Global Vaginal Health Probiotic Supplements Market Size

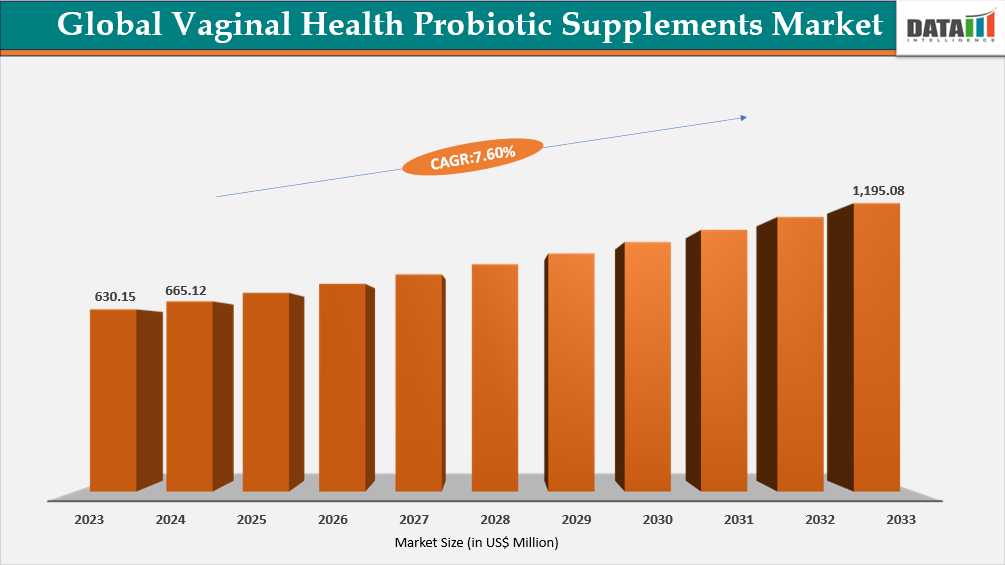

Global Vaginal Health Probiotic Supplements Market reached US$ 665.12 million in 2024 and is expected to reach US$ 1,195.08 million by 2032, growing with a CAGR of 7.6% during the forecast period 2025-2032. The global vaginal health probiotic supplements market is experiencing robust growth, driven by increasing awareness of women’s health and preventive care. In the US, bacterial vaginosis affects nearly 29% of women aged 14–49, highlighting a strong need for preventive interventions. The rising prevalence of urinary tract infections and recurrent yeast infections further supports the demand for probiotic supplements. Consumers are increasingly seeking safe, non-antibiotic solutions to maintain urogenital health, which is driving higher adoption of oral and topical probiotic products.

A significant trend in the market is the growing demand for personalized and clean-label probiotic supplements. Women are increasingly looking for products tailored to their specific health conditions, including hormonal balance and microbiome support. There is also a preference for clean-label, vegan, and allergen-free formulations, reflecting broader health-conscious consumer behavior. Additionally, emerging initiatives in microbiome research are helping companies develop more targeted strains for vaginal health, enhancing product efficacy and consumer trust.

Vaginal Health Probiotic Supplements Industry Trends and Strategic Insights

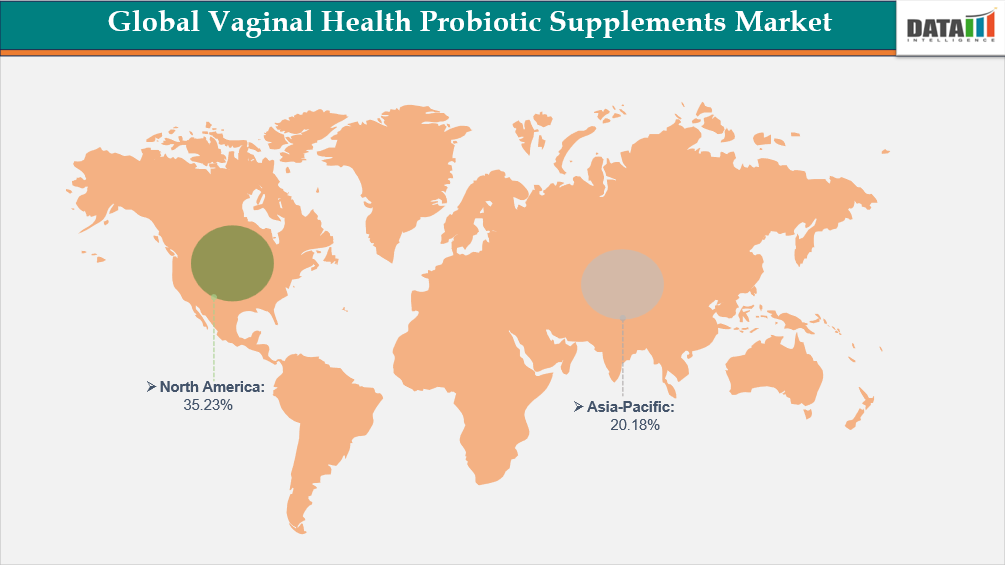

- North America dominates the vaginal health probiotic supplements market, capturing the largest revenue share of 35.23% in 2024.

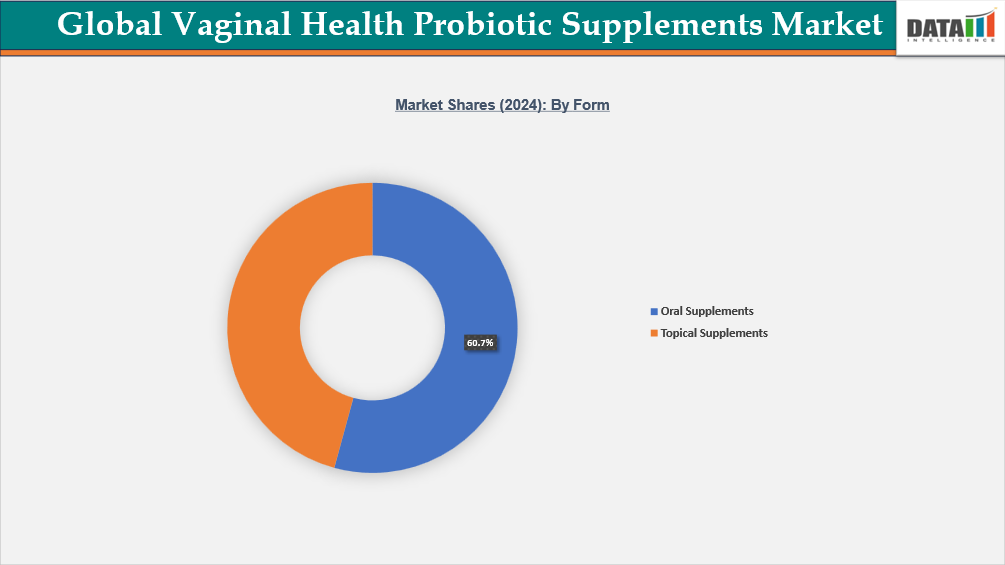

- By form, the oral supplements segment is projected to be the largest market, holding a significant share of 60.7% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 665.12 Million

- 2032 Projected Market Size: US$ 1,195.08 Million

- CAGR (2025-2032): 7.6%

- Largest Market: North America

- Fastest Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Form | Oral Supplements, Topical Supplements |

| By Application | Bacterial Vaginosis (BV) Prevention & Treatment, Menopause Support and Healthy Ageing, Infection Prevention & Vaginal Microbiome Support, Urinary Tract Health & Vaginal pH Balance, General Vaginal Health & Hygiene |

| By End-User | Pre-Menopausal Women, Peri-Menopausal Women, Post-Menopausal Women |

| By Distribution Channel | Online Retailers, Pharmacies and Drug Stores, Supermarkets/Hypermarkets, Convenience Stores, Other Distribution Channels |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed Information, Request for Sample

Market Dynamics

Rising Awareness of Vaginal Microbiome and Preventive Health

The global vaginal health probiotic supplements market is witnessing strong growth due to increasing awareness of the vaginal microbiome and preventive health. In the US, the National Institutes of Health reports that bacterial vaginosis affects nearly 29% of women aged 14–49, highlighting the need for effective preventive solutions. Additionally, surveys from the CDC indicate growing consumer interest in non-antibiotic interventions to maintain vaginal health. These factors are driving higher adoption of probiotic supplements that support urogenital microbiome balance.

Stringent Regulatory Compliance and Safety Requirements

The global vaginal health probiotic supplements market faces challenges due to stringent regulatory compliance and safety requirements. In the US, the FDA mandates that probiotic products intended to diagnose, treat, or prevent diseases must undergo rigorous clinical trials and receive approval before marketing. Additionally, the FDA has raised concerns about probiotic products being marketed for use in hospitalized preterm infants, highlighting potential safety risks. These regulatory hurdles can delay product development and increase costs for manufacturers, thereby restraining market growth.

Segmentation Analysis

The global vaginal health probiotic supplements market is segmented based on form, application, distribution channel, end-user and region.

Demand for Oral Supplements in Vaginal Health Probiotics

Oral probiotic supplements dominate the vaginal health market due to their convenience and effectiveness. In North America, oral supplements accounted for approximately 66% of the vaginal health probiotic market in 2024, reflecting strong consumer preference for easy-to-consume daily capsules or tablets.

These supplements, often containing strains like Lactobacillus rhamnosus and Lactobacillus reuteri, are utilized to support vaginal microbiome balance, prevent infections, and alleviate symptoms associated with bacterial vaginosis and urinary tract infections. The growing trend towards preventive healthcare and the increasing awareness of women's health issues further drive the demand for oral probiotic supplements.

Rise of Topical Probiotic Supplements for Vaginal Health

Topical probiotic supplements are gaining traction as an alternative or complement to oral formulations, particularly for targeted vaginal health support. These products, such as suppositories and creams, are designed to deliver beneficial bacteria directly to the vaginal area, aiming to restore and maintain a healthy microbiome. Clinical studies have demonstrated the efficacy of such topical treatments in relieving symptoms like vaginal itching and discomfort associated with bacterial vaginosis. The convenience of application and the targeted delivery mechanism contribute to their growing popularity among consumers seeking localized treatment options for vaginal health concerns.

Geographical Penetration

Rising Demand for Vaginal Supplements in Asia-Pacific

In Asia-Pacific, women's concern for intimate and vaginal health is increasingly observed in supplement trends, notably probiotics designed for feminine wellbeing. Notable breakthroughs include the clinically proved Lactobacillus rhamnosus GR-1 and L. reuteri RC-14 strains, which have showed promise in lowering bacterial vaginosis and urinary tract infections. Gummies, chewables and suppositories are among the new formulations available to women, providing more practical and palate-friendly delivery options. These advances have been widely documented to improve probiotic survival and precision targeting.

Probiotic supplement formats are changing in response to consumer demands. Asia-Pacific showed significant increase in chewables and gummies, which are now the fastest-growing delivery option nationwide, while tablets and gummies remain the largest by sales. India is expected to lead in terms of growth rate in the coming years, indicating strong regional adoption of user-friendly formats.

The region is experiencing an expansion of probiotic applications related to women's health, including research into the gut-vagina axis to treat illnesses such as PCOS, endometriosis and inflammation. For example, in 2025, Biome Australia Limited expanded its Activated Probiotics line with two additional women's health products. It launched Biome Her Pessary, a vaginal probiotic combining Lactobacillus acidophilus LA02 and Lactobacillus fermentum LF10 strains that have been shown to reduce vaginal thrush recurrence.

India Vaginal Health Probiotic Supplements Market Outlook

The demand for vaginal health probiotic supplements in India stems from the widespread prevalence of vaginal infections among women. According to the World Health Organization (WHO), around 25–30% of women globally experience some form of vaginal infection during their lifetime, with bacterial vaginosis (BV) and yeast infections being the most frequent. India mirrors this global trend, as gynecological outpatient data from institutions such as the All India Institute of Medical Sciences (AIIMS) and state-level health surveys consistently show high rates of reproductive tract infections among women. These conditions not only cause discomfort and disruption to daily life but, when untreated, can lead to serious complications such as pelvic inflammatory disease, adverse pregnancy outcomes, and infertility. Such clinical realities underscore the need for preventive and safe solutions like probiotics that can restore and maintain a balanced vaginal microbiome.

In India, conversations around women’s intimate health have historically been restricted due to cultural stigma. However, over the past decade, there has been a notable shift, with growing awareness campaigns by the Ministry of Health and Family Welfare (MoHFW) under the National Reproductive and Child Health Programme. These initiatives, combined with the increased visibility of women’s health issues on social media platforms, have created an environment where women are more willing to seek preventive health solutions. Younger, urban women in particular are showing greater acceptance of nutraceuticals and natural products. Probiotic supplements, being drug-free and positioned as natural microbiome balancers, fit well within this cultural shift toward self-care and preventive health.

China Vaginal Health Probiotic Supplements Market Trends

The demand for vaginal health probiotic supplements in China is underpinned primarily by the high prevalence of gynecological conditions, particularly vaginitis, among women of reproductive age. Official surveys conducted in China have consistently shown that vaginal infections remain one of the most common gynecological complaints. For instance, a large-scale public health survey covering over 37,000 women across multiple provinces reported a vaginitis prevalence of around 32 percent, with bacterial vaginosis, vulvovaginal candidiasis, and trichomonas infection as the dominant subtypes. The burden of disease was highest among women in their mid-30s to early 50s, an age group that is both health-conscious and more likely to purchase supplements.

In July 2024, A recent prospective controlled pilot study from Jiangxi, China, evaluated the effectiveness of Lactobacillus crispatus chen-01 in women with high-risk HPV infection. One hundred women were enrolled and randomly assigned to either a placebo group or a probiotic treatment group receiving intravaginal transplantation of L. crispatus chen-01. After six months, results showed that probiotic treatment significantly reduced HPV viral load, enhanced clearance rates, and alleviated vaginal inflammation without notable adverse reactions. Microbiome sequencing confirmed that L. crispatus chen-01 helped restore vaginal microbial balance. The study highlights the link between disrupted vaginal microbiota and persistent HPV infection, as reduced Lactobacillus populations are associated with higher risk of cervical disease. Since HPV vaccines do not cover all high-risk strains and no effective therapies exist for women already infected, this research positions vaginal probiotics as a promising, safe intervention for preventing progression to cervical cancer.

Rising Demand for Vaginal Supplements in North America

The market is growing rapidly, fueled by rising awareness of women’s intimate health and the increasing prevalence of vulvovaginal discomfort. A US survey of 913 women found that 79.1% were diagnosed with genitourinary syndrome of menopause (GSM), with vaginal dryness (100%), painful intercourse (77.6%), and infections being the most common issues, while gynecologists observed signs such as mucosal dryness (99%) and thinning of vaginal tissue (92.1%). These findings underscore a massive unmet need for safe, natural, and effective solutions.

In response to this demand, companies are developing innovative products to support vaginal health. For instance, in June 2025, New York-based company Evvy launched its Women's Complete Probiotic, a once-daily supplement designed to support vaginal, gut, and urinary health. The probiotic combines clinically studied Lactobacillus strains, postbiotics, and vitamins D and E in a delayed-release capsule. This product builds on Evvy's at-home vaginal microbiome test and prescription treatments, offering a comprehensive approach to women's health. The launch of such products reflects a growing recognition of the interconnectedness of vaginal, gut, and urinary health and the importance of maintaining a balanced microbiome.

US Vaginal Health Probiotic Supplements Market Insights

The US holds a dominant position in the North American vaginal health probiotic supplements market, driven by a combination of strong consumer awareness, robust healthcare infrastructure, and an increasing focus on women’s wellness. As of 2025, approximately 9 million women in the US are affected by yeast infections, or Candida vaginitis (VVC), out of 138 million cases globally, highlighting the significant prevalence and the ongoing need for effective treatments.

This rising health concern coincides with a growing consumer inclination toward preventive care, as reflected in a survey showing that 41% of respondents have taken over-the-counter probiotics to support gut and vaginal health. Leading brands such as BIOM Probiotics, Garden of Life, Happy V., Lemme, Love Wellness, O POSITIV, Physician’s Choice, Seed Health, and VH Essentials are actively addressing this demand with clinically-backed formulations designed to maintain vaginal flora balance, pH regulation, and overall feminine wellness.

Market expansion in the US vaginal health segment is being bolstered by strategic retail growth, exemplified by Love Wellness. For instance, in July 2023, the company extended its presence to over 1,600 Walmart stores nationwide, marking its third major national retail partnership in four years. This wider accessibility of women’s wellness products not only meets growing consumer demand but also reinforces the US market’s significant share in the North American vaginal health probiotic supplements sector.

Canada Vaginal Health Probiotic Supplements Industry Growth

Canada is steadily emerging as a key player in the North American vaginal health probiotic supplements market, driven by a unique combination of innovation, research, and a growing focus on personalized women’s wellness. The urgency for preventive care is clear: in 2022, the Canadian Cancer Society reported 488 deaths from other female genital system cancers, highlighting critical gaps in women’s health. Maintaining vaginal health is a key preventive strategy, as imbalances can increase the risk of infections and other complications. Vaginal probiotic supplements, clinically formulated to support healthy vaginal flora, play an important role in reducing these risks. By promoting a balanced microbiome, such probiotics help prevent conditions like bacterial vaginosis, which affects nearly 30% of women.

.Women are seeking interventions that combine clinical science with convenience, making digital platforms and targeted supplements an ideal approach. For instance, in February 2025, Montreal-based startup Coral secured CAD$4.1 (US$2.9) million in Seed funding led by Brightspark, aiming to transform menopause care through personalized, evidence-based virtual support for women navigating perimenopause. This investment reflected both the unmet needs of mid-life women and the growing appetite for science-backed digital interventions, illustrating how Canadian startups are translating awareness into actionable, tech-enabled healthcare solutions.

Sustainability Analysis

Sustainability in the vaginal health probiotic market focuses on responsible ingredient sourcing, low-impact manufacturing, and transparent labeling. BioGaia reported ~17% sales growth in 2023, highlighting increased production volumes and the need for environmentally conscious operations. Chr. Hansen and Nestlé Health Science have committed to reducing environmental impact, including transitioning factories to renewable energy. Regulatory guidance emphasizes accurate CFU labeling and safety, ensuring consumer protection and social responsibility. Overall, sustainable practices combine eco-friendly production, quality assurance, and energy-efficient operations to strengthen market credibility.

Competitive Landscape

- The global vaginal health probiotic supplements market features intense competition among major nutraceutical, pharmaceutical, and probiotic-focused companies.

- Key players include Chr. Hansen Holding A/S, Probi AB, BioGaia AB, Church & Dwight Co., Inc., Lallemand Health Solutions Inc., Bayer AG, DuPont de Nemours, Inc., and Nestlé Health Science S.A.

- Companies compete through clinically validated probiotic strains, innovative delivery systems, and targeted formulations addressing women’s urogenital and microbiome health.

- Strategic investments in R&D, clinical trials, and sustainability-focused production are central to maintaining market leadership amid growing demand for science-backed, preventive health solutions.

Key Developments

- In January 2024, Lemme launched a capsule version of its bestselling Lemme Purr gummies, expanding its lineup of women’s health products. The new capsules, clinically formulated to support vaginal pH balance, odor control, taste, and overall vaginal and urinary tract health, follow high demand and multiple sell-outs of the gummy version.

- In June 2023, Love Wellness expanded into over 1,600 Walmart stores in US, bringing its clean, doctor-developed personal care products closer to everyday consumers. Shoppers can now access popular gut and vaginal health solutions, including Good Girl Probiotics, Flora Power, Sparkle Fiber, and Bye Bye Bloat, at everyday low prices. The expansion also features immersive consumer activations in Austin and Nashville this summer to promote awareness of the gut-vagina connection.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies