Market Growth

Canada is emerging as a significant growth hub in the North American vehicle analytics market, supported by smart fleet management adoption and increasing investment in connected transportation networks. The country’s focus on sustainable mobility, combined with rising use of analytics in logistics, commercial fleets, and autonomous testing, is accelerating market expansion. Collaboration between Canadian automotive startups and global analytics firms is fostering innovation in AI-powered mobility platforms, positioning Canada as a rising force in data-driven vehicle intelligence.

FASTEST GROWING MARKET:

Asia-Pacific Emerges as the Fastest-Growing Region Driven by Connected Mobility and Smart Vehicle Innovation

The global vehicle analytics market is expanding rapidly, with Asia-Pacific standing out as the fastest-growing region. Growth is fueled by the widespread adoption of connected and intelligent vehicles, rapid digital transformation across the automotive sector, and strong government support for smart mobility and safety initiatives. Rising investments in AI-powered analytics, telematics, and cloud-based platforms are accelerating the shift toward data-driven transportation ecosystems.

India Vehicle Analytics Market Trends

India is witnessing the rapid adoption of vehicle analytics, driven by the growing use of connected fleet management solutions, digital transformation in mobility services, and government programs promoting intelligent transport systems. Collaboration between automakers and technology providers is enhancing predictive maintenance, driver performance analytics, and EV integration, making India a rising hub for connected vehicle innovation in Asia-Pacific.

China Vehicle Analytics Market Outlook

China remains a key driver of regional growth, supported by its robust automotive manufacturing base, rapid expansion of electric and connected vehicles, and strong focus on data analytics for mobility optimization. However, China’s car sales declined by 0.8% to 2.27 million units in October 2024, ending an eight-month growth streak, according to the China Passenger Car Association. The slowdown was linked to reduced tax exemptions and government subsidies, which dampened consumer sentiment. Despite this short-term dip, China continues to invest heavily in AI analytics, smart vehicle infrastructure, and connected car ecosystems, reinforcing its leadership in automotive innovation.

Sustainability and ESG Analysis

Sustainability and ESG considerations are playing an increasingly vital role in the global vehicle analytics market, influencing corporate strategies, investment priorities, and compliance frameworks. Industry players are focusing on energy efficiency, responsible innovation, and transparent governance to strengthen long-term competitiveness and align with global sustainability goals.

On the environmental side, companies are emphasizing low-carbon operations, improving data center efficiency, and leveraging analytics to reduce fuel consumption and emissions. The growing integration of analytics into electric and hybrid vehicles further supports the transition to sustainable mobility by optimizing energy use and enabling smarter, cleaner transport solutions.

From a social perspective, vehicle analytics providers are working with automakers, governments, and smart city programs to enhance road safety, driver performance, and accessibility. These collaborations foster safer, more inclusive transportation systems while contributing to community well-being.

In terms of governance, organizations are strengthening data security, ethical AI practices, and regulatory transparency to ensure compliance and build stakeholder trust. Robust ESG frameworks are enabling companies to demonstrate accountability and maintain high standards of digital responsibility.

Overall, by embedding sustainability across technology development, operations, and data management, the global vehicle analytics market is evolving toward a cleaner, safer, and more responsible mobility ecosystem, balancing innovation with environmental and social impact.

Competitive Landscape

- The global vehicle analytics market is highly competitive, featuring a mix of leading multinational corporations and prominent regional players. Key companies, including Microsoft, IBM, Teletrac Navman US Ltd, HARMAN International, Azuga (a Bridgestone Company), SAP SE, Continental AG, Genetec Inc, Xevo, Agnik LLC, Acerta Analytics Solutions Inc., and Procon Analytics, sustain market leadership through advanced analytics platforms, robust telematics solutions, and continuous investments in AI, IoT integration, and research and development.

- Many players are expanding their footprint in emerging markets via strategic partnerships, collaborations with fleet management solutions, and enhanced data integration capabilities. These initiatives allow companies to offer real-time vehicle monitoring, predictive maintenance, and optimized fleet performance across commercial, logistics, and automotive sectors globally.

- Market competition is driven by rising adoption of connected vehicle technologies, demand for operational efficiency and safety, and innovations in AI-powered predictive and diagnostic tools. Compliance with evolving regulations, platform differentiation, and seamless integration with smart mobility and telematics systems remain key factors influencing market leadership and long-term growth in the global vehicle analytics industry.

Investment & Funding Landscape

The global vehicle analytics market is witnessing strong investment activity and strategic initiatives, reflecting growing confidence in AI-driven fleet management and advanced automotive solutions.

In 2025, Intangles, a deeptech startup specializing in AI-powered fleet and automotive analytics, secured $30 million (INR 266 crore) in a Series B funding round led by Avataar Venture Partners, with participation from Baring Private Equity Partners India and Cactus Partners. The company will use the capital to expand internationally, broaden its product portfolio, and strengthen its talent base.

Also in 2025, Volkswagen announced plans to invest up to €8 billion in artificial intelligence (AI) research and development by 2030. The investment marks the automaker’s transition from a traditional hardware-centric model to a software-driven mobility provider, leveraging AI and analytics to enhance vehicle performance, fleet efficiency, and next-generation mobility solutions.

These moves underscore the market’s focus on technological innovation, AI integration, and strategic investments, positioning the global vehicle analytics industry for sustained growth and improved operational efficiency.

| Company | Investment/Funding | Year | Details | |

| Intangles | Funding | 2025 | Intangles, a deeptech startup specializing in AI-powered fleet and automotive analytics, secured $30 million (INR 266 crore) in a Series B funding round led by Avataar Venture Partners, with participation from Baring Private Equity Partners India and Cactus Partners. The company will use the capital to expand internationally, broaden its product portfolio, and strengthen its talent base. | |

| Volkswagen | Investment | 2025 | Volkswagen announced plans to invest up to €8 billion in artificial intelligence (AI) research and development by 2030. The investment marks the automaker’s transition from a traditional hardware-centric model to a software-driven mobility provider, leveraging AI and analytics to enhance vehicle performance, fleet efficiency, and next-generation mobility solutions. | |

What Sets This Global Vehicle Analytics Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by product type, stage, form, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect vehicle analytics commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.