Overview

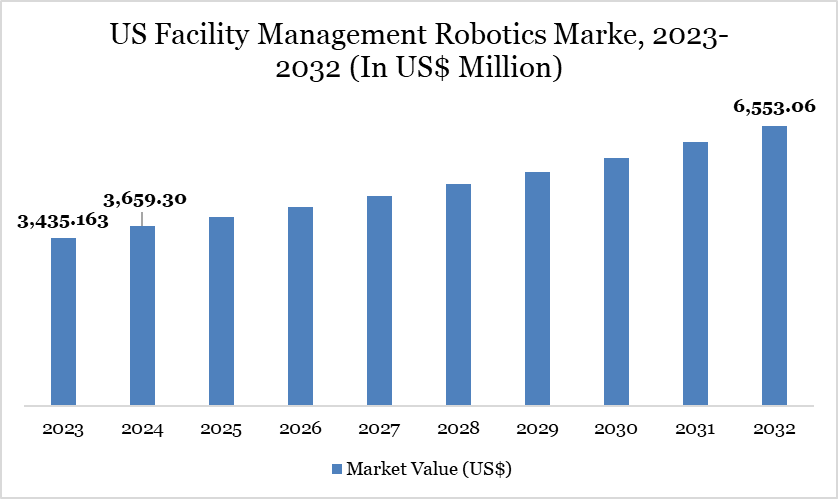

The US facility management robotics market reached US$3,659.30 million in 2024 and is expected to reach US$6,553.06 million by 2032, growing at a CAGR of 7.67% during the forecast period 2025-2032.

The US facility management robotics market is experiencing steady growth, primarily driven by rising labor shortages and wage inflation. According to ManpowerGroup, there is a 70% labor shortage and a labor force participation rate of just 62.7%. This persistent labor gap has accelerated demand for automated solutions in cleaning, security, and landscaping services. Robotics offers a reliable alternative to manual labor, especially as wages and salaries rose 4.3% in March 2024 and another 3.4% in the 12 months ending March 2025, according to BIS.

Businesses facing mounting operational costs are increasingly adopting autonomous and semi-autonomous robots to maintain facilities efficiently. In March 2024 alone, the sector saw a 4.1% growth, underscoring the ongoing transition toward automation. Robotic solutions are gaining ground in commercial buildings, hospitals, malls, and educational institutions, offering 24/7 productivity and minimal human intervention. The convergence of economic pressure and tech innovation is reshaping the way facilities are managed in the US.

Facility Management Robotics Market Trend

Technological integration is a key trend driving growth in the US Facility Management Robotics Market, as facility operators increasingly demand smart, data-driven solutions to boost efficiency and reduce reliance on manual labor. Modern robotics is now equipped with advanced AI, sensors, and autonomous navigation systems to handle complex tasks in dynamic environments.

A prime example is Tennant Company’s launch of the X6 ROVR in April 2025, a next-generation autonomous floor scrubber designed for large commercial and light-industrial spaces. Powered by BrainOS navigation, 3D LiDAR, and automated docking, the X6 showcases how intelligent features are becoming standard to improve performance, precision, and usability. These technologies also enable real-time data collection, remote monitoring, and predictive maintenance capabilities that align with the growing demand for seamless integration into digital facility ecosystems.

Market Scope

Metrics | Details |

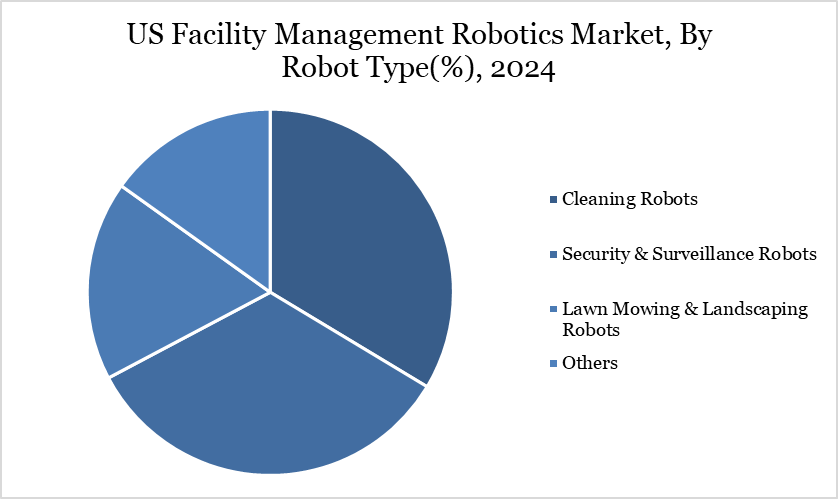

By Robot Type | Cleaning Robots, Security & Surveillance Robots, Lawn Mowing & Landscaping Robots, Others |

By Operation Mode | Semi-Autonomous Robots, Fully Autonomous Robots |

By Deployment Mode | Ownership Model, Robotics-as-a-Service |

By End-User | Commercial Buildings, Educational Institutions, Healthcare Facilities, Retail & Shopping Malls, Industrial Facilities, Hospitality, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Labor Costs & Labor Shortages in Janitorial Services

The rise in smart building and infrastructure projects is significantly propelling the growth of the US Facility Management Robotics Market. With increasing emphasis on energy efficiency, automation, and sustainable operations, smart buildings are becoming ideal environments for deploying robotic solutions. For instance, in June 2024, the US General Services Administration (GSA) announced a US$80 million investment to implement smart building technologies across 560 federal buildings, aiming for net-zero emissions by 2045. This large-scale initiative highlights the federal government’s commitment to digitized facility management, driving demand for intelligent robotic systems.

These buildings often require integrated, automated solutions like robotic cleaners, security bots, and surveillance drones for optimal performance. Robotics complements IoT-enabled infrastructures, facilitating predictive maintenance, real-time monitoring, and data-driven facility operations. As smart buildings adopt connected platforms, robots equipped with AI and remote management tools become essential assets. The growing synergy between smart infrastructure and robotics is also pushing private developers to adopt similar models. This technological alignment is fostering innovations and encouraging both public and private sector investments in facility management robotics.

High Upfront Costs & Financial Investment

High upfront costs and financial investment are significant restraints in the US Facility Management Robotics Market, particularly for small and mid-sized enterprises. Purchasing advanced robots requires not just the machine itself but also integration with building systems, workforce training, and ongoing maintenance. These costs can run into hundreds of thousands of dollars per site, making ROI uncertain for companies with tight operational budgets. Additionally, the need for specialized infrastructure, such as automated docking stations and cybersecurity systems, adds to the capital burden. As a result, many facility managers delay adoption despite long-term efficiency benefits.

Segment Analysis

The US facility management robotics market is segmented based on robot type, operation mode, deployment model, and end-user.

Security & Surveillance Robots Hold a Significant Share ue to Rising Demand for Automated, 24/7 Safety Solutions.

Security and surveillance robots are gaining a significant share in the US Facility Management Robotics Market as organizations increasingly seek reliable, round-the-clock safety solutions. Their ability to perform autonomous monitoring, detect anomalies, and respond in real time addresses both rising security demands and ongoing labor shortages.

This trend is evident in February 2025, when Knightscope, Inc. expanded its AI-powered solutions across three US healthcare organizations, demonstrating growing reliance on robotic security systems. A Texas hospital enhanced its emergency communication infrastructure, while another strengthened parking lot surveillance with the deployment of the K5 Autonomous Security Robot. At the same time, a Department of Health facility in the Northeast implemented Knightscope’s advanced technologies to improve public safety. As facilities prioritize smarter, data-driven protection, the role of security and surveillance robots continues to grow across sectors.

Technological Analysis

Technological advancements are significantly transforming the US Facility Management Robotics Market, driven by innovations in AI, sensors, and autonomous navigation. The integration of advanced LiDAR, 3D mapping, and SLAM technologies is enhancing the precision and efficiency of robotic operations in commercial spaces.

A key example is LG Electronics US’s launch on April 2, 2025, of a commercial-grade robotic vacuum developed in collaboration with the Marriott Design Lab, showcasing the real-world application of Vision Fusion SLAM for autonomous overnight cleaning. This deployment across Marriott hotels demonstrates the hospitality sector’s shift toward smart, disruption-free facility upkeep. The trend reflects a broader move toward AI-powered automation that reduces manual intervention while maintaining high service standards.

Competitive Landscape

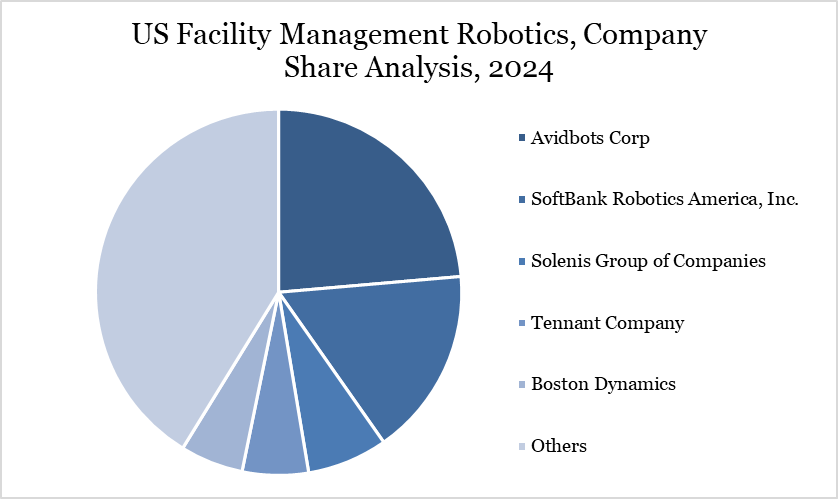

The major players in the market include Avidbots Corp, SoftBank Robotics America, Inc., Solenis Group of Companies, Tennant Company, Boston Dynamics, ICE Cobotics, Brain Corporation, Pringle Robotics, ANSCER Robotics, Peppermint Robotics and others.

Key Developments

In November 2024, Israeli company Verbotics debuted its AI-powered window-washing robot, Ibex, in Dallas, Texas. Designed to resemble Spiderman in action, the robot autonomously climbs high-rise buildings using advanced AI algorithms, vision systems, and sensors to detect window frames and ensure thorough cleaning. With onboard cameras and tablet-based controls, Ibex enhances safety by minimizing human risk while delivering precise, data-driven cleaning.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies