US Smart Pills Market Size

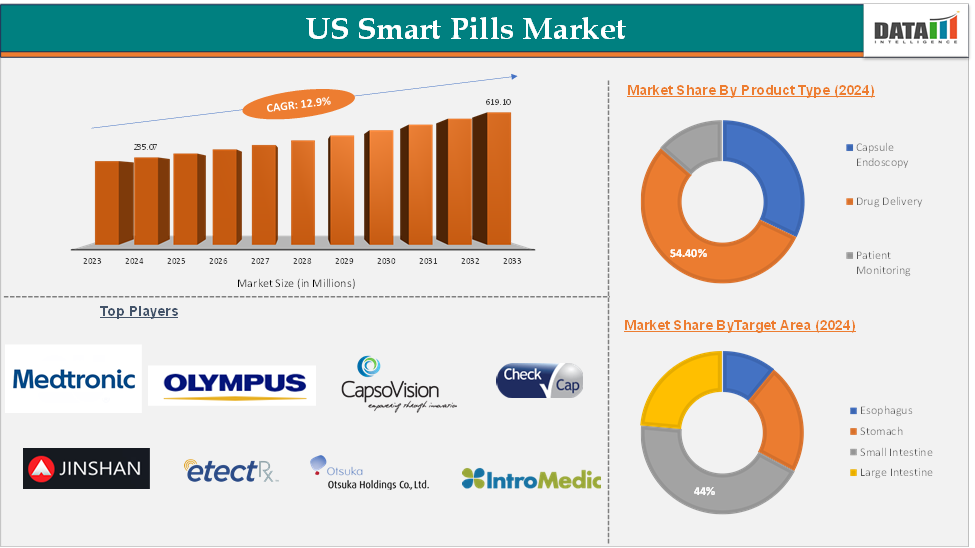

The US Smart Pills Market size reached US$ 235.07 Million in 2024 and is expected to reach US$ 619.10 Million by 2033, growing at a CAGR of 12.9% during the forecast period 2025-2033.

Smart pills are innovative ingestible devices that combine sensors and medication to monitor health and improve disease diagnosis and treatment.

In 2025, the global smart pill market is projected to surpass USD 1.5 billion, driven by rising cases of gastrointestinal disorders, such as irritable bowel syndrome and Crohn’s disease, and the increasing need for minimally invasive diagnostics. In the U.S., FDA approvals of next-generation smart pills, such as the CapsoCam Plus and PillCam Genius, have accelerated adoption. Key trends include the development of AI-integrated pills for real-time data analysis, wireless transmission systems for continuous patient monitoring, and growing investment in pills that offer targeted drug delivery alongside diagnostics—making them valuable tools for personalized medicine and chronic disease management.

Executive Summary

For more details on this report – Request for Sample

US Smart Pills Dynamics: Drivers

Rising demand for minimally invasive devices

Patients are increasingly opting for minimally invasive procedures due to their numerous benefits, including reduced discomfort, shorter recovery times, and lower risks of complications compared to traditional invasive methods. For instance, while procedures like endoscopy can be uncomfortable and often require sedation, smart pills provide a non-invasive alternative that patients can easily swallow without the need for anesthesia.

Minimally invasive U.S. smart pills enhance diagnostic accuracy by providing real-time data and imaging capabilities directly from within the GI tract. Traditional methods often rely on indirect measurements or external imaging techniques that may not offer a complete picture of internal health. U.S. smart pills can capture detailed images and physiological data, enabling healthcare professionals to make more informed decisions based on accurate, real-time information.

Additionally, key players in the industry research activities, their product launches, and approvals would drive the US smart pills market growth. For instance, in March 2024, researchers at the California Institute of Technology developed an innovative location-aware smart pill that utilizes magnetic fields to accurately determine its position within the complex environment of the gastrointestinal (GI) tract. This innovation has significant implications for monitoring digestive health and diagnosing gastrointestinal disorders.

Also, in February 2023, AnX Robotica Corp. launched the NaviCam Small Bowel System in the U.S., which utilizes aspherical lenses. This technology represents a significant advancement in the field of medical imaging, particularly for gastrointestinal diagnostics.

Similarly, in January 2024, AnX Robotica announced that the U.S. Food and Drug Administration (FDA) had granted clearance for its innovative NaviCam ProScan, an artificial intelligence (AI)-assisted reading tool designed to enhance the process of small bowel capsule endoscopy. This marks a significant advancement in gastrointestinal diagnostics, particularly for adult patients suspected of having gastrointestinal bleeding. All these factors drive the U.S. smart pills market.

Moreover, the rising demand for technological advancements contributes to the expansion of the U.S. smart pills market.

US Smart Pills Dynamics: Restraints

Privacy and data security concerns

The integration of smart pills into healthcare offers substantial benefits, but it also raises significant concerns regarding privacy and data security. As these devices collect sensitive health information, it is crucial to ensure the secure transmission, storage, and handling of this data to build trust among patients and healthcare providers.

Smart pills are designed to gather various types of health data, including medication adherence, physiological parameters, and potentially real-time imaging from within the body. While this information is essential for effective healthcare delivery, it poses risks if not managed properly. Unauthorized access to this sensitive data can lead to privacy violations and misuse.

The data collected by smart pills must be transmitted wirelessly to external devices such as smartphones or healthcare monitoring systems. This transmission process must be secure to prevent unauthorized access or interception by malicious actors. Any breach during this transmission could result in significant privacy violations, undermining patient trust in the technology. Thus, the above factors could be limiting the U.S. smart pills market's potential growth.

US Smart Pills Market - Segment Analysis

The US smart pills market is segmented based on product type, target area, disease indication, and end-user.

Product Type:

The capsule product type segment is expected to hold 54.4% of the US smart pills market

Capsule endoscopy allows patients to swallow a capsule containing a miniature camera and light source. As the capsule travels through the digestive system, it captures thousands of images of the GI tract, which are transmitted to a recording device worn by the patient.

The increasing prevalence of gastrointestinal diseases, including Crohn's disease, celiac disease, and colorectal cancer, is significantly driving demand for effective diagnostic tools such as U.S. smart pills. Capsule endoscopy presents a less invasive option for assessing these conditions, making it an attractive alternative to traditional methods like colonoscopy.

Continuous improvements in U.S. smart pills, including capsule technology, are contributing to market growth. Modern capsules now feature enhanced imaging capabilities and longer battery life, allowing for high-resolution images and real-time data collection that improve diagnostic accuracy.

Furthermore, key players in the industry's product launches would drive the U.S. smart pills market's potential growth. For instance, in November 2024, Guam Regional Medical City (GRMC) announced the launch of an advanced capsule endoscopy service, marking a significant advancement in gastrointestinal (GI) healthcare for Guam and its surrounding regions. This service introduces a minimally invasive diagnostic solution that leverages innovative medical technology to enhance patient comfort and improve diagnostic accuracy for digestive health issues.

Also, in November 2023, Sussex Premier Health launched a capsule endoscopy service, providing patients with an innovative and minimally invasive diagnostic tool for gastrointestinal (GI) health. This service allows healthcare providers to visualize the entire small intestine, which is often difficult to access through traditional endoscopic methods. These factors have solidified the segment's position in the U.S. smart pills market.

US Smart Pills Market - Major Players

The major players in the US smart pills market include Medtronic, CapsoVision, Inc., Olympus, Check-Cap, IntroMedic, JINSHAN Science & Technology (Group) Co., Ltd., EtectRx, Shenzhen Jifu Medical Technology Co., Ltd, MEDISPACE, and RF Co., Ltd., among others.

Key Developments

- In April 2025, Centor Inc., a Gerresheimer company, expanded its product range with the introduction of a new smart weekly pill organizer. This connected device is designed to enhance patient adherence to prescribed medications, a key factor in achieving successful therapy outcomes. The smart pill organizer enables real-time monitoring of medication intake, allowing pharmacies and clinical partners to deliver straightforward, patient-friendly support.

- In November 2024, the healthcare brand DEFI (Don't Ever Forget It) is set to launch its innovative DEFI Smart Pill Bottle through a Kickstarter campaign. This product is designed to revolutionize medication management by ensuring users never miss a dose, thereby enhancing adherence to prescribed medication regimens.

- In January 2024, PillSafe introduced a disruptive technology with its innovative smart pill bottle designed specifically for prescription drugs. This product aims to enhance safety and compliance in medication management, addressing critical issues related to prescription drug misuse and adherence.

US Smart Pills Market - Scope

| Metrics | Details | |

| CAGR | 12.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Capsule Endoscopy, Drug Delivery, Patient Monitoring |

| Target Area | Esophagus, Stomach, Small Intestine, Large Intestine | |

| Disease Indication | Barrett's Esophagus Disease, Small Bowel Disease, Colon Disease Others | |

| End-User | Hospitals & Clinics, Diagnostic Centers, Others | |

The US smart pills market report delivers a detailed analysis with 42 key tables, more than 33 visually impactful figures, and 126 pages of expert insights, providing a complete view of the market landscape.