Smart Irrigation Market Overview

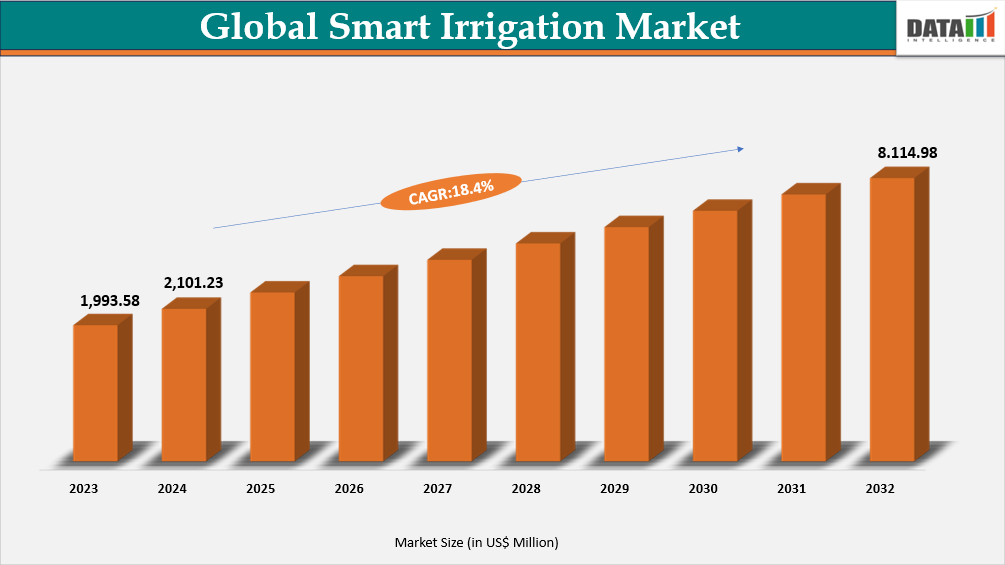

The global smart irrigation market reached US$1,993.58 million in 2023, rising to US$2,101.23 million in 2024 and is expected to reach US$8,114.98 million by 2032, growing at a CAGR of 18.4% from 2025 to 2032.

The smart irrigation market is expanding rapidly as global pressures on food production intensify. With the world population expected to reach 10 billion by 2050 and arable land per person falling by 20%, farmers are under growing pressure to produce more using fewer natural resources. Water scarcity further accelerates this shift, especially as agriculture already consumes 70% of global freshwater. As warming temperatures increase crop water needs and Aqueduct projects a 16% rise in irrigation demand by 2050, the push for precise, technology-driven irrigation has become unavoidable.

Technological innovation is accelerating this shift, as AI-enabled platforms help optimize water use and reduce operational losses. For instance, in January 2025, Hong Kong–based Full Nature Farms launched its Rocket 2.0 Smart Irrigation Platform, integrating sensors, AI, and weather forecasting to automate irrigation, reducing water costs by up to 30% and improving yields. By offering a subscription model costing just US$10–US$20 per sensor per month with no upfront investment, the company is removing adoption barriers and making advanced irrigation accessible to farmers across Hong Kong, Saudi Arabia, the UK, and soon North America.

Smart Irrigation Market Industry Trends and Strategic Insights

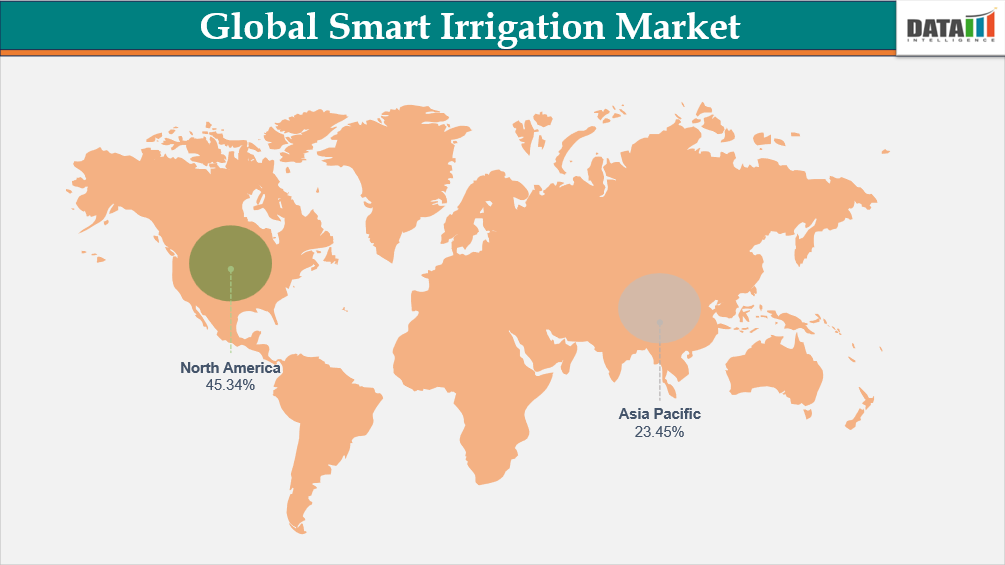

- North America leads the global smart irrigation market, capturing the largest revenue share of 45.34% in 2024.

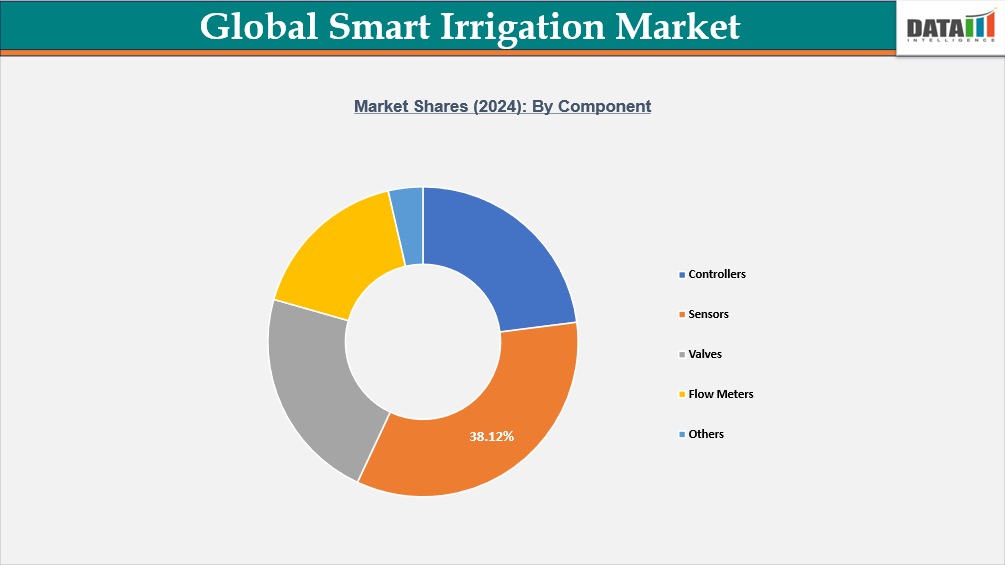

- By Component segment, sensors lead the global smart irrigation market, capturing the largest revenue share of 38.12% in 2024.

Global Smart Irrigation Market Size and Future Outlook

- 2024 Market Size: US$2,101.23 million

- 2032 Projected Market Size: US$8,114.98 million

- CAGR (2025–2032): 18.4%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Component | Controllers, Sensors, Valves, Flow Meters, Others |

| By System | Climate-Based, Sensor-Based |

| By Application | Agriculture, non-agriculture |

| By End-User | Farmers, Agri-Tech Companies, Residential Users, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growth in Precision Agriculture

The growing threat of climate-related disasters has highlighted the urgent need for resilient farming systems, as disasters have caused US$3.26 trillion in agricultural losses over 33 years, averaging US$99 billion annually, or 4% of global agricultural GDP, according to the FAO 2025 report. These rising losses are accelerating the adoption of digital technologies that enable farmers to monitor risks, anticipate impacts, and safeguard livelihoods, positioning precision agriculture as a critical tool in mitigating such challenges.

This pressing need has accelerated the deployment of AI-powered precision agriculture, with over 60% of large farms projected to adopt these tools by 2025. The trend is supported by the gradual uptake among small and medium farms, where adoption currently stands at 20–25% but is rising steadily as technologies become more affordable and user-friendly. The growing accessibility of these solutions drives a clear shift from traditional irrigation methods to data-driven, automated systems, linking the urgency created by disaster risks to tangible operational improvements on farms.

Segmentation Analysis

The global smart irrigation market is segmented based on component, system, application, end-user, and region.

Sensors Led with 38.12% Share as Real-Time Field Data is now the Backbone of Precision Irrigation

The smart irrigation market is increasingly dominated by sensors, as they enable farmers to make precise, real-time decisions on water use, reducing waste and improving crop yields. Soil moisture, weather, and evapotranspiration sensors provide actionable insights, allowing irrigation to respond directly to crop needs rather than fixed schedules.

This need for efficiency has driven innovations like CropX’s Actual ET sensor, launched in November 2024 in Australia and New Zealand, which monitors plant water use in real time and reduces irrigation by up to 50%. By delivering field-specific evapotranspiration data, CropX helps detect crop stress early and lessens dependence on traditional weather stations. These advanced sensors are not standalone tools but part of integrated systems that link field data with agronomic management platforms, creating a data-driven irrigation ecosystem.

Similarly, in April 2024, GroGuru launched its fully integrated wireless underground soil sensor probe, featuring six sensors at different depths and a 10-year battery life, providing continuous root zone monitoring for annual crops. Both CropX and GroGuru illustrate how sensors feed cloud-based AI systems to generate precise irrigation recommendations, helping farmers make better decisions and optimize water efficiency across entire fields.

Controllers have the Fastest Growth Rate Due to the Rising Demand for Automated Irrigation Scheduling

Controllers in the smart irrigation market are expanding rapidly as the demand for efficient water management grows among farmers and homeowners. By integrating data from sensors, soil monitors, and weather stations, modern controllers can automate watering schedules and optimize water usage precisely. This reduces wastage, lowers costs, and improves overall system performance. In line with this trend, in August 2025, Irrigreen introduced its AI-powered Smart Controller 3 alongside the Sprinkler 3, enabling residential lawns to save up to 50% of water while maintaining healthy landscapes.

The launch of Irrigreen 3.0 highlights how technological innovation drives market growth, combining compact design, advanced flow sensing, and real-time weather integration for seamless operation. By simplifying installation and improving reliability, such smart controllers make precision irrigation accessible and effective for a wide range of users. As water scarcity and rising utility costs continue to challenge traditional systems, these intelligent controllers are increasingly central to modern irrigation strategies. Consequently, controllers are emerging as the fastest-growing segment, connecting sustainability, technology, and efficiency across the irrigation market.

Global Smart Irrigation Market, Geographical Penetration

DOMINATING MARKET:

North America holds the Highest 45.34% Share due to Early Tech Adoption and Strong Investment in Water-Efficient Irrigation Systems

North America holds the highest share in the global smart irrigation market due to strong adoption of IoT-enabled controllers, weather-based systems, and advanced fertigation technologies across both agriculture and landscaping. Robust infrastructure, water-efficiency regulations, and rapid uptake of precision farming tools further strengthen regional dominance. Continuous product innovations and large-scale deployments across commercial farms, orchards, and public green spaces keep North America ahead in market penetration.

US Smart Irrigation Market Outlook

US drives the majority of this regional share, supported by aggressive investment in precision irrigation technologies. According to the 2023 Irrigation and Water Management Survey by NASS, US precision-irrigation spending surged from US$2.5 billion in 2018 to US$3.8 billion in 2023, reflecting a 52% rise. This rapid scaling of smart controllers, connected soil sensors, and automated water systems has positioned the US as the technological backbone of the North American market. Government incentives for water conservation further fuel this growth trajectory.

Canada Smart Irrigation Market Trends

Canada contributes steadily to North America’s leadership through targeted adoption of smart irrigation in high-value crops and orchards. A notable example is the March 22, 2023 announcement that Water Ways Technologies secured an CAD$850,000 (US$6,04,643.25) smart irrigation and fertigation project for an apple orchard in Southern Ontario, deploying advanced Israeli control technologies. Such investments highlight Canada’s shift toward precision irrigation, with provinces increasingly integrating smart systems to manage water scarcity and boost agricultural productivity.

FASTEST GROWING MARKET:

Asia-Pacific Records the Fastest 19.4% CAGR Driven by Rapid Farm Digitalisation and Rising Government Support for Precision Irrigation

Asia‑Pacific has the fastest growth in the global smart irrigation market due to its massive agricultural scale and vulnerability to climate extremes. According to FAO, the region accounts for 47% of global agricultural losses, totaling US$1.53 trillion, driven by floods, storms, and droughts. These losses create an urgent need for efficient water management technologies, linking climate risk directly to market growth. The region’s large farming population and rising food demand further amplify the adoption of precision irrigation systems.

India Smart Irrigation Market Insights

India remains the largest market in Asia-Pacific, due to increasing emphasis on water efficiency and climate-resilient farming. Initiatives like the FAO-backed climate-smart irrigation pilot, launched on June 30, 2025, showcase the use of closed-pipe systems with soil moisture sensors, optical fibre, and mobile controls, enabling precise water management. Managed by Water User Associations, these systems empower farmers and promote local governance, boosting adoption of smart irrigation technologies. Regional strategies, such as “Indian Irrigation Towards 2030,” further reinforce infrastructure development and investment, positioning India as a key growth driver in the global smart irrigation market.

China Smart Irrigation Market Industry Growth

China similarly reinforces Asia-Pacific’s lead through its strategic push in water-saving equipment, announced on November 4, 2025. By 2027, China aims to achieve breakthroughs in smart water management, recirculating cooling, and high-efficiency irrigation technologies. Establishing core independent technologies and a comprehensive standards system positions China to commercialize advanced solutions, creating both domestic and export demand for smart irrigation. This technological drive complements adoption trends in India and other APAC countries, reinforcing regional market dominance.

Sustainability Analysis

Smart irrigation technologies are revolutionizing agricultural water management by enabling precise, data-driven irrigation, which can reduce water use by 10%–40% depending on crop type and climate, according to the University of California. These efficiency gains help conserve freshwater resources, maintain soil health, and reduce nutrient runoff. By optimizing water application, farms also cut energy use associated with pumping, lowering greenhouse gas emissions. This sets the stage for a sustainable agricultural ecosystem where productivity aligns with environmental responsibility.

Building on this foundation, in January 2025, Full Nature Farms launched its Rocket 2.0 Smart Irrigation Platform, winning the CES 2025 Innovation Award in Sustainability & Energy/Power. Rocket 2.0 integrates AI and advanced sensors to optimize irrigation, reduce water waste, and improve crop yields, demonstrating how technology can convert theoretical efficiency gains into real-world impact. Its affordability and global rollout across Hong Kong, Saudi Arabia, the UK, and North America further reinforce the potential for widespread adoption, linking technological innovation directly to global sustainability goals.

Complementing technological solutions, in June 2025, FAO and the Saudi Irrigation Organization launched an intensive training programme for lead farmers in Saudi Arabia. This initiative equipped over 150 participants with practical skills to operate and maintain modern smart irrigation systems, translating Rocket 2.0–style innovations into actionable practices at the farm level. By empowering lead farmers as community change agents, the programme ensures that efficient water use spreads regionally, connecting advanced technology with human capacity-building for sustainable impact.

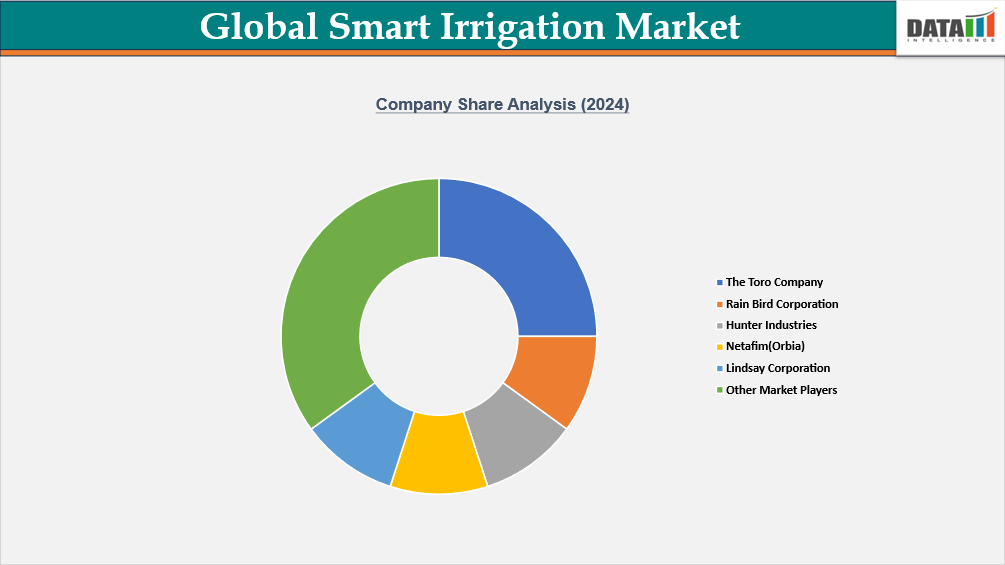

Competitive Landscape

- The competitive landscape in the smart irrigation market is quite dynamic, characterized by strong innovation, moderate concentration, and fierce price and technology competition.

- The landscape is dominated by a handful of global players, including The Toro Company, Rain Bird Corporation, Hunter Industries, Netafim (Orbia), Lindsay Corporation, John Deere (Deere & Company), Rivulis, Jain Irrigation Systems, HydroPoint and Valmont Industries, Inc.

- Key players compete on advanced sensor technology, AI-driven controllers, and cloud‑based analytics platforms, emphasizing precision water scheduling and predictive maintenance.

- Differentiation increasingly relies on ecosystem partnerships, open APIs, and integration with farm‑management or weather data systems, enabling interoperability.

Key Developments

- In June 2025, Universitas Gadjah Mada (UGM) launched SIPASI 2.0, a web-based smart irrigation management system designed to boost water-use efficiency and agricultural productivity across Indonesia. The platform integrates real-time data from rainfall, soil moisture, and water-level sensors to deliver precise irrigation recommendations, with pilot trials in South Sulawesi showing major efficiency gains.

- In November 2024, Cisgenics launched its flagship smart-irrigation platform, CisgenX, in the US at the 2024 Irrigation Show in Long Beach, introducing an IoT- and ML-driven system designed to cut water use by 40–70%. The platform targets rising water scarcity challenges across agriculture, landscapes, and large properties by optimizing water and energy consumption through real-time data analytics and advanced decoder technology.

Investment & Funding Landscape

Investment and funding in the smart irrigation market are accelerating as tech giants, agritech firms, and climate-focused investors prioritize water efficiency and data-driven farming. Major players like Google and regional agriculture funds are channeling capital into precision irrigation, sensor networks, and AI-based water management solutions. Public–private partnerships are expanding, with governments supporting pilots and subsidies to scale smart irrigation across farms and urban landscapes. Overall, rising climate risks and water scarcity are driving sustained investor momentum, strengthening the market’s long-term growth outlook.

| Company | Investment/Funding | Year | Details | |

| Google (with Arable Labs) | US$4M investment in smart-irrigation projects | 2025 | Google has invested $4 million in two smart-irrigation and water-replenishment projects across North and South Carolina in partnership with Arable Labs. The initiative will deploy precision irrigation on 20,000 acres of farmland, projected to save 500+ million gallons of water annually over eight years. This effort supports Google’s commitment to replenish 120% of its freshwater use by 2030 while enhancing watershed health in the region. | |

| Irrigreen | US$15 million Seed Funding | 2023 | Irrigreen raised $15 million in Seed financing led by Ulu Ventures to accelerate its robotic smart-sprinkler technology designed for US homeowners facing rising water costs. The funding will support product innovation and national expansion as Irrigreen positions itself as a leading solution for precise, water-efficient residential irrigation. | |

What Sets This Global Smart Irrigation Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by Component, source, distribution channel, end-user and application segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect Smart Irrigation commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.