Overview

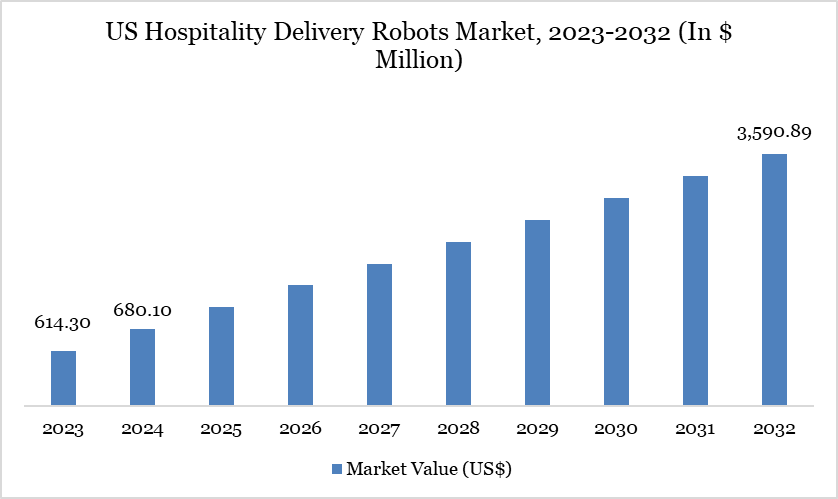

The US hospitality delivery robots market reached US$ 680.10 million in 2024 and is expected to reach US$ 3,590.89 million by 2032, growing at a CAGR of 23.12% during the forecast period 2025-2032.

The US market for hospitality delivery robots—comprising autonomous bots that transport food, packages, and amenities across venues like hotels, restaurants, campuses, and event facilities—is witnessing growth driven by labor shortages in service industries and rising demand for contactless guest services. In 2024, professional service robots in transportation and logistics—including hospitality delivery bots—accounted for the majority of about 205,000 units sold globally, with roughly 9,000 deployed in the Americas. This uptick reflects real-world adoption across US venues.

Hospitality Delivery Robots Market Trend

Autonomous sidewalk delivery robots are being adopted rapidly in major hospitality hubs. For example, DoorDash and Coco Robotics launched robot deliveries in Chicago and Los Angeles in April 2025, enabling emission-free service from around 600 participating merchants. Coco's fleet has already completed over 500,000 deliveries globally, illustrating scalable deployment. These systems integrate seamlessly into operations, boosting order accuracy, speed, and sustainability—making them increasingly favored in contactless hospitality experiences.

Market Scope

Metrics | Details |

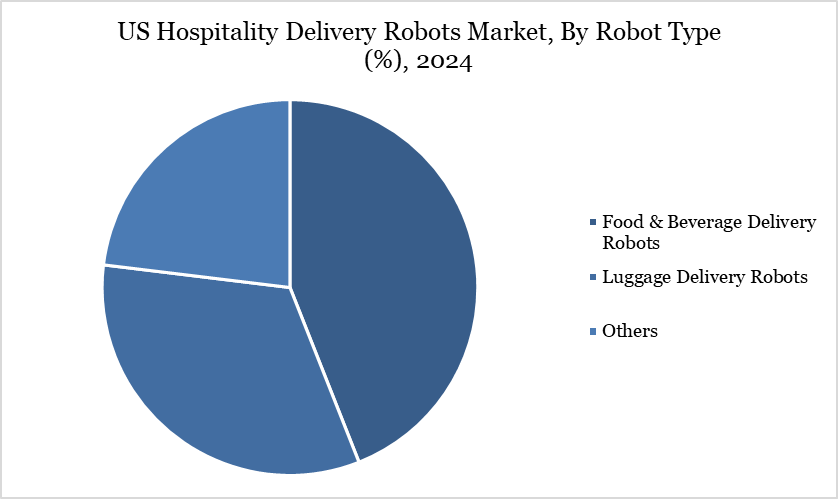

By Robot Type | Food & Beverage Delivery Robots, Luggage Delivery Robots, Others |

By Functionality | Fully Autonomous, Semi-Autonomous |

By Deployment Model | Owned In-House Robotics Systems, Robot-as-a-Service / Rental Models |

By End-User | Hotels Restaurants & Cafes (HoReCa), Cruise Ships & Casinos, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand for Contactless Guest Services in Hotels and Restaurants

US hotels and restaurants are increasingly turning to autonomous delivery robots to meet growing guest expectations for contactless service. Nearly 79% of US hotels report persistent staffing shortages, especially for housekeeping, leading to unmet guest service demands. At properties like Hilton Austin Airport, robots vacuum guest rooms, shaving off an average of 5.5 minutes per room, boosting staff efficiency. Hotel executives cite that over 40% of guests express strong interest in using robotics-based service solutions. Deployments of delivery bots have enabled consistent, touch‑free amenity delivery while helping hotels manage tight labor availability without sacrificing service quality.

Limited Elevator and Infrastructure Integration in Older Hospitality Properties

The widespread adoption of hospitality delivery robots in the US is being hindered by infrastructure challenges in legacy hotel properties. Over 60% of hotels currently operating in the US were built before 2000, many of which lack modern elevator systems with programmable access panels or API-enabled interfaces required for robot navigation. In such properties, integration with elevators, hallway access, and room delivery mechanisms remains largely manual, reducing the operational efficiency and autonomy that delivery robots are designed to provide. These structural constraints not only increase installation costs but also limit the scalability of robot deployments beyond newer, tech-enabled hospitality environments.

Segment Analysis

The US hospitality delivery robots market is segmented by robot type, functionality, deployment model, end-user.

Food & Beverage Delivery Robots Segment Holds a Significant Share

As of mid‑2024, about 65–76% of US hotels report persistent staffing shortages, with housekeeping identified as the most critical gap—and a majority unable to fill multiple vacancies per property. In response, hotels and restaurants are turning to autonomous delivery robots to meet guest expectations for timely, contactless service while offsetting labor limitations. Companies such as Starship Technologies have recorded millions of emissions-free deliveries globally and are expanding to hospitality venues. The rapid pace of robot adoption—particularly in hotel corridors, lobbies, and dining areas—reflects strong operator demand for reliable, efficient delivery solutions that reduce reliance on understaffed human teams.

Sustainability Analysis

The deployment of food and amenity delivery robots in US hospitality venues is delivering measurable environmental benefits through reduced vehicle miles traveled and cleaner logistics operations. One global operator alone has surpassed 8 million autonomous deliveries, cutting over 500,000 miles of car journeys and saving more than 137 tons of CO₂ emissions—plus reductions in NOₓ and particulate matter.

In urban hospitality settings, delivery robots reduce traffic congestion by up to 29% and decrease carbon emissions by approximately 16%, replacing short car or van trips with zero-emission sidewalk mobility. Powered entirely by electricity, these robots contribute to hotel sustainability goals by minimizing operational emissions and aligning with broader carbon reduction targets in the hospitality sector.

Competitive Landscape

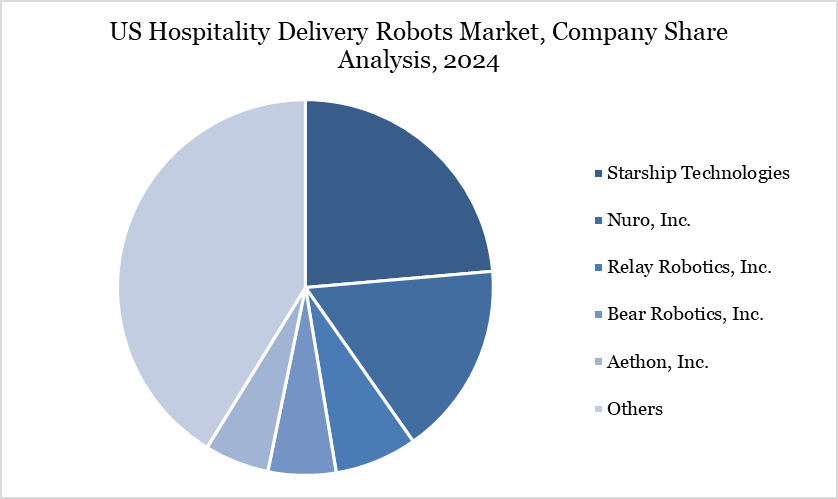

The major players in the market include Starship Technologies, Nuro, Inc., Relay Robotics, Inc., Bear Robotics, Inc., Aethon, Inc., Savioke, Inc., Robomart, Inc., Ubtech Robotics, Inc., Pudu Robotics Co., Ltd., and SoftBank Robotics Corp.

Key Developments

In April 2025, DoorDash partnered with Coco Robotics to roll out sidewalk robot deliveries in parts of Chicago and Los Angeles. Customers ordering from nearly 600 merchants may have their orders delivered by Coco’s zero-emission robots via the DoorDash app. This expands on an earlier pilot with Wolt, DoorDash’s international platform, operating in Helsinki.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report