Sustainable Healthcare Packaging Market Size and Trends

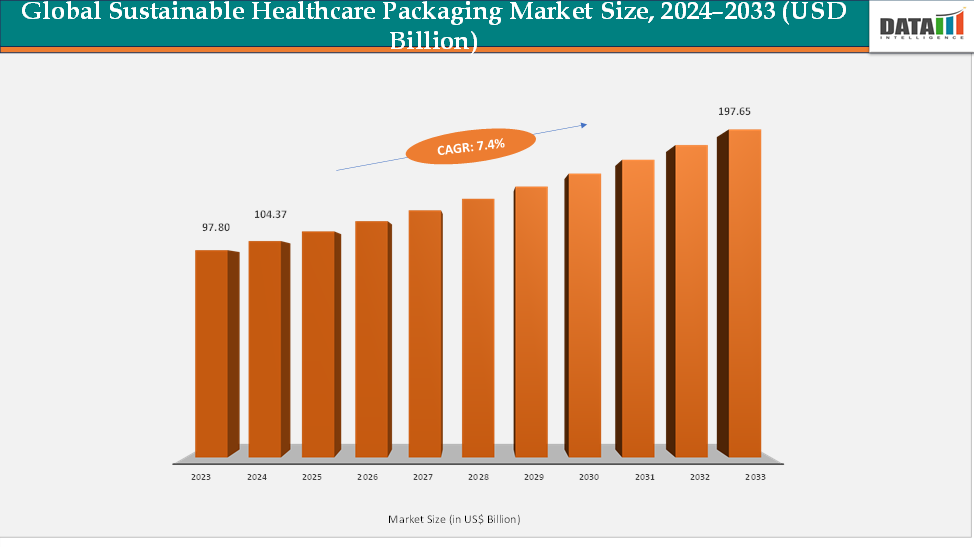

The global sustainable healthcare packaging market reached US$ 97.80 billion in 2023, with a rise to US$ 104.37 billion in 2024, and is expected to reach US$ 197.65 billion by 2033, growing at a CAGR of 7.4% during the forecast period 2025–2033. The global sustainable healthcare packaging market is witnessing strong growth, driven by increasing regulatory mandates, rising environmental awareness among healthcare providers, and expanding adoption of eco-friendly materials across the pharmaceutical and medical device sectors. Innovations in recyclable, biodegradable, and bio-based packaging solutions, including high-barrier mono-material films, paperboard composites, and renewable polymer laminates, are enabling companies to maintain sterility, safety, and performance standards while reducing their carbon footprint. Moreover, growing corporate ESG commitments, government incentives, and initiatives to implement circular economy practices are further propelling market expansion. Continuous R&D, technological advancements, and collaborations among key players to develop sustainable packaging solutions are enhancing operational efficiency and supporting the transition to greener healthcare systems globally.

Key Market highlights

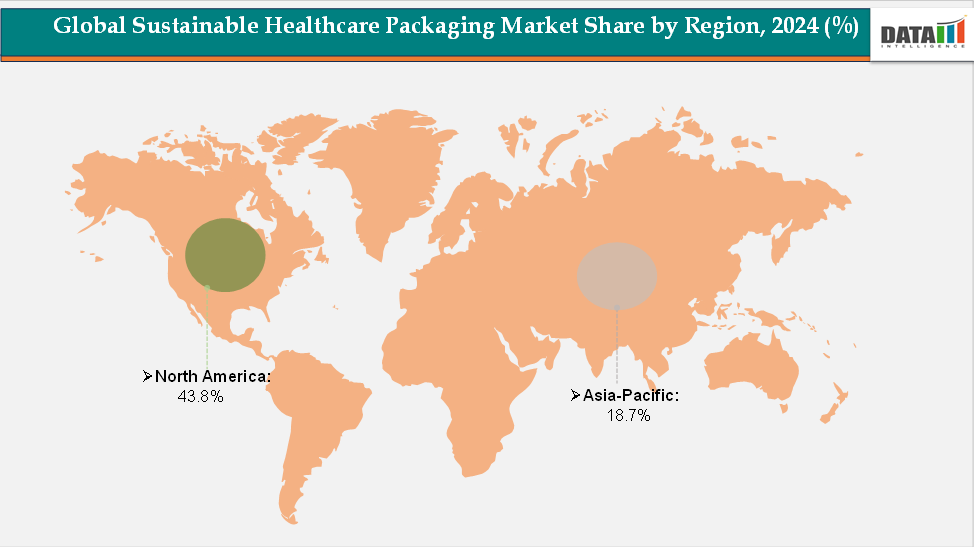

- North America leads the global Sustainable Healthcare Packaging market, accounting for approximately 43.8% of total revenue. The region’s dominance is supported by its well-established healthcare infrastructure, stringent regulatory frameworks promoting eco-friendly packaging, and high adoption of recyclable and biodegradable materials across the pharmaceutical and medical device sectors. Strong R&D capabilities, active collaboration between packaging manufacturers and healthcare providers, and growing corporate ESG initiatives further reinforce North America’s leadership in the market.

- Asia–Pacific represents the fastest-growing market, contributing around 18.7% of the global share. Rapid market expansion in the region is driven by increasing healthcare infrastructure, rising awareness of environmental sustainability, and growing adoption of innovative packaging solutions in countries such as China, Japan, and India.

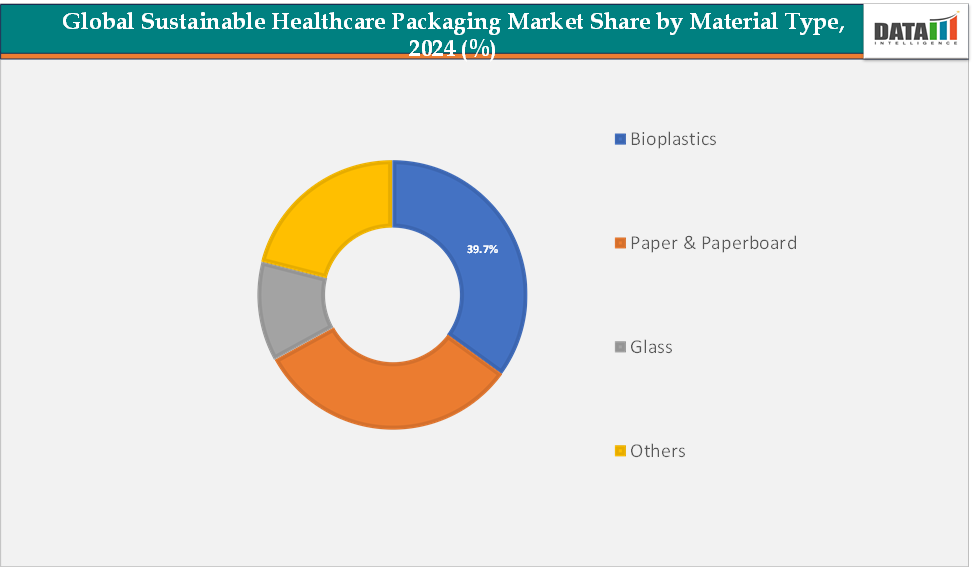

- Bioplastics dominate the material segment, accounting for approximately 39.7% of global revenue. Their strong market position is attributed to high biodegradability, compatibility with existing healthcare packaging standards, and increasing preference among pharmaceutical and medical device manufacturers for materials that reduce carbon footprint while maintaining sterility and performance. Advances in bio-based polymers and widespread industry adoption continue to drive the growth of this segment globally.

Market Size & Forecast

- 2024 Market Size: US$104.37 billion

- 2033 Projected Market Size: US$ 197.65 billion

- CAGR (2025–2033): 7.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics

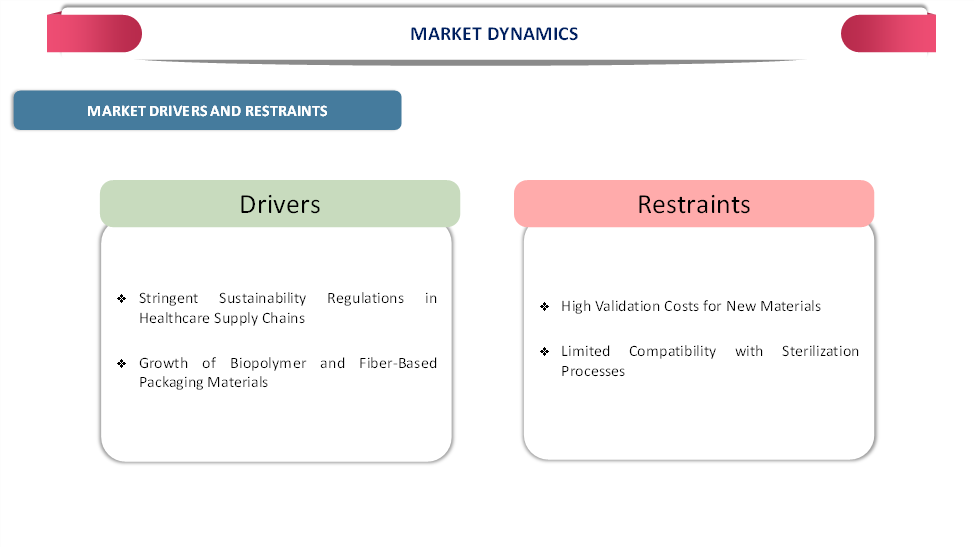

Driver: Stringent Sustainability Regulations in Healthcare Supply Chains

Stringent sustainability regulations in healthcare supply chains are significantly driving the growth of the sustainable healthcare packaging market by compelling pharmaceutical and medical device manufacturers to adopt eco-friendly materials and processes. Regulatory frameworks such as the European Union’s Packaging and Packaging Waste Directive, the U.S. FDA’s guidance on environmentally responsible packaging, and regional mandates in Asia-Pacific set clear requirements for recyclability, reduction of single-use plastics, and material traceability.

These regulations push manufacturers to replace traditional plastics with biodegradable polymers, recyclable films, and fiber-based materials that meet both sustainability and sterility standards. For instance, hospitals and contract manufacturers are now required to ensure packaging aligns with extended producer responsibility (EPR) schemes, while pharmaceutical exporters must comply with environmental criteria in target markets. This regulatory pressure has led companies like Amcor and Berry Global to develop certified recyclable laminates, bio-based blister packs, and sustainable prescription bottles, effectively accelerating the adoption of sustainable packaging solutions. By enforcing compliance, reducing environmental impact, and promoting circular economy practices, these regulations are transforming healthcare packaging from conventional single-use plastics to environmentally responsible alternatives, making sustainability not just a preference but a regulatory necessity.

Restraint: High Validation Costs for New Materials

High validation costs for new materials are hampering the sustainable healthcare packaging market because healthcare packaging must meet strict standards for sterility, chemical resistance, and shelf life. Testing and regulatory approval for each new biodegradable or recyclable material can be expensive and time-consuming, discouraging small and mid-sized manufacturers from adopting sustainable alternatives despite environmental benefits.

For more details on this report, Request for Sample

Sustainable Healthcare Packaging Market, Segmentation Analysis

The global sustainable healthcare packaging market is segmented by material type, packaging type, process type, end-user and region.

Material Type: The bioplastics segment is estimated to have 39.7% of the sustainable healthcare packaging market share.

The bioplastics segment currently dominates the sustainable healthcare packaging market due to its ability to combine environmental benefits with functional performance suitable for pharmaceutical and medical device requirements. Bioplastics such as PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), and bio-PET are increasingly used for blister packs, prescription bottles, syringes, and vials, where they replace traditional single-use plastics without compromising sterility, barrier properties, or chemical resistance.

Recent instances include Amcor introducing PLA-based thermoformed blister packs in North America, which offer full recyclability and lightweighting benefits, and Huhtamaki launching bio-based syringe trays in Europe designed to comply with ISO 11607 standards. Bioplastics are favored because they integrate relatively seamlessly into existing production lines while helping healthcare manufacturers meet ESG and regulatory requirements, making this segment the largest by adoption and volume in sustainable healthcare packaging.

The paper and paperboard segment is estimated to have 26.8% of the sustainable healthcare packaging market share.

The paper and paperboard is the fastest-growing segments due to increasing emphasis on the circular economy, recyclability, and reduction of plastic usage in secondary and tertiary packaging. European regulations, such as the EU Packaging and Packaging Waste Directive, are accelerating the switch from plastic cartons and inserts to paperboard alternatives. For instance, Gerresheimer is piloting fully recyclable paperboard cartons for vial packs in Germany, and Pfizer in Asia-Pacific is adopting FSC-certified paperboard cartons and trays for vaccine distribution, replacing laminated plastic-coated materials. Growth is also driven by innovations in barrier coatings for paperboard that preserve sterility and shelf life while allowing recyclability, enabling healthcare packaging companies to expand their sustainable offerings rapidly in both mature and emerging markets.

