Overview

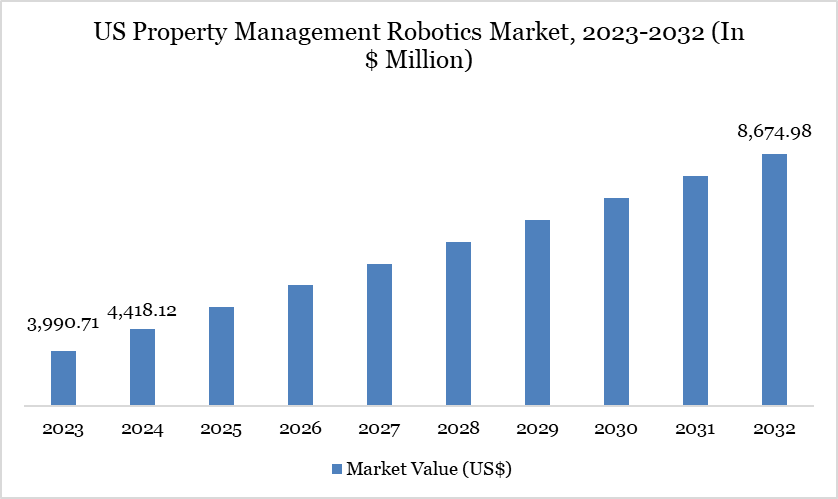

The US property management robotics market reached US$ 4,418.12 million in 2024 and is expected to reach US$ 8,674.98 million by 2032, growing at a CAGR of 8.80% during the forecast period 2025-2032.

The US property management robotics market is gaining traction as commercial real estate (CRE) operators increasingly integrate robots into facility upkeep. Robotics applications span cleaning, security, HVAC monitoring, and delivery services—optimizing operations and elevating tenant experiences.

According to US Census Bureau data from the 2019 Annual Business Survey, nearly 30% of workers across various industries are exposed to automation technologies—and cleaning and maintenance sectors are among the fastest adopters of robots for routine tasks. As labor shortages intensify, property managers are turning to robotics to sustain cleanliness and functionality: the janitorial workforce grew by under 1% projected over 2019–2029, while the population of autonomous cleaning robots is expected to rise from about 4,200 units in 2019 to over 683,000 by 2030, representing roughly 28% of janitorial labor equivalent.

Property Management Robotics Market Trend

A key trend in the US property management robotics market is the rapid replacement of low-skill labor with autonomous cleaning robots. The number of robotic units used in custodial services is projected to increase over 160 times between 2019 and 2030. These robots are expected to perform the equivalent of nearly 28% of human janitorial tasks by the end of the decade. This shift is largely driven by stagnant workforce growth and increased demand for 24/7 maintenance. Property managers are adopting robotics not just for cost savings, but to meet rising hygiene and efficiency standards.

Market Scope

Metrics | Details |

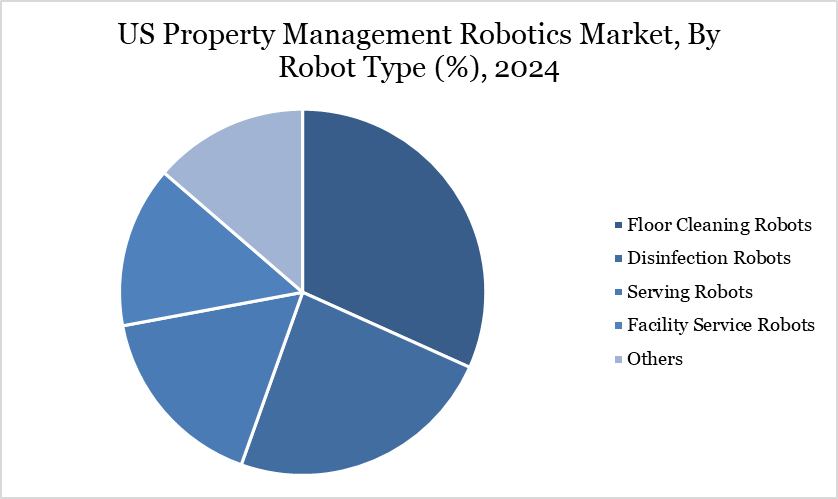

By Robot Type | Floor Cleaning Robots, Disinfection Robots, Serving Robots, Facility Service Robots, Others |

By Functionality | Autonomous Navigation Robots, Semi-Autonomous Service Robots |

By Deployment Model | Owned In-House Robotics Systems, Robot-as-a-Service / Rental Models |

By End-User | Real-Estate Facilities, Hospitality, Healthcare Facilities, Transportation Hubs, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand for Autonomous Building Maintenance to Offset Skilled Labor Shortages

The rising demand for autonomous building maintenance to offset skilled labor shortages is driving the US property management robotics market. Employment for janitors and building cleaners is projected to grow slowly, despite hundreds of thousands of annual openings driven by retirements and turnover. Over 60% of facility service providers report challenges in hiring qualified cleaning staff. As a result, property managers are turning to robotics to maintain operational standards and reduce dependency on limited human resources.

High Initial Capital Investment and Integration Complexity with Legacy Building Systems

High initial capital investment and integration complexity with outdated infrastructure are key restraints in the US property management robotics market. According to official data, over 70% of US commercial buildings were constructed before 1999, many of which lack the digital infrastructure needed for robotic system integration. Additionally, costs for advanced cleaning robots like autonomous floor scrubbers can exceed $35,000 per unit, not including installation or system upgrades. These financial and technical barriers make adoption difficult for small and mid-sized property managers, limiting broader market penetration.

Segment Analysis

The US property management robotics market is segmented by robot type, functionality, deployment model, end-user.

Floor Cleaning Robots Segment Holds a Significant Share

The floor cleaning robots segment holds a significant share of the US property management robotics market, driven by widespread adoption in commercial buildings and large residential complexes. According to the US Department of Energy, commercial buildings spend nearly US$ 20 billion annually on cleaning and maintenance, with a major portion allocated to floor care. Companies like Tennant Company report that their autonomous floor scrubbers, such as the T7AMR, can reduce labor needs by up to 66% while conserving up to 70% more water compared to conventional equipment. This dual benefit of operational efficiency and sustainability is prompting property managers to increasingly adopt robotic floor cleaners as a core component of building maintenance strategies.

Sustainability Analysis

The integration of robotics in US property management is significantly advancing sustainability goals through reduced energy usage, optimized resource consumption, and lower greenhouse gas (GHG) emissions. According to the US Department of Energy (DOE), buildings account for approximately 40% of total US energy consumption and over 30% of GHG emissions. Robotics used for HVAC optimization, automated cleaning, and maintenance scheduling can reduce energy waste by up to 20%, as highlighted in DOE’s Building Technologies Office findings.

For example, Tennant Company, in its 2023 Sustainability Report, reported that its T7AMR robotic floor scrubber uses up to 70% less water than traditional cleaning methods due to its ec-H2O NanoClean technology. Similarly, Avidbots' Neo robot claims to reduce water usage by up to 85%, contributing to more eco-efficient facility operations. These improvements align with the US EPA's SmartWay initiative goals, reinforcing how robotics can drive cleaner, leaner property management in line with national climate and energy efficiency targets.

Competitive Landscape

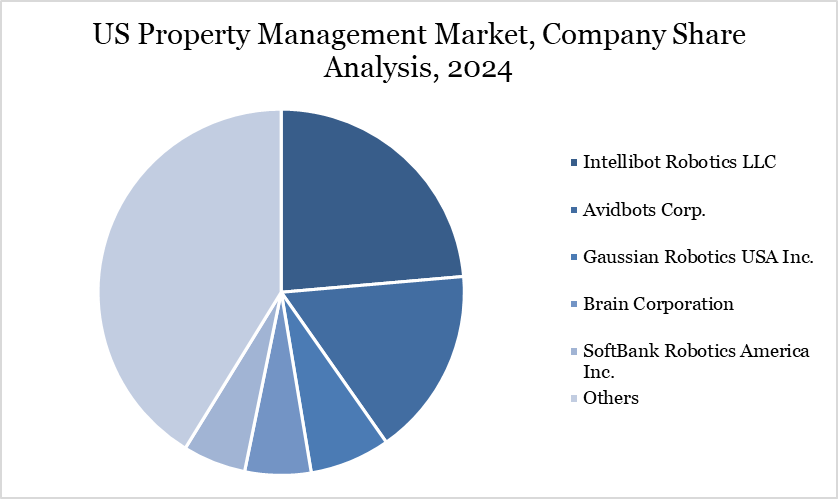

The major players in the market include Intellibot Robotics LLC, Avidbots Corp., Gaussian Robotics USA Inc., Brain Corporation, SoftBank Robotics America Inc., ICE Robotics US Inc., Xenex Disinfection Services Inc., Tennant Company, Fetch Robotics Inc., and Cobalt Robotics Inc.

Key Developments

In June 2025, SoftBank Robotics America announced the official launch of SoftBank Robotics Connect for the US market. SoftBank Robotics Connect is an online platform that provides a streamlined, automated approach to managing heterogeneous fleets of autonomous solutions, enabling operational transparency and increased productivity.

In July 2025, DNX Group is leading a new frontier in private equity by launching a platform centered on robotic rentals, enabling investors to tap into the rapidly growing automation economy. As labor costs rise and efficiency becomes paramount, demand for robotic solutions across industries has exploded — and DNX is positioned at the forefront.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies