Overview

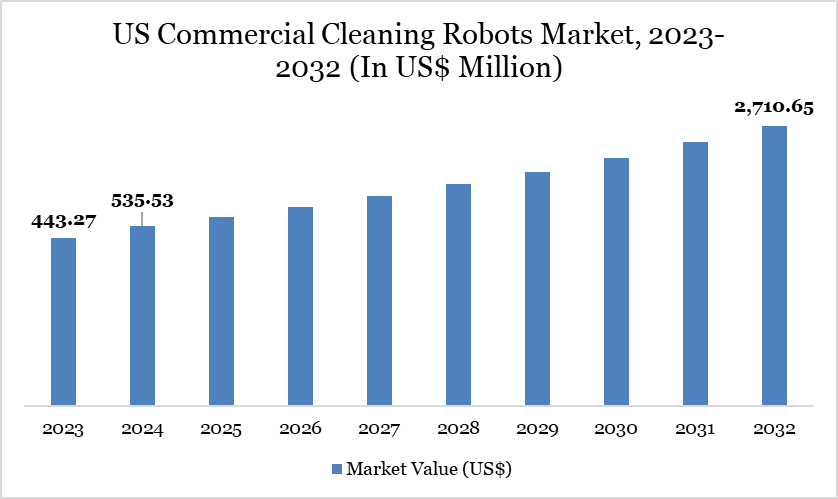

The US commercial cleaning robots market reached US$535.53 million in 2024 and is expected to reach US$2,710.65 million by 2032, growing at a CAGR of 22.7% during the forecast period 2025-2032.

The U.S. Commercial Cleaning Robots Market is witnessing robust growth driven by rising labor costs and persistent workforce instability. According to the Bureau of Labor Statistics, the median hourly wage for janitors and building cleaners reached US$17.27 in May 2024, significantly increasing operational expenses for facility managers. This financial strain is further compounded by high employee turnover, a trend fueled by the “Great Reshuffle.”

For instance, Juniper Cleaning reports that over 50 million workers resigned in 2022 and nearly 48 million in 2021, with another 30.6 million resignations logged by October 31, 2023. These challenges are pushing organizations to adopt autonomous cleaning solutions to ensure consistency and cost-efficiency. The demand is particularly strong in sectors like retail, hospitality, and healthcare, where hygiene standards are non-negotiable. As a result, commercial cleaning robots are emerging as a viable alternative to traditional labor-intensive methods, fueling sustained market growth across the U.S.

Commercial Cleaning Robots Market Trend

A key trend in the US commercial cleaning robots market is the growing collaboration between technology providers and end-user industries, particularly hospitality, to co-develop tailored robotic solutions. This approach ensures the technology addresses specific operational needs and real-world challenges. A prime example is LG Electronics USA’s launch of a commercial-grade autonomous robotic vacuum cleaner on April 2, 2025, developed in partnership with the Marriott Design Lab. The robot, designed for efficient cleaning of hotel corridors and meeting spaces, was piloted at Marriott properties before commercial rollout. This reflects a broader shift toward user-centric innovation in the field of cleaning robotics. Such collaborations signal a trend toward integrated, scalable, and efficient robotic cleaning systems customized for high-demand commercial environments.

Market Scope

Metrics | Details |

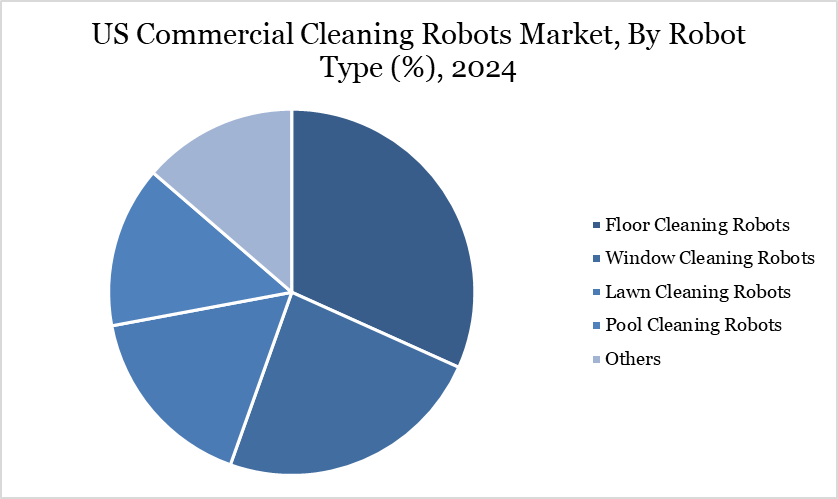

By Robot Type | Floor Cleaning Robots, Window Cleaning Robots, Lawn Cleaning Robots, Pool Cleaning Robots, Others |

By Operation Mode | Semi-Autonomous Robots, Fully Autonomous Robots |

By Deployment Model | Ownership Model, Robotics-as-a-Service |

By End-User | Hospitality, Healthcare, Retail Stores & Shopping Malls, Corporate Offices, Educational Institutions, Others |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand for Operational Efficiency

The rising demand for operational efficiency is a key driver of the U.S. Commercial Cleaning Robots Market, as businesses seek to streamline cleaning processes, reduce labor dependency, and maintain consistent hygiene standards. Automation offers time and cost savings, particularly in large commercial spaces where manual cleaning is resource-intensive. In response to this, companies are investing in advanced technologies to scale operations efficiently.

A prime example is the 2024 partnership between Tennant Company and Brain Corp, which involved a US$32 million investment and an exclusive technology agreement to accelerate AI-enabled autonomous mobile robots (AMRs). This collaboration resulted in the launch of the X4 ROVR, Tennant’s first purpose-built autonomous floor scrubber tailored for small to mid-sized areas. Such innovations are transforming routine operations into data-driven, optimized workflows, reinforcing the industry’s shift toward intelligent, efficient, and labor-light cleaning solutions.

Maintenance and Technical Complexity

Maintenance and technical complexity significantly restrain the growth of the U.S. commercial cleaning robots market. These robots often require regular servicing, firmware updates, and troubleshooting, which can disrupt operations and demand specialized technical expertise. Many businesses lack in-house personnel trained to manage such complexities, leading to increased dependency on external support. Unexpected breakdowns or software glitches can result in costly downtime, especially in time-sensitive commercial environments. Additionally, navigating the integration of robots with existing cleaning workflows and infrastructure adds to the complexity. These challenges deter smaller businesses from adopting robotic solutions despite their long-term benefits.

Segment Analysis

The US commercial cleaning robots market is segmented based on robot type, operation mode, deployment model, end-user.

Floor Cleaning Robots Dominate Due to High Demand for Automated Scrubbing in Large Facilities

Floor cleaning robots hold a significant share in the US commercial cleaning robots Market due to their wide application across commercial, industrial, and institutional spaces. These robots offer consistent, high-coverage cleaning, which is crucial amid labor shortages and increasing hygiene standards. A notable example is the April 2025 launch of Tennant Company’s X6 ROVR, a mid-sized autonomous floor scrubber tailored for large and complex environments.

Powered by BrainOS, the X6 ROVR autonomously cleans up to 75,000 square feet per cycle and includes advanced features like real-time routing, autonomous docking, and high-capacity tanks. Its ability to deliver efficient, low-supervision cleaning aligns with the demand for smarter, cost-effective solutions. Floor cleaning robots are particularly dominant in sectors such as retail, airports, and healthcare, where large surface areas require regular maintenance. Their growing adoption is further driven by improvements in AI navigation, battery life, and integration with facility management systems.

Technological Analysis

The US Commercial Cleaning Robots Market is witnessing rapid technological advancements, driven by the integration of AI, machine learning, and autonomous navigation systems. A notable example is Kärcher US’s launch of the KIRA B 100 R on April 11, 2022, in Denver, CO, powered by Brain Corp’s BrainOS—recognized as the world’s most validated platform for autonomous mobile robots in indoor public spaces. This innovation, along with earlier models like the KIRA CV 60/1 autonomous vacuum, underscores a strong industry pivot toward automation.

These robots enable precise, efficient cleaning across large commercial venues such as airports, shopping malls, and hospitals. The adoption of smart sensors, real-time data analytics, and cloud-based fleet management systems further enhances operational efficiency. As a result, the fully autonomous robot segment is gaining dominance in the market. Additionally, user-friendly interfaces and seamless integration with facility management systems are improving deployment rates. This tech-driven evolution is reshaping commercial cleaning into a smarter, data-enabled service model.

Competitive Landscape

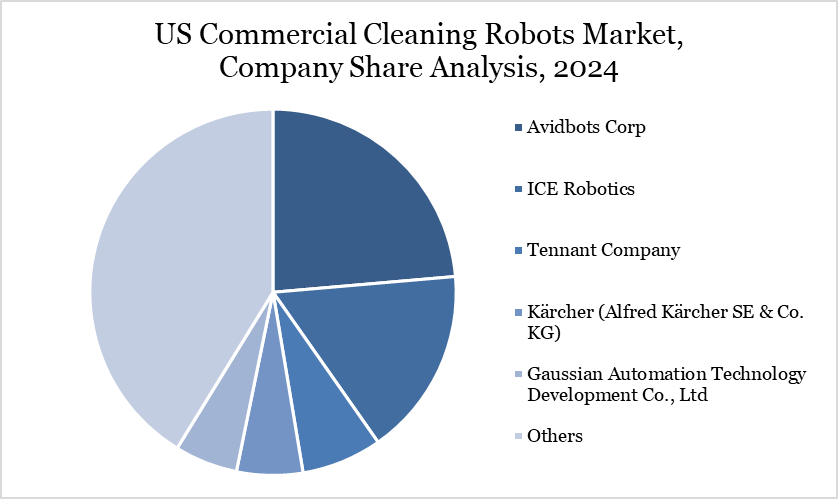

The major players in the market include Avidbots Corp, ICE Robotics, Tennant Company, Kärcher (Alfred Kärcher SE & Co. KG), Gaussian Automation Technology Development Co., Ltd, Brain Corp, Peppermint Robotics, Solenis Group Companies, SoftBank Robotics America, Inc., Nilfisk A/S and others.

Key Developments

In April 2025, LG Electronics US, in partnership with Marriott Design Lab, launched a commercial-grade robotic vacuum featuring Vision Fusion SLAM for autonomous overnight cleaning. The deployment across Marriott hotels highlights the hospitality sector’s shift toward AI-driven, disruption-free maintenance.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report