Overview

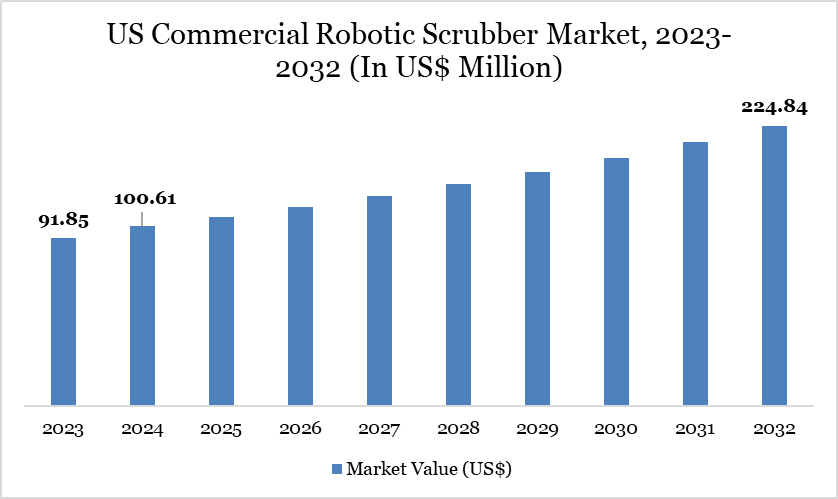

The US Commercial Robotic Scrubber market reached US$100.61 million in 2024 and is expected to reach US$224.84 million by 2032, growing at a CAGR of 10.69% during the forecast period 2025-2032.

The US commercial robotic scrubber market is experiencing strong growth, driven by increasing automation needs across hospitality, education, healthcare, and retail sectors. With US hotel occupancy rebounding to around 63.6% in 2024, nearly matching pre-pandemic levels, and over 1.3 billion room nights in 2023, according to the American Hotel & Lodging Association, hospitality teams face intensified cleaning demands. Robotic scrubbers are helping maintain consistent cleanliness and productivity across high-traffic properties, allowing staff to shift focus toward guest-facing roles. Since vacuuming alone can consume up to 30% of housekeeping time, robots relieve physical workload and boost staffing efficiency.

Meanwhile, educational institutions are adopting robotics through government-backed facility upgrades. For instance, districts like Dallas ISD, which received over US$784.6 million in ESSER II/III funding, are piloting technology-assisted sanitation as part of modernization efforts. These developments signal a broader trend toward robotics-driven operational resilience and hygiene excellence in commercial settings.

Commercial Robotic Scrubber Market Trend

A prominent trend in the US Commercial Robotic Scrubber Market is the rising demand for compact, intelligent scrubbers capable of operating efficiently in high-traffic, tight-space environments. This demand is driven by increasing pressure on commercial sectors like retail, healthcare, transportation, and education to maintain high hygiene standards while optimizing space and reducing labor dependency.

In response, companies are developing advanced solutions tailored for such settings, as demonstrated in April 2024 when Avidbots, an Ontario-based robotics company, launched Kas at MODEX 2024 in Atlanta. Kas is a compact, fully autonomous cleaning robot designed specifically for dynamic commercial environments, offering seamless navigation and minimal disruption during operations. With advanced AI, a 15-sensor system, and commercial-grade hardware, Kas ensures efficient, safe, and consistent cleaning performance for over 3 hours on a single charge. This innovation aligns with the growing industry focus on future-ready, touch-free cleaning strategies.

Market Scope

Metrics | Details |

By Variant | Only Scrubber, Scrubber and Dryer |

By Operation Mode | Fully Autonomous, Semi-Autonomous |

By Scrubber Head Type | Disc, Cylindrical |

By End-User | Retail Stores and Malls, Airports and Transportation Facilities, Healthcare Facilities, Educational Institutions, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Labor Costs & Labor Shortages in Janitorial Services

Rising labor costs and persistent shortages in janitorial services are significantly driving the growth of the US Commercial Robotic Scrubber Market. According to the Bureau of Labor Statistics (BIS), the median hourly wage for janitors and building cleaners reached US$17.27 in May 2024, reflecting the increasing cost burden on facility management. At the same time, the sector continues to face workforce instability due to the broader employment shift known as the “Great Reshuffle.” Juniper Cleaning, a California-based company, highlights that over 50 million workers resigned in 2022 and nearly 48 million in 2021, with 30.6 million resignations already recorded by October 31, 2023.

This exodus includes many janitorial workers who have transitioned to better-paying or more flexible industries, leaving a staffing void in cleaning operations. As a result, commercial spaces such as airports, malls, healthcare facilities, and educational institutions are increasingly turning to robotic scrubbers to ensure consistent cleanliness. These machines offer a cost-effective and reliable alternative to human labor, reducing dependency on an unstable workforce. The integration of automation not only helps manage rising wages but also enhances operational efficiency in high-traffic environments.

Frequent Maintenance Requirements and Limited Capacity

Frequent maintenance requirements and limited cleaning capacity are significantly restraining the growth of the US Commercial Robotic Scrubber Market. These machines often require regular servicing, software updates, and part replacements, leading to increased downtime and higher operational costs. Their limited tank size and battery life reduce cleaning efficiency in large commercial spaces, necessitating multiple cycles or human intervention. This diminishes the intended benefits of automation, especially in high-traffic environments like airports, malls, and healthcare facilities. As a result, many facility managers hesitate to invest, favoring traditional cleaning methods for reliability. The combination of high upkeep and constrained performance limits wider adoption across sectors.

Segment Analysis

The US commercial robotic scrubber market is segmented based on variant, operation mode, scrubber head type, end-user.

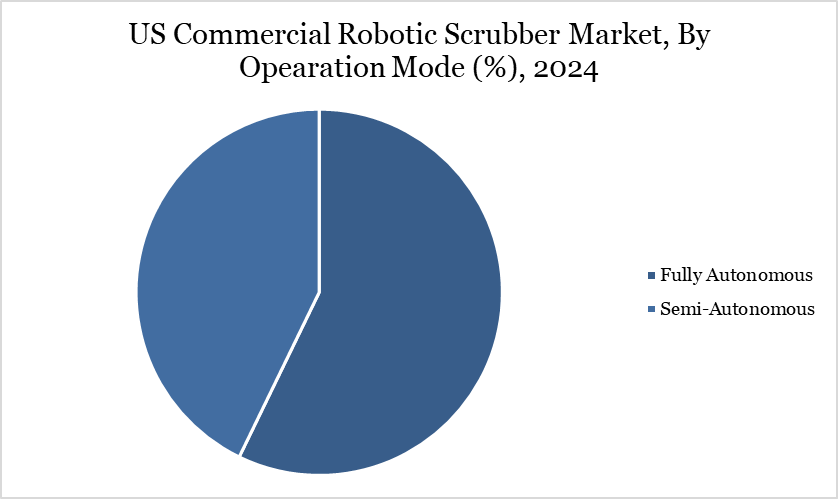

Autonomous Segment Drives the Market Growth Due to Rising Demand for Smart and Efficient Cleaning Solutions

Autonomous robotic scrubbers hold a significant share in the US Commercial Robotic Scrubber Market due to their ability to address key industry challenges like labor shortages, rising operational costs, and the need for consistent cleaning quality. These machines reduce the reliance on manual labor and offer enhanced productivity through advanced navigation and self-operation capabilities.

A notable example is Kärcher US’s launch of the KIRA B 100 R on April 11, 2022, in Denver, CO, powered by Brain Corp’s BrainOS, the world’s most validated software platform for autonomous mobile robots in indoor public spaces. This launch, along with the earlier KIRA CV 60/1 autonomous vacuum, reflects a growing industry shift toward automation. Such innovations enable efficient cleaning of large commercial spaces like airports, malls, and hospitals. As demand for scalable, smart cleaning solutions grows, the autonomous segment continues to dominate the market landscape.

Technological Analysis

Technological advancements are playing a critical role in shaping the US commercial robotic scrubber Market, with a strong focus on AI-driven automation, smart navigation, and performance analytics. The integration of advanced sensors, real-time mapping, and machine learning capabilities is enabling scrubbers to operate efficiently in dynamic environments with minimal supervision.

A significant milestone was marked in 2024 when Tennant Company formalized its partnership with Brain Corp, signing an exclusive technology agreement and investing US$32 million to fast-track the development of AI-enabled autonomous mobile robots (AMRs). This collaboration led to the launch of the X4 ROVR, Tennant’s first purpose-built autonomous floor scrubber for small to mid-sized spaces, showcasing the shift toward intelligent and scalable cleaning solutions. Such innovations are not only boosting cleaning productivity and safety but also allowing for remote fleet management and data-driven optimization, setting a new standard for facility maintenance in commercial sectors.

Competitive Landscape

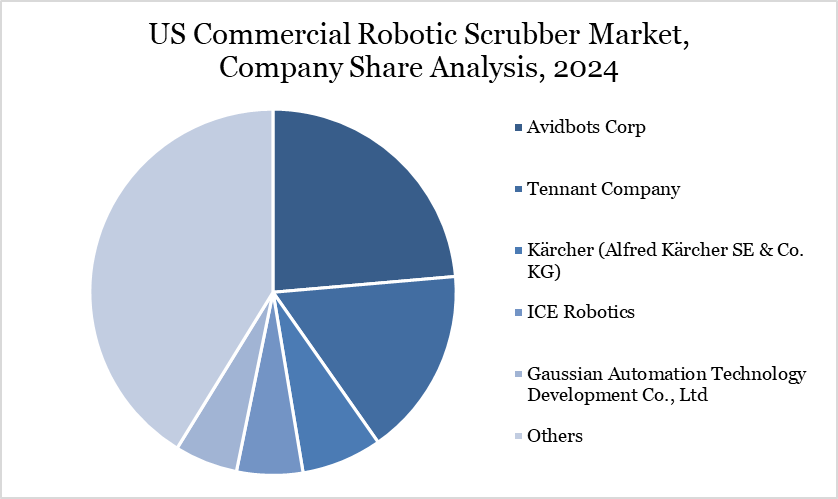

The major players in the market include Avidbots Corp, Tennant Company, Kärcher (Alfred Kärcher SE & Co. KG), ICE Robotics, Gaussian Automation Technology Development Co., Ltd, Brain Corp, Fimap S.p.A, Nilfisk A/S, Peppermint Robotics, Solenis Group Companies and others.

Key Developments

In April 2025, Minneapolis-based Tennant Company launched the X6 ROVR, a mid-sized autonomous floor scrubber designed for large and complex commercial and light-industrial environments. Built for commercial and light-industrial environments, the mid-sized robotic scrubber delivers maximum floor coverage with minimal human assistance to meet rising demands for smarter cleaning. Powered by BrainOS, the X6 ROVR can clean up to 75,000 square feet per cycle and features autonomous docking, real-time routing, and high-capacity tanks, offering a dependable, efficient solution amid ongoing staffing challenges.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies