Supply Chain Management Market Overview

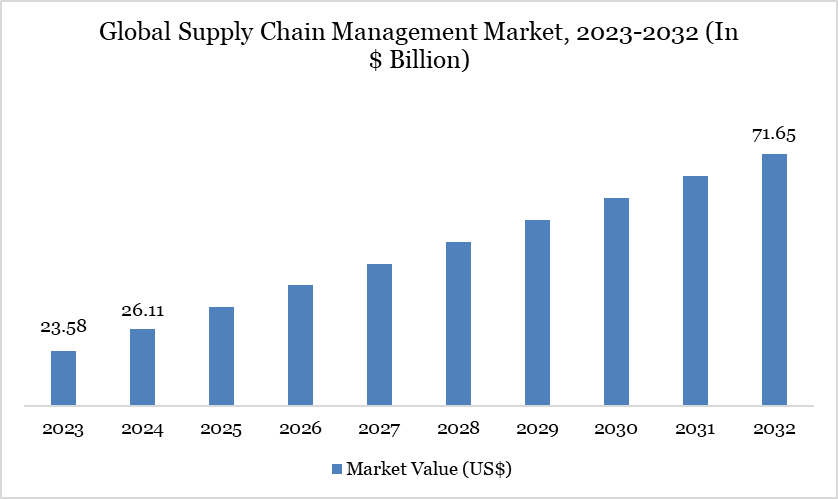

Global Supply Chain Management (SCM) Market reached US$ 26.11 billion in 2024 and is expected to reach US$ 71.65 billion by 2032, growing with a CAGR of 13.45% during the forecast period 2025-2032.

Transportation continues to be a cornerstone of SCM, with transportation services contributing 6.7% of the US GDP in 2022, equivalent to about US$ 1.7 trillion, and remaining above pre-pandemic levels in 2023 at 6.5%, or US$ 1.8 trillion—highlighting the sector’s critical economic role. Additionally, US business logistics costs reached an all-time high of over US$ 2.3 trillion in 2022, accounting for 9.1% of the US GDP, even though these costs eased slightly to 8.7% in 2023, reflecting a gradual move toward greater efficiency amid ongoing disruptions.

Supply Chain Management Market Trend

Globally, digitally deliverable services exports surged 9% in 2024, following similar growth in 2023, bringing their total to nearly US$ 3,680 billion from developed economies and US$ 1,180 billion from developing ones. These digital services now make up over 50% of all services exports worldwide, significantly reshaping trade composition. The shift reflects accelerated digital transformation, as approximately 95% of these services have been delivered digitally since 2021, up from around 87% pre-pandemic, underlining enduring structural change in global supply chains.

For more details on this report - Request for Sample

Market Scope

| Metrics | Details |

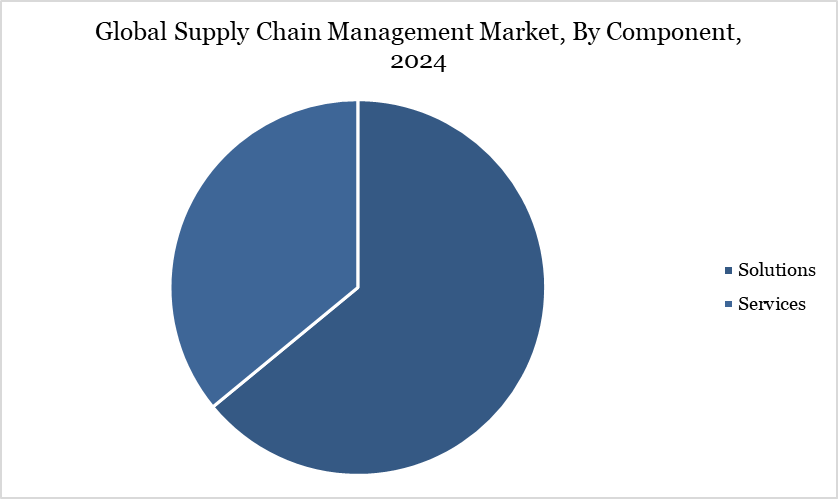

| By Component | Solutions, Services |

| By Deployment Mode | On-Premise, Cloud |

| By Enterprise Size | Large Enterprises, Small & Medium Enterprises (SMEs) |

| By End-User | Transportation & Logistics, Automotive, Healthcare, IT & Telecom, Retail, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Supply Chain Management Market Dynamics

AI-Driven Predictive Logistics Optimization

AI is transforming global supply chain logistics by enabling smarter, leaner operations worldwide. A recent survey notes that AI demand in supply chains is projected to skyrocket from US$ 2.7 billion in 2025 to US$ 55 billion by 2029, reflecting widespread adoption across firms like SAP, Oracle, Microsoft, and Blue Yonder. Meanwhile, autonomous shipping technologies are making a measurable environmental impact: Orca AI finds that AI-enhanced sea navigation could reduce the shipping industry’s carbon emissions by 47 million tonnes annually, cut route deviations by 38 million nautical miles per year, and save approximately US$ 100,000 in fuel per vessel. Together, these advances highlight how AI-driven predictive tools are optimizing routing, reducing environmental impact, and significantly enhancing efficiency across global logistics networks.

Cybersecurity Vulnerabilities in Connected Supply Networks

Nearly 98% of companies report being negatively affected by a breach within their supply chain, with 40% of such attacks resulting from unauthorized network access. Supply-chain cyberattacks in the US surged 115% year-over-year in 2023, reaching a record high of 242 reported incidents. Additionally, over 183,000 customers were impacted by such attacks in 2024 marking a 33% increase from the prior year.

Supply Chain Management Market Segment Analysis

The global supply chain management market is segmented based on component, deployment mode, enterprise size end-user and region.

Solutions Segment Driving Supply Chain Management Market

The solutions segment in supply chain management is being propelled by rapid adoption of AI, IoT, and automation platforms, with US Census Bureau data showing that over 92% of large manufacturers now use some form of cloud-based planning or inventory software to manage operations. Real-time tracking has become mainstream, with the Federal Maritime Commission noting that more than 80% of containerized cargo moving through major US ports is now digitally visible end-to-end. In the retail sector, over 16% of total US sales in 2024 occurred online, intensifying demand for integrated order management, demand forecasting, and last-mile optimization solutions that can handle high-frequency, multi-channel fulfillment.

Supply Chain Management Market Geographical Share

North America Drives the Global Supply Chain Management Market

The US continues to be an engine for supply chain demand, with e-commerce sales soaring to US$ 308.9 billion in Q4 of 2024 alone, driving urgent investment in advanced logistics, automated warehousing, and real-time tracking systems. On the transportation-front, nearly 70,000 trucking industry jobs were recovered by early 2022, pushing employment above pre-pandemic levels and buttressing freight capacity. Meanwhile, ports have seen drastic improvements in throughput: long-dwelling containers at the Ports of Los Angeles and Long Beach have declined by 70%, significantly reducing delays and enhancing cargo velocity.

Technological Advancement Analysis

At-scale digital networks, government single-window digitization, and IoT-enabled logistics are reshaping SCM. In 2023, a leading global supply chain platform handled US$ 5.3 trillion in commerce across 746 million B2B transactions, evidencing platformized, data-rich procurement and fulfillment at global scale. In customs, automated clearance systems now process ~75% of cargo electronically and ~97% of entry summaries, while e-Manifests run ~30% faster than paper—showcasing how state digital rails de-bottleneck border flows and feed upstream planning systems. On the logistics side, global carriers move ~12 million containers/year and extend IoT visibility via remote container monitoring tools, enabling real-time tracking of reefer temperature, humidity, and CO₂ tightening cold-chain control and exception response.

Supply Chain Management Market Major Players

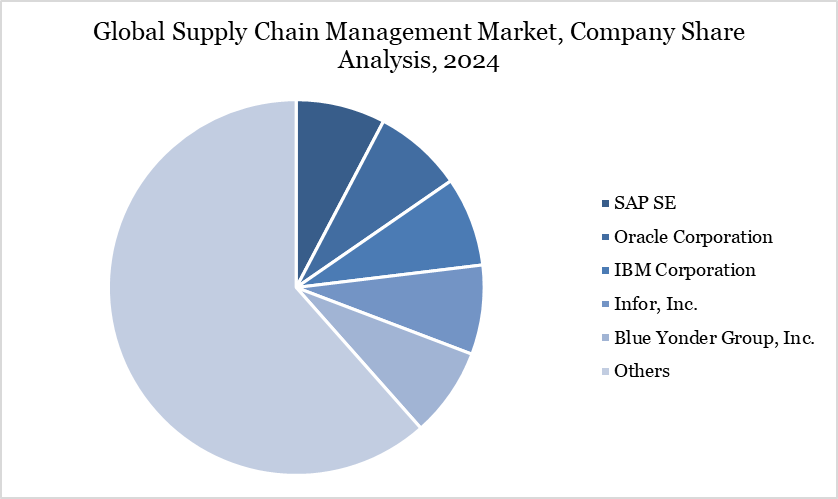

The major global players in the market include SAP SE, Oracle Corporation, IBM Corporation, Infor, Inc., Blue Yonder Group, Inc., Manhattan Associates, Inc., Kinaxis Inc., Epicor Software Corporation, Descartes Systems Group Inc., and E2open, LLC.

Key Developments

In April 2025, OCP Group’s Specialty Products & Solutions (SPS) unit and Maersk signed a global MoU to enhance innovative, resilient, and sustainable supply chain solutions. The agreement builds on years of successful collaboration in logistics excellence. It focuses on delivering agile, digitalized, and eco-friendly logistics to support OCP’s global expansion.

In August 2024, FPT Software partnered with Blue Yonder to deliver end-to-end supply chain management solutions across Southeast Asia. The collaboration targets six key markets, including Singapore, Malaysia, Thailand, Indonesia, Vietnam, and the Philippines. It combines Blue Yonder’s advanced digital supply chain platforms with FPT Software’s regional implementation expertise. The partnership aims to provide rapid, tailored strategies addressing industry-specific supply chain challenges.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies