US and EU Mechanical Ventilators Market Size & Industry Outlook

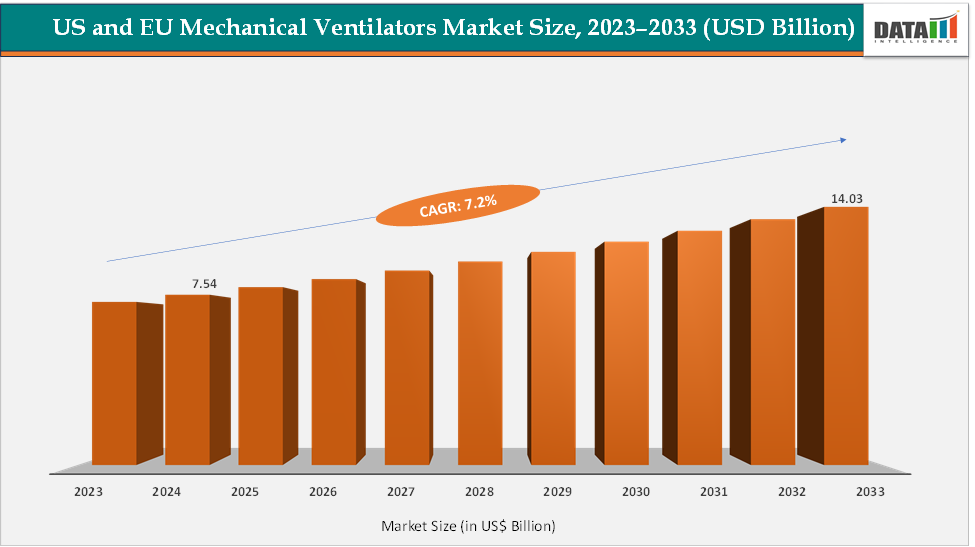

The US and EU mechanical ventilators market size reached US$ 7.54 Billion in 2024 from US$ 7.07 Billion in 2023 and is expected to reach US$ 14.03 Billion by 2033, growing at a CAGR of 7.2% during the forecast period 2025-2033. The market is projected to grow steadily due to the rising burden of respiratory diseases, an aging population, and an increasing shift toward advanced critical and home-care respiratory support solutions. The market is further accelerating its growth with novel product launches in EU and the US.

For instance, in July 2024, Monnal TEO is a ventilator designed and manufactured in France, intended for intensive care and critical care services. Air Liquide Medical Systems continues its history in the field of mechanical ventilation, continuing its pioneering spirit, by offering its brand new ICU ventilator, entirely designed and manufactured in France.

Recent years have witnessed a significant technological evolution in both regions, driven by the need for devices that are smarter, more compact, and integrated with digital and therapeutic functionalities. For instance, GE HealthCare’s CARESCAPE R860 ventilator has strengthened its position in the US market by providing advanced lung-protective ventilation modes and intuitive interfaces for critical care settings. In Europe, Dräger’s Evita V600 and V800 series have gained traction for their flexible configuration, user-friendly design, and integration with hospital networks.

Similarly, Hamilton Medical’s HAMILTON-C6 and HAMILTON-T1 continue to set benchmarks in adaptive ventilation and mobility-focused applications, aligning closely with emerging market demand for integrated aerosol-therapy capabilities. Parallel innovations are also evident in the home-care segment, where manufacturers such as ResMed (Astral series) and Philips (Trilogy) are focusing on portable, connected ventilators that support chronic disease management and remote monitoring.

Key Market Highlights

- US dominates the US and EU mechanical ventilators market with the largest revenue share of 64.07% in 2024.

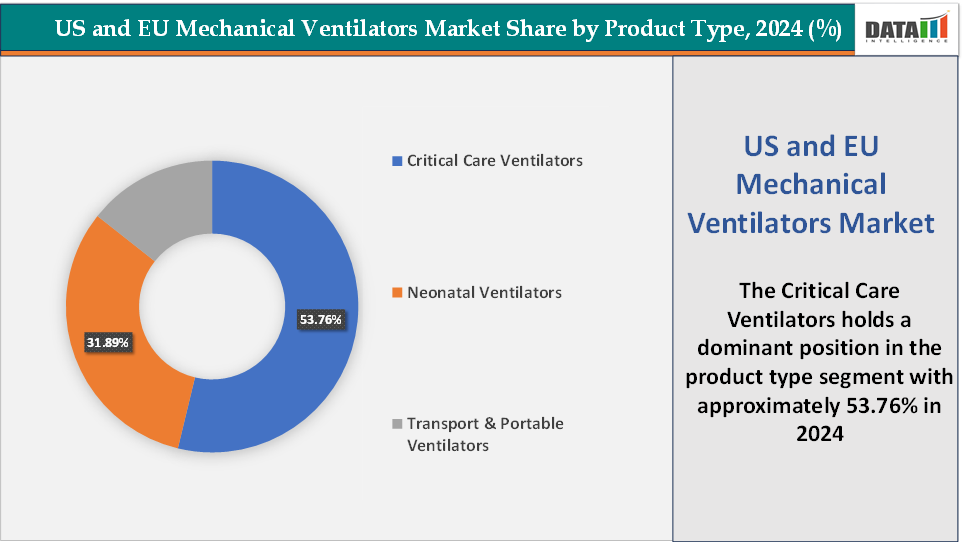

- Based on product type, the critical care ventilators segment led the market with the largest revenue share of 53.76% in 2024.

- The major market players in the US and EU mechanical ventilators market are Hamilton Medical, Drägerwerk AG & Co. KGaA, Getinge, Medtronic, Koninklijke Philips N.V., GE HealthCare, ResMed, Nihon Kohden Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and ZOLL Medical Corporation, among others

Market Dynamics

Drivers: Rising prevalence of chronic respiratory diseases in the US and EU is significantly driving the mechanical ventilators market growth

The escalating prevalence of chronic respiratory diseases (CRDs), particularly Chronic Obstructive Pulmonary Disease (COPD), is a significant driver of the mechanical ventilators market in the United States and Europe. According to the American Lung Association, in the U.S., approximately 11.1 million adults were diagnosed with COPD in 2023, equating to an age-adjusted prevalence of 3.8%. This condition is more prevalent among women (4.1%) compared to men (3.4%), and its incidence increases with age, reaching 10.5% in individuals aged 75 and older. Additionally, according to the European Federation of Allergy and Airways Diseases Patients’ Association (EFA), in Europe, over 36 million people are affected by COPD, with a median prevalence of 3,230 per 100,000 in men and 2,202 per 100,000 in women.

This rising prevalence underscores the growing demand for mechanical ventilators tailored to the needs of CRD patients. Innovative products like the Philips Trilogy 100 have been developed to address this need. The Trilogy 100 offers non-invasive ventilation for COPD patients, enhancing mobility and quality of life.

The increasing burden of COPD, coupled with advancements in ventilator technology, is propelling market growth. Companies are focusing on developing portable, user-friendly ventilators that facilitate home care, thereby reducing hospital admissions and improving patient outcomes. This trend aligns with the broader shift towards home-based healthcare and personalized medicine, positioning mechanical ventilators as integral components in the management of chronic respiratory diseases.

Restraints: High regulatory and clinical validation burden is hampering the growth of the market

The high regulatory and clinical validation burden is a major restraint on the mechanical ventilator market’s growth. Because ventilators are life-support devices, manufacturers must undergo lengthy and costly approval processes such as the FDA’s 510(k) or PMA in the US and MDR certification in the EU requiring extensive safety, performance, and clinical validation data. The shift from the EU’s old MDD to MDR has further tightened scrutiny, causing product launch delays and re-certification bottlenecks.

Smaller firms often lack the resources to meet these demanding standards, leading to market exits or postponed innovations. The complex regulatory requirements increase development costs, slow time-to-market, and consolidate power among established players, ultimately limiting competition and restraining overall market expansion.

For more details on this report – Request for Sample

Mechanical Ventilators Market, Segmentation Analysis

The US and EU mechanical ventilators market is segmented based on product type, ventilation mode, end-user, and region.

Product Type: The critical care ventilators segment is dominating the US and EU mechanical ventilators market with a 53.76% share in 2024

The critical care ventilators segment holds a dominant position in the US and EU mechanical ventilators market, driven by the increasing prevalence of severe respiratory conditions and advancements in ventilator technology. Leading manufacturers have developed advanced critical care ventilators to meet the demands of modern healthcare.

For instance, Hamilton Medical's HAMILTON-C6 offers intelligent features like Adaptive Support Ventilation (ASV) and IntelliSync+, which automatically adjust ventilation parameters based on real-time patient data. Similarly, Dräger's Evita V600 provides comprehensive ventilation modes and integrated monitoring, enhancing patient care in critical situations. GE Healthcare's CARESCAPE R860 integrates seamlessly with hospital IT systems, allowing for continuous monitoring and data analysis. Philips Respironics' Trilogy Evo combines invasive and non-invasive ventilation capabilities, offering versatility in patient management.

These innovations are essential in managing patients with complex respiratory needs, such as those with acute respiratory distress syndrome (ARDS), chronic obstructive pulmonary disease (COPD) exacerbations, or post-surgical respiratory failure. The integration of advanced features in critical care ventilators not only improves patient outcomes but also enhances the efficiency of healthcare delivery in intensive care units across the US and EU.

The neonatal ventilators segment is fastest-growing in the US and EU mechanical ventilators market with a 31.89% share in 2024

The neonatal ventilators segment is the fastest-growing in the US and EU mechanical ventilator markets, driven by rising preterm birth rates and expanding neonatal intensive care units (NICUs). Advances in technology have enabled the development of highly sensitive and non-invasive systems tailored for fragile newborn lungs. Products such as the Dräger Babylog VN500, GE Healthcare’s Carestation Neonatal, and Medtronic’s Puritan Bennett 980 with neonatal mode exemplify this trend, offering precise pressure control, gentle ventilation modes, and advanced monitoring features.

Governments and hospitals are investing heavily in improving neonatal care infrastructure especially in Europe, where regional programs fund NICU modernization. In the US, increasing awareness of neonatal respiratory distress syndrome (RDS) and improved survival rates for premature infants have boosted equipment demand. Continuous innovation in lung-protective ventilation and integrated monitoring technologies further accelerates adoption, making neonatal ventilators the fastest-expanding segment despite their smaller market share compared to adult critical-care devices.

Geographical Analysis

The US is dominating the US and EU mechanical ventilators market with a 64.07% in 2024

The United States has emerged as the dominant region in the mechanical ventilators market in both the US and EU context, driven by a combination of strong demand, presence of major market players, and a robust regulatory framework that facilitates rapid innovation and deployment of ventilatory devices. The growth is also supported by the rising prevalence of chronic respiratory diseases such as COPD, asthma, and neuromuscular disorders that require long-term and acute ventilatory support.

The FDA plays a pivotal role in this dominance by providing timely clearances and guidance for novel and advanced ventilators; for instance, in November 2024, CorVent Medical announced that its RESPOND ventilator received U.S. FDA 510(k) clearance. The RESPOND Ventilator is cost-effective and designed to deliver simple, safe and smart ventilation, expanding access to quality care for healthcare systems, providers and patients.

Additionally, Dräger’s Evita V600 and V800 series received 510(k) clearance in 2023, demonstrating active regulatory facilitation for critical care and transport-ready solutions. Leading U.S.-based companies like Philips, GE HealthCare, and CorVent Medical have leveraged this regulatory support to introduce innovative ventilators such as Philips Trilogy Evo for home and chronic care, GE CARESCAPE R860 for ICU integration with hospital IT systems, and CorVent RESPOND for rapid deployment in acute care settings.

Mechanical Ventilators Market Competitive Landscape

Top companies in the Mechanical Ventilators market include Hamilton Medical, Drägerwerk AG & Co. KGaA, Getinge, Medtronic, Koninklijke Philips N.V., GE HealthCare, ResMed, Nihon Kohden Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and ZOLL Medical Corporation, among others.

Market Scope

| Metrics | Details | |

| CAGR | 7.2% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Critical Care Ventilators, Neonatal Ventilators, and Transport & Portable Ventilators |

| Ventilation Mode | Invasive and Non-Invasive | |

| End-User | Hospitals, Ambulatory Surgery Centers, Home Care Settings, and Others | |

The US and EU mechanical ventilators market report delivers a detailed analysis with 50 key tables, more than 38 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here