Underground Mining Equipment Market Size

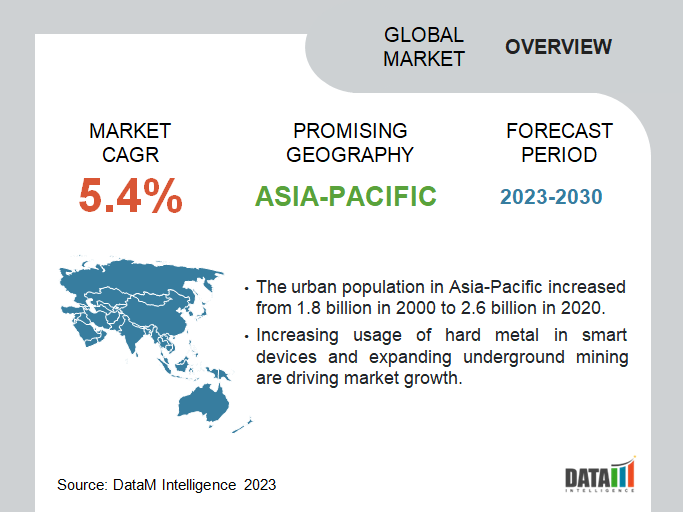

Global Underground Mining Equipment Market reached USD 15.5 billion in 2022 and is expected to reach USD 19.0 billion by 2030, growing with a CAGR of 2.6% during the forecast period 2024-2031. The expanding world population and industrialization drive the demand for minerals and products, including coal, copper, gold and iron ore.

The successful extraction of these resources frequently necessitates underground mining, which raises the need for underground mining equipment. Additionally, continuing reduction of surface reserves of minerals and metals makes converting to underground mining necessary.

Asia-Pacific is among the growing regions in the global underground mining equipment market covering more than 1/3rd of the market and the expansion of coal and metal exploration for energy production, the start of new thermal power energy projects in nations like China and India, as well as high investment levels in developing nations like China, Indonesia, Australia and Malaysia, are the main factors propelling the market for underground mining equipment in this region.

Market Scope

| Metrics | Details |

| CAGR | 2.6% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Product, Mining Method, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics

Rising Demand for Reserves and Government Initiation

There is an increasing focus on identifying and exploiting deposits in diverse places as the demand for minerals and resources continues to rise on a worldwide scale. Due to the need for equipment built particularly for efficient extraction in difficult below-ground conditions, underground mining equipment is in high demand.

Governments play a crucial role in driving the growth of the mining industry by implementing initiatives and policies that promote exploration, mining operations and resource development. This includes providing incentives, tax breaks and regulatory frameworks that encourage investment in the mining sector.

Executive government orders increase mining in U.S., for example, through the production of essential minerals or by changes to regulations. This is reportedly going to help the underground mining equipment market. Another potential in the underground mining equipment market is for major firms to invest in environmentally friendly technologies.

Increasing Usage of Hard Metal in Smart Devices and Expanding Underground Mining

The demand for underground mining equipment is driven by the rising demand for lead, silver and gold for their many uses in smart gadgets such as conductors and emulators. Additionally, it is crucial to use these components in thin film layers, wiring, connections and smartphone technologies. However, cutting-edge smart technologies such as loT rollout, artificial intelligence and sophisticated sensing technology are assisting in the whole market revolution.

Additionally, the productivity and efficiency of mining operations are also rising as a result of the use of machines combined with autonomous vehicles. By reducing the number of personnel entering the mining caverns and protecting them from any unfortunate events, these market improvements also increase safety.

In addition, as lead is the soft, heavy, poisonous, malleable metallic component utilized in the solder connecting the various components of each smartphone, the demand for smartphones has skyrocketed, resulting in a greater need for lead.

High Cost of Acquiring Underground Mining Equipment

The equipment and machinery used for underground mining must be specialized and designed to stand up to the difficult conditions of the mine. Loaders, transport trucks, drilling rigs and ventilation systems are examples of the equipment covered by this. Depending on the size and complexity of the equipment, acquiring these specialized devices may be expensive, costing anything from thousands to millions of dollars per unit.

Additional equipment and infrastructure are required in addition to the primary mining equipment. Mine shafts, ventilation systems, power supply systems, communication networks and maintenance facilities are examples of such things. This infrastructure has to be built and maintained at a substantial cost.

Market Segment Analysis

The global underground mining equipment market is segmented based on product, mining method, application and region.

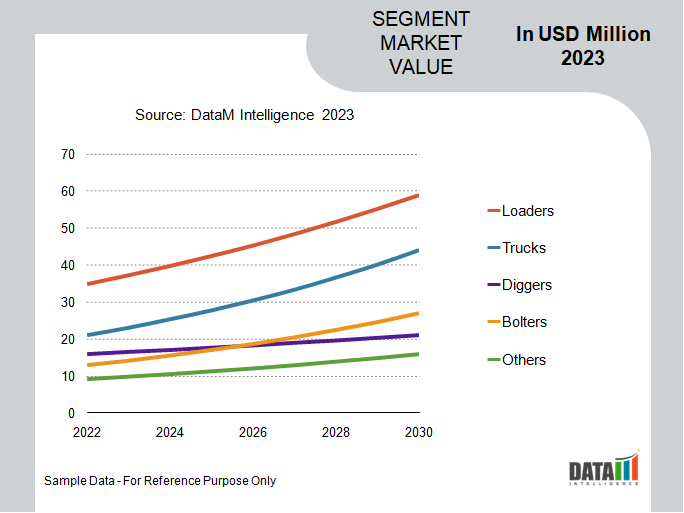

Rising Demand for Trucks in The Mining Industry

The tracks segment holds a major share of around 39.8% of the global underground mining equipment market. There is a significant demand for mining tracks because diesel equipment produces harmful gases that are harmful to the operators when they work underground. Trucks are in great demand because underground mining equipment is required to transport dirt, minerals, metals and coal. Since subterranean mining equipment is thought to be more likely to be electrified than surface mining equipment.

Mine dozers and hydraulic excavators, among other pieces of further underground mining machinery, are more likely to be electrified. Additionally, the demand for underground mining equipment, including trucks, is increasing as mining operations are expanding, particularly in developing countries. Trucks are increasingly needed to move the harvested minerals to the surface as mining corporations look into new mineral resources and develop old mines.

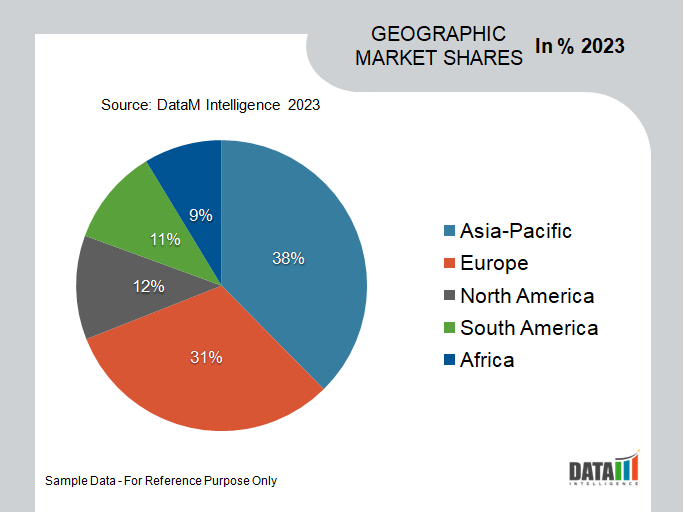

Market Geographical Share

Asia-Pacific Growing Construction and Mining Industries

The Asia-Pacific underground mining equipment market has witnessed significant growth and popularity covering 1/3th share in 2022. Underground mining equipment is becoming increasingly essential owing to the expansion of the mining and construction industries in China, India and other countries and the increased need for infrastructure development in nations like India, China, Malaysia and others.

Additional factors driving market expansion include significant expenditures in construction projects and rising coal use for power generation. In addition, these companies are concentrating on mergers and acquisitions in order to stay competitive in global markets. Vedanta Ltd., for instance, was purchased by Vedanta Resources for USD 2 billion.

They were merging Alacer Gold and SSR Mining for USD 1.9 billion in 2020. The business is expected to generate more than 750,000 ounces of gold equivalent per year, placing them among the top worldwide gold miners. In 2019, Sandvik purchased Miranda Tools, an Indian firm. This transaction raised the profits per share of Sandvik.

Underground Mining Equipment Companies

The major global players include Caterpillar Inc., Komatsu Ltd., Sandvik AB, Epiroc AB, Hitachi Construction Machinery Co., Ltd., Boart Longyear Ltd., FLSmidth & Co. A/S, Liebherr Group, SANY Group Co., Ltd and Normet Group.

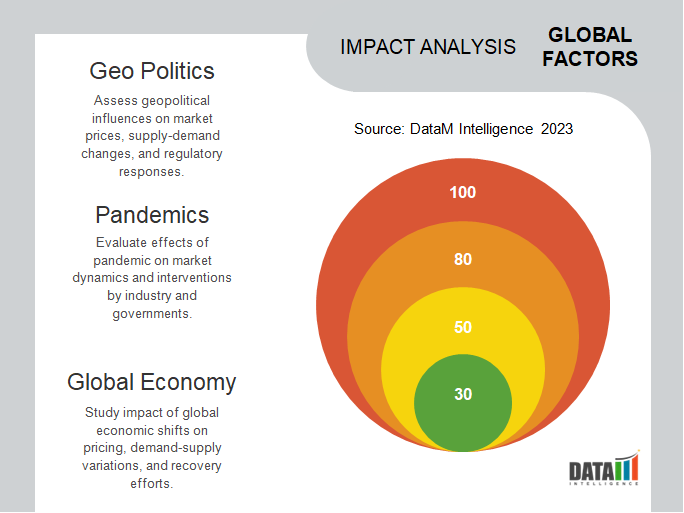

COVID-19 Impact on Market

The mining industry has been severely impacted by the pandemic, which has resulted in a significant decrease in the demand for mining equipment. Lockdowns around the country caused businesses to shut down, which prevented the manufacture of mining equipment. This further hampered its distribution network and supply chain. In addition to halting technological advancements in mining equipment, ongoing lockdowns also reduced demand for underground mining equipment.

Because of the pandemic's impact on the world's economies, unemployment and other problems that have caused individuals to lose more money than ever before, the market for expensive commodities like gold, silver, diamonds and other gems has completely dried up. The demand for mining equipment was also adversely impacted by the ongoing travel restrictions placed on the import-export of raw materials and the recurrent cancellation of mining projects.

By Product

- Loaders

- Trucks

- Diggers

- Bolters

- Others

By Mining Method

- Room and Pillar Mining

- Borehole Mining

- Longwall Mining

- Cut and Fill Mining

- Others

By Application

- Metal Mining

- Mineral Mining

- Coal Mining

- Salt Mining

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On December 20, 2022, Komatsu acquired GHH Group GmbH (GHH), a manufacturer of underground mining, tunneling and special civil engineering equipment headquartered in Gelsenkirchen, Germany. The combined team will then work together to expand Komatsu’s offering for underground mining equipment and increase customer access to products in new territories.

- On June 15, 2022, Komatsu Ltd., through its wholly-owned subsidiary in Australia, acquired Mine Site Technologies Pty Ltd, a provider of operational optimization platforms for underground mining that leverage communication devices and position tracking systems.

- On July 7, 2021, Sandvik acquired SI Underground’s owner Triton, a private equity investment firm and will acquire 100% ownership of DSI Underground for a purchase price of €943m (USD 1.15bn) on a cash and debt-free basis.

Why Purchase the Report?

- To visualize the global underground mining equipment market segmentation based on product, mining method, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of underground mining equipment -level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Technology mapping available as excel consisting of key technologies of all the major players.

The global underground mining equipment market report would provide approximately 61 tables, 63 figures and 181 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies