UK Private Healthcare Market Size & Industry Outlook

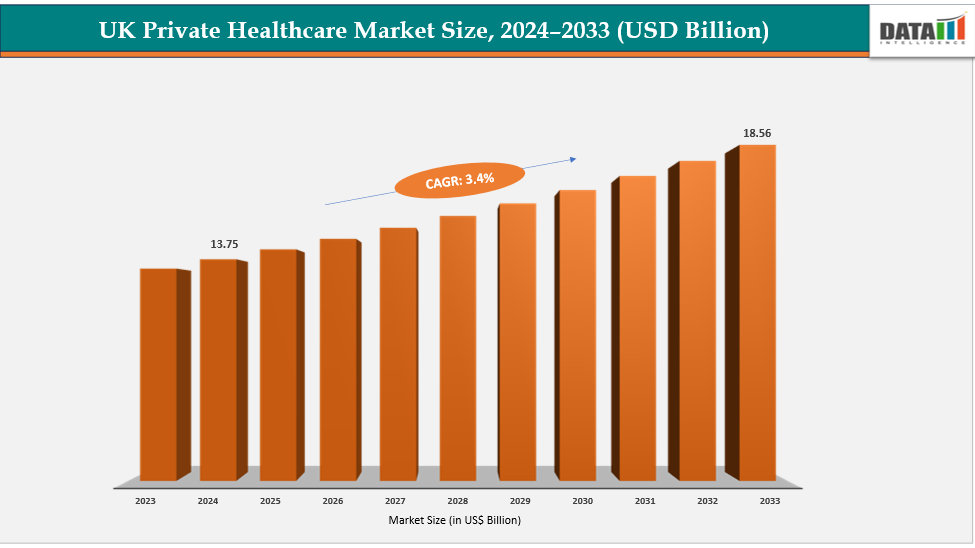

The UK private healthcare market size reached US$ 13.75 billion in 2024 is expected to reach US$ 18.56 billion by 2033, growing at a CAGR of 3.4% during the forecast period 2025-2033. The shift toward minimally invasive procedures, same-day surgery, and high-end diagnostics is accelerating the growth of the UK private healthcare market. Private providers are often the first to introduce new imaging platforms, robotic surgery systems, and digital health solutions because they are not tied to NHS procurement cycles.

For instance, several private hospital groups such as Spire Healthcare and Circle Health Group have invested in robotic-assisted orthopaedic surgery and rapid-access MRI/CT scanning, enabling faster turnaround times and a premium patient experience. This technological edge attracts both self-pay patients and NHS contracts for complex or high-volume procedures, making advanced technology and outpatient/ambulatory models a major driver of market expansion beyond traditional inpatient care.

Key Highlights

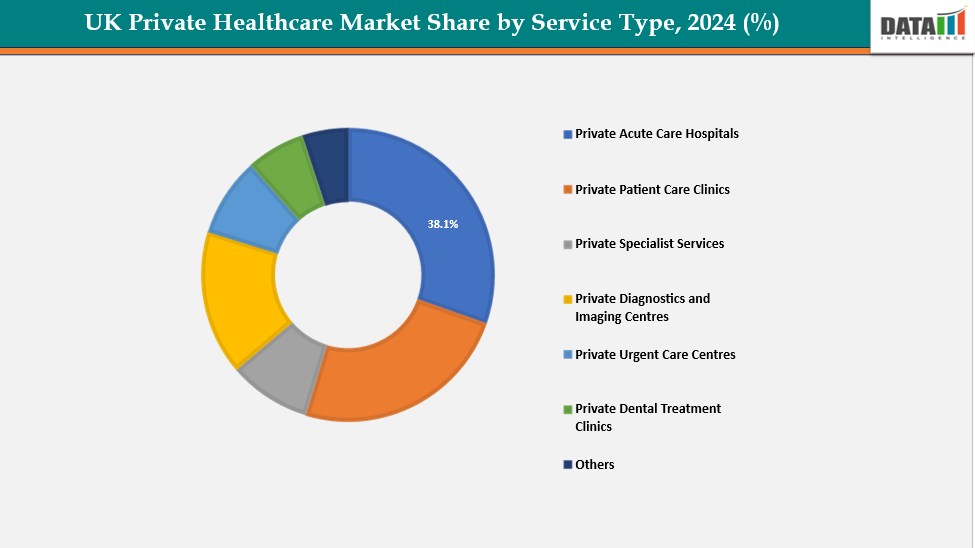

- Based on service type, private acute care hospitals segment led the market with the largest revenue share of 38.1% in 2024.

- The major market players in the UK Private Healthcare market includes Bupa Cromwell Hospital, Althea Group, The London Clinic, GenesisCare, Great Ormond Street Hospital (GOSH), Ramsay Health Care UK, Aspen Healthcare (Tenet Healthcare), Spire Healthcare Group plc, The Bournemouth Private Clinic Limited, Circle Health Group (PureHealth) and among others.

Market Dynamics

Drivers: Rising self-pay and private medical insurance uptake is significantly driving the UK private healthcare market growth

Over the past five years, the UK private healthcare market has seen a significant increase in self-pay procedures and employer-funded private medical insurance (PMI), boosting revenue for hospital operators. Spire Healthcare reported that self-pay revenue reached one-third of its total UK income in 2023, while large employers expanded PMI benefits to support staff retention and reduce sickness absence. This has fueled growth at insurers like Bupa, AXA Health, and Vitality Health, and pushed more insured patients into private hospital networks. This has led to a larger flow of privately funded patients and insured referrals, underpinning capital investment in new facilities.

For instance, UK's Private Healthcare Information Network (PHIN) reported 238,000 more private hospital admissions in January to March 2024 compared to any previous quarter. The majority of these admissions were funded using private medical insurance (PMI), with the largest increases in the 20-29 and 30-39 age groups by 13%.

Restraints: High treatment costs & affordability issues are hampering the growth of the UK private healthcare market

Private healthcare costs remain a significant barrier to access, especially for self-pay patients and small-to-medium enterprises offering PMI. Complex procedures like joint replacements and advanced cancer therapies can cost thousands of pounds, limiting access to higher-income segments. Even with insurance coverage, high excesses or co-payments reduce affordability, constraining volume growth. This challenge affects private hospitals' ability to expand beyond premium and insured populations, driving competition around price transparency, bundled-care packages, and elective day-case procedures to attract cost-conscious patients.

For more details on this report – Request for Sample

Segmentation Analysis

The UK private healthcare market is segmented based on service type, application, and end user.

Service Type: The private acute care hospitals from service type segment to dominate the UK private healthcare market with a 38.1% share in 2024

The private acute care hospital segment is gaining popularity due to increased demand for elective surgeries, specialist care, and NHS outsourcing. Long waiting times for orthopaedic, cardiology, and ophthalmology interventions have led to patients choosing private hospitals like Spire Healthcare, Ramsay Health Care UK, and Bupa Cromwell. Growth in employer-sponsored private medical insurance and self-pay packages has provided a steady revenue stream for hospitals, enabling investment in advanced surgical theatres, robotic-assisted surgery, and diagnostic imaging.

Moreover, private acute care hospitals are at the forefront of adopting cutting-edge medical technologies. Investments in robotic-assisted surgeries, advanced imaging systems, and state-of-the-art surgical theatres have enhanced the quality and efficiency of care. For instance, Spire Healthcare has reported a 12.7% increase in revenue, partly attributed to its investment in technology and expansion of services, including orthopaedic surgeries and cancer treatments.

Application: The general surgery segment is estimated to have a 40.1% of the UK private healthcare market share in 2024

The UK private healthcare market is experiencing growth in the general surgery segment due to rising demand for elective procedures, technological advancements, and the flexibility of private care providers. Patients are choosing private hospitals like Spire Healthcare, Ramsay Health Care UK, and Bupa Cromwell for procedures like hernia repairs and minor abdominal surgeries to avoid long NHS waiting times. The adoption of minimally invasive and laparoscopic techniques makes private general surgery more attractive to self-pay and insured patients. NHS outsourcing contracts and corporate health schemes support this growth. Rising awareness of preventive care and patient-centric services also drives demand in this segment.

For instance, in August 2025, Bupa has completed the acquisition of New Victoria Hospital, an independent private facility located in Kingston upon Thames. This marks Bupa’s first hospital acquisition in the UK since 2008 and allows for more integrated patient pathways, linking primary care services directly with secondary care. The hospital features 33 beds and offers specialised care in orthopaedics, gynaecology, general surgery, and gastroenterology. Its state-of-the-art infrastructure includes a 128-slice CT scanner, a fluoroscopy suite, and a 1.5‑tonne MRI system.

Competitive Landscape

Top companies in the UK private healthcare market include Bupa Cromwell Hospital, Althea Group, The London Clinic, GenesisCare, Great Ormond Street Hospital (GOSH), Ramsay Health Care UK, Aspen Healthcare (Tenet Healthcare), Spire Healthcare Group plc, the Bournemouth Private Clinic Limited, Circle Health Group (PureHealth) and among others.

Bupa Cromwell Hospital:- Bupa Cromwell Hospital is a leading UK private acute care facility, offering specialist services in cardiology, orthopaedics, oncology, and paediatrics. It bridges the gap between NHS capacity and patient demand, providing faster access to complex procedures for both self-pay and insured patients. With advanced diagnostic and treatment infrastructure like MRI, CT, and state-of-the-art surgical theatres, it supports high-quality, consultant-led care. Bupa Cromwell contributes significantly to the growth and development of the UK's private healthcare sector.

Market Scope

| Metrics | Details | |

| CAGR | 3.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Service Type | Private Acute Care Hospitals, Private Patient Care Clinics, Private Specialist Services, Private Diagnostics and Imaging Centres, Private Urgent Care Centres, Private Dental Treatment Clinics, Others |

| Application | General Surgery, Trauma and Orthopedics, Oncology Cardiology, Urology, Dental, Others | |

| End User | International Tourists, NHS Referrals & PMI, Self-pay Individuals | |

The UK private healthcare market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.