Testing, Inspection and Certification Market Size

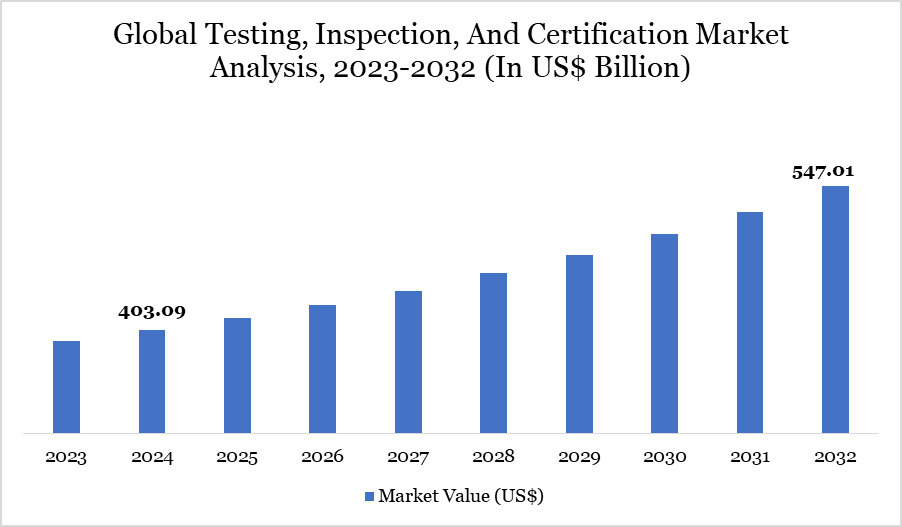

Testing, Inspection and Certification Market size reached US$ 403.09 billion in 2024 and is expected to reach US$ 547.01 billion by 2032, growing with a CAGR of 3.89% during the forecast period 2025-2032.

The global testing, inspection, and certification (TIC) market is undergoing significant growth, propelled by increasing regulatory compliance requirements, heightened consumer awareness of product safety and quality, and swift industrial expansion in sectors including automotive, energy, healthcare, and manufacturing.

Digitalization is markedly improving the efficiency of TIC services, as artificial intelligence (AI), machine learning, and automation transform inspection and testing procedures. Principal market categories, including food safety, industrial testing, consumer goods, and energy, are making substantial contributions, while burgeoning trends in electric vehicles (EVs) and renewable energy systems are presenting new opportunities for market growth.

The increasing complexity of globalization and international trade is heightening the significance of TIC providers because to more stringent cross-border testing and certification requirements. The market is contending with macroeconomic issues, such as ongoing inflation, high interest rates, and geopolitical tensions, as indicated by UNCTAD's April 2024 forecast of 2.6% global economic growth slightly above the recessionary threshold of 2.5%.

Testing, Inspection, And Certification Market Trend

The TIC industry is experiencing a significant transition due to technology improvements and digital integration. A significant trend is the extensive implementation of AI-driven testing and remote inspection capabilities, facilitating more efficient, rapid, and precise services. Digital certification is increasingly becoming the norm, particularly in heavily regulated industries like as food and drinks. This trend is exemplified in Spain, where more than 30,000 food and beverage enterprises participated in exports in 2023, generating a demand for stringent international compliance testing.

Likewise, renewable energy testing is advancing swiftly, driven by the Energy Information Administration's projection that global electricity generation will increase by 70% by 2050, attaining 42,000 TWh. This shift necessitates sophisticated TIC services customized for energy storage, smart grid dependability, and infrastructure inspection. Global supply chains are being restructured by privatized laboratories and elevated standards, leading to greater need on TIC to guarantee product integrity, safety, and sustainability within intricate industrial networks.

For more details on this report – Request for Sample

Testing, Inspection, And Certification Market Scope

| Metrics | Details | |

| By Service | Testing, Inspection, Certification | |

| By Sourcing | In-House, Outsourced | |

| By Application | Consumer Goods and Retail, Food and Agriculture, Oil and Gas, Construction and Engineering, Energy and Chemicals, Manufacturing, Transportation, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

The Surge in Quality Assurance in Emerging Economies Accelerates TIC Market Expansion

The increasing wealth and changing customer expectations in emerging economies are substantially driving the demand for high-quality, safe, and compliance products. Markets in Asia, Africa, and Latin America are experiencing more stringent governmental rules and increasing consumer scrutiny.

India's Bureau of Indian Standards (BIS) has strengthened safety regulations in the electronics, automobile, and food industries, requiring third-party certification for imports. Similarly, China's enhancement of pollution standards and food safety laws highlights a national transition towards sustainability and international adherence. TIC providers like SGS SA and Bureau Veritas are augmenting its activities in these regions to satisfy increasing demand.

The increase in electric vehicles, AI-enhanced healthcare, and intelligent manufacturing is amplifying the demand for specialist TIC services. As global production and consumption rapidly migrate to emerging nations, corporations are becoming more reliant on dependable TIC services to guarantee product acceptance in foreign markets, thereby setting the industry for ongoing growth.

Regulatory Fragmentation Increases TIC Operational Expenses

The TIC industry encounters considerable obstacles due to the absence of regulatory harmonization across areas, resulting in elevated operational expenses. Firms involved in international commerce must adhere to diverse local and worldwide norms, leading to redundant testing, conflicting tax and administrative obligations, and the necessity for localized expertise.

Divergent emission rules in the US and EU such as CAFE norms compared to GHG limits necessitate TIC providers to tailor testing processes, hence increasing prices. This regulatory gap is especially onerous in the automotive, energy, and manufacturing industries. Increased pressure arises from the necessity for specialized infrastructure and skilled individuals to satisfy various compliance standards, rendering market entry and expansion more capital-intensive. Thus, although TIC services are essential for product credibility, the substantial costs and complexities of compliance may dissuade small and medium-sized firms from utilizing comprehensive TIC solutions, thereby limiting total market accessibility.

Market Segmentation

The global testing, inspection, and certification market is segmented based on service, sourcing, application and region.

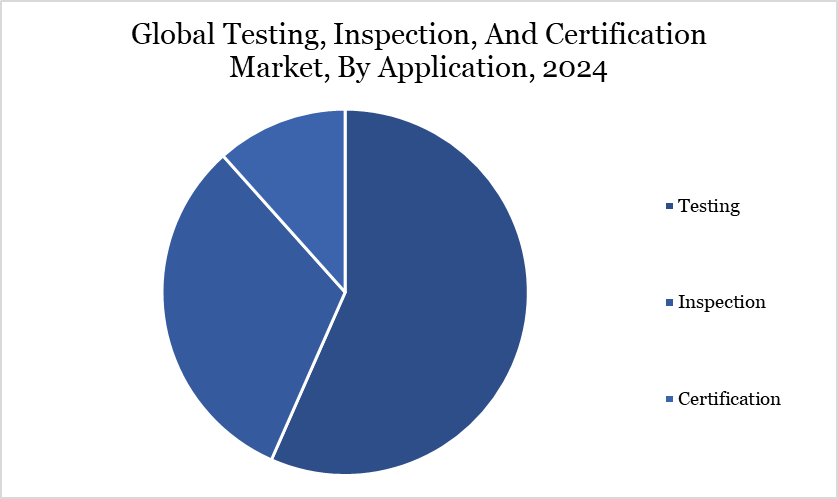

Increasing Significance of Certification Services in the TIC Market

The certification sector of the Testing, Inspection, and Certification (TIC) industry is set for significant growth, driven by increasing regulatory demands, the globalization of commerce, and heightened consumer expectations for certified quality and sustainability. Certification services are becoming increasingly vital as firms strive to exhibit adherence to developing standards concerning product safety, environmental accountability, and operational integrity.

The advent of modern technologies and the growth of areas like renewable energy, smart manufacturing, and linked devices are increasing the demand for accurate and dependable certification. A significant advancement is TÜV Rheinland's introduction in November 2024 of extensive testing services for Zigbee-compliant platforms, Matter 1.4, and Thread protocols—enhancing its position in wireless certification and allowing manufacturers to verify the functionality, reliability, and interoperability of their products. As industries change, certification is crucial for enabling market access, preserving customer trust, and assuring compliance with local and international standards.

Market Regional Analysis

Regulation-Driven Growth and Technological Advancement Propel Europe's TIC Market

Europe continues to be a fundamental component of the global TIC business, supported by a developed regulatory framework, superior infrastructure, and a robust emphasis on sustainability and technology. In 2024, Germany, the predominant market in the region, commanded over 36% market share, supported by its robust automotive and industrial sectors, and bolstered by rigorous regulation from DIN and other standards organizations.

Germany hosts leading TIC providers, such TÜV Rheinland, TÜV SÜD, and DEKRA, which persistently foster innovation in inspection and certification. The nation's TIC industry is projected to expand at a about 5% CAGR until 2029, bolstered by heightened investments in electric vehicles and renewable energy infrastructure.

The broader European region, encompassing the UK, France, Spain, and Norway, is experiencing growth attributed to the digitalization of manufacturing and heightened environmental norms. The region's proactive approach to technology advancements and sustainability is positioning Europe as a benchmark market for the global TIC ecosystem.

Sustainability Analysis

The testing, inspection, and certification industry is essential for facilitating sustainable growth across industries by verifying adherence to environmental, social, and governance (ESG) norms. As worldwide emphasis on minimizing carbon footprints and improving safety escalates, TIC providers play a pivotal role in green transformation efforts, particularly in high-impact industries such as construction, energy, and manufacturing.

The industry's expanding participation in renewable energy initiatives, including solar and wind farms, underscores its increasing significance in guaranteeing the efficacy and dependability of environmentally essential technology. By international frameworks such as the Paris Agreement, TIC services assist in validating sustainability assertions, ensuring energy efficiency in infrastructure, and enabling the secure implementation of electric vehicles and smart grids.

The digitization of certification processes lowers paper waste and enhances traceability. The collaboration between Applus+ and Four Hills Group in Australia (October 2024) exemplifies the TIC industry's commitment to sustainable employment and inclusive growth, hence advancing long-term environmental and socioeconomic objectives.

Major Players

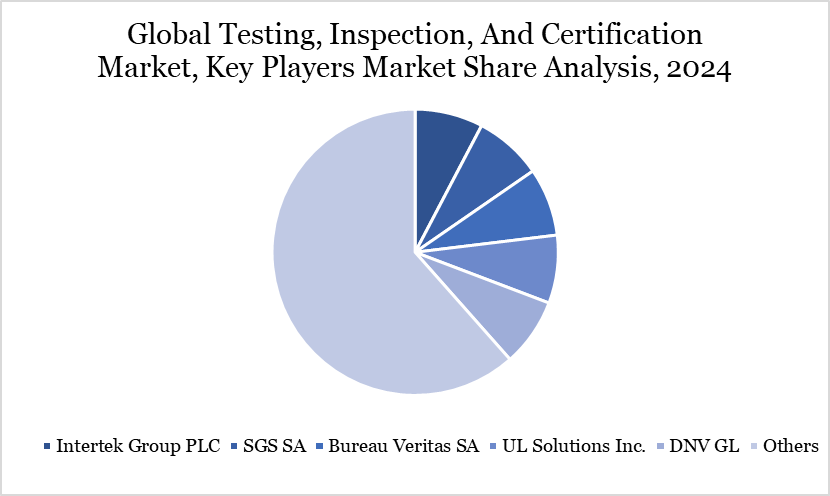

The major global players in the market include Intertek Group PLC, SGS SA, Bureau Veritas SA, UL Solutions Inc., DNV GL, Eurofins Scientific SE, Dekra SE, ALS Limited, BSI Group, CIS Commodity Inspection Services BV and others.

Key Developments

- In October 2024, Applus+ collaborated with Four Hills Services Pty Ltd, a provider of construction equipment services, to deliver inspection and testing services in Australia. Inspection Partners Pty Ltd seeks to generate employment opportunities, enabling both Indigenous and non-Indigenous individuals to embark on careers in the testing and inspection sectors of the construction and mining industries.

In September 2024, Eurofins Scientific collaborated with Pharmaoffer, a digital pharmaceutical platform provider, to set new norms for quality and safety standards in pharmaceutical supply chain audits. Pharmaoffer incorporates Eurofins Healthcare Assurance’s comprehensive audit libraries into its platform, granting Active Pharmaceutical Ingredients (API) buyers and suppliers streamlined access to vital auditing resources.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies