Global Underwater Drone Market: Industry Outlook

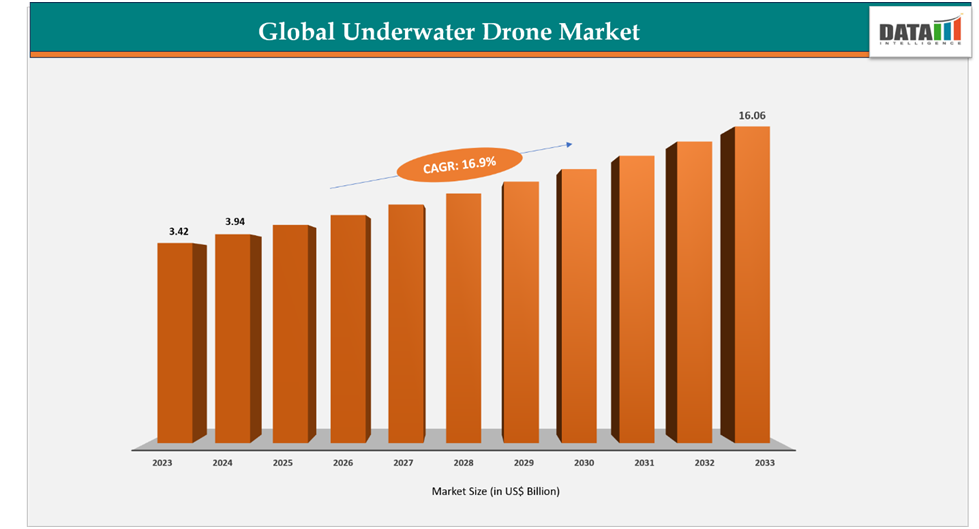

The global underwater drone market reached US$ 3.42 billion in 2023, with a rise to US$ 3.94 billion in 2024, and is expected to reach US$ 16.06 billion by 2033, growing at a CAGR of 16.9% during the forecast period 2025–2033.

The global underwater drone market is expanding steadily, driven by increasing applications in defense, offshore energy, oceanographic research, and environmental monitoring. These drones, also known as Unmanned Underwater Vehicles (UUVs), are becoming vital tools for naval surveillance, subsea inspections, and maritime security. Growth is further supported by technological advancements in autonomy, AI-based navigation, and energy-efficient propulsion systems, alongside rising investments in maritime robotics. Industry dynamics are also being reshaped by strategic collaborations, defense contracts, and partnerships between naval forces and commercial suppliers.

United States leads the underwater drone market with strong demand from defense and military programs. The U.S. Navy and Department of Defense are investing heavily in UUVs for surveillance, mine countermeasures, and undersea combat applications. For instance, the Defense Innovation Unit (DIU) is actively seeking solutions that meet the U.S. military’s need for undersea kamikaze drones and UUVs deployable from submarines. Supported by robust R&D capabilities, extensive defense budgets, and collaborations with leading UUV manufacturers, the U.S. remains at the forefront of market growth.

Japan is also emerging as a significant player, strengthening its maritime security capabilities through procurement of advanced underwater drones. In 2024, Japan ordered REMUS 300 undersea drones from the U.S. to bolster Pacific maritime security, reflecting its commitment to enhancing naval readiness and undersea surveillance. Japan’s focus on defense modernization, coupled with partnerships with global suppliers, is expected to accelerate the adoption of underwater drones for both security and research purposes.

Key Market Trends & Insights

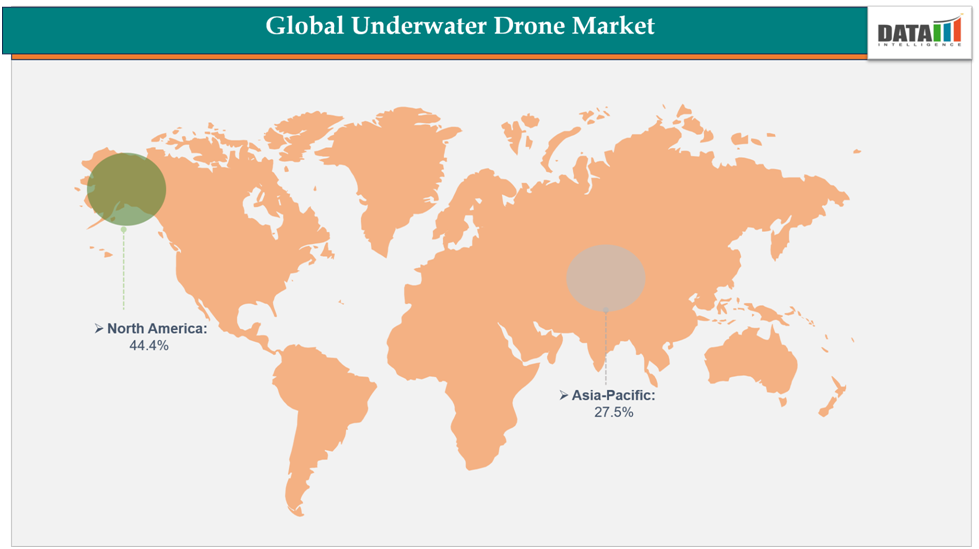

North America accounted for approximately 44.4% of the global underwater drone market in 2024 and is expected to retain its dominance throughout the forecast period. This leadership is supported by significant defense investments, growing demand for maritime surveillance, and extensive adoption of UUVs in offshore energy and research. For instance, the U.S. Defense Innovation Unit (DIU) is exploring solutions such as undersea kamikaze drones and submarine-launched UUVs to meet evolving military requirements.

Asia-Pacific is projected to be the fastest-growing region, driven by rising investments in naval modernization, offshore energy projects, and environmental monitoring. Japan, in particular, is strengthening its maritime security capabilities highlighted by its recent order of REMUS 300 undersea drones from the U.S. to enhance Pacific defense operations. Expanding applications in defense, coastal security, and scientific exploration continue to accelerate regional growth.

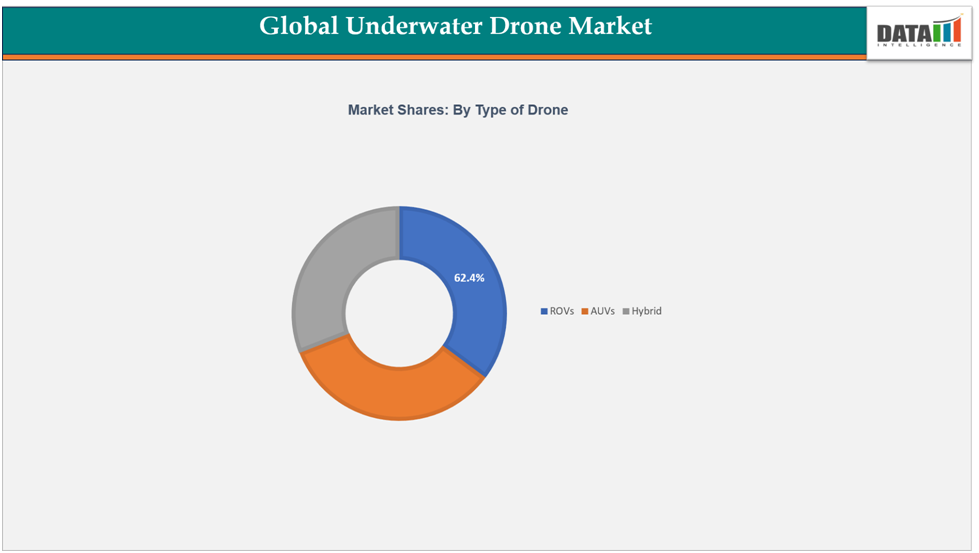

The ROVs segment remains the dominant product category due to its vital role in undersea inspections, naval reconnaissance, and offshore oil and gas operations. Its broad adoption across both defense and commercial sectors underlines its importance in driving technological advancements and enabling next-generation undersea capabilities.

Market Size & Forecast

2024 Market Size: US$3.94 Billion

2033 Projected Market Size: US$16.06 Billion

CAGR (2025–2033): 16/9%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing market

Drivers & Restraints

Driver: Growing Defense and Naval Demand

The global underwater drone market, composed of companies designing and producing advanced UUVs and ROVs, has become a vital component of modern naval and defense strategies. By concentrating on high-performance, reliable designs, manufacturers are accelerating innovation and delivering drones capable of performing surveillance, mine detection, anti-submarine warfare, and reconnaissance tasks. The market’s importance lies in its ability to provide precise and dependable undersea capabilities that enhance national security and operational readiness.

For instance, In 2024, the U.S. Defense Innovation Unit (DIU) launched initiatives to identify UUVs and undersea kamikaze drones that can be deployed from submarines, underscoring how growing defense requirements are driving the expansion of the underwater drone market and reinforcing its strategic value.

Restraint: Technical Reliability Challenges

Despite their strategic significance, underwater drones face technical reliability challenges that can limit operational effectiveness and adoption. Mechanical failures, limited pressure tolerance, propulsion system malfunctions, and battery life constraints remain major concerns, particularly for long-duration or deep-sea missions. Such vulnerabilities can lead to mission interruptions or the loss of costly equipment.

For instance, several research and commercial UUV deployments have been cut short due to failures in propulsion or control systems, highlighting the critical need for enhanced durability, fault-tolerant designs, and robust autonomous operation. Without continued technological improvements in materials, energy systems, and fault recovery mechanisms, technical reliability challenges are likely to remain a key barrier to the sustainable growth of the underwater drone market.

For more details on this report, Request for Sample

Segmentation Analysis

The global underwater drone market is segmented based on type of drone, size, propulsion and region.

Type of Drone:

The ROVs segment accounts for an estimated 62.4% of the global underwater drone market.

ROVs are a key component of the underwater drone ecosystem, enabling precise operations in defense, offshore energy, scientific exploration, and maritime inspection. Companies in this segment focus on developing robust, high-performance ROVs equipped with advanced cameras, sensors, and navigation systems for real-time monitoring and control.

Market growth is driven by rising demand for subsea inspections, pipeline monitoring, mine detection, and environmental research. Leading providers such as Saab Seaeye, Oceaneering International, and Teledyne Marine dominate the space with advanced ROV platforms, while newer entrants are developing lightweight, modular, and mission-specific designs for specialized or shallow-water operations. Regional developments further support expansion; for example, in 2024, Japan ordered REMUS 300 undersea drones from the U.S. to enhance Pacific maritime security, underscoring the strategic importance of ROVs in both defense and commercial sectors. U.S. companies continue to lead the global market, leveraging strong R&D capabilities, defense collaborations, and extensive deployments across naval and commercial projects.

Looking forward, ROVs are expected to maintain their dominant position within the underwater drone market, driven by growing needs in automated subsea inspection, maritime security, and offshore energy monitoring. Although challenges such as high operational costs and technical reliability remain, advancements in autonomy, energy efficiency, and modular design are anticipated to sustain the segment’s strong growth trajectory.

Geographical Analysis

The North America underwater drone market was valued at 44.4%market share in 2024

The North America underwater drone market was valued at 44.4% of the global market share in 2024 and continues to be the largest regional contributor. The region’s growth is driven by significant defense spending, naval modernization programs, and the increasing adoption of unmanned underwater vehicles (UUVs) and remotely operated vehicles (ROVs) for military, commercial, and research applications. For instance, the U.S. Defense Innovation Unit (DIU) is actively seeking solutions for submarine-launched UUVs and undersea kamikaze drones, highlighting the strategic importance of North America in developing next-generation undersea warfare technologies. Strong R&D capabilities, defense partnerships, and technological expertise further reinforce the region’s leadership in the global underwater drone market.

The Asia-Pacific underwater drone market was valued at 27.5% market share in 2024

Asia-Pacific is projected to be the fastest-growing region, driven by rising investments in maritime security, offshore energy exploration, and scientific research. Countries like Japan, China, and South Korea are leading regional growth, with Japan recently procuring REMUS 300 undersea drones from the U.S. to enhance Pacific maritime surveillance. China is also expanding its domestic UUV and ROV programs for defense and commercial applications, while South Korea focuses on advanced maritime research and offshore infrastructure inspections. The combination of government-backed programs, regional defense initiatives, and commercial adoption continues to accelerate Asia-Pacific’s share of the underwater drone market.

Competitive Landscape

The major players in the underwater drone market include Oceaneering International, Inc., Kongsberg Discovery, Lockheed Martin Corporation., Teledyne Marine Technologies Incorporated., Saab Seaeye Ltd, Blueye ,General Dynamics Mission Systems, Inc., Fugro, VideoRay LLC, Blue Robotics Inc

Oceaneering International, Inc: Oceaneering International, Inc. is a leading player in the global underwater drone market, specializing in advanced remotely operated vehicles (ROVs), unmanned underwater vehicles (UUVs), and subsea robotics solutions that support defense, offshore energy, and scientific applications. Its flagship ROV platforms integrate high-precision sensors, manipulators, and autonomous navigation systems, delivering reliable performance and operational efficiency for subsea inspection, maintenance, and exploration missions. With strong R&D capabilities and strategic partnerships with defense agencies, energy operators, and research institutions, Oceaneering continues to drive innovation in deep-water autonomy, operations, and subsea robotics, reinforcing its position as a key enabler of the global underwater operations ecosystem.

Market Scope

Metrics | Details | |

CAGR | 16.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Type Of Drone | ROVs, AUVs, Hybrid |

| Size | Small/Mini Drones, Medium Drones, Large Drones |

| Propulsion | Electric, Mechanical, Hybrid |

| Application | Oil & Gas / Offshore Energy, Defense & Security, Marine Science & Research, Aquaculture & Fisheries Search & Rescue / Forensics, Recreational & Photography |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global underwater drone market report delivers a detailed analysis with 70 key tables, more than 65visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.