Overview

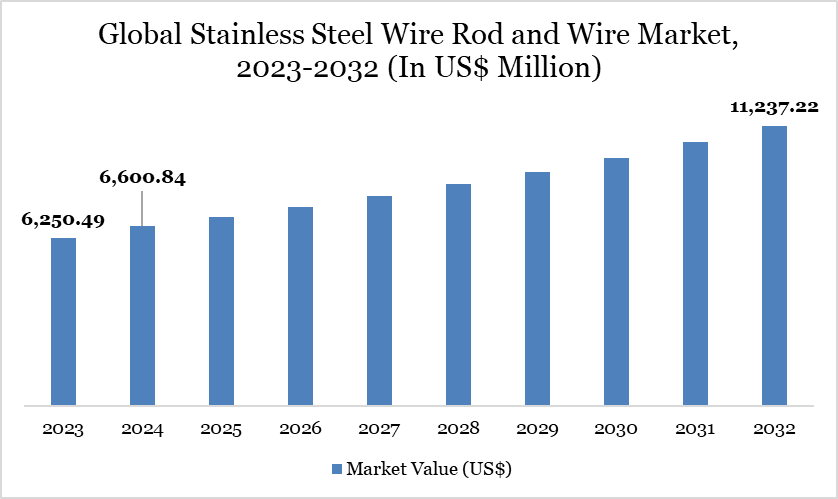

The global stainless steel wire & wire rod market reached US$6,600.84 million in 2024 and is expected to reach US$11,237.22 million by 2032, growing at a CAGR of 7.0% during the forecast period 2025-2032.

The global stainless steel Wire & Wire Rod market is witnessing steady growth, driven by robust demand from construction, automotive, energy, and industrial sectors that rely on durable, corrosion-resistant materials. One of the key drivers is the expanding infrastructure and urbanization in emerging economies, which fuels demand for high-strength wire rods in reinforced concrete, bridges, and buildings. Additionally, the automotive industry’s shift towards lighter and more fuel-efficient vehicles boosts the use of stainless steel wires in exhaust systems, fasteners, and springs. The market is also benefiting from technological advancements in precision manufacturing and wire drawing processes that improve product quality and performance.

The overall market growth aligns with the rise in global stainless steel production, which in 2024 increased by 7% compared to 2023, reaching 62.621 million tons, according to the World Stainless Association. Regionally, Europe, including Ukraine, saw a 1.5% increase to 6.09 million tons, while the US boosted output by 6.9% to 1.95 million tons. In Asia, excluding China and South Korea, production rose by 6.4% to 7.32 million tons, and China alone produced 39.44 million tons, up 7.5% year-on-year, highlighting Asia’s dominant role. Sustainability trends, recycling initiatives, and stringent quality standards are further shaping market dynamics as manufacturers strive to meet diverse end-user requirements.

Stainless Steel Wire & Wire Rod Market Trend

Sustainability and environmental compliance have emerged as key trends shaping the stainless steel wire & wire rod market, as manufacturers face increasing pressure to reduce their carbon footprint and adopt green practices. Companies are investing in cleaner technologies, renewable energy, and efficient water management to align with global climate goals and meet stringent regulations.

For example, in April 2025, Bansal Wire Industries Ltd., India India-based stainless steel wire manufacturer, inaugurated its new facility in Dadri, Uttar Pradesh, with an initial capacity of 3.6 lakh MTPA, scalable to 6 lakh MTPA in the future. This plant is designed to set benchmarks in automation, sustainability, and innovation, integrating solar power generation, rainwater harvesting, energy-efficient machinery, and acid-free cleaning processes. A robust Effluent Treatment Plant (ETP) ensures safe wastewater disposal, reinforcing BWIL’s commitment to sustainable manufacturing. Such initiatives not only help companies comply with environmental norms but also appeal to eco-conscious clients in the automotive, construction, agriculture, and power sectors.

Market Scope

Metrics | Details |

By Product | Stainless Steel Wire Rod, Stainless Steel Wire |

By Distribution Channel | B2B, B2C |

By Application | Construction, Automotive, Energy & Power, Industrial, Agriculture, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Investment in Infrastructure Upgradation

Growing investment in infrastructure upgrades is a major driver propelling the stainless steel wire and wire rod market forward. As economies worldwide prioritize modernizing their transport networks, developing smart cities, and establishing industrial clusters, the demand for durable and corrosion-resistant stainless steel wire rods continues to surge. According to the World Steel Demand - Analysis of Steel Consumption data in 2024, the construction sector alone accounts for 49% of global steel demand, highlighting its dominance as the largest end-use sector for steel.

In line with this, manufacturers are expanding capacity and regional presence to meet rising consumption. For example, in November 2024, Taiwan’s Walsin Lihwa approved a US$ 9.15 million investment to build a new stainless steel wire rod plant in Morowali Industrial Park, Indonesia, through its subsidiary Walsin Singapore Pte. Ltd. Supported by Mimosa International Limited, the project aims to produce 300 series stainless steel wire rods with an annual capacity of 300,000 tons, further strengthening Walsin Lihwa’s foothold in Southeast and South Asia. Such strategic expansions not only cater to growing local demand but also enhance global competitiveness by ensuring steady supply for infrastructure and industrial applications.

Volatility in Raw Material Prices

Volatility in raw material prices is significantly restraining the growth of the stainless steel wire & wire rod market. Frequent fluctuations in nickel, chromium, and molybdenum prices create uncertainty in production costs for manufacturers. This unpredictability makes it challenging for companies to plan long-term contracts and maintain stable pricing for their customers. Small and medium enterprises are particularly affected, as they often lack the financial resilience to absorb sudden cost spikes. Additionally, volatile prices discourage investment in capacity expansion and technological upgrades. End-user industries such as automotive and construction also face cost pass-throughs, impacting demand. Overall, this price instability disrupts supply chains and hampers the market’s sustainable growth.

Segment Analysis

The global stainless steel wire & wire rod market is segmented by product, distribution channel, application and region.

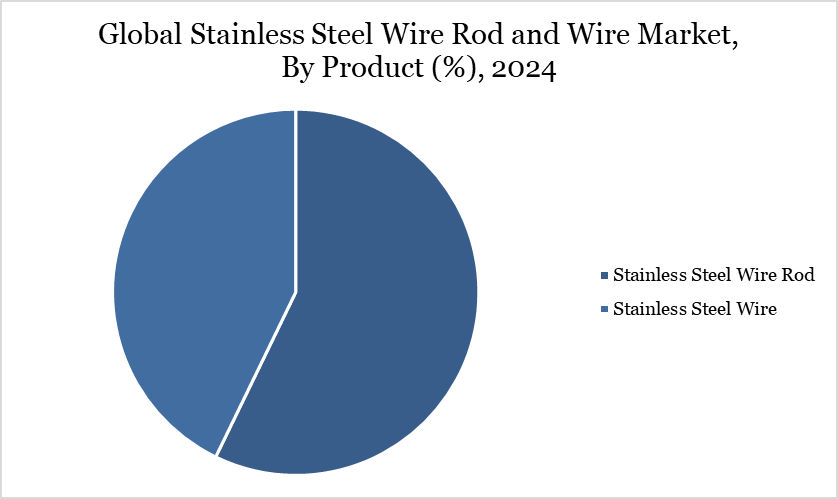

Stainless Steel Wire Rod Commands a Significant Share as the Essential Feedstock for Wire Production

Stainless steel wire rods hold a significant share in the stainless steel wire and wire rod market due to their versatile applications across the automotive, construction, and industrial sectors. Their high strength, corrosion resistance, and formability make them essential raw materials for producing various stainless steel wires. The growing demand for durable and high-quality wire products further boosts wire rod consumption.

For instance, in November 2023, Synergy Steels Limited established a new stainless steel wire rod plant in Desula, Alwar, Rajasthan, with a capacity of 1.5 lakh (0.15 million)TPA and an investment of US$931.80 thousand (₹8 crore). This move aims to reduce India’s dependency on stainless steel wire rod imports from China, enhancing local production capabilities. Such investments strengthen the domestic supply chain and ensure steady availability, solidifying the wire rod segment’s dominant market position.

Geographical Penetration

Asia-Pacific Holds a Dominant Share Due to Rapid Industrialization, Infrastructure Growth, and Rising Stainless Steel Consumption

The Asia-Pacific region holds a significant share in the Stainless Steel Wire & Wire Rod market due to its robust industrial base, rapid infrastructure development, and expanding automotive and construction sectors. Countries like China, India, Japan, and South Korea are major producers and consumers, driving regional demand. For example, according to the Government of India, total finished stainless steel consumption in India has shown steady growth over the past five years, recording a CAGR of 4.36%. Notably, consumption rose from 3.43 million tonnes in 2022–23 to 3.75 million tonnes in 2023–24, marking a healthy 9.33% annual growth.

This sustained demand momentum highlights the country’s growing appetite for stainless steel wire and wire rods, especially for infrastructure and manufacturing. Moreover, the region benefits from abundant raw material availability, competitive labor costs, and supportive government initiatives, which attract investments and capacity expansions. As industries shift towards modernization and export opportunities increase, Asia-Pacific continues to strengthen its dominant position in the global stainless steel wire & wire rod market.

Sustainability Analysis

The regulatory landscape for the stainless steel wire & wire rod market is shaped by stringent quality, safety, and environmental compliance frameworks enforced globally. Governments and industry bodies mandate that manufacturers adhere to a range of certifications and standards to ensure product integrity and consumer safety. Certifications and standards are the bedrock of quality assurance in the stainless steel manufacturing industry. ASTM (the American Society for Testing and Materials) and ISO (the International Organization for Standardization) provide quality assurance certifications that validate material grades, tensile strength, corrosion resistance, and other critical properties.

Certifications are formal declarations by an accredited body that a product, process, or system complies with specific requirements, often set forth in standards. Standards, on the other hand, are documents that outline precise specifications and guidelines for the design, manufacture, or performance of a particular product or process. Additionally, environmental regulations push companies to adopt sustainable production practices, manage waste effectively, and reduce emissions.

Competitive Landscape

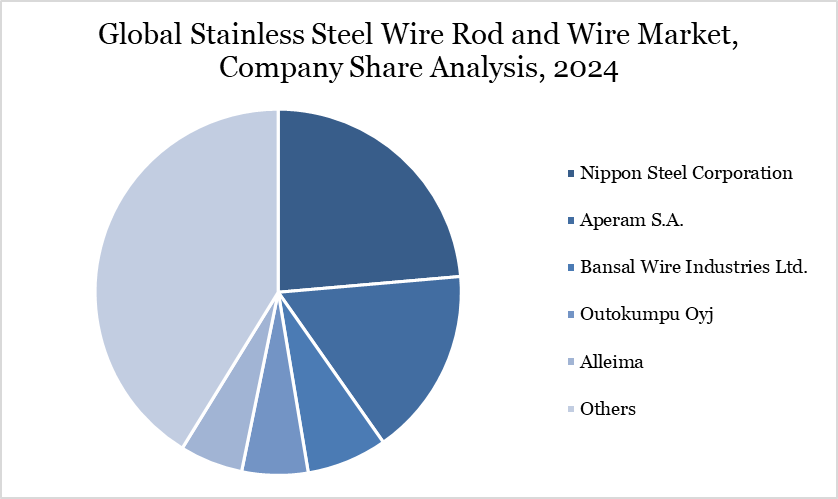

The major global players in the market include Nippon Steel Corporation, Aperam S.A., Bansal Wire Industries Ltd., Outokumpu Oyj, Alleima, Walsin Lihwa Corporation, Kobe Steel, Ltd., Tsingshan Holding Group, Yieh Corp, Venus Wires and others.

Key Developments

In April 2025, Sweden-based Fagersta Stainless commissioned Italy’s Danieli to install a new stainless steel blooming mill with an annual capacity of 70,000 metric tons at its Fagersta plant, set to start by end-2026. The advanced mill will produce round bars and billets ranging from 35–220 mm in diameter, boosting product variety and operational flexibility.

In November 2024, Marcegaglia Fagersta Stainless announced a significant US$116.77 (€100) million investment to double its stainless steel production capacity at its Fagersta, Sweden site. Revealed on November 6, 2024, during the company’s 150th anniversary, the plan targets boosting output from the current 60,000 metric tons of wire rod to include increased bar and stainless wire rod production. This expansion underlines Marcegaglia’s commitment to meeting rising demand and strengthening its position in the European stainless steel market.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies