Global Softgels Dietary Supplements Market Size & Overview

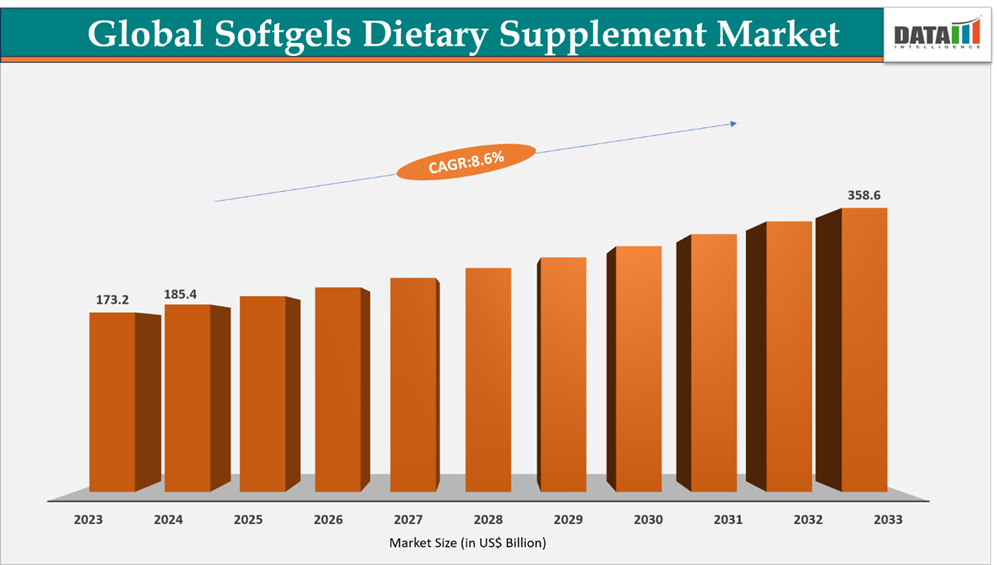

Global Softgels Dietary Supplements Market reached US$ 185.4 billion in 2024 and is expected to reach US$ 358.6 billion by 2032, growing with a CAGR of 8.6% during the forecast period 2025-2032. The global softgels dietary supplements market is experiencing strong growth, fueled by increasing health awareness, rising demand for convenient dosage forms, and superior bioavailability compared to other supplement forms. Expanding consumer preference for immunity boosters, beauty supplements, and functional nutrition products is driving market adoption across North America, Europe, and Asia-Pacific. Governments and regulatory bodies are also emphasizing quality, safety, and standardization in dietary supplements, with initiatives supporting manufacturing compliance and exports. Under the FD&C Act, it is the responsibility of dietary supplement companies to ensure their products meet the safety standards for dietary supplements and are not otherwise in violation of the law. For instance, in 2024, several countries introduced streamlined regulatory pathways for nutraceuticals, enabling faster market entry and greater consumer access, which is expected to further propel softgels dietary supplements demand globally.

Softgels Dietary Supplements Industry Trends and Strategic Insights

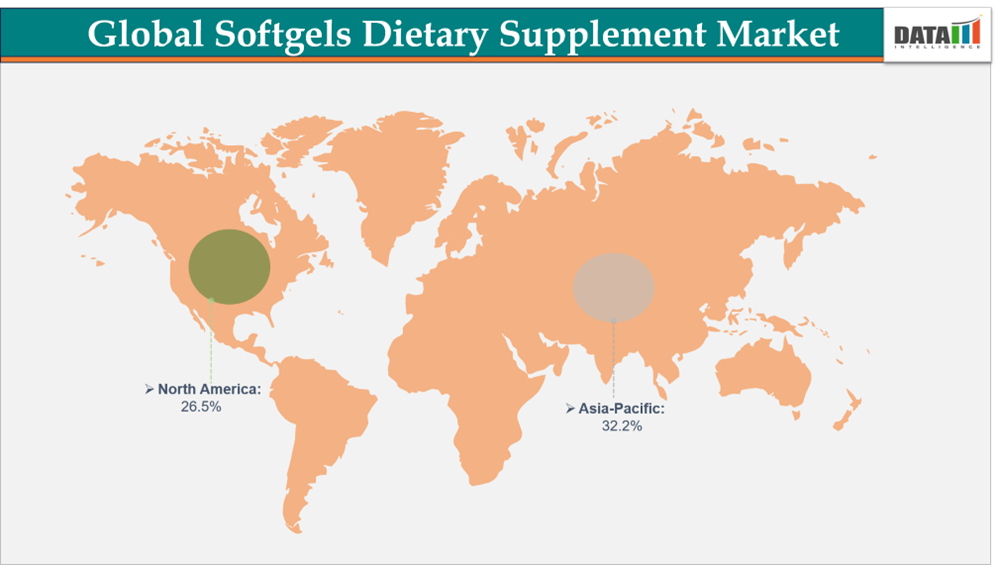

- Asia Pacifc dominates the softgels dietary supplements market, capturing the largest revenue share of 32.2% in 2024.

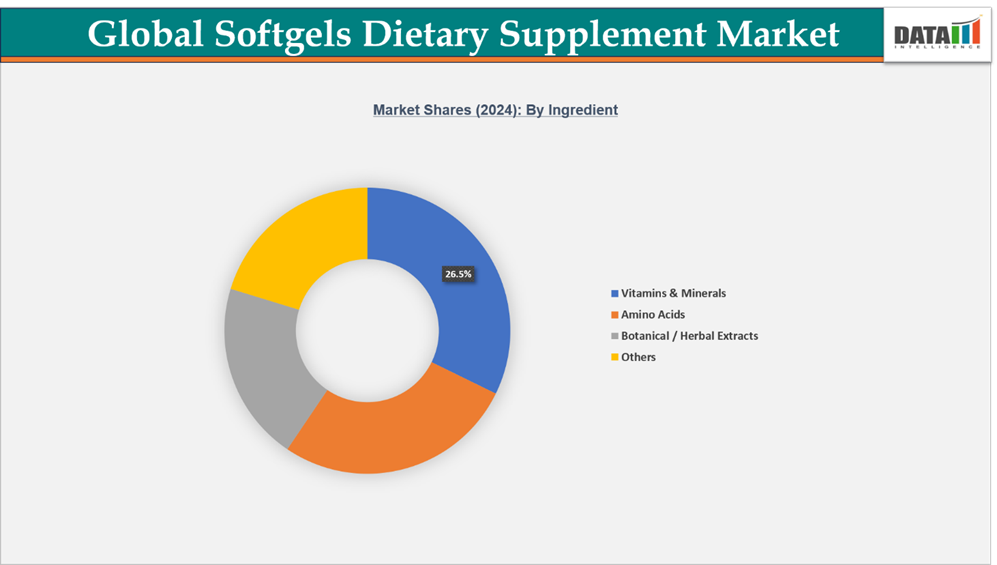

- By Ingredients, the Vitamins & Minerals segment is projected to be the largest market, holding a significant share of 26.5% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 185.4 Billion

- 2032 Projected Market Size: US$ 358.6 Billion

- CAGR (2025-2032): 8.6%

- Largest Market: Asia-Pacific

- Fastest Market: North America

Market Scope

| Metrics | Details |

| By Ingredient | Vitamins & Minerals, Amino Acids, Botanical / Herbal Extracts, Others |

| By Application | General Well-being, Bone & Joint Health, Immune Support, Sports Nutrition, Heart Health, Others |

| By End-User | Adults, Geriatric, Pediatric, Pregnant Women |

| By Distribution Channel | Online, Offline |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detail information Request for Sample

Market Dynamics

Growing Preventive Healthcare Awareness

The global softgels dietary supplements market is witnessing strong growth, driven by increasing awareness of preventive healthcare. Consumers are becoming more focused on overall wellness, immunity support, and long-term health management. Busy lifestyles, rising stress levels, and evolving dietary habits have further fueled demand for softgels, which are preferred for their ease of consumption and higher bioavailability compared to traditional tablets or powders.

For instance, on June 22, 2022, Nature Made® Wellblends™ partnered with Clea Shearer and Joanna Teplin, stars of Netflix’s Get Organized with The Home Edit, to encourage people to build healthier routines by balancing stress, sleep, and immune health. Nature Made®, with over 50 years of expertise in science-backed supplements, launched Wellblends™ as a collection of 13 blends specifically designed to support holistic wellness. This illustrates the rising trend of consumers seeking supplements aligned with preventive care and lifestyle management.

As health awareness continues to rise globally, demand for supplements addressing immunity, stress relief, and mental wellness is expected to grow, strengthening softgels’ position as a preferred supplement format.

High Production Costs

One of the main restraints in the global softgels dietary supplements market is the high cost of production. Unlike conventional tablets or capsules, softgels require advanced encapsulation technology, strict environmental controls during production, and high-quality raw materials such as gelatin or plant-based polymers. These factors add significant capital investment and operational costs.

Moreover, volatility in raw material prices including gelatin, vegetarian alternatives, and active ingredients further impacts manufacturing costs. This often puts smaller companies at a disadvantage compared to larger multinational players that benefit from economies of scale and stronger supply chain networks.

Although demand for softgels is steadily increasing, high production costs continue to challenge market expansion, particularly in cost-sensitive regions where affordability strongly influences consumer choices.

Segmentation Analysis

The global high speed steel market is segmented based on ingredient, application, end-user, distribution channel and region.

Preventive Healthcare Trends Drive the Growth of the Vitamins & Minerals Segment

The Vitamins & Minerals segment is projected to account for a substantial share of the global softgels dietary supplements market in 2024. These micronutrients play a vital role in supporting immunity, bone strength, cardiovascular health, and overall wellness. As consumers place increasing importance on preventive healthcare, demand for multivitamin and mineral-based softgels continues to rise. Lifestyle-related health concerns such as diabetes, hypertension, and obesity are further accelerating adoption.

According to the World Health Organization (WHO), over 2 billion people worldwide suffer from micronutrient deficiencies, underscoring the need for supplementation. Softgels are gaining traction as they enhance nutrient bioavailability, mask unpleasant tastes, and offer easier swallowing compared to conventional tablets and capsules. This trend is especially strong among older populations seeking targeted benefits for joint, bone, and eye health.

Global players such as Pfizer (Centrum), Amway (Nutrilite), and Bayer (One A Day) lead the segment with broad product portfolios, while niche nutraceutical brands are innovating with vegan, plant-based, and organic formulations to appeal to health-conscious consumers. Rising healthcare expenditure, growing e-commerce adoption, and increasing consumer willingness to invest in long-term health are expected to reinforce the segment’s dominance.

Expanding Fitness and Wellness Culture Accelerates the Amino Acids Segment

The Amino Acids segment is emerging as a dynamic growth area in the softgels dietary supplements market, fueled by rising interest in sports nutrition, fitness-driven lifestyles, and personalized nutrition solutions. Amino acids such as L-carnitine, glutamine, and branched-chain amino acids (BCAAs) are widely incorporated into softgel supplements to support muscle growth, recovery, energy metabolism, and weight management. Greater consumer awareness of the role of amino acids in reducing fatigue and enhancing endurance has broadened their appeal beyond athletes to general wellness seekers.

The global fitness industry reflects this momentum. The International Health, Racquet & Sportsclub Association (IHRSA) reported that the sector surpassed USD 100 billion in revenues in 2023, illustrating growing consumer investments in health, performance, and recovery. Softgels are gaining preference over powders and tablets for their convenience, accurate dosing, and faster absorption.

The market landscape is shaped by leading nutrition companies such as Abbott Laboratories, Herbalife, and Optimum Nutrition (Glanbia), alongside specialized manufacturers catering to niche demands like vegan athletes and weight-conscious consumers. Advancements in encapsulation technology are also enhancing the stability, shelf life, and efficacy of amino acid formulations, strengthening their adoption across diverse consumer groups.

Geographical Penetration

Rising Demand for Preventive Healthcare and Nutritional Products in Asia-Pacific

The Asia-Pacific softgels dietary supplements market is the largest globally, expected to account for 32.2% of the global market in 2024, led by China’s vast nutraceutical and functional food industries. Growing health awareness, rising disposable incomes, and expanding middle-class populations are driving strong demand for vitamins, minerals, and herbal supplements. Japan and South Korea dominate the high-value segment, focusing on premium formulations for healthy aging, immunity, and beauty-from-within trends.

India Market Outlook

India’s market is rapidly growing due to preventive healthcare adoption, a young health-conscious population, and initiatives like Ayushman Bharat and Fit India. Lifestyle-related diseases and digital retail expansion are accelerating demand, with international players collaborating with local manufacturers. For instance, In 2024, Tata 1mg partnered exclusively with Vitonnix UK to launch sublingual sprays in India, reflecting growing adoption of innovative supplement formats.

China Market Trends

China dominates the region, holding over 40% of the market. Domestic companies like BY-HEALTH and Harbin Pharmaceutical innovate in immunity, digestion, and anti-aging, while global firms maintain strong presence through local partnerships. For instance, in 2022, Irio Pharma’s shares jumped after it announced the acquisition of an 80% stake in US rival Best Formulations for USD 180 million, highlighting China’s aggressive global expansion in dietary supplements. Mass-market affordability and premium personalized nutrition are both seeing robust growth, especially among urban millennials and older adults.

Presence of Advanced Healthcare Infrastructure in North America

North America is expected to be a significant region in the global softgels dietary supplements market, holding about 25.2% of the market in 2024. The regional market is supported by strong demand from health-conscious consumers, growing preventive healthcare adoption, and the presence of advanced pharmaceutical and nutraceutical infrastructure. The US and Canada benefit from mature manufacturing facilities, robust R&D capabilities, and well-established distribution channels, which ensure steady consumption of vitamins, minerals, and herbal supplements. Increasing awareness of immunity, healthy aging, and overall wellness trends is further driving market growth.

US Softgels Dietary Supplements Market Insights

he US accounts for the largest share of the North America softgels dietary supplements market, driven by rising health awareness, preventive healthcare adoption, and widespread e-commerce penetration. Major players such as Pfizer (Centrum), Amway, and Nature’s Bounty maintain strong brand presence and product portfolios covering immunity, joint health, heart health, and beauty-from-within supplements. Additionally, collaborations between international brands and local manufacturers, such as joint ventures for sublingual sprays and personalized nutrition, are boosting product innovation and accessibility. For instance, in 2023, Bioriginal, a subsidiary of Cooke Inc., acquired all operating assets of Softgel Co., including a softgel, squeeze tube, and tincture manufacturing facility specializing in human and pet nutrition, highlighting ongoing consolidation and expansion in North America. The US market also benefits from stringent quality regulations, which reinforce consumer trust and promote adoption of premium formulations.

Canada Softgels Dietary Supplements Industry Growth

In Canada, the market is smaller compared to the US but continues to grow steadily due to increasing consumer interest in preventive health, wellness, and immunity. Canadian consumers favor high-quality, research-backed supplements, and major distributors ensure wide availability across pharmacies, health stores, and online channels. Companies like Jamieson Wellness and Nature’s Bounty serve as key players, while rising e-commerce adoption is expanding reach to urban and semi-urban populations. A significant development is In 2023, Bioriginal Food & Science Corp., a subsidiary of Cooke Inc., expanding further into the US and Canada through the acquisition of all operating assets of Softgel Co., including a state-of-the-art softgel, squeeze tube, and tincture manufacturing facility specializing in human and pet nutrition products. This highlights ongoing consolidation and expansion of advanced nutraceutical manufacturing capabilities in North America. Government initiatives promoting wellness and preventive healthcare also contribute to steady demand growth, although at a slightly slower pace than in the US.

Sustainability Analysis

The softgels dietary supplements market is increasingly prioritizing sustainability, integrating environmental responsibility with product performance. Manufacturers are adopting eco-friendly production practices, minimizing energy consumption, and sourcing raw materials such as gelatin, plant extracts, and oils responsibly. Innovative packaging solutions, including recyclable and biodegradable options, are also being implemented to reduce waste and lower carbon emissions.

For instance, in 2024, Catalent, a leading global softgel manufacturer, launched a sustainability initiative to shift its production lines to renewable energy while expanding the use of plant-based and responsibly sourced gelatin alternatives. The initiative targets reductions in water usage, energy consumption, and greenhouse gas emissions across its North American and European facilities. This effort highlights how high-quality nutraceutical manufacturing can align with circular economy principles, establishing a new standard for environmentally conscious production in the softgels dietary supplements market.

Competitive Landscape

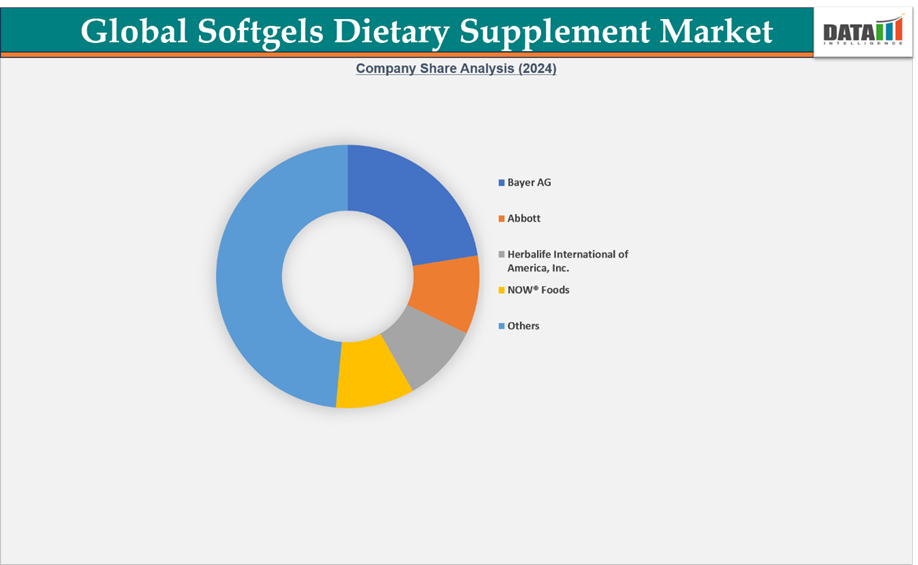

- The global softgels dietary supplements market is characterized by a competitive landscape that includes both established steel makers and specialist tool producers.

- Key players include Bayer AG, Abbott, Herbalife International of America, Inc., NOW® Foods, Glanbia plc, Amway India Enterprises Pvt. Ltd, dsm-firmenich, The Nature's Bounty, GSK plc, Rouzel Pharma Pvt Ltd

- Companies emphasize product differentiation by developing premium softgel formulations that offer improved bioavailability, targeted health benefits, and enhanced stability for vitamins, minerals, and herbal supplements.

- Strategic investments in R&D, sustainable production practices, and operational efficiency are crucial, especially as the market faces competition from alternative supplement formats such as gummies, tablets, and liquid nutraceuticals.

Key Developments

- In November 2023, Boncha Bio is thrilled to announce a strategic partnership in Asia with DSM-Firmenich, a global leader in nutrition, health, and beauty. The partnership was formally established on September 21st during the Vitafoods Asia 2023 exhibition in Bangkok, Thailand. This collaboration aims to transform the dietary supplement sector by launching market-ready “candyceuticals” that combine enjoyable sensory experiences with health benefits. Leveraging Boncha Bio’s innovative candy-capsule technology, the alliance with DSM-Firmenich is set to advance the next generation of nutraceutical supplements in the region.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies