Global Telecom Infrastructure Market: Industry Outlook

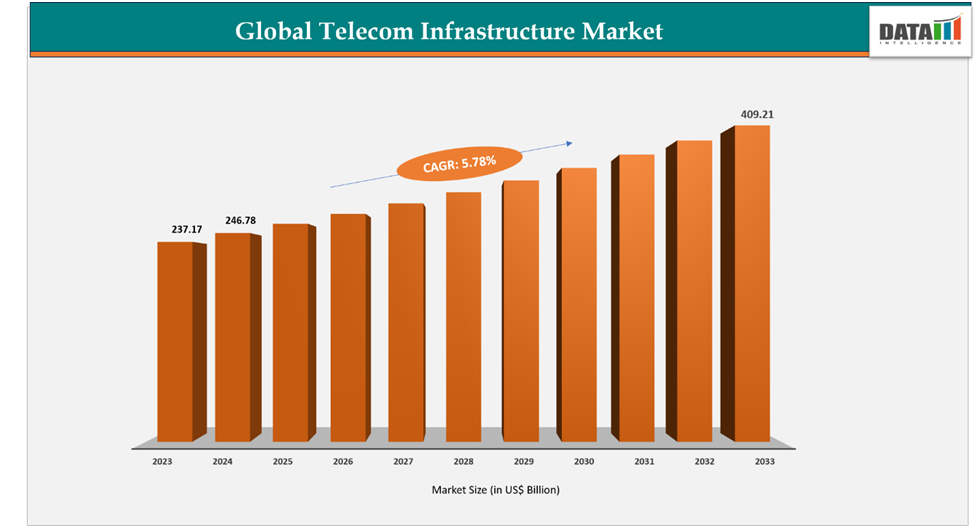

The global telecom infrastructure market reached US$ 237.17 billion in 2023, with a rise to US$ 246.78 billion in 2024, and is expected to reach US$ 409.21 billion by 2033, growing at a CAGR of 5.78% during the forecast period 2025–2033.

The global telecom infrastructure market is witnessing steady growth, driven by surging demand for high-speed connectivity, rapid cloud adoption, and the rollout of 5G networks. Expanding use cases across defense, smart cities, healthcare, and industrial automation are fueling large-scale investments in fiber, mobile, and private wireless networks. Advancements in virtualization, AI-powered network optimization, and energy-efficient solutions are further accelerating progress, supported by rising digital transformation initiatives. In addition, the market is being shaped by strategic partnerships, government funding programs, and collaborations between telecom operators and technology providers aimed at enhancing innovation and expanding global connectivity.

The US made major strides in telecom infrastructure from 2019–2024 with 5G rollouts, fiber expansion, and federal programs like IIJA and BEAD driving nationwide connectivity, but sustaining momentum will require higher capex, spectrum access, and industry-government collaboration to boost the Communications Infrastructure Index (CII) 30% by 2030. Meanwhile, Japan is positioning itself as a leader in open and disaggregated networks, highlighted by KDDI’s partnership with DriveNets to deploy Network Cloud by FY2025, reinforcing its commitment to scalable, cloud-native infrastructures that will advance 5G expansion and digital economy growth.

Key Market Trends & Insights

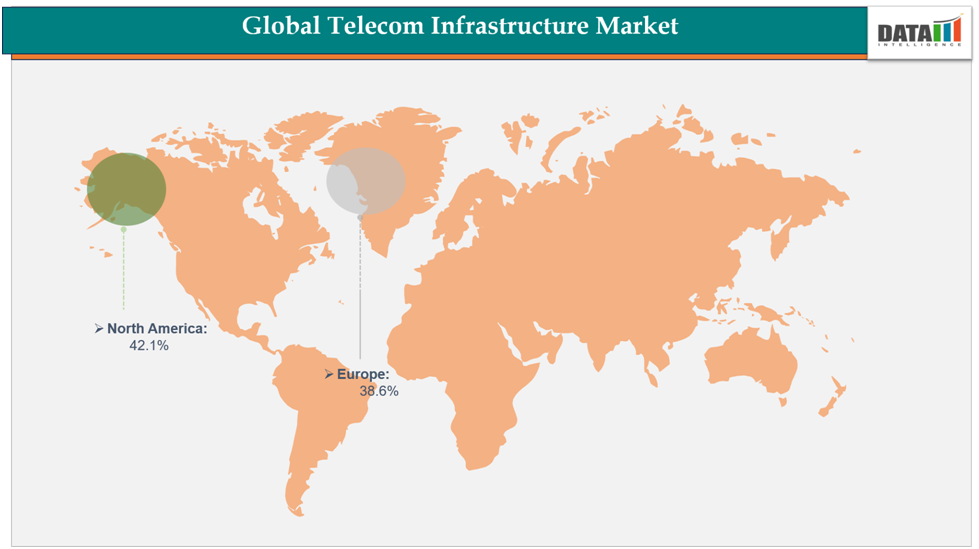

North America leads the telecom infrastructure market, driven by heavy investments in 5G deployment, broadband expansion, and federal initiatives focused on bridging connectivity gaps. Programs like the Infrastructure Investment and Jobs Act (IIJA) and BEAD are accelerating rural and underserved access, while rising demand for cloud services, private networks, and enterprise-grade connectivity strengthens the region’s dominance.

Europe is set to witness the fastest growth, supported by strong digital sovereignty policies, sustainability goals, and major investments in fiber networks and open architectures. Rapid 5G rollouts, coupled with government-backed modernization projects, are fueling adoption across industries. Key markets such as Germany, the UK, and France are at the forefront of deploying advanced telecom systems to enhance commercial, industrial, and public connectivity.

5G continues to be the leading technology segment, providing the foundation for high-speed, low-latency communications across consumer, enterprise, and industrial use cases. Its role in enabling smart cities, industrial IoT, and autonomous mobility underlines its importance in next-generation connectivity. Additionally, 5G adoption is driving advancements in edge computing, cloud-native networks, and digital service ecosystems, cementing its position as the cornerstone of telecom infrastructure growth.

Market Size & Forecast

2024 Market Size: US$ 246.78 Billion

2033 Projected Market Size: US$ 409.21 Billion

CAGR (2025–2033): 5.78%

North America: Largest market in 2024

Europe: Fastest-growing market

Drivers & Restraints

Driver: Accelerated 5G Rollouts and Broadband Expansion Driving Connectivity

The global telecom infrastructure market is gaining momentum as operators worldwide push ahead with large-scale 5G deployments and broadband expansion to meet soaring demand for high-speed connectivity. The transition to 5G Standalone (SA) networks built on a cloud-native 5G core independent of 4G has been a critical leap forward, enabling capabilities such as ultra-low latency, advanced network slicing, and scalable digital services.

Initially, only a handful of carriers had embraced 5G SA since its debut in 2019. However, 2024 marked a turning point, with major launches by Virgin Media O2 and EE in the UK, alongside deployments by Vodafone Germany, Norway’s Ice, and Iliad’s Free in France. These rollouts demonstrate a global shift toward next-generation mobile infrastructure.

At the same time, governments in emerging markets are laying ambitious foundations for future growth. For example, India’s Department of Telecommunications (DoT) released its draft National Telecom Policy 2025, targeting 100% 4G coverage and 90% 5G coverage by 2030. The policy also outlines objectives to double telecom exports, foster start-ups, and strengthen the country’s role in global telecom innovation. Together, such initiatives are reinforcing the critical role of telecom infrastructure in powering economic growth and digital inclusion.

Restraint: Elevated Costs and Regulatory Hurdles Slowing Adoption

Despite strong growth drivers, the telecom infrastructure sector continues to face headwinds from high capital investment requirements and ongoing maintenance expenses. Rolling out 5G and broadband networks demands heavy spending on spectrum, equipment, and operations, creating barriers for operators in cost-sensitive regions.

The financial burden is further complicated by regulatory challenges. For instance, Reliance Projects recently filed a petition with the Supreme Court of India contesting Haryana’s municipal and panchayati raj laws on telecom network erection and maintenance fees. The company argued these charges conflicted with the Telecommunications (Right of Way) Rules, 2024. While the court called for a response from the state, it declined to suspend the High Court ruling that upheld Haryana’s legislative authority.

Such disputes illustrate how rising costs and regulatory uncertainties can delay network deployments, discourage investment, and hinder operators’ ability to scale infrastructure efficiently. Without streamlined policies and more cost-effective deployment models, the expansion of advanced telecom services could face significant delays, especially in developing markets.

For more details on this report - Request for Sample

Segmentation Analysis

The global telecom infrastructure market is segmented based on component, technology, infrastructure type, end user and region.

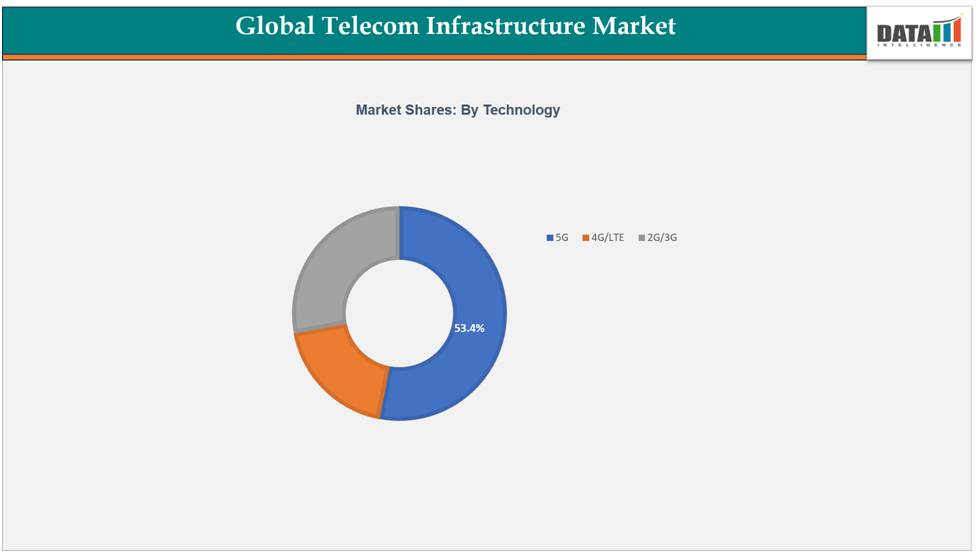

Technology: The 5G segment accounts for an estimated 53.4% of the global telecom infrastructure market.

The 5G segment represented approximately 53.4% of the global telecom infrastructure market in 2024, maintaining its position as the leading category. The global shift from 4G LTE to 5G is accelerating investments in base stations, small cells, fiber backhaul, and cloud-native core networks. With its ability to deliver high bandwidth, ultra-low latency, and reliable connectivity, 5G has become the foundation for advanced applications such as smart cities, autonomous mobility, industrial IoT, and immersive digital services.

Growth within this segment is also being fueled by strategic acquisitions and partnerships that enhance deployment capabilities. For instance, in June 2024, Accenture finalized the acquisition of Fibermind, an Italy-based network services provider specializing in fiber and 5G rollout. This acquisition expands Accenture’s expertise in telecom network engineering while integrating advanced capabilities in automation, robotics, data, and AI, helping clients accelerate and optimize 5G deployments.

As nations and enterprises continue to prioritize digital transformation, spectrum expansion, and advanced connectivity infrastructure, the 5G segment is expected to remain at the forefront of telecom infrastructure growth. Its critical role in supporting cloud, edge computing, and AI-driven ecosystems ensures strong demand over the coming years.

Geographical Analysis

The North America telecom infrastructure market was valued at 42.1% market share in 2024

The North America telecom infrastructure market accounted for 42.1% of the global share in 2024, maintaining its position as the largest regional contributor. Growth in the region is driven by extensive investments in network modernization, rapid 5G deployments, and expansion of digital infrastructure to meet rising consumer and enterprise demand. Mobile carriers and technology providers are increasingly upgrading network capacities to support high-speed connectivity, low-latency services, and next-generation applications such as autonomous vehicles, IoT, and cloud-based enterprise solutions.

Private equity and infrastructure investment are playing a critical role in accelerating market growth. For instance, Apollo Global Management, Inc., which, through its affiliated funds, acquired a US telecommunications platform from Lendlease. This portfolio includes operating cell towers and a pipeline of contracted towers under development, reflecting growing investor confidence in the long-term stability and revenue potential of telecom infrastructure assets. Such strategic acquisitions provide capital for network expansion, technology upgrades, and deployment of advanced 5G services, further strengthening North America’s leadership position.

In addition to investment activity, federal programs and regulatory support have bolstered growth. Initiatives such as the Infrastructure Investment and Jobs Act (IIJA) and the Broadband Equity, Access, and Deployment (BEAD) program have facilitated rural broadband expansion, private network rollouts, and enhanced connectivity in underserved areas. Together with strong technological expertise and a mature ecosystem of equipment manufacturers, network operators, and service providers, North America continues to dominate global telecom infrastructure development.

The Europe telecom infrastructure market was valued at 38.6% market share in 2024

The Europe telecom infrastructure market held 38.6% of the global share in 2024, emerging as a key hub for network innovation and expansion. Growth in the region is fueled by increasing 5G adoption, infrastructure consolidation, and a strong policy focus on digital connectivity and interoperability. European countries are investing heavily in upgrading mobile and fixed-line networks, with a focus on enhancing coverage, reliability, and network efficiency to support the surge in data traffic, smart city initiatives, and industrial digitalization.

Strategic investments and partnerships have accelerated market momentum. For instance, InfraBridge, a leading infrastructure investment manager, and Swiss Life Asset Managers entered into a binding agreement to acquire a co-controlling equity stake in Telecom Infrastructure Partners (TIP), a global lease aggregator of telecom sites across Europe and Latin America. This investment, which includes additional equity commitments, is aimed at expanding TIP’s platform, optimizing site utilization, and scaling deployment of next-generation telecom infrastructure. Such collaborations highlight the role of institutional investors in driving growth, facilitating technology upgrades, and enhancing the operational efficiency of telecom networks.

Europe’s market is further supported by regulatory initiatives promoting open-access networks, energy-efficient deployment, and cross-border connectivity. Combined with rising private sector adoption of 5G-enabled services, the region is poised for strong growth, positioning Europe as a strategic player in the global telecom infrastructure ecosystem.

Competitive Landscape

The major players in the telecom infrastructure market include Infineon Technologies AG, Huawei Technologies Co., Ltd., Cellnex, Telefonaktiebolaget LM Ericsson, Nokia, Cisco Systems, Inc, Juniper Networks, Inc., SAMSUNG, NEC Corporation, ATC TRS V LLC

Infineon Technologies AG: Infineon Technologies AG is a leading German semiconductor manufacturer providing advanced solutions for telecom infrastructure, including power management, connectivity, and signal processing components. The company’s offerings enable high-performance and energy-efficient network equipment, supporting 5G deployments, broadband expansion, and data center connectivity. Infineon’s products are widely used in base stations, routers, optical networks, and other critical telecom infrastructure devices. With a strong focus on R&D, Infineon continues to develop scalable and secure semiconductor solutions that enhance network reliability, reduce power consumption, and support the rollout of next-generation telecom technologies globally.

Market Scope

Metrics | Details | |

|---|---|---|

CAGR | 5.78% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component | Hardware, Software, Services |

| Technology | 5G, 4G/LTE, 2G/3G |

| Infrastructure Type | Wireless Infrastructure, Wired Infrastructure, Satellite & Other Infrastructure |

| End User | Telecom Operator, Enterprises |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global telecom infrastructure market report delivers a detailed analysis with 70 key tables, more than 61 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more telecom infrastructure-related reports, please click here