Softgels Capsules Market Overview

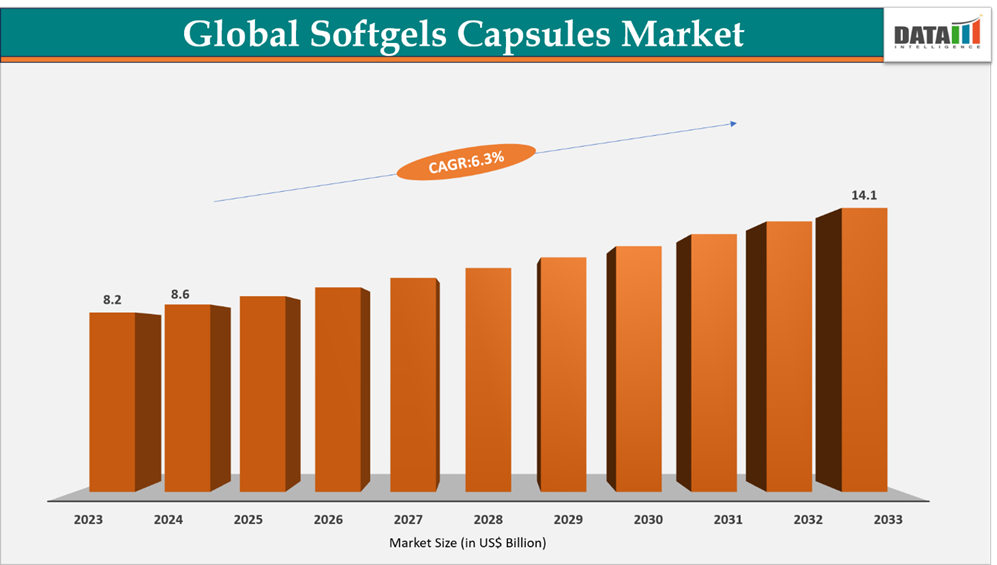

Global Softgels Capsules Market reached US$ 8.6 billion in 2024 and is expected to reach US$ 14.1 billion by 2032, growing with a CAGR of 6.3% during the forecast period 2025-2032. The market is experiencing strong growth, driven by rising demand from the pharmaceutical, nutraceutical, and healthcare sectors. Increasing health awareness and the preference for convenient, easy-to-swallow dosage forms are key factors supporting market expansion. North America dominates the market due to the presence of major manufacturers, high consumer awareness, and a well-established healthcare infrastructure. Government initiatives promoting local production and quality standards are further expected to support the manufacturing, adoption, and distribution of softgels capsules, strengthening the market outlook over the forecast period..

Softgels Capsules Industry Trends and Strategic Insights

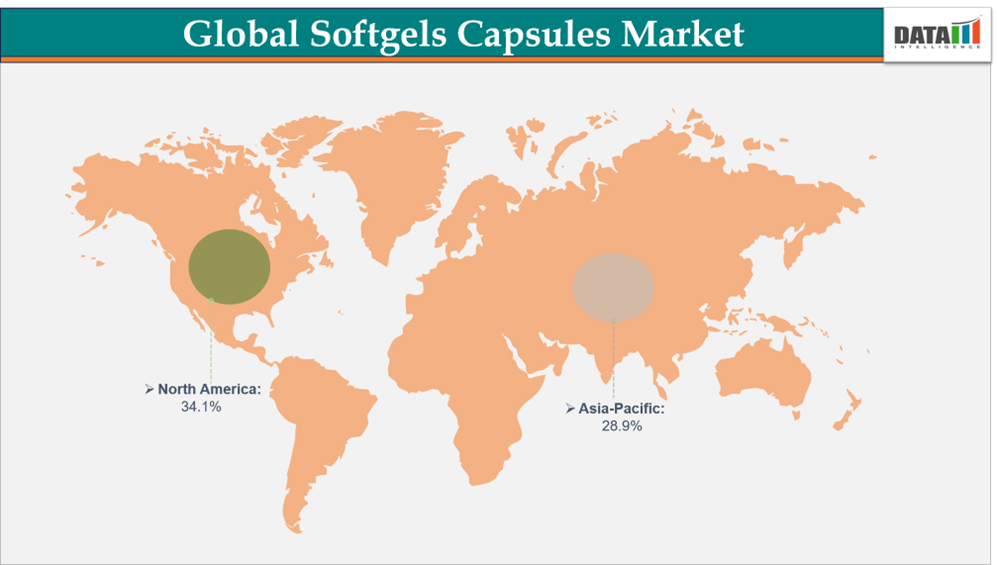

- North America dominates the softgels capsules market, capturing the largest revenue share of 34.1% in 2024.

- By type, the gelatin based segment is projected to be the largest market, holding a significant share of 58.7% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 8.6 Billion

- 2032 Projected Market Size: US$ 14.1 Billion

- CAGR (2025-2032): 6.3%

- Largest Market: North America

- Fastest Market: Asia-Pacific

For More Detail information Request for Sample

Market Scope

| Metrics | Details |

| By Type | Gelatin based, Non-Gelatin based |

| By Application | Pharmaceuticals, Nutraceuticals & Dietary Supplement, Cosmetics & Personal Care, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Health Awareness

The global softgels capsules market is experiencing strong growth, largely fueled by increasing health awareness and consumer preference for convenient, effective, and easy-to-swallow dosage forms. For instance, On May 14, 2024, Roquette, a global leader in plant-based ingredients and pharmaceutical/nutraceutical excipients, launched its LYCAGEL® Flex hydroxypropyl pea starch premix for softgel capsules. This plasticizer-free, plant-based excipient allows manufacturers to customize formulations, optimize production, and maintain high standards of stability and quality.

The rising demand for plant-based and high-quality softgels reflects a broader market trend toward health-conscious, sustainable, and functional products. This factor not only drives higher consumption of nutraceuticals and pharmaceuticals but also encourages innovation, leading to expanded product offerings and market growth across regions. As consumers increasingly seek supplements that support wellness and preventive healthcare, softgels are becoming a preferred dosage form, further strengthening market adoption.

Allergen Concerns

A significant restraint for the softgels capsules market is the potential allergenicity associated with gelatin-based capsules, which are derived from animal sources. This can limit usage among vegetarians, vegans, and consumers with dietary or religious restrictions, posing a challenge to market expansion.

However, the market is actively counterbalancing this challenge through the development of plant-based and hypoallergenic softgel alternatives, such as gelatin-free capsules made from pea starch, carrageenan, or other vegetarian-friendly excipients. These innovations allow manufacturers to cater to a broader consumer base while maintaining product stability, performance, and safety, helping to mitigate the impact of allergen concerns on market growth

Segmentation Analysis

The global softgels capsules market is segmented based on type, application and region.

Gelatin-Based Softgels Dominate the Segment Growth

Gelatin-based softgels are expected to hold the largest share of the global softgels capsules market in 2024, owing to their wide acceptance, cost-effectiveness, and proven stability. They are commonly used to encapsulate liquid or semi-solid nutraceuticals, vitamins, and pharmaceuticals, providing enhanced bioavailability and easy ingestion.

The dominance of gelatin-based softgels is supported by established manufacturing processes and a large base of manufacturers worldwide. Companies such as Catalent, Lonza, and Aenova produce premium gelatin-based softgels for a range of applications, from dietary supplements to over-the-counter pharmaceuticals.

For instance, In 2025, Amneal Pharmaceuticals has collaborated to produce Icosapent ethyl acid soft gelatin capsules, demonstrating a commitment to advancing high-quality, innovative softgel solutions. By combining expertise, resources, and cutting-edge manufacturing capabilities, such partnerships enhance production efficiency, improve product performance, and ensure high-quality outcomes that benefit manufacturers, consumers, and stakeholders alike.

Despite growing interest in plant-based alternatives, gelatin softgels continue to be the preferred choice for high-volume production, especially in regions where cost, reliability, and established performance are critical.

Rising Adoption of Non-Gelatin (Plant-Based) Softgels Drives the Segment Growth

Non-gelatin or plant-based softgels are emerging as the fastest-growing segment, driven by increasing consumer demand for vegetarian, vegan, and allergen-free alternatives. These softgels use plant-derived polymers such as hydroxypropyl methylcellulose (HPMC), carrageenan, and pea starch, offering similar stability and bioavailability to traditional gelatin capsules.

The growth of non-gelatin softgels is particularly strong in North America and Europe, fueled by rising health consciousness, clean-label trends, and the preference for sustainable and ethical products. On May 14, 2024, Roquette launched its LYCAGEL® Flex hydroxypropyl pea starch premix for nutraceutical and pharmaceutical softgels, highlighting technological advancements enabling high-quality, plant-based alternatives.

Further innovations are reinforcing this segment. On April 19, 2023, IFF introduced its VERDIGEL™ SC pectin-based technology, expanding its vegan softgel offerings. This carrageenan-free solution enables manufacturers to produce high-demand vegan softgels, addressing consumer preferences for allergen-free and plant-based products. Such innovations enhance product versatility and support the growing adoption of non-gelatin softgels across nutraceuticals, pharmaceuticals, and functional foods, meeting market needs while maintaining stability, quality, and performance standards..

Geographical Penetration

Rising Demand in Pharmaceutical and Nutraceutical Sectors in North America

The North American softgels capsules market is the world’s second-largest, accounting for a significant share of the global market in 2024, driven by strong demand from pharmaceutical, nutraceutical, and healthcare industries. The US represents the largest portion of the regional market, supported by advanced healthcare infrastructure, high consumer awareness, and a well-established manufacturing base for softgels capsules.

US Softgels Capsules Market Outlook

The US market is expanding steadily, fueled by increasing nutraceutical and dietary supplement consumption, along with growing pharmaceutical production. Rising interest in plant-based and allergen-free formulations has encouraged manufacturers to innovate and diversify product portfolios. In a notable development, in 2023, Bioriginal Food & Science Corp., a subsidiary of Cooke Inc. and a global leader in food and nutraceuticals, acquired all operating assets of Softgel Co., including a state-of-the-art softgel, squeeze tube, and tincture manufacturing facility specializing in human and pet nutrition products. This strategic move strengthens domestic production capacity, expands technological capabilities, and reinforces North America’s leadership in softgel manufacturing.

Government initiatives and regulatory support for domestic production further bolster the market, ensuring consistent supply and high-quality standards.

Canada Softgels Capsules Market Trends

Canada holds a smaller yet strategically important share of the North American softgels capsules market, driven by high per-capita supplement consumption and strict quality standards. Canadian manufacturers focus on premium and specialty softgels, catering to niche segments such as omega-3, herbal extracts, functional nutraceuticals, and medical cannabis.

In a notable development in 2022, ZYUS Life Sciences Inc., a Canadian life sciences company specializing in phyto-therapeutics, launched Zylem 1:20 Softgel Capsules and Zylem 5:5 Softgel Capsules for direct sales and distribution to registered medical cannabis patients across Canada. This launch demonstrates the growing demand for innovative, specialty softgel products in the Canadian market and highlights the role of softgels in delivering high-value, therapeutic nutraceutical and cannabinoid formulations.

Collaboration with global firms and adoption of advanced manufacturing technologies further enhance Canada’s competitiveness in the premium softgels segment. Overall, the Canadian market is positioned for steady growth, supported by innovation, regulatory compliance, and a focus on specialty and high-value products.

Presence of Advanced Manufacturing Infrastructure in Asia-Pacific

Asia-Pacific is expected to be a significant region of the global softgels capsules market, holding about 28.9% of the market in 2024. The regional market is supported by strong demand from industries such as automotive, aerospace, healthcare, and nutraceutical manufacturing. The region benefits from advanced manufacturing infrastructure and a growing base of pharmaceutical and nutraceutical production facilities, which ensures steady consumption of softgels capsules for vitamins, dietary supplements, and functional nutraceuticals.

Despite growing adoption of plant-based alternatives, gelatin-based softgels continue to hold relevance in applications requiring proven stability, high bioavailability, and cost efficiency. Asia-Pacific also has a notable base of large-scale manufacturers and end-user industries, maintaining the region’s position as one of the leading consumers of softgels globally.

India Softgels Capsules Market Insights

India accounts for a substantial share of the Asia-Pacific softgels market, driven primarily by its rapidly expanding pharmaceutical, nutraceutical, and dietary supplement industries. The growing domestic production of softgels is supported by government initiatives such as “Make in India”, which encourage local manufacturing and technological upgrades. Rising demand for health supplements, combined with the adoption of plant-based and allergen-free formulations, is fueling market growth in India.

Recent strategic collaborations are further strengthening the market. For instance, in 2023, Strides Pharma Science partnered with Amneal Pharmaceuticals to launch Icosapent Ethyl Acid Soft Gel capsules, expanding access to high-quality softgel products for cardiovascular health. Such initiatives not only enhance domestic manufacturing capabilities but also improve product availability and innovation, supporting the growing adoption of softgels in India.

China Softgels Capsules Industry Growth

China holds the largest share of the Asia-Pacific softgels capsules market, driven by high-volume production and strong export capabilities. Chinese companies such as Tiangong International and Baosteel Special Metals are increasing production to meet growing global and domestic demand for softgels capsules. Premium segments are supported by Japanese and global players like Nachi-Fujikoshi, Hitachi Metals, and Voestalpine, who maintain a presence in China through partnerships and subsidiaries.

Recent strategic developments are strengthening the market further. In 2023, CVC Technologies announced the acquisition of Changsung Softgel System, enhancing its production capabilities and technological expertise in softgel manufacturing. Such expansions support the growing demand for high-quality gelatin-based and plant-based softgels across pharmaceutical and nutraceutical applications.

China’s pharmaceutical and nutraceutical sectors benefit from a mature industrial base and advanced manufacturing capabilities, supporting steady growth. The expansion of healthcare infrastructure, rising consumer awareness, and focus on premium formulations are expected to sustain market growth in the region over the forecast period.

Sustainability Analysis

The softgels capsules market is increasingly focusing on sustainability, adopting energy-efficient production, plant-based excipients, and recyclable packaging. For example, in April 2023, IFF launched VERDIGEL™ SC, a pectin-based, carrageenan-free technology enabling eco-friendly, plant-based softgels. These initiatives reduce reliance on animal-derived gelatin, minimize environmental impact, and align with circular economy principles, supporting sustainable growth in the market.

Competitive Landscape

- The global softgels capsules market is characterized by a highly competitive landscape comprising both established pharmaceutical and nutraceutical manufacturers as well as specialist softgel producers.

- Key players include Catalent, Inc, Fuji Capsule, Sirio Europe GmbH Co KG, CAPTEK® Softgel International Inc, Thermo Fisher Scientific Inc, EuroCaps, Aenova Group, Lonza, Soft Gel Technologies, Inc, GELITA

- These companies emphasize product differentiation by offering gelatin-based and plant-based softgels with enhanced stability, bioavailability, and allergen-free formulations. Strategic investments in R&D, innovative excipients, sustainable manufacturing processes, and advanced encapsulation technologies are critical, as the industry faces competition from alternative dosage forms such as tablets, hard capsules, and gummies.

Key Developments

- In May 2025, Gummi World Expands into Capsule Manufacturing, Positioning Itself as a Highly Agile Full-Spectrum Supplement Producer in the Industry.

- In September 2022, Singapore-based Everstone Capital, the private equity arm of the Everstone Group, has acquired a controlling stake in Softgel Healthcare (SHPL), a specialized manufacturer of niche dosage forms serving the global nutraceutical, pharmaceutical, and OTC segments. The partnership aims to transform SHPL into a scaled, diversified, and globally recognized contract research, development, and manufacturing organization (CDMO) in India, leveraging Everstone’s strategic resources and expertise.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies