Overview

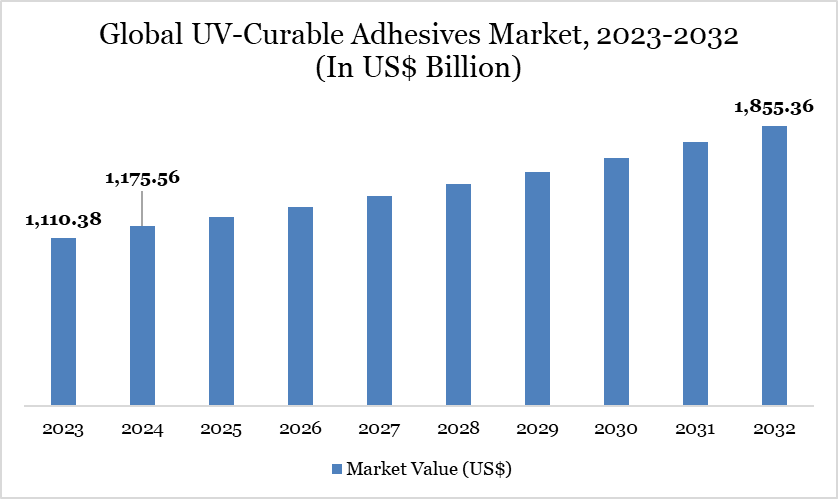

The global UV-Curable Adhesives market reached US$1,175.56 million in 2024 and is expected to reach US$1,855.36 million by 2032, growing at a CAGR of 5.87% during the forecast period 2025-2032.

The UV-curable adhesives market is witnessing strong growth as industries increasingly demand fast-curing, sustainable, and high-performance bonding solutions. This momentum is being fueled by sectors like electronics, automotive, packaging, and healthcare, where precision and durability are critical.

For instance, in June 2023, when Intertronics launched the IUV101 Medical Kit, allowing medical device manufacturers to trial LED UV adhesives with ease, demonstrating how the technology enables faster, cleaner, and more reliable assembly processes. This move underlined the growing adoption of UV-curable adhesives in healthcare, where safety, efficiency, and adaptability to different substrates are vital.

Building on this trend, in July 2025, Permabond introduced UV6357, a cold-resistant UV-curable adhesive that cures transparently within seconds and withstands extreme temperatures, humidity, and chemicals, making it ideal for refrigeration and freezer applications. Together, these innovations highlight how manufacturers are tailoring UV adhesives to address specific industry challenges, from medical precision to appliance durability.

Such product advancements also reflect the market’s shift toward adhesives that not only meet performance needs but also align with eco-friendly and low-VOC standards. At the same time, regulatory emphasis on eco-friendly, solvent-free solutions is encouraging the faster adoption of these solutions worldwide. The integration of UV-LED curing systems further strengthens the market by offering energy efficiency and versatility across substrates.

UV-Curable Adhesives Market Trend

The UV-curable adhesives market is witnessing steady growth driven by increasing demand for fast-curing, eco-friendly, and high-performance bonding solutions across industries such as electronics, automotive, medical devices, and packaging. Rising adoption of lightweight materials and miniaturized components is further fueling market expansion. Additionally, the shift toward sustainable manufacturing practices and advancements in UV LED curing technology are enhancing efficiency and reducing energy consumption. Growing applications in flexible displays, optical devices, and 3D printing are expected to create new opportunities for the market.

Market Scope

Metrics | Details |

By Resin Type | Epoxy, Acrylic, Silicone, Polyurethane, Others |

By Substrate | Ceramic, Glass, Metal, Plastics, Rubber, Composites, Others |

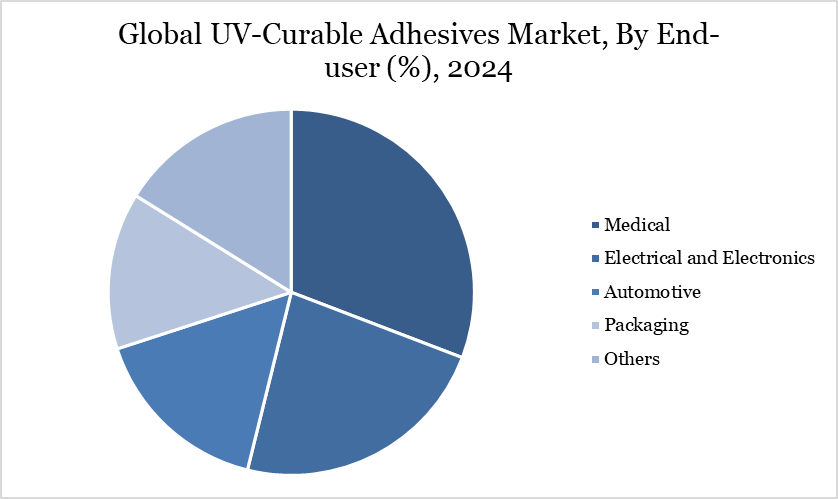

By End-User | Medical, Electrical and Electronics, Automotive, Packaging, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Request for Free Sample : Click here

Market Dynamics

Need for Fast Curing Speed and High-Efficiency Adhesives

Fast curing speed and high efficiency are the key factors propelling the global UV-curable adhesives market, as industries increasingly demand solutions that minimize downtime and accelerate production. These adhesives cure within seconds under UV exposure, ensuring higher throughput and cost savings for manufacturers. Their efficiency allows strong, durable bonds with minimal material use, making them more resource-efficient compared to traditional adhesives.

This growing demand is reflected in the adhesives and sealants industry, which, according to The Adhesive and Sealant Council, Inc., produced 10.3 billion pounds valued at over US$22 billion in 2022, highlighting their economic and industrial importance. To meet these demands, manufacturers are investing in advanced technologies that combine rapid curing with adaptability to various applications.

For instance, on November 29, 2023, Master Bond launched UV23FLDC-80TK, a dual-cure epoxy that not only cures in 20–30 seconds under UV light but also offers secondary heat curing for shadowed areas, ensuring reliable performance even in complex assemblies. With its thixotropic nature, toughness, and flexibility, it addresses challenges in encapsulation, bonding, and thermal cycling resistance, further showcasing the efficiency of next-generation UV adhesives.

High Capital Investment for Equipment

The UV-curable adhesives market faces restraint due to the high capital investment required for specialized curing equipment, such as UV lamps and LED curing systems. Many small and medium-scale manufacturers find it challenging to allocate significant upfront costs, which limits widespread adoption. Additionally, the need for continuous maintenance and periodic upgrades further adds to operational expenses. This financial barrier slows market penetration, particularly in emerging economies, despite the long-term efficiency and sustainability benefits of UV-curable adhesives.

Segment Analysis

The global UV-Curable Adhesives market is segmented based on resin type, substrate, and end-user and region.

The Medical Sector Holds a Significant Share in the Global UV-Curable Adhesives Market Due to Their Use in Bonding Disposable Medical Devices

The medical end-user segment holds a significant share in the global UV-curable adhesives market as healthcare devices demand highly reliable, safe, and regulatory-compliant bonding solutions. Growing adoption of minimally invasive devices, catheters, wearables, and diagnostic instruments has accelerated the need for UV-curable adhesives that provide precision, biocompatibility, and strong adhesion to complex substrates. The stringent regulatory landscape, particularly the FDA and EU MDR 2017, has fueled the shift toward adhesives that eliminate risks from harmful substances like DEHP in PVC, creating an opportunity for safer alternatives. Rising demand for thermoplastic elastomers (TPEs) in medical tubing and devices has further increased the adoption of UV-curable adhesives that can bond these challenging materials.

On January 29, 2025, in Düsseldorf, Germany, Henkel expanded its medical solutions portfolio with the launch of Loctite AA 3952 and Loctite SI 5057, two advanced light-cure adhesives tailored for flexible medical device assembly. These innovations directly support the industry’s transition away from DEHP-based PVC by offering durable bonding solutions compatible with TPEs. Meeting ISO 10993 biocompatibility standards, the adhesives ensure patient safety and compliance with evolving healthcare regulations. Their ability to withstand heat and humidity highlights the durability required for long-lasting device performance in critical medical environments.

Geographical Penetration

North America Holds a Significant Share in the Global UV-Curable Adhesives Market Due to Strong Demand from Electronics, Automotive, and Medical Industries

North America holds a significant share in the global UV-Curable Adhesives market, primarily driven by its strong industrial base, advanced manufacturing ecosystem, and growing demand across electronics, medical, and automotive sectors. The region’s leadership in technology adoption has accelerated the use of UV-curable adhesives in high-performance applications requiring fast curing, durability, and environmental compliance. The US, being home to leading electronics and semiconductor industries, plays a critical role in shaping market demand.

The US Department of Commerce recently announced a US$1.6 billion investment to boost semiconductor production at Texas Instruments’ Sherman facilities, which is expected to produce over 100 million chips daily once fully operational, directly driving the need for advanced adhesives in chip packaging and assembly.

Technological Analysis

The global UV-curable adhesives market is experiencing strong growth as technology and innovation continue to transform manufacturing efficiency and material performance. Rising demand for fast, reliable, and sustainable bonding solutions has encouraged companies to develop advanced formulations that cater to diverse substrates and complex industrial needs. On May 8, 2024, Permabond launched UV643, an ultra-fast curing adhesive capable of bonding rigid plastics, thermoplastics, and even dissimilar materials like plastic-to-metal, curing in just a fraction of a second under high-intensity UV light. Its multi-wavelength compatibility from 365–420 nm allows reliable performance even through UV-stabilized or thick plastics, ensuring design flexibility for automotive, electronics, and household appliance industries. This innovation reflects a broader trend of tailoring adhesives for demanding conditions, with UV643’s thixotropic dispensing and resistance to heat, humidity, and thermal cycling highlighting advanced engineering approaches.

Simultaneously, regulatory frameworks in Europe, such as REACH and RoHS, are accelerating the transition toward eco-friendly UV-curable systems, creating opportunities for greener material innovation. According to Fuji Gosei Co., Ltd., these regulations are not restricting but inspiring new advancements in UV-curable resin technologies, helping manufacturers align performance with sustainability goals.

Competitive Landscape

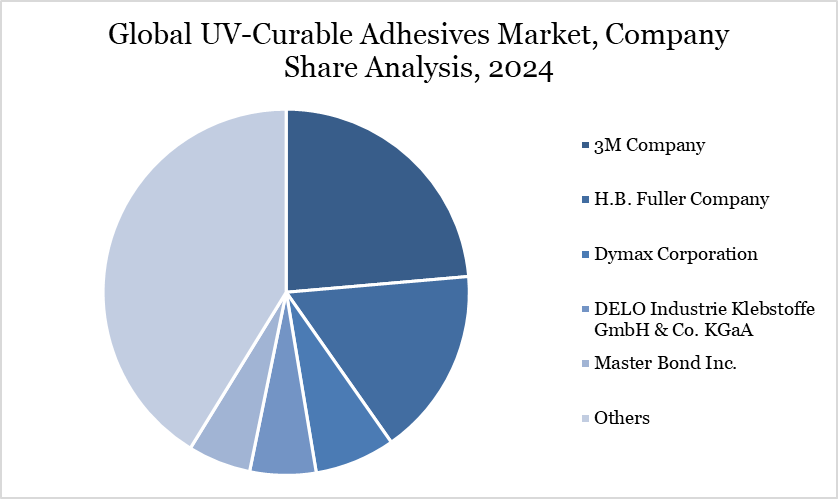

The major global players in the market include 3M Company, H.B. Fuller Company, Dymax Corporation, DELO Industrie Klebstoffe GmbH & Co. KGaA, Master Bond Inc., BASF SE, Permabond Engineering Adhesives, Ashland Global Holdings Inc., Sika Services AG, Panacol-Elosol GmbH.

Key Developments

On June 10, 2024, Dymax partnered with Ingenieria en Sistemas de Adhesivos (ISASA) in Mexico, combining Dymax’s 40 years of light-curing expertise with ISASA’s strong industrial network to enhance efficiency and customer support.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies