Synthetic Milk Market Size

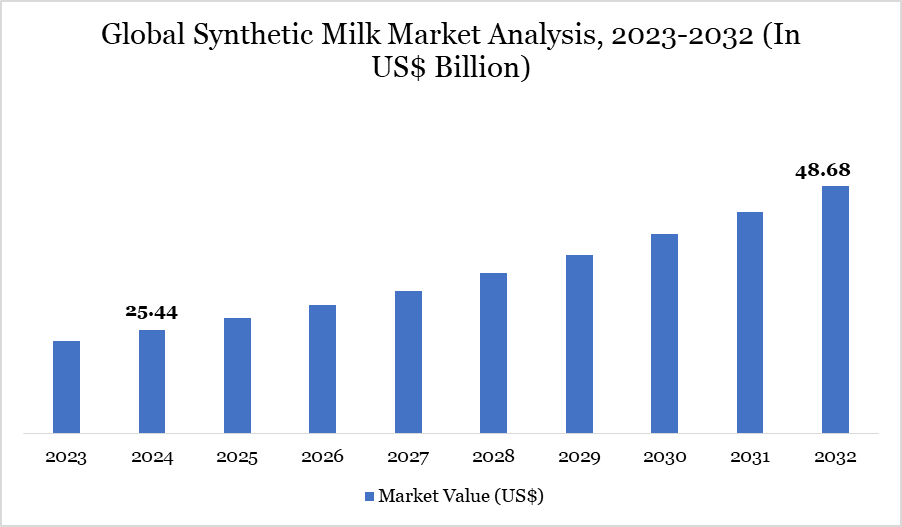

Synthetic Milk Market Size reached US$ 25.44 billion in 2024 and is expected to reach US$ 48.68 billion by 2032, growing with a CAGR of 8.45% during the forecast period 2025-2032.

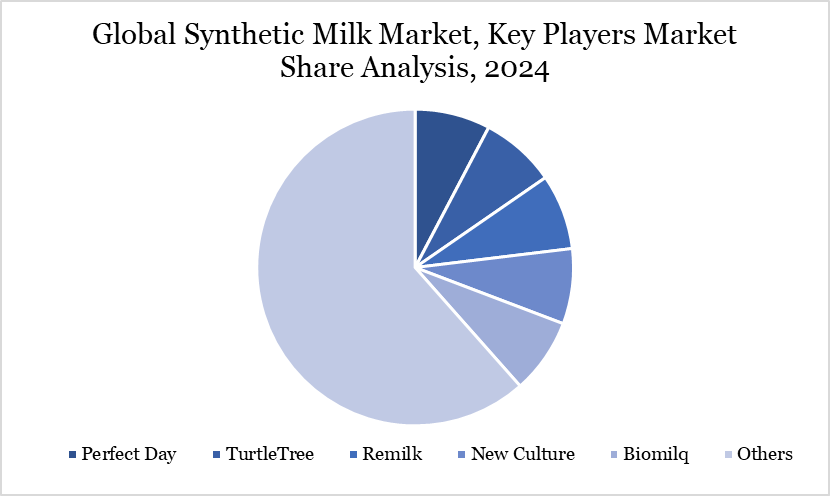

Synthetic milk, created by precision fermentation technologies, is set to transform the worldwide dairy industry. Synthetic milk, in contrast to plant-based alternatives, emulates the flavor, texture, appearance, and nutritional composition of cow's milk. US-based Perfect Day is at the forefront of this transformation, incorporating lab-grown dairy proteins into ice cream, cream cheese, chocolate, and protein powders.

The sector is still in the research and development stage, but is growing swiftly due to environmental, ethical, and technological factors. Analysts forecast that synthetic milk may provide more than 700,000 jobs worldwide by 2030, signifying substantial market potential. Notwithstanding conservative consumer mood and regulatory intricacies, especially with labeling regulations, the market's growth trajectory remains promising.

Synthetic milk provides an environmentally sustainable and scalable alternative by mitigating methane emissions, water pollution, land use, and addressing animal welfare issues. With the advancement of technology, synthetic milk is expected to become a prevalent dairy alternative worldwide.

Synthetic Milk Market Trend

The synthetic milk industry is experiencing rapid innovation driven by precision fermentation. Startups such as Perfect Day, New Culture, and Remilk are progressively commercializing dairy proteins for various end products. Perfect Day's animal-free proteins are being incorporated in items like protein powders and dairy desserts, while New Culture is introducing mozzarella created from synthetic milk.

The phrase “We’re changing the process, not the food” effectively encapsulates the industry's endeavor to provide indistinguishable substitutes for cow's milk. With the increasing awareness of environmental sustainability, synthetic milk is regarded not only as an alternative but as a superior solution.

Moreover, enterprises such as Australia’s All G Foods are prioritizing cost-efficiency, to render synthetic milk more economical than conventional dairy in the imminent future. The affordability aspect may be a significant trend in facilitating broader consumer acceptance. The industry is transitioning from specialized innovation to widespread commercialization and integration across food sectors.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Type | Plant-based Synthetic Milk, Lab-cultured Synthetic Milk | |

| By Form | Liquid, Powder | |

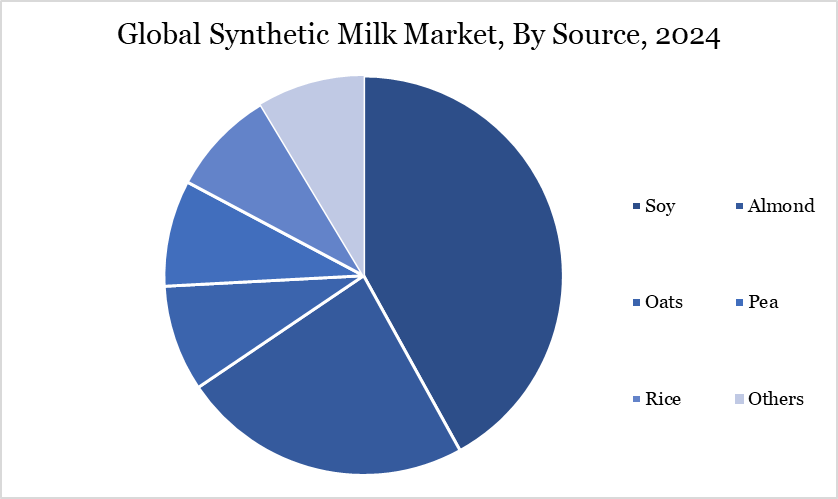

| By Source | Soy, Almond, Oats, Pea, Rice, Others | |

| By Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others | |

| By End-user | Household, Food & Beverage Industry, Nutraceuticals, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Synthetic Milk Market Dynamics

Sustainability is a Major Factor Propelling Market as it Reduces Emissions, Land Use, and Water Pollution.

The synthetic milk industry is gaining momentum mainly because of its ability to substantially mitigate environmental harm linked to traditional dairy farming. Experts, including Dr. Diana Bogueva from Curtin University’s Sustainability Policy Institute, assert that synthetic milk may result in a diminished carbon footprint, negligible water contamination, and decreased land utilization, while entirely addressing animal welfare issues.

Methane emissions from dairy calves significantly contribute to global warming, and synthetic milk presents a feasible method to alleviate this issue. Moreover, the anticipated rise in global dairy demand over the next decade positions precise fermentation as a scalable and ethical solution to fulfill consumption requirements without augmenting livestock numbers. The increasing alignment with environmental, social, and governance (ESG) norms is prompting governments, investors, and startups to endorse breakthroughs in lab-grown dairy, thereby expediting commercialization.

Societal Skepticism and Labeling Obstacles Impede Growth

Synthetic milk encounters considerable opposition due to consumer conservatism and intricate regulatory frameworks, notwithstanding its technological and environmental potential. In November 2023, Italy became the inaugural nation to officially prohibit the sale of lab-grown meat, indicating significant popular concern regarding synthetic meals.

Consumer sentiments in Russia favor conventional dairy due to price sensitivity and a preference for traditional flavors. Labeling constitutes a significant impediment. In June 2023, the US National Milk Producers Federation implored the FDA to ban the designation "milk" for synthetic dairy products, contending that these products fail to comply with federal identity standards.

