Tuberculosis Drug Market Size & Industry Outlook

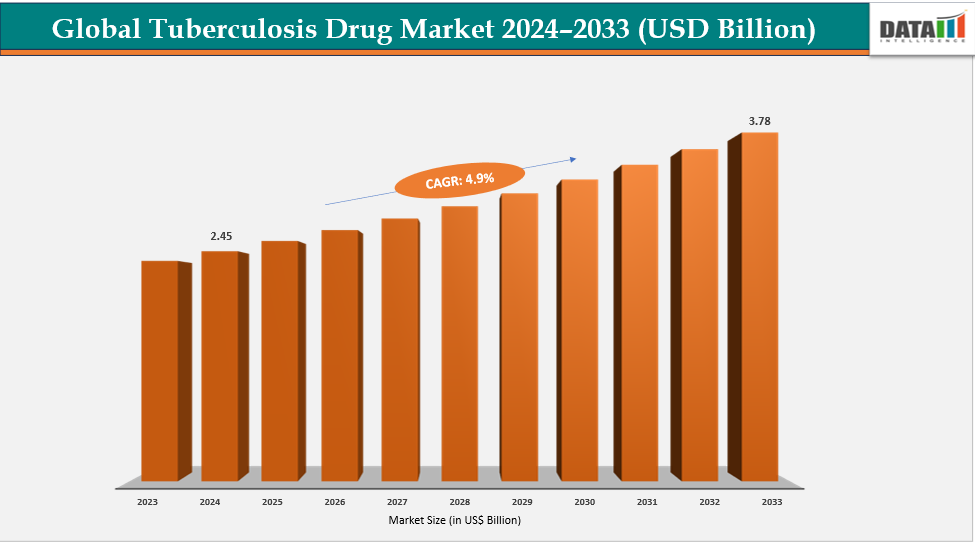

The global tuberculosis drug market size reached US$ 2.34 Billion in 2023 with a rise of US$ 2.45 Billion in 2024 and is expected to reach US$ 3.78 Billion by 2033, growing at a CAGR of 4.9% during the forecast period 2025-2033.

Innovation in drug development and government-backed global health programs has been pivotal in driving tuberculosis (TB) drug market growth. Particularly for multidrug-resistant TB, pharmaceutical companies are implementing shorter, all-oral regimens, including the BPaLM regimen, which increase treatment adherence and success rates. By addressing unmet medical needs, novel drug candidates in advanced clinical trials are increasing therapeutic alternatives. At the same time, government programs and international health initiatives, such as public-private partnerships, subsidized drug distribution, and TB awareness campaigns, are improving early diagnosis and accessibility. Programs that improve case detection and treatment coverage include Who is End TB Strategy and national campaigns in China, India, and Indonesia.

Key Highlights

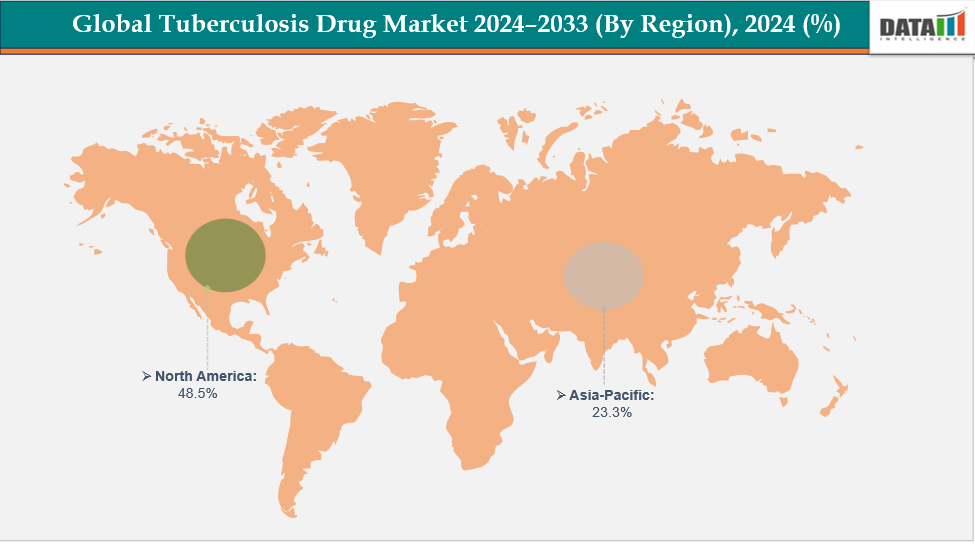

- North America is dominating the global tuberculosis drug market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global tuberculosis drug market, with a CAGR of 7.5% in 2024

- The active TB-type segment from disease type is dominating the tuberculosis drug market with a 72.5% share in 2024

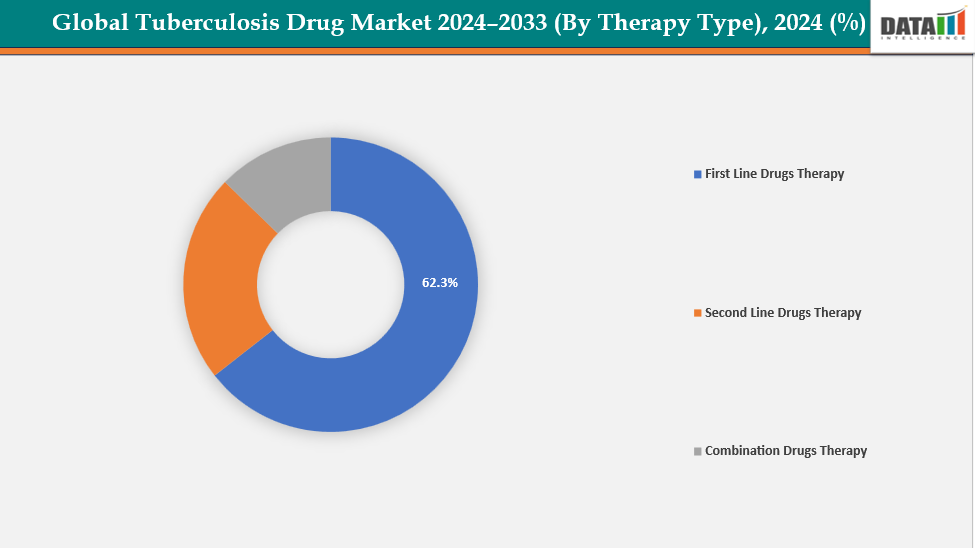

- The first-line drugs therapy segment from therapy type is dominating the tuberculosis drug market with a 62.3% share in 2024

- Top companies in the tuberculosis drug market include Sanofi, LEDERLE PHARMACEUTICAL DIVISION, Hospira, Inc., Bayer AG, JAMP Pharma Corporation, Pfizer Inc., Mylan N.V., Otsuka Pharmaceutical, Lupin Limited, Macleods Pharmaceuticals, and Novartis AG, among others.

Market Dynamics

Drivers: Rising tuberculosis prevalence is significantly driving the tuberculosis drug market growth

Rising tuberculosis (TB) prevalence is a major driver of the global TB drug market. Since tuberculosis is still one of the most common infectious diseases, the increasing number of patients raises the need for both second-line treatments for drug-resistant strains and first-line medications like isoniazid and rifampin. The need for newer, more sophisticated drugs is fueled by the advent of extensively and multidrug-resistant tuberculosis. Widespread screening programs and more government and non-profit initiatives encourage early diagnosis and treatment.

Owing to factors like the prevalence of tuberculosis, for instance, recent data from the WHO published in March 2025 shows that, in 2023, an estimated 10.8 million people worldwide fell ill with tuberculosis, including 6.0 million men, 3.6 million women, and 1.3 million children. The disease affected all countries and age groups but remained curable and preventable.

Restraints: Drug resistance associated with tuberculosis drugs is hampering the growth ofthe tuberculosis drug market

The rise of drug-resistant tuberculosis (TB) is significantly hampering the growth of the TB drug market. Standard first-line medications like isoniazid and rifampin are less successful in treating multidrug-resistant (MDR-TB) and extensively drug-resistant (XDR-TB) TB, requiring more involved and prolonged treatment plans. These therapies frequently entail several second-line medications with serious adverse effects, raising medical expenses and necessitating careful observation. Resistance is made worse by patient noncompliance with intricate regimens, which reduces the overall efficacy of treatments.

Additionally, the development of new anti-TB drugs has not kept pace with resistance, restricting available treatment options. Higher economic burdens on healthcare systems and reduced confidence in treatment outcomes collectively constrain market growth despite rising TB prevalence.

For more details on this report, see Request for Sample

Segmentation Analysis

The global tuberculosis drugs market is segmented based on therapy type, disease type, route of administration, distribution channel and region.

By Therapy Type: The first-line drugs therapy segment from therapy type is dominating the tuberculosis drug market with a 62.3% share in 2024

The First-Line Drugs Therapy segment dominates the tuberculosis (TB) drug market due to the high prevalence of drug-sensitive TB, which can be effectively treated with isoniazid, rifampin, pyrazinamide, and ethambutol. These drugs are widely available, affordable, and form the backbone of national TB control programs, ensuring consistent demand.

Moreover, government initiatives and global health programs, such as the WHO End TB Strategy, prioritize first-line therapy, often providing bulk procurement and subsidies. Fixed-dose combinations improve patient adherence by simplifying regimens. For instance, in India, the Revised National Tuberculosis Control Program (RNTCP) provides isoniazid, rifampin, pyrazinamide, and ethambutol as part of its first-line therapy to treat the majority of TB cases. Since most patients are drug-sensitive, these drugs are supplied in fixed-dose combinations to improve adherence and reduce pill burden.

The active TB-type segment from disease type is dominating the tuberculosis drug market with a 72.5% share in 2024

The Active TB Type segment dominates the tuberculosis (TB) drug market due to the high prevalence and immediate treatment needs of symptomatic patients. Active TB is contagious, requiring prompt intervention with first-line and, in some cases, second-line drugs to prevent disease spread. National and global health programs, including the WHO End TB Strategy, prioritize diagnosing and treating active TB, leading to large-scale drug procurement and widespread use.

Additionally, the rise of multidrug-resistant and extensively drug-resistant TB cases further increases demand for intensive treatment regimens. In contrast, latent TB requires preventive therapy, resulting in lower drug consumption and market share.

Geographical Analysis

North America is dominating the global tuberculosis drug market with a 48.5% in 2024

North America dominates the global tuberculosis (TB) drug market due to its strong healthcare infrastructure, high healthcare expenditure, and widespread access to diagnostics and treatments. Demand is driven by the region's adoption of cutting-edge treatments, such as second-line and innovative medications for extensively and multidrug-resistant tuberculosis. Pharmaceutical businesses that conduct thorough research and development are able to introduce new drugs more quickly and receive regulatory approvals more quickly.

Moreover, government programs and campaigns and public health initiatives ensure patient access to both first-line and advanced TB treatments. High awareness, active screening, and early diagnosis further support market growth. For instance, in March 2024, the New Jersey Department of Health commemorated World Tuberculosis Day, raising awareness about TB prevention, education, and control. Health officials emphasized continued efforts to combat the disease and support statewide prevention and treatment initiatives.

Europe is the second region after North America which is expected to dominate the global Tuberculosis Drug market with a 34.5% in 2024

Europe ranks as the second-largest region in the global tuberculosis (TB) drug market, following North America. Strong public healthcare systems, insurance coverage, and emphasis on early diagnosis, preventive programs, and clinical trials drive adoption of first-line, second-line, and novel TB therapies, boosting market growth and regional share. Additionally, the prevalence of tuberculosis in the Europe region is further boosting the market growth. For instance, a recent data published in March 2025, according to the WHO, in In the WHO European Region, an estimated 225,000 people fell ill with tuberculosis in 2023, and 172,300 cases were reported to health systems.

Germany’s tuberculosis drug market is driven by advanced healthcare infrastructure, supportive regulations, and high disease awareness. Well-equipped hospitals, diagnostic laboratories, and government support ensure widespread access, while public funding and adoption of modern TB therapies sustain market growth and enhance treatment outcomes across the country.

The Asia Pacific region is the fastest-growing region in the global tuberculosis drug market, with a CAGR of 7.5% in 2024

The Asia-Pacific tuberculosis drug market, including India, China, Japan, and South Korea, is expanding due to rising TB awareness, urbanization, and improved healthcare access. Government programs, research advancements, clinical trials, and educational initiatives are driving adoption of first-line, second-line, and novel TB therapies across the region. In India growth is further boosted by company collaboration and partnerships for manufacturing. For instance, in March 2024, Cepheid inaugurated a new manufacturing facility in Bangalore, India, reinforcing its commitment to global tuberculosis efforts. The expanded presence strengthened production capabilities and underscored the company’s dedication to advancing TB diagnostics and solutions.

China is witnessing growing demand for tuberculosis drugs due to rising disease awareness, expanding healthcare infrastructure, and government health initiatives. Improved access through hospitals, clinics, pharmacies, and diagnostic laboratories, along with increased focus on drug approvals and clinical trial availability, is driving adoption of TB therapies.

Competitive Landscape

Top companies in the tuberculosis drug market include Sanofi, LEDERLE PHARMACEUTICAL DIVISION, Hospira, Inc., Bayer AG, JAMP Pharma Corporation, Pfizer Inc., Mylan N.V., Otsuka Pharmaceutical, Lupin Limited, Macleods Pharmaceuticals, and Novartis AG, among others.

Sanofi: Sanofi is an established player in the tuberculosis (TB) market, offering treatments like Priftin (rifapentine) for active and latent TB and TUBERSOL for TB screening. The company participates in global TB initiatives, ensures quality standards, and invests in research to develop new therapies targeting drug-resistant TB strains.

Key Developments:

- In July 2024, the Ministry of Health of Indonesia and TB Alliance signed a Memorandum of Understanding (MOU), marking a major step in combating TB and mycobacterial diseases, demonstrating their commitment to developing and implementing innovative treatments that improved and simplified TB care.

Market Scope

| Metrics | Details | |

| CAGR | 4.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Therapy Type | First-line drug therapy, Second Line Drugs Therapy, Combination Drugs Therapy |

| By Disease Type | Latent TB Type, Active TB Type | |

| By Route of Administration | Parenteral, Oral | |

| By Distribution Channel | Hospital Pharmacy, Retail Pharmacy | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global tuberculosis drug market report delivers a detailed analysis with 76 key tables, more than 81 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here