Uterine Cancer Treatment Market Size

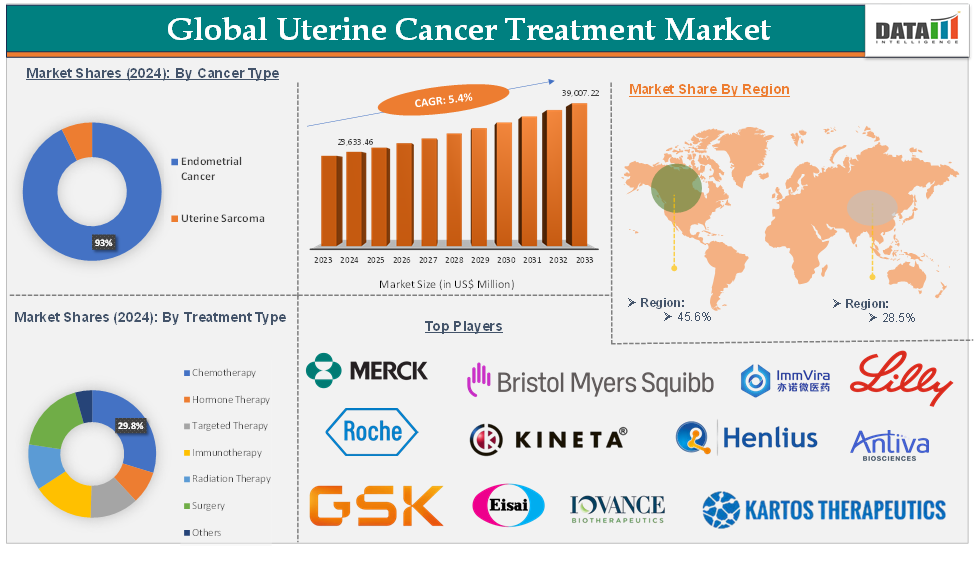

Uterine Cancer Treatment Market size reached US$ 23,633.46 Million in 2024 and is expected to reach US$ 39,007.22 Million by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033.

Uterine cancer refers to malignancies that develop in the uterus (womb), primarily affecting women who have gone through menopause. This disease is characterized by abnormal cell growth within the uterine tissues and is often linked to elevated estrogen levels as a primary risk factor.

The industry outlook remains positive, with a steady increase in demand for advanced therapies. Key industry trends include a shift toward minimally invasive surgical techniques, the integration of targeted therapy and immunotherapy for recurrent and advanced cases, and a growing emphasis on personalized medicine. Trends also show that the adoption of robotic surgery and molecular diagnostics is improving patient outcomes and expanding the scope of treatment.

Key drivers of market growth include the increasing global incidence of uterine cancers, particularly linked to rising obesity rates and aging populations. Opportunities abound in the development of novel targeted therapies and immunotherapies, especially for uterine sarcoma, where unmet medical needs remain significant. Expansion of healthcare infrastructure in emerging markets and supportive government initiatives further broaden the market’s scope.

Executive Summary

For more details on this report, Request for Sample

Uterine Cancer Treatment Market Dynamics: Drivers & Restraints

Rising Incidence of Uterine Cancer

The growing number of new uterine cancer cases worldwide is a significant driver of the global uterine cancer treatment market. According to National Institutes of Health data, in 2023, the rate of new uterine cancer cases is 28.3 per 100,000 women per year, while the death rate stands at 5.3 per 100,000 women per year (age-adjusted, based on 2018–2022 incidence and 2019–2023 mortality data). Additionally, the lifetime risk for women developing uterine cancer is approximately 3.1%, meaning about 1 in 32 women will be diagnosed with this disease during their lifetime.

The rising incidence of uterine cancer directly increases the number of patients need care, thereby expanding the market for all types of uterine cancer treatments. As more women are diagnosed with uterine cancer each year, the demand for all categories of treatment- chemotherapy, hormone therapy, targeted therapy, immunotherapy, radiation, surgery, and supportive care- rises proportionally. This trend encourages innovation, investment, and expansion across the entire spectrum of therapies and services, making it one of the most important drivers of market growth.

Side Effects and Toxicity Associated with the Treatment

One of the significant challenges restraining the growth of the global uterine cancer treatment market is the side effects and toxicity associated with various treatment modalities. Treatments such as chemotherapy, hormone therapy, targeted therapy, immunotherapy, radiation, and surgery, while effective in controlling or eliminating cancer, often cause adverse effects that can severely impact patients’ quality of life and limit their ability to continue therapy.

Chemotherapy drugs like paclitaxel, carboplatin, and doxorubicin, which are commonly used in uterine cancer treatment, are known for their systemic toxicity. Patients frequently experience side effects such as nausea, vomiting, hair loss, fatigue, myelosuppression (leading to increased infection risk), and neuropathy.

Hormone therapies, including agents like medroxyprogesterone acetate and tamoxifen, can cause weight gain, blood clots, hot flashes, and other hormonal imbalances. While targeted therapies and immunotherapies represent promising advances, they are not without their side effects. Targeted agents such as lenvatinib and bevacizumab can cause hypertension, proteinuria, and gastrointestinal issues. These toxicities often necessitate dose reductions, treatment delays, or discontinuation, thereby limiting the overall effectiveness of therapy.

Uterine Cancer Treatment Market - Epidemiology Analysis

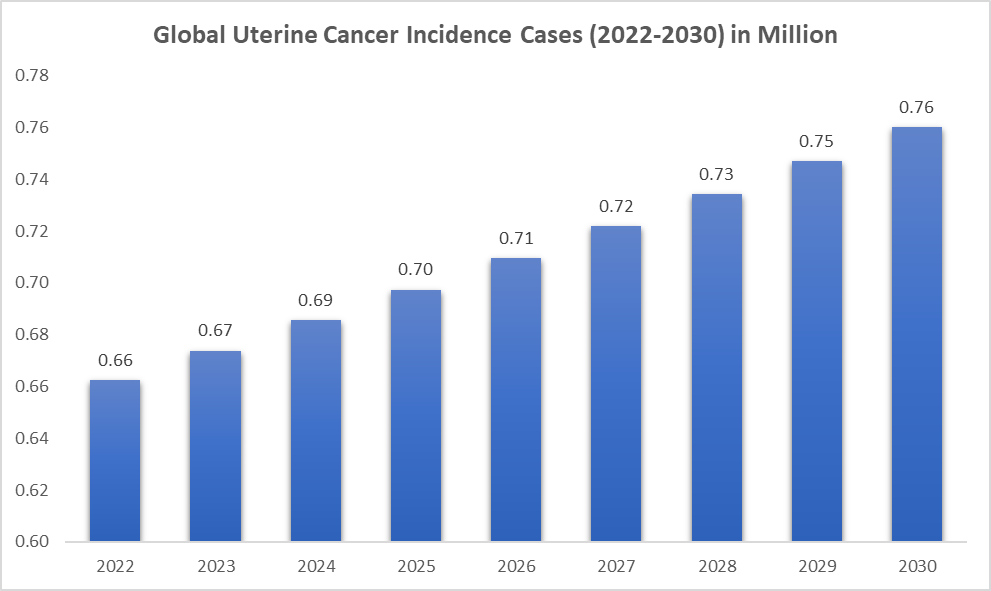

The rising incidence of uterine cancer is creating significant challenges for global healthcare systems. According to DataM Intelligence estimates, the number of prevalent uterine cancer cases is projected to grow from approximately 0.69 million in 2024 to 0.76 million by 2030. This upward trend underscores the urgent need for effective interventions, especially in regions where uterine cancer rates are highest, such as developing countries and among high-risk populations.

While early detection, improved treatment options, and advancements in healthcare infrastructure have led to better outcomes in developed nations, substantial challenges persist in low- and middle-income countries. These include limited access to timely diagnosis, fewer available treatment modalities, and disparities in healthcare resources, which contribute to poorer prognoses and higher mortality rates.

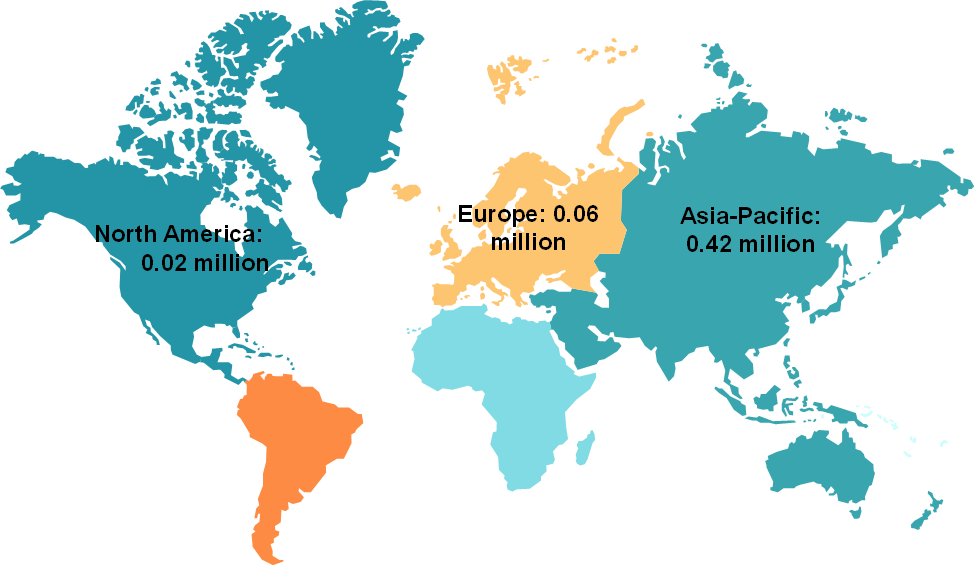

Uterine Cancer Treatment Market - Epidemiology Analysis (By Region)

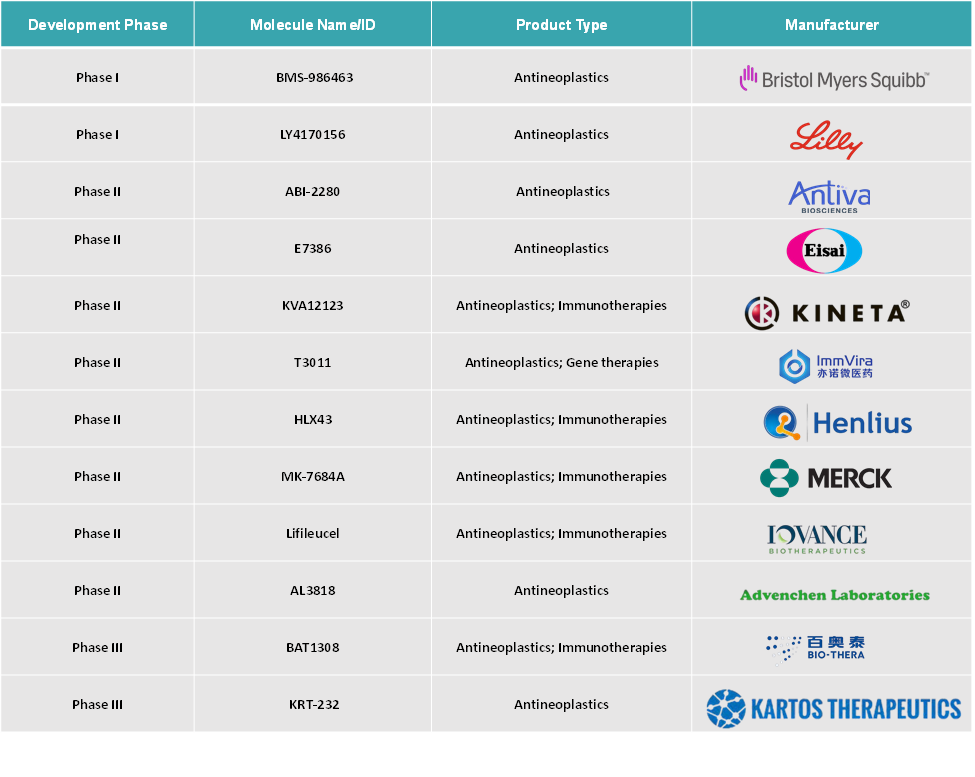

Uterine Cancer Treatment Market - Pipeline Analysis

Top Phase Pipeline Products for Uterine Cancer:

Uterine Cancer Treatment Market - Segment Analysis

The global uterine cancer treatment market is segmented based on cancer type, treatment type, and region.

Treatment Type:

The chemotherapy segment was valued at US$ 334.55 million in 2024 and is estimated to reach US$ 715.89 million by 2033, growing at a CAGR of 7.8% during the forecast period from 2025-2033

Chemotherapy involves the use of cytotoxic drugs that target rapidly dividing cancer cells, and it is often administered as a combination regimen to maximize effectiveness. Chemotherapy remains a cornerstone in the treatment of uterine cancer, especially for advanced, recurrent, or metastatic disease. It involves the use of cytotoxic drugs that kill rapidly dividing cancer cells. In the global market, chemotherapy is widely adopted due to its proven effectiveness, established protocols, and availability of both branded and generic drugs.

Chemotherapy can be administered as a single agent or, more commonly, in combination regimens to enhance effectiveness and overcome resistance. It remains a cornerstone of treatment, especially for advanced, recurrent, or metastatic uterine cancer. The most commonly used agents in uterine cancer include paclitaxel, carboplatin, cisplatin, doxorubicin, liposomal doxorubicin, bevacizumab, docetaxel, gemcitabine, and others.

Additionally, key players in the industry and their product launches & approvals will drive this segment's growth. For instance, in August 2024, GSK plc announced that the US Food and Drug Administration (FDA) had approved Jemperli (dostarlimab) to be used in a new treatment regimen for adult patients with primary advanced or recurrent endometrial cancer. The approved regimen consists of Jemperli administered in combination with the chemotherapy drugs carboplatin and paclitaxel, followed by Jemperli as a single-agent maintenance therapy. This approval represents an important advancement in treatment options for patients with advanced or recurrent endometrial cancer.

Uterine Cancer Treatment Market - Geographical Share

The North America uterine cancer treatment market was valued at US$ 11,257.95 million in 2024 and is estimated to reach US$ 24,282.77 million by 2033, growing at a CAGR of 7.9% during the forecast period from 2025-2033

The number of new uterine cancer cases is steadily increasing in North America, driven by factors such as an aging population, obesity, and lifestyle changes. According to the American Cancer Society, uterine cancer is the most common gynecologic malignancy in the U.S., resulting in higher demand for all treatment modalities.

According to the American Cancer Society’s projections for 2025, approximately 69,120 new cases of uterine cancer are expected to be diagnosed in the United States. Additionally, about 13,860 women are anticipated to die from cancers of the uterus. These figures include both endometrial cancers and uterine sarcomas. Since uterine sarcomas account for up to 10% of all uterine cancer cases, the actual numbers for endometrial cancer alone are slightly lower than these estimates.

Significant progress in chemotherapy, targeted therapy, and immunotherapy (such as pembrolizumab and dostarlimab) has expanded the range of effective treatments. New drug approvals and combination regimens are improving survival outcomes and expanding the market.

For instance, in June 2024, the U.S. Food and Drug Administration (FDA) approved a new treatment regimen for adult patients with primary advanced or recurrent endometrial carcinoma, a type of uterine cancer. This regimen combines pembrolizumab (Keytruda, Merck), an immunotherapy drug, with the chemotherapy agents carboplatin and paclitaxel. Patients first receive this combination therapy to target and reduce the cancer, followed by maintenance treatment with pembrolizumab alone.

The Asia-Pacific uterine cancer treatment market was valued at US$ 7,014.73 million in 2024 and is estimated to reach US$ 15,607.68 million by 2033, growing at a CAGR of 8.2% during the forecast period from 2025-2033

The Asia-Pacific uterine cancer treatment market is projected to witness robust growth over the forecast period, driven by rising cancer awareness, increasing healthcare expenditure, and improvements in diagnostic infrastructure.

Countries like Japan, with their advanced healthcare systems and aging populations, are at the forefront of this regional expansion. Japan is a major contributor to the Asia-Pacific uterine cancer treatment market, due to its advanced healthcare system, robust research infrastructure, and high adoption of innovative therapies. Japan’s aging population and proactive screening programs further drive demand for effective uterine cancer treatments.

Additionally, government initiatives to support cancer research and the growing presence of international pharmaceutical companies in the region are further accelerating development. Other key drivers in the Asia-Pacific region include increasing access to cancer screening programs, a rising prevalence of obesity, and expanding health insurance coverage, especially in emerging markets like India and Southeast Asia.

Uterine Cancer Treatment Market - Major Players

Top companies in the uterine cancer treatment market include Bristol-Myers Squibb Company, Pfizer Inc., Janssen Pharmaceuticals (Johnson & Johnson), F. Hoffmann-La Roche Ltd, Sanofi, Eli Lilly Services Inc, Novartis AG, AstraZeneca, Eisai Inc., GSK Plc, and Merck & Co., Inc., among others.

Uterine Cancer Treatment Market - Emerging Players

Emerging players in the uterine cancer treatment market include Antiva Biosciences, Eisai Co., Ltd., Kineta, IMMVIRA CO., LTD, Shanghai Henlius Biotech, Inc., and Iovance Biotherapeutics, Inc. and among others.

Uterine Cancer Treatment Market - Key Developments

- In January 2025, GSK plc announced that the European Commission had approved Jemperli (dostarlimab) in combination with chemotherapy (carboplatin and paclitaxel) as a first-line treatment for adult patients with primary advanced or recurrent endometrial cancer requiring systemic therapy.

- In June 2024, the FDA approved Imfinzi (durvalumab), an immunotherapy agent, in combination with chemotherapy for the treatment of mismatch repair deficient (dMMR) advanced or recurrent endometrial cancer in the United States. This approval represents a significant advancement in treatment options for this specific molecular subtype of endometrial cancer.

Market Scope

| Metrics | Details | |

| CAGR | 5.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Cancer Type | Endometrial Cancer, Uterine Sarcoma |

| Treatment Type | Chemotherapy, Hormone Therapy, Targeted Therapy, Immunotherapy, Radiation Therapy, Surgery, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global uterine cancer treatment market report delivers a detailed analysis with 75 key tables, more than 52 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.