Sustainable Healthcare Packaging Market, Geographical Analysis

The North America sustainable healthcare packaging market was valued at 43.8% market share in 2024

North America’s dominance in sustainable healthcare packaging is driven by a convergence of regulatory pressure, deep-pocketed pharmaceutical and device manufacturers, advanced waste-management infrastructure, and rapid commercialization of sustainable solutions. In the U.S., regulators and purchasers are increasingly requiring packaging that supports pharmaceutical integrity while reducing lifecycle impact, and large suppliers have moved quickly to meet that demand. For instance, Berry Global announced in May 2024 a dedicated line of pharmacy packaging designed around recyclability and material reduction, and Amcor has rolled out medical laminates engineered to be recyclable in common polyethylene streams.

The combination of available capital for validation and line retrofits, greater availability of recycling streams in many metropolitan areas, and established sterile-packaging standards that vendors can aim their innovations at makes North America the region where sustainable healthcare packaging tends to be adopted fastest at scale and where new sustainable SKUs are most rapidly commercialized.

The Europe Sustainable Healthcare Packaging market was valued at 21.9% market share in 2024

Europe holds a significant share in the global TKIs market, supported by advanced healthcare systems, well-established oncology protocols, and strong clinical research capabilities. The region benefits from widespread access to targeted therapies, comprehensive cancer registries, and robust reimbursement frameworks that facilitate patient adoption. Countries such as Germany, France, and the UK are at the forefront of clinical trials for both first- and next-generation TKIs, ensuring early availability of innovative treatments. The increasing prevalence of cancers, coupled with growing emphasis on precision medicine and personalized oncology, reinforces Europe’s position as a key market contributor while complementing the growth seen in North America and Asia-Pacific.

The Asia-Pacific Sustainable Healthcare Packaging market was valued at 18.7% market share in 2024

Asia-Pacific’s position as the fastest-growing region reflects rapidly expanding healthcare manufacturing, accelerating regulatory alignment with global markets, and a fertile ground for both localized innovation and scale-up of sustainable materials. Concrete recent moves underline this trend: pharmaceutical cold-chain and life-science supply chains in Australia have adopted pragmatic substitutions, while university-industry collaborations are progressing prototypes that could be scaled locally. Coupled with rising domestic demand for pharmaceuticals and diagnostics, lower manufacturing costs for producing novel biopolymers at scale, and an eagerness among regional CMOs to meet EU/US customer requirements, APAC is where new sustainable packaging formats are being piloted and ramped fastest.

Competitive Landscape

The major players in the sustainable healthcare packaging market include DuPont, Amcor plc, Gerresheimer AG, SCHOTT Pharma AG & Co. KGaA, Mayr-Melnhof Karton AG, CCL Healthcare, Printpack, Körber AG, Billerud, Huhtamaki, among others.

Key Developments:

- In October 2025, Olympus partnered with DuPont de Nemours to create environmentally responsible packaging for its single-use endotherapeutic devices. Olympus will integrate DuPont’s Tyvek with Renewable Attribution (RA) into the sterile packaging of over 100 single-use device categories in 2026.

- In November 2024, DuPont launched Tyvek with Renewable Attribution (RA), an extension of its Tyvek portfolio for healthcare packaging, designed to significantly reduce carbon footprint and promote more sustainable packaging solutions.

- In October 2024, TekniPlex Healthcare unveiled the first ISCC PLUS-certified bio-based PVC compounds, providing a sustainable alternative for medical packaging. The new materials are suitable for applications such as tubing, tray films, pouches, and other plastic components, offering eco-friendly options for healthcare packaging.

- In November 2023, Amcor launched the next generation of its Medical Laminates. The innovation supports all-film packaging that is recyclable in the polyethylene stream, reducing the carbon footprint of the final package while maintaining the performance standards required for medical device applications.

Market Scope

| Metrics | Details | |

| CAGR | 7.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Material Type | Bioplastics, Paper & Paperboard, Glass, Others |

| Packaging Type | Primary Packaging, Secondary Packaging, Tertiary Packaging | |

| Process Type | Recyclable Packaging, Reusable Packaging, Compostable/Biodegradable Packaging, Renewable Material Packaging | |

| End-User | Pharma Manufacturing, Contract Packaging, Institutional Pharmacy, Retail Pharmacy, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global sustainable healthcare packaging market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more packaging-related reports, please click here