Proposals for alternatives such as "synthetic whey beverage" exist, although they may impede consumer acceptance. Milena Bojovic, a researcher at Macquarie University, asserts that the successful incorporation of synthetic proteins into final goods will necessitate addressing intricate marketing, legislative, and cultural obstacles—factors that may impede but not halt the industry's growth.

Synthetic Milk Market Segment Analysis

The global synthetic milk market is segmented based on type, form, source, distribution channel, end-user and region.

Health and Wellness Trends Drive the Expansion of Almond Milk

Almond milk is increasingly prominent in the synthetic milk market owing to its robust nutritional profile and health benefits. Rich in vitamin E and omega-3 fatty acids while being low in calories and cholesterol, it has emerged as a favored plant-based dairy substitute. Strategic alliances, exemplified by the 2024 collaboration between Blue Diamond Growers and Kagome Co., Ltd. in Japan, are enhancing its international presence.

The retail environment has transformed, with off-trade channels driving expansion and facilitating broad customer access via adaptable pricing. In 2022, global per capita consumption exceeded 1.28 kg, indicating heightened demand. Product diversity, encompassing unsweetened, chocolate, and vanilla variations, is responding to changing preferences. Prominent businesses such as Alpro and Califia Farms are spearheading innovation, particularly within the foodservice industry. Almond milk, with its digestive advantages and attractiveness to calorie-conscious customers, is poised to influence the future of synthetic milk in health-conscious and specialized markets globally.

Synthetic Milk Market Geographical Share

Europe's Market is proven to be an Ambivalent indicator for Synthetic Dairy

Europe exhibits a multifaceted environment for synthetic milk, marked by innovation in certain areas and opposition in others. The Italian government's prohibition on lab-grown meat in November 2023 underscores the region's dominant conservative position regarding lab-grown food. Minister of Agriculture Francesco Lollobrigida underscored the move as a protective measure against the "social and economic hazards of synthetic food," hence bolstering consumer distrust.

Additionally, nations like as Hungary and Poland have expressed analogous views, supporting possible limitations on lab-grown alternatives. This prudent regulatory stance may hinder swift market entry, although Western European countries with advanced sustainability initiatives may be more amenable. As environmental rules intensify and the need for ethical food sources increases, certain European markets may ultimately adopt synthetic milk technology. Successful penetration, however, will hinge on surmounting regulatory resistance and conforming to cultural norms.

Sustainability Analysis

Synthetic milk has considerable sustainability benefits compared to conventional dairy production. Precision fermentation, the fundamental technique underlying synthetic milk, significantly decreases greenhouse gas emissions, especially methane, a powerful pollutant linked to cattle. It reduces water consumption, lowers land exploitation, and eliminates animal welfare concerns associated with traditional farming practices.

Given the prominence of climate change mitigation on the global agenda, the environmental advantages of synthetic milk establish it as a significant contributor to sustainable food systems. Dr. Diana Bogueva of Curtin University highlights that lab-grown milk is "the next food frontier." The commitment to providing dairy-identical goods without the use of livestock is particularly appealing, since consumers, particularly younger populations, seek environmentally sustainable options.

Furthermore, enterprises such as All G Foods are striving for cost reductions, potentially democratizing access to sustainable dairy products. With the intensification of climate policies and the increase in ethical consumerism, synthetic milk is poised to become not merely an alternative, but an essential component of global food systems.

Synthetic Milk Market Major Players

The major global players in the market include Perfect Day, TurtleTree, Remilk, New Culture, Biomilq, Nobell Foods, Eden Brew, Better Dairy, Imagindairy, Vivici and others.

Key Developments

- In October 2022, SunOpta Inc. finalized the initial phase of a US$ 100 million sterile alternative milk facility in Midlothian to produce sustainable milk and food items.

- In January 2022, Danone North America launched Silk Extra Creamy Almondmilk, an enhancement to its almond milk range, comprising a combination of three almond varieties.

- In March 2022, ITC introduced the 'Aashirvaard Svasti Easy Digest Milk' for commercial distribution in the Indian market. The company asserts that this product is lactose-free and primarily intended for individuals with lactose intolerance.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies