U.S. Nasal Polyps Treatment Market Size

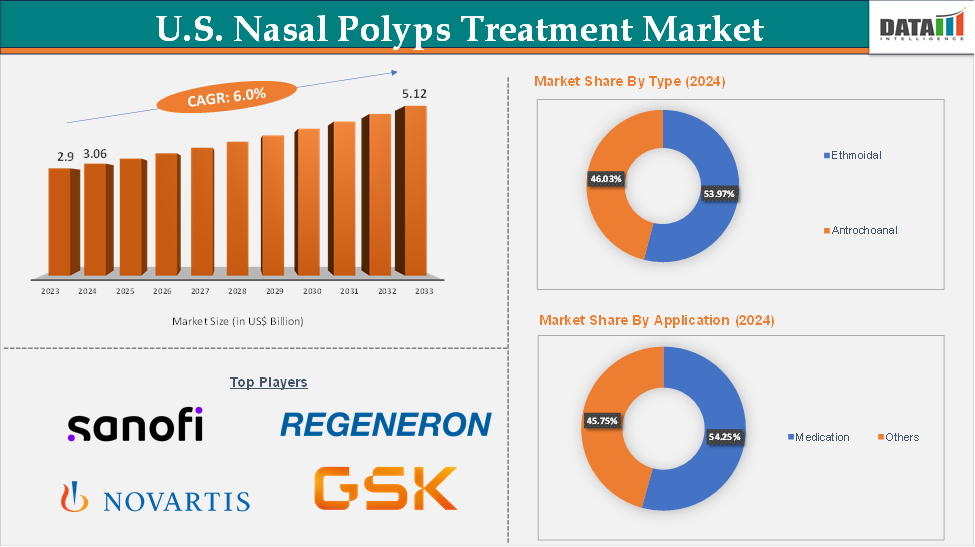

In 2023, the U.S. Nasal Polyps Treatment Market was valued at US$ 2.9 Billion. The U.S. Nasal Polyps Treatment Market size reached US$ 3.06 Billion in 2024 and is expected to reach US$ 5.12 Billion by 2033, growing at a CAGR of 6.0% during the forecast period 2025-2033.

U.S. Nasal Polyps Treatment Market Overview

The U.S. nasal polyps treatment market is poised for significant growth, driven by a combination of increasing disease prevalence, advancements in treatment options, and improved diagnostic rates. As awareness of the condition rises and more patients seek medical intervention, the demand for effective, long-term treatment solutions continues to grow.

A key catalyst for market expansion is the emergence of biologic therapies that offer targeted, disease-modifying effects. Unlike conventional treatments such as corticosteroids and surgery, biologics address the underlying inflammatory pathways responsible for nasal polyps, providing sustained symptom relief and reducing recurrence. The development and approval of new biologics, particularly monoclonal antibodies targeting interleukins, are expected to reshape the treatment landscape and present lucrative opportunities for pharmaceutical companies.

Overall, with strong clinical pipelines, supportive reimbursement frameworks, and a shift toward personalized medicine, the U.S. nasal polyps market is well-positioned for dynamic growth during the forecast period.

U.S. Nasal Polyps Treatment Market Executive Summary

U.S. Nasal Polyps Treatment Market Dynamics: Drivers & Restraints

Drivers:

Rising prevalence of chronic rhinosinusitis with nasal polyps (CRSwNP) is significantly driving the U.S. nasal polyps treatment market growth

The rising prevalence of nasal polyps in the United States is a key factor propelling the growth of the nasal polyps treatment market. For instance, according to the Allergy & Asthma Network, the nasal polyps affect 4% of the U.S. population. Additionally, according to the National Institute of Health report in 2025, it is stated that in the United States, prevalence estimates for nasal polyps vary. Approximately 2.1% of individuals meet the diagnostic criteria for CRSwNP based on the presence of two major symptoms, while about 13.0% report experiencing just one symptom.

Among all patients diagnosed with chronic rhinosinusitis (CRS), an estimated 25% to 30% are further classified as having CRSwNP. The condition most commonly develops between the ages of 40 and 60. This growing patient pool is accelerating the demand for advanced therapies, especially biologics like Dupixent and Xolair, which offer targeted treatment for patients who do not respond well to corticosteroids or surgery.

The surge in cases is also encouraging pharmaceutical companies to invest more in R&D and expand their biologic pipelines, further contributing to market expansion and innovation.

Restraint:

The high cost of biologic treatments is hampering the growth of the U.S. Nasal Polyps Treatment market

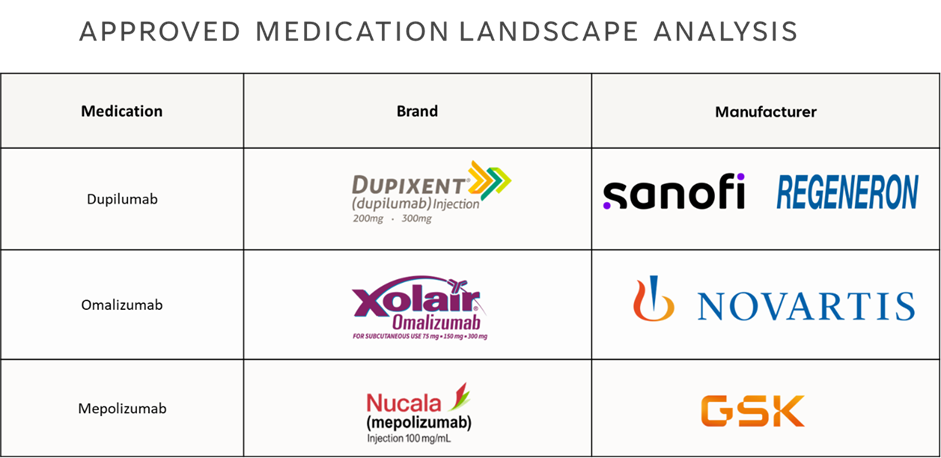

A limited number of approved drugs presents a notable challenge to the growth and diversity of the U.S. nasal polyps treatment market. Currently, only a few FDA-approved biologics are available, namely Dupixent, Xolair, and Nucala, which restricts therapeutic choices for both patients and healthcare providers. This is especially concerning for individuals who do not respond well to these treatments or who experience side effects.

With all approved therapies targeting similar inflammatory pathways like IL4, IL5, or IgE, the potential for personalized treatment approaches remains limited. The high cost of these biologics, combined with a lack of alternative options, also adds pressure to insurance systems and makes access difficult for many patients, ultimately reducing broader adoption.

For instance, the current annual list price of XOLAIR ranges from approximately $30,000 to $60,000, depending on dosage and treatment regimen.

Opportunity:

Pipeline development of new biologics is expected to create a lucrative opportunity for the growth of the U.S. nasal polyps treatment market

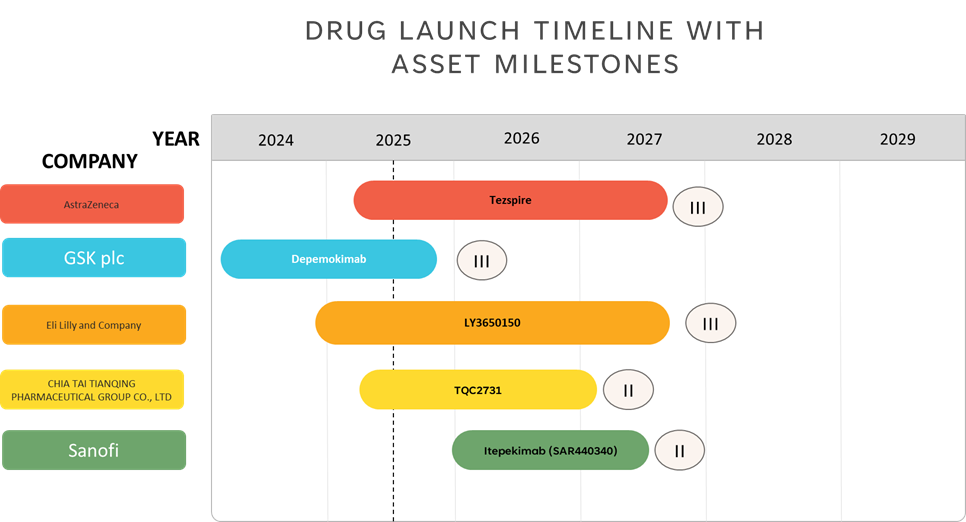

The pipeline development of new biologics presents a significant opportunity for the U.S. nasal polyps treatment market, primarily by addressing limitations in current therapies and targeting the underlying causes of the condition.

Biologics offer targeted, long-acting relief by modulating key inflammatory pathways involved in chronic rhinosinusitis with nasal polyps (CRSwNP), such as IL-4, IL-5, and IL-13. As more biologics advance through clinical trials, they hold the potential to dramatically reduce recurrence rates, delay or eliminate the need for repeated surgeries, and improve quality of life for patients with moderate-to-severe disease.

Additionally, the increasing focus on personalized medicine, expanding clinical evidence, and growing insurance coverage for biologic therapies are expected to further drive their adoption, making this an attractive and high-growth segment within the U.S. nasal polyps market.

Pipeline Analysis:

Approved Medication

For more details on this report – Request for Sample

U.S. Nasal Polyps Treatment Market, Segment Analysis

The U.S. nasal polyps treatment market is segmented based on type, treatment type, and route of administration.

The medication from the treatment type segment are expected to hold 54.25% of the market share in 2024 in the U.S. nasal polyps treatment market

The medication segment is expected to dominate the U.S. nasal polyps market, driven by the increasing adoption of advanced, non-invasive treatments that effectively manage chronic rhinosinusitis with nasal polyps (CRSwNP). Biologic therapies, such as monoclonal antibodies, are transforming disease management by targeting specific inflammatory pathways, offering relief to patients who do not respond to conventional corticosteroids.

There is a growing momentum in the development and approvals of the drugs, which is significantly driving the segment’s growth. For instance, in February 2024, the FDA approved an expanded use of Xolair (omalizumab) to help reduce allergic reactions, including nasal polyps, in patients with IgE-mediated food allergies.

This growing integration of novel biologics into clinical practice reflects increasing confidence in targeted therapies and underscores the strong potential of the medication segment to lead the U.S. nasal polyps treatment market.

U.S. Nasal Polyps Treatment Market Competitive Landscape

Top companies in the U.S. nasal polyps treatment market include Sanofi and Regeneron Pharmaceuticals, Inc., Novartis Pharmaceuticals Corporation, GSK plc., among others.

U.S. Nasal Polyps Treatment Market Key Developments

Regeneron Pharmaceuticals and Sanofi announced that the U.S. FDA approved Dupixent (dupilumab) as an add-on maintenance treatment for adolescents aged 12 to 17 years with inadequately controlled chronic rhinosinusitis with nasal polyps (CRSwNP).

U.S. Nasal Polyps Treatment Market Scope

Metrics | Details | |

CAGR | 6.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Ethmoidal, Antrochoanal |

Treatment Type | Medication, Others | |

Route of Administration | Nasal, Oral, Injectables | |

DMI Insights

According to DataM Intelligence, the U.S. nasal polyps treatment market is witnessing robust growth driven by a rising burden of chronic rhinosinusitis with nasal polyps (CRSwNP), increasing awareness among patients, and a noticeable shift toward biologic therapies. DMI notes that the emergence of targeted biologics such as monoclonal antibodies is reshaping the treatment landscape, offering more effective and longer-lasting solutions compared to traditional corticosteroids and surgical interventions.

With a strong pipeline of novel therapies under clinical development and expanding reimbursement support, DataM Intelligence expects the market to experience accelerated growth over the forecast period. Furthermore, the growing emphasis on personalized medicine and physician education is expected to improve diagnosis rates and therapeutic outcomes, reinforcing the market’s long-term potential.

The U.S. nasal polyps treatment market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.