Sustainable Packaging Coatings Market Size

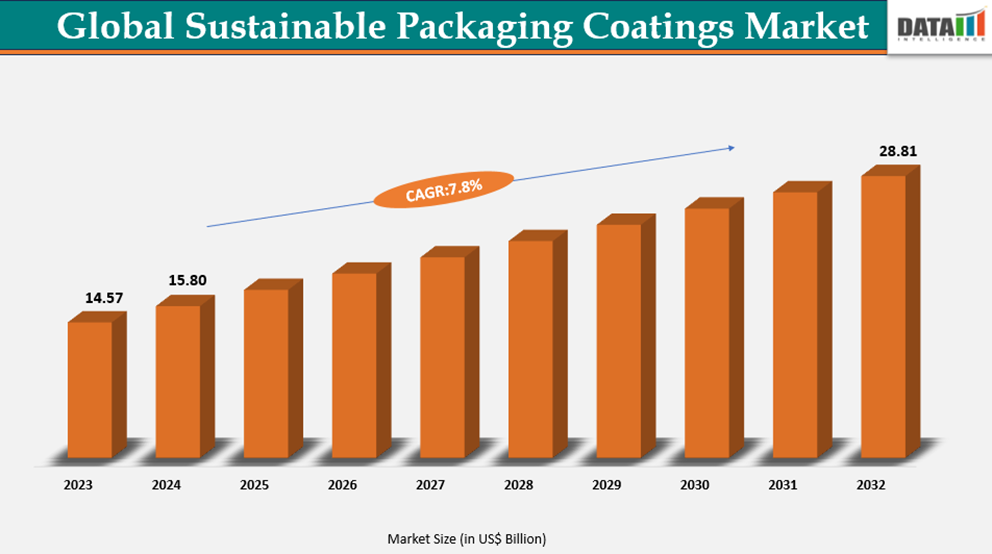

The global sustainable packaging coatings market reached US$15.80 billion in 2024 and is expected to reach US$28.81 billion by 2032, growing at a CAGR of 7.8% during the forecast period 2025-2032.

This momentum comes from the global push toward eco-friendly and circular packaging solutions, including recyclable films, compostable materials, water-based coatings, and bio-based polymers, which not only reduce environmental impact but also enhance product protection and durability. Supportive government regulations, sustainability mandates, and rapid technological innovation are making sustainable packaging coatings more accessible, driving the shift toward a greener and more circular global packaging economy.

Sustainable Packaging Coatings Industry Trends and Strategic Insights

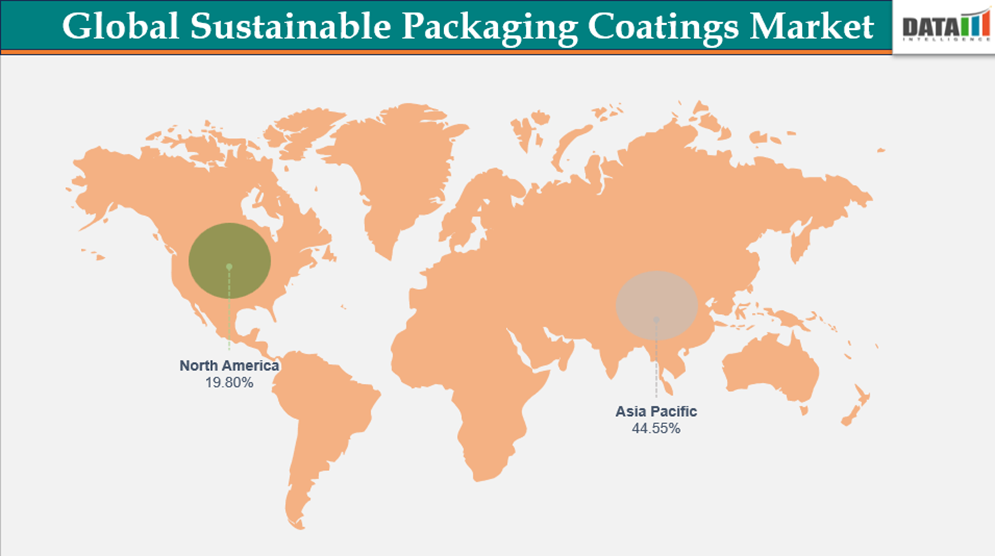

- The Asia-Pacific region leads the global sustainable packaging coatings market, capturing the largest revenue share of 44.55% in 2024.

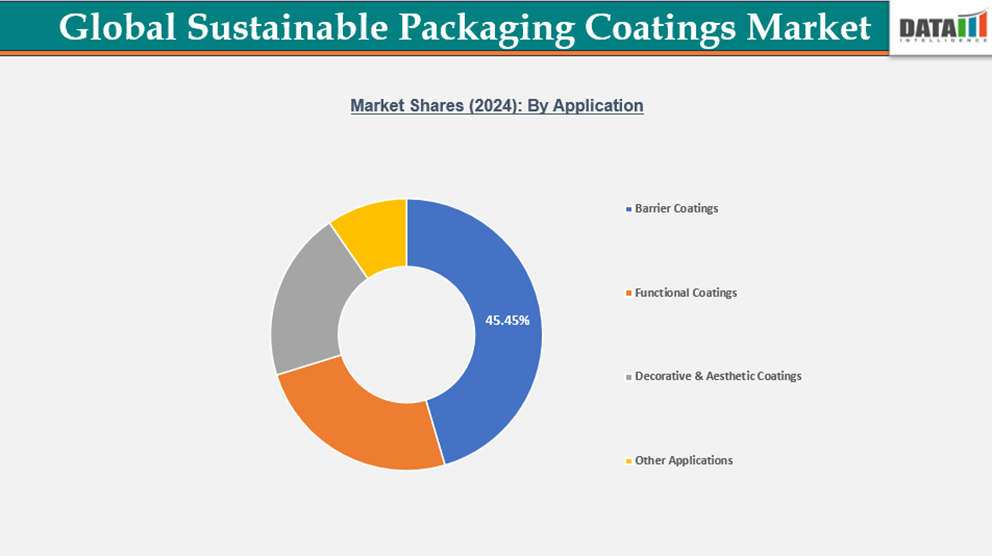

- By application, barrier coating segment dominates the market, capturing the largest revenue share of 45.45% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 15.80 Billion

- 2032 Projected Market Size: US$ 28.81 Billion

- CAGR (2025-2032): 7.8%

- Largest Market: Asia-Pacific

- Fastest Market: North America

Market Scope

| Metrics | Details |

| By Material Type | Water-Based Coatings, Powder Coatings, Bio-Based & Renewable Coatings, UV-Curable & EB-Curable Coatings, Other Material Types |

| By Application | Barrier Coatings, Functional Coatings, Decorative & Aesthetic Coatings, Other Applications |

| By Packaging Substrate | Paper & Paperboard, Plastics, Metal, Glass |

| By End Use Industry | Food & Beverage, Personal Care & Cosmetics, Healthcare & Pharmaceuticals, Household Products, Other End Use Industries |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising consumer demand for eco-friendly packaging solutions globally

The global packaging industry is witnessing a significant shift driven by increasing consumer awareness and preference for sustainable, eco-friendly packaging solutions. Modern consumers, particularly in North America, Europe, and Asia-Pacific, are increasingly prioritizing environmental responsibility, recyclability, and reduced carbon footprints when making purchasing decisions. This behavioral shift is compelling brands across FMCG, food and beverages, pharmaceuticals, and e-commerce sectors to adopt sustainable packaging coatings that meet both regulatory standards and consumer expectations.

Sustainability-focused coatings, including water-based, bio-based, and UV-curable formulations, are gaining traction due to their reduced environmental impact, compatibility with recyclable substrates, and enhanced functional performance. Companies investing in R&D, product innovation, and eco-certifications are better positioned to capture this growing market segment. Additionally, the rise of e-commerce and retail packaging has accelerated the adoption of eco-conscious coatings, as brands seek to differentiate themselves through environmentally responsible packaging.

Segment Analysis

The global sustainable packaging coatings market is segmented based on material type, application, packaging substrate end use industry and region.

Government regulations promoting recyclable, compostable, and low-emission coatings

Government policies and regulatory frameworks are increasingly shaping the sustainable packaging coatings market by mandating environmentally responsible practices. Countries across North America, Europe, and Asia-Pacific are implementing regulations that require recyclable, compostable, and low-emission coatings for packaging used in food, pharmaceuticals, and consumer goods. These policies are driven by global commitments to reduce plastic waste, minimize greenhouse gas emissions, and advance circular economy initiatives.

Compliance with these regulations is now a critical factor for manufacturers, incentivizing the adoption of water-based, bio-based, and low-VOC coating technologies. Brands that proactively align with regulatory requirements gain a competitive edge by enhancing consumer trust, avoiding penalties, and improving supply chain sustainability. Governments are supporting innovation through grants, subsidies, and collaborative research programs, enabling companies to develop high-performance, eco-friendly coatings that meet evolving standards.

High Production Costs of Bio-Based and Waterborne Coating Technologies

Unlike conventional solvent-based coatings, these eco-friendly alternatives often require specialized raw materials, such as bio-resins, plant-derived polymers, and natural additives, which are costlier due to limited availability and complex extraction processes. Additionally, manufacturing waterborne formulations demands advanced processing technologies to ensure stability, adhesion, and performance, further increasing operational expenditures.

These elevated costs can impact pricing strategies and profit margins, particularly for small- and medium-sized coating manufacturers, limiting adoption among cost-sensitive end-use industries. While demand for sustainable coatings is growing, the economic feasibility of scaling production remains a critical challenge. Companies are investing in process optimization, R&D, and partnerships to reduce costs over time, but until economies of scale are achieved, high production costs will continue to act as a significant barrier to market expansion, especially in emerging regions.

Geographical Penetration

North America Leading the Charge in Sustainable Packaging Coatings

North America is emerging as one of the largest and fastest-growing regions in the sustainable packaging coatings market, driven by increasing demand across automotive, aerospace, FMCG, and construction sectors. The region benefits from advanced industrial infrastructure, cutting-edge coating technologies, and strategic investments in circular economy initiatives. Growing consumer awareness and corporate sustainability commitments are accelerating adoption of eco-friendly, recyclable, and bio-based coatings, positioning North America as a hub for green innovation and sustainable packaging growth.

US Sustainable Packaging Coatings Market Insights

The United States continues to witness steady market expansion, supported by industrial demand, regulatory incentives, and strong R&D capabilities. Companies are prioritizing sustainable solutions for high-value packaging applications, including food, personal care, and e-commerce sectors. Technological advancements in waterborne, bio-based, and multifunctional coatings are enhancing performance and process efficiency, enabling faster adoption while supporting corporate ESG goals.

Canada Sustainable Packaging Coatings Industry Growth

Canada’s market is experiencing gradual expansion, driven by industrial applications and government support for sustainable manufacturing. Leveraging abundant natural resources and modern energy infrastructure, Canadian companies are integrating eco-friendly coatings into packaging solutions for food, consumer goods, and industrial products. Initiatives such as facility modernization and investments in green manufacturing technologies underscore Canada’s commitment to decarbonization, sustainability, and long-term industrial growth, contributing to the broader North American sustainable packaging coatings landscape.

Asia-Pacific Leads the Sustainable Packaging Coatings Market Driven by Industrial Growth and Infrastructure

The Asia-Pacific region dominates the global sustainable packaging coatings market, fueled by rapid industrialization, urbanization, and expanding manufacturing sectors in countries such as China, India, and Japan. Rising demand from construction, automotive, FMCG, and industrial sectors is driving the adoption of eco-friendly coatings, recyclable substrates, and multifunctional packaging solutions across the region.

Government initiatives promoting large-scale infrastructure projects, including highways, metro networks, and smart cities, are accelerating sustainable packaging adoption. Innovations in bio-based coatings, waterborne formulations, and energy-efficient manufacturing processes are enhancing system performance, durability, and environmental compliance. Combined with competitive manufacturing capabilities and abundant natural resources, Asia-Pacific is expected to maintain its leading position in the global market in the coming years.

India Sustainable Packaging Coatings Market Outlook

India’s market is experiencing robust growth, driven by infrastructure expansion, rising industrial output, and growing consumer awareness of eco-friendly packaging. Government programs, including the smart cities mission and large-scale infrastructure investments, are boosting adoption of recyclable coatings and sustainable packaging solutions. Domestic innovation in bio-based and multifunctional coatings further supports market growth, positioning India as a high-potential regional player.

China Sustainable Packaging Coatings Market Trends

China continues to be a global leader in sustainable packaging, investing heavily in bio-based coatings, multifunctional substrates, and green manufacturing technologies. Strong domestic demand from industrial, automotive, and urban sectors drives market expansion, while government-led policies and technological advancements accelerate adoption of eco-friendly packaging. These initiatives ensure China’s sustainable packaging coatings market remains robust and poised for steady growth over the coming years.

Sustainability Analysis

The sustainable packaging coatings market is increasingly embracing eco-friendly and circular practices, driven by the global push toward low-carbon manufacturing and sustainable materials adoption. Companies are investing in bio-based resins, waterborne coatings, and energy-efficient production technologies to reduce environmental impact. Sustainable practices, including responsible sourcing, regulatory compliance, and waste minimization, are becoming standard across the sector.

Lightweight, multifunctional coatings contribute to reduced material usage and improved recyclability, indirectly lowering carbon footprints across food, personal care, industrial, and e-commerce packaging sectors. The market is evolving toward a more sustainable, innovation-driven packaging ecosystem, where technological advancements, operational efficiency, and responsible practices are aligned with global environmental and circular economy goals.

Competitive Landscape

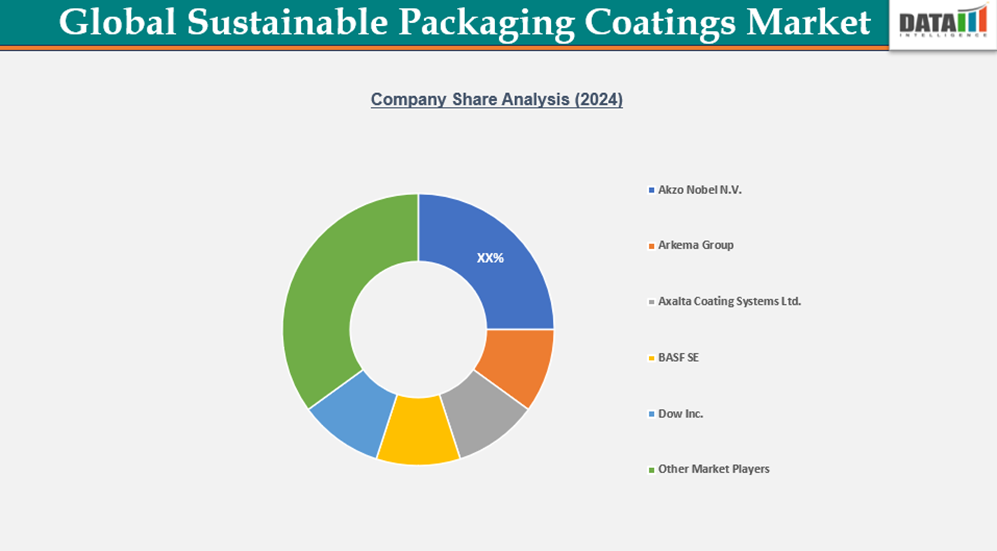

- Companies are focusing on product innovation, sustainability-driven R&D, and global distribution networks, strengthening their market positioning across North America, Europe, and Asia-Pacific. While the top-tier players lead in technology development and brand recognition, the market remains moderately fragmented, with smaller regional companies providing niche eco-friendly coating solutions for specialized packaging applications.

- Strategic initiatives, including collaborations, joint ventures, and sustainable product portfolios, are key to maintaining competitive advantage, driving adoption of recyclable, compostable, and multifunctional packaging coatings, and expanding market reach globally.

Key Developments

- January 2025 - Akzo Nobel N.V. leads the sustainable packaging coatings market with bio-based, waterborne, and multifunctional formulations. Strategic R&D, collaborations, and eco-friendly product development strengthen its position across food, beverage, and industrial packaging, supporting global circular economy initiatives.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies