Vaccine Refrigerators Market Size

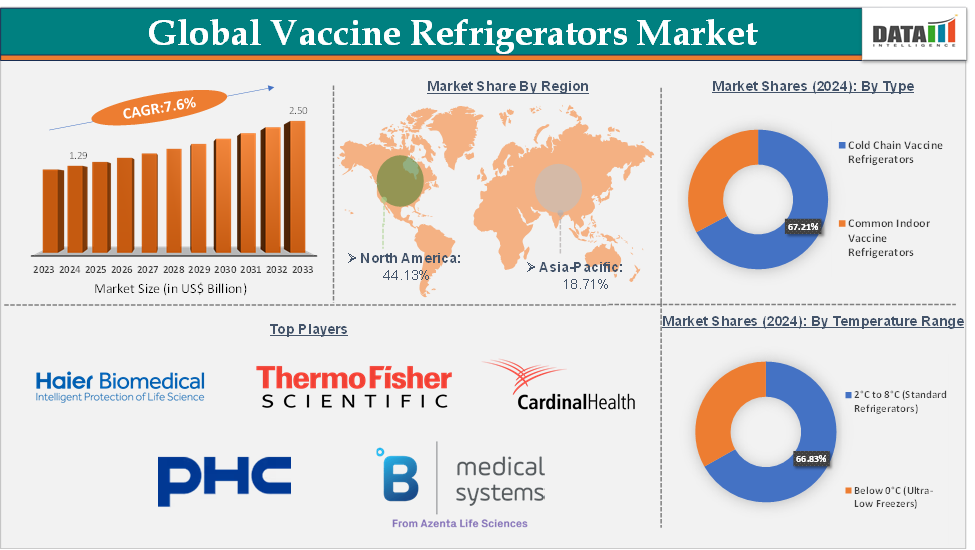

The global vaccine refrigerators market size reached US$ 1.29 Billion in 2024 from US$ 1.21 Billion in 2023 and is expected to reach US$ 2.50 Billion by 2033, growing at a CAGR of 7.6% during the forecast period 2025-2033.

Market Overview

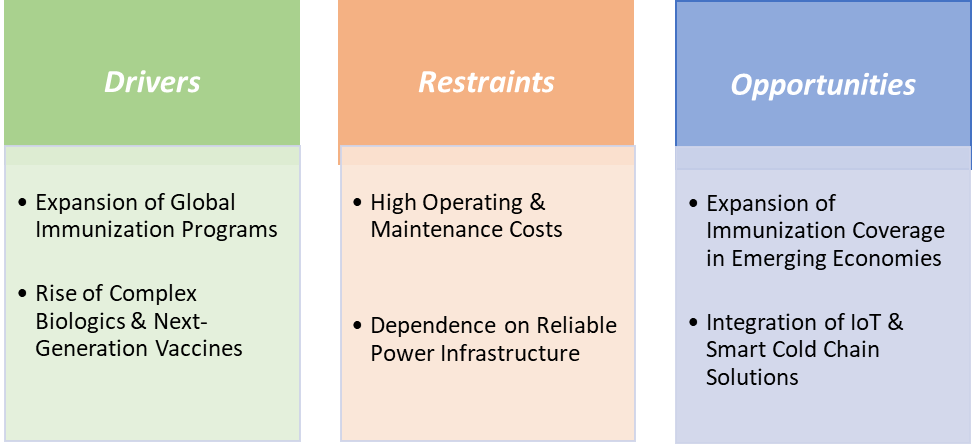

The vaccine refrigerators market is expanding steadily, driven by the rising emphasis on immunization programs worldwide and the heightened importance of cold-chain reliability following the COVID-19 pandemic. Governments, NGOs, and private healthcare providers are investing in advanced storage solutions to ensure vaccine potency and regulatory compliance.

Growth drivers include large-scale vaccination initiatives, rapid adoption of IoT-enabled smart refrigerators with remote monitoring, and the rising deployment of solar-powered and ice-lined refrigerators to address energy gaps in low-resource regions. The pandemic has further accelerated modernization, making reliable cold-chain infrastructure a top public health priority.

At the same time, the market faces restraints such as the high upfront and operating costs of medical-grade refrigerators, infrastructure challenges in rural areas, environmental concerns around refrigerants, and supply chain disruptions affecting component costs.

North America dominates the vaccine refrigerators market with the largest revenue share of 44.13% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.7% over the forecast period.

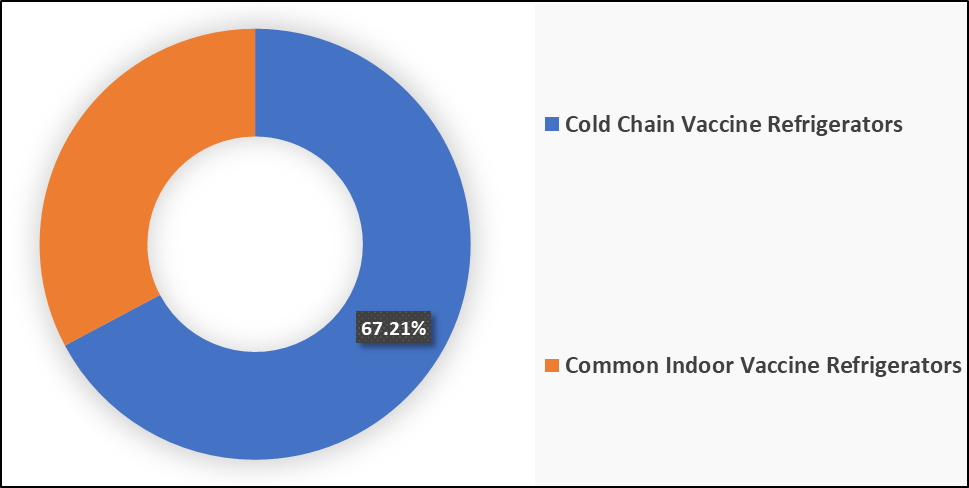

Based on type, the cold chain vaccine refrigerators segment led the market with the largest revenue share of 67.21% in 2024.

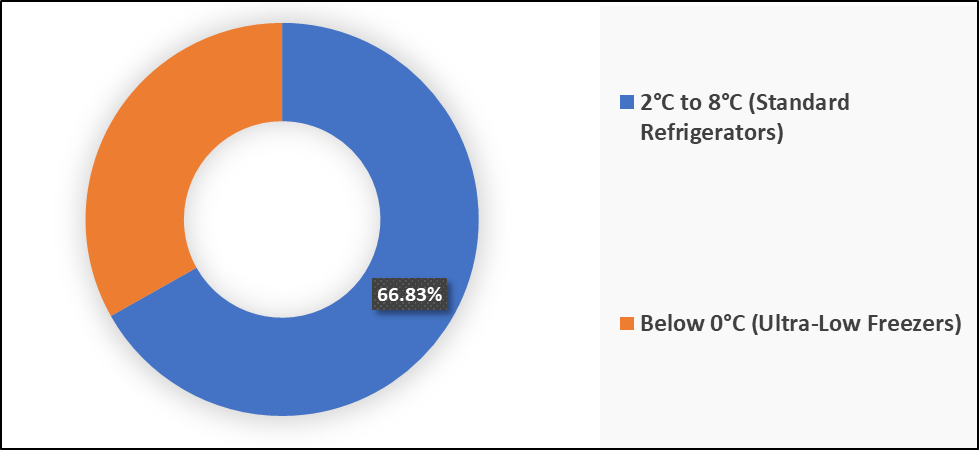

Based on temperature range, the 2°C to 8°C (standard refrigerators) segment is expected to lead the market with the largest revenue share of 66.83% in 2024.

The major market players in the vaccine refrigerators market are Haier Biomedical, Cardinal Health, Thermo Fisher Scientific Inc., PHC Corporation, B Medical Systems, Dulas Ltd., Godrej, and Blue Star Limited, among others

Market Summary

Market Dynamics

Drivers-Expansion of global immunization programs is significantly driving the vaccine refrigerators market growth

The expansion of global immunization programs is one of the most powerful forces driving growth in the vaccine refrigerators market, as it directly increases the need for reliable cold chain infrastructure. Most vaccines, from traditional childhood immunizations like measles, polio, and DTP to newer ones such as HPV and rotavirus, require storage at 2–8°C to remain effective. As governments aim to achieve universal vaccine coverage under WHO’s Immunization Agenda 2030, the number of vaccination sites in both urban and rural regions is rising, creating strong demand for medical-grade refrigerators at hospitals, community health centers, and pharmacies.

For instance, India’s Universal Immunization Programme (UIP), which covers over 27 million infants and 30 million pregnant women annually, depends on an extensive network of cold chain equipment, including solar-powered and ice-lined refrigerators in remote areas. Similarly, Gavi, the Vaccine Alliance, through its Cold Chain Equipment Optimization Platform (CCEOP), has funded the procurement and installation of tens of thousands of WHO-prequalified refrigerators across Africa and Asia to ensure vaccine availability in hard-to-reach communities. The rollout of new malaria vaccines in sub-Saharan Africa is another instance where last-mile cold chain strengthening is essential to achieving program success.

Even in developed countries, expanded seasonal flu vaccination drives and booster campaigns for COVID-19 continue to add incremental demand for refrigerators in pharmacies and clinics. As immunization programs broaden to cover a wider range of diseases, larger populations, and new geographies, the supporting cold chain must scale proportionally, ensuring steady and long-term market growth for vaccine refrigerators.

Restraints-High operating & maintenance costs are hampering the growth of the vaccine refrigerators market

The high operating and maintenance costs of vaccine refrigerators are a significant barrier to market growth, particularly in low- and middle-income countries where budget constraints are severe. Unlike household refrigerators, medical-grade units are engineered to maintain strict and uniform temperature ranges, which often makes them 2–10 times more energy-intensive, thereby increasing electricity bills for hospitals and clinics. Ultra-low temperature (ULT) freezers, needed for certain biologics and mRNA vaccines, consume even more power and require backup systems like generators or UPS units, further raising operational expenses.

For instance, during the COVID-19 vaccine rollout, many developing countries struggled with the cost of running ULT freezers continuously, as seen in parts of sub-Saharan Africa, where the energy burden exceeded local facility budgets. Beyond energy use, maintenance costs are also substantial, compressors, sensors, and refrigerants must be serviced regularly, and in remote regions, a lack of trained technicians and spare parts means repair delays often result in vaccine spoilage. Collectively, these high operating and maintenance expenses slow down widespread adoption, particularly in regions where donor funding or subsidies are not available to offset long-term costs.

For more details on this report – Request for Sample

Market Segment Analysis

The vaccine refrigerators market is segmented based on type, capacity, temperature range, end-user, and region.

Type-The cold chain vaccine refrigerators segment is dominating the vaccine refrigerators market with a 67.21% share in 2024

The cold chain vaccine refrigerators segment is dominating the vaccine refrigerators market because it forms the backbone of global immunization programs, ensuring vaccines remain potent from central warehouses down to the last mile. Unlike common indoor refrigerators that are mostly used in hospitals and urban clinics, cold chain refrigerators, including solar direct-drive (SDD) units, ice-lined refrigerators (ILRs), chest models, and portable carriers, are deployed in remote, rural, and resource-constrained areas where uninterrupted cooling is critical. This dominance is reinforced by large-scale donor funding and procurement initiatives.

For instance, UNICEF and Gavi’s Cold Chain Equipment Optimization Platform (CCEOP) has deployed over 65,000 WHO-prequalified cold chain refrigerators in Africa and Asia over the past few years, drastically expanding vaccine access in hard-to-reach communities. Similarly, the rollout of the world’s first malaria vaccine in sub-Saharan Africa in 2023–24 relied heavily on SDD refrigerators, since many regions lack stable electricity. During the COVID-19 pandemic, cold chain units were also prioritized for rural vaccine distribution, with manufacturers like B Medical Systems, Haier Biomedical, and others reporting record orders for off-grid and solar solutions.

Temperature Range - The 2°C to 8°C (standard refrigerators) segment is dominating the vaccine refrigerators market with a 66.83% share in 2024

The 2°C to 8°C (standard vaccine refrigerators) segment is dominating the vaccine refrigerators market because the vast majority of vaccines worldwide are formulated for storage within this temperature range. From traditional immunizations such as measles, polio, diphtheria, and tetanus to newer additions like HPV and rotavirus, nearly all essential vaccines used in global immunization schedules depend on 2–8°C stability. This makes standard refrigerators the largest and most indispensable category in the cold chain infrastructure.

For instance, under India’s Universal Immunization Programme (UIP), which reaches over 27 million infants annually, most vaccines are stored in standard refrigerators or ice-lined units before distribution to health centers. Similarly, during routine immunization drives in Africa funded by UNICEF and Gavi, the bulk of refrigerators deployed are 2–8°C models, including solar direct-drive units for off-grid areas. Even in high-income countries, pharmacies and clinics rely heavily on compact medical-grade refrigerators to store flu shots and COVID-19 booster doses, which also fall within this range.

Market Geographical Share

North America is expected to dominate the global vaccine refrigerators market with a 44.13% in 2024

North America is the dominant region in the global vaccine refrigerators market, driven by its advanced healthcare infrastructure, stringent regulatory standards, and strong emphasis on vaccine coverage. The US Centers for Disease Control and Prevention (CDC) mandates the use of medical-grade refrigerators that comply with its vaccine storage and handling toolkit, which has accelerated adoption across hospitals, pharmacies, and vaccination centers. During the COVID-19 pandemic, the US led one of the world’s largest vaccine distribution campaigns, requiring a rapid scale-up of both 2–8°C standard refrigerators and ultra-low temperature (ULT) freezers for mRNA vaccines such as Pfizer-BioNTech.

Major manufacturers like Haier Biomedical, Thermo Fisher Scientific, and PHC Corporation of North America experienced record demand as federal and state governments procured thousands of units to support mass vaccination sites. Canada also reinforced its cold chain through nationwide investments, ensuring reliable storage for seasonal flu and COVID-19 boosters in both urban and rural regions.

The region also benefits from well-established maintenance networks, digital monitoring solutions, and eco-friendly refrigeration adoption, which ensure compliance with both healthcare and environmental standards. With its combination of high immunization coverage, advanced R&D infrastructure, and regulatory-driven demand, North America has secured the leading share of the vaccine refrigerators market and is expected to maintain dominance in the near term.

Market Companies and Competitive Landscape

Top companies in the vaccine refrigerators market include Haier Biomedical, Cardinal Health, Thermo Fisher Scientific Inc., PHC Corporation, B Medical Systems, Dulas Ltd., Godrej, and Blue Star Limited, among others.

Haier Biomedical: Haier Biomedical is one of the leading players in the vaccine refrigerators market, recognized for its wide portfolio of WHO PQS-certified cold chain solutions. The company offers a diverse range of products, including 2–8°C vaccine refrigerators, ice-lined refrigerators (ILRs), solar direct-drive (SDD) refrigerators, and a smart vaccine refrigerator that supports both routine immunization programs and advanced biologics like mRNA vaccines. With its emphasis on energy efficiency, green refrigerants, and IoT-enabled monitoring systems, Haier Biomedical has positioned itself as a critical partner for governments, NGOs, and healthcare providers in building resilient and sustainable vaccine cold chain infrastructure.

Market Scope

Metrics | Details | |

CAGR | 7.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Common Indoor Vaccine Refrigerators and Cold Chain Vaccine Refrigerators |

Capacity | Less than 100 liters, 100–200 liters, 200–300 liters and Above 300 liters | |

Temperature Range | 2°C to 8°C (Standard Refrigerators) and Below 0°C (Ultra-Low Freezers) | |

End-User | Hospitals and Clinics, Pharmaceutical Companies, Blood Banks, Research Laboratories, Pharmacies and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

By Type (Common Indoor Vaccine Refrigerators and Cold Chain Vaccine Refrigerators), By Capacity (Less than 100 liters, 100–200 liters, 200–300 liters and Above 300 liters), By Temperature Range (2°C to 8°C (Standard Refrigerators) and Below 0°C (Ultra-Low Freezers)), By End-User (Hospitals and Clinics, Pharmaceutical Companies, Blood Banks, Research Laboratories, Pharmacies and Others)

The global vaccine refrigerators market report delivers a detailed analysis with 64 key tables, more than 62 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here