Short Bowel Syndrome Market Size

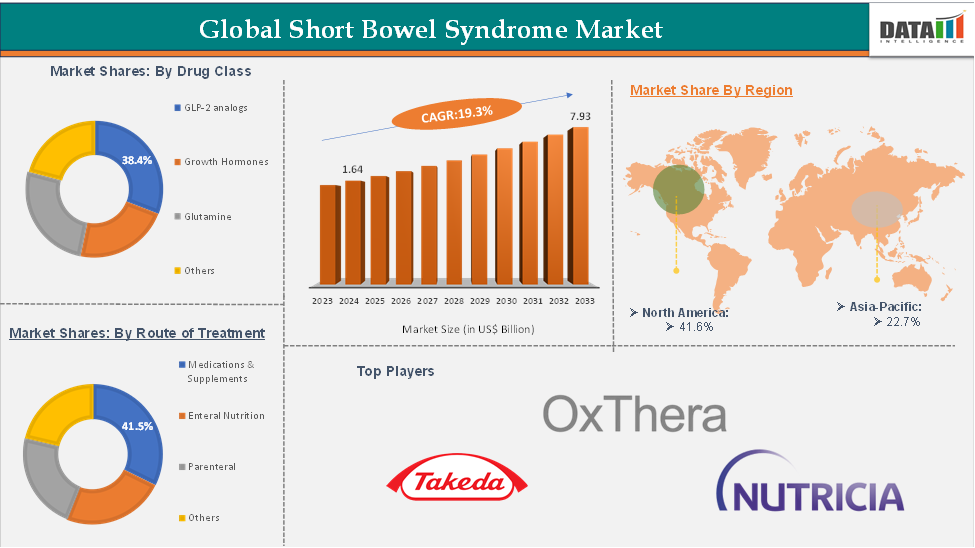

In 2023, the global short bowel syndrome market was valued at US$ 1.39 Billion, and the market size reached US$ 1.64 Billion in 2024 and is expected to reach US$ 7.93 Billion by 2033, growing at a CAGR of 19.3% during the forecast period 2025-2033.

Short Bowel Syndrome Market Overview

The global short bowel syndrome (SBS) market is undergoing rapid evolution, driven by the growing incidence of gastrointestinal surgeries, particularly in neonates, along with increased adoption of advanced therapies such as GLP-2 analogs, including teduglutide. Key market drivers include rising prevalence of SBS due to conditions like Crohn’s disease and necrotizing enterocolitis, the clinical success of absorption-enhancing drugs that reduce reliance on parenteral nutrition, and improving access to care in emerging markets.

North America dominates the market due to high diagnosis rates, established reimbursement frameworks, and early drug approvals. Meanwhile, Asia-Pacific is the fastest-growing region, fueled by rising awareness, expanding pediatric surgical capabilities, and strategic entry by global pharmaceutical players.

Emerging opportunities lie in the development of biosimilars to reduce treatment costs, digital platforms for individualized nutrition management, and a robust pipeline of long-acting GLP-2 analogs and regenerative therapies that address long-term intestinal failure. These trends position the SBS market as a high-value niche with substantial room for targeted innovation and regional expansion.

Short Bowel Syndrome Market Executive Summary

Short Bowel Syndrome Market Dynamics: Drivers & Restraints

Rising prevalence of SBS & related GI disorders is significantly driving the short bowel syndrome market growth

The rising prevalence of short bowel syndrome (SBS), driven by increasing rates of gastrointestinal surgeries, Crohn’s disease, and necrotizing enterocolitis, especially among neonates and older adults, is a key growth driver for the SBS market. As more patients are diagnosed with SBS and require long-term nutritional and therapeutic support, demand for specialized treatments such as GLP-2 analogs and parenteral nutrition continues to rise.

This expanding patient population not only creates a larger commercial opportunity for pharmaceutical companies but also accelerates investment in drug development, diagnostic tools, and supportive care infrastructure, collectively propelling market growth.

Advancements in therapeutics are expected to boost the Short Bowel Syndrome market growth

Advancements in therapeutics are playing a pivotal role in driving growth in the Short Bowel Syndrome (SBS) market by offering more effective and convenient treatment options that reduce reliance on parenteral nutrition. A notable example is Apraglutide, a long-lasting GLP‑2 analogue developed by Ironwood/VectivBio, which recently demonstrated statistically significant reductions in weekly parenteral support in a Phase III trial.

Another notable development is Glepaglutide from Zealand Pharma, an investigational GLP‑2 analog in an autoinjector format, which earned FDA orphan drug designation and showed strong phase III results, though a Complete Response Letter in December 2024 prompted plans for an additional confirmatory trial. Collectively, such developments are fueling investment and adoption in the SBS market, creating sustained growth momentum.

Restraint:

The high cost of treatment and nutritional support are hampering the growth of the Short Bowel Syndrome market

The high cost of treatment and nutritional support is a significant barrier to the growth of the Short Bowel Syndrome (SBS) market, particularly in low- and middle-income regions. Managing SBS often requires lifelong dependence on parenteral nutrition (PN), specialized medical care, and advanced pharmacological therapies such as GLP‑2 analogs (e.g., teduglutide).

For instance, teduglutide therapy can exceed $300,000 annually per patient in the U.S., while long-term PN can cost tens of thousands of dollars each year, excluding the additional burden of hospitalizations, catheter-related infections, and liver complications.

Opportunity:

Emergence of novel therapies is expected to create a lucrative opportunity for the growth of the short bowel syndrome market

Focusing on immuno-oncology and precision medicine is expected to create lucrative opportunities for the short bowel syndrome market by enabling the development of highly targeted, effective treatments tailored to individual patients. thymic tumors often present unique molecular and immune characteristics, making them suitable candidates for precision-based approaches. advances in genomic profiling, biomarker identification, and next-generation sequencing are allowing researchers to better understand the biology of short bowel syndrome, leading to the creation of personalized therapies that improve treatment response and reduce side effects.

For more details on this report – Request for Sample

Short Bowel Syndrome Market, Segment Analysis

The global short bowel syndrome market is segmented based on drug class, Route of Administration, distribution channel, and region.

The GLP-2 analogs from the drug class segment are expected to hold 31.6% of the market share in 2024 in the short bowel syndrome market

The GLP-2 analogs segment is expected to dominate the short bowel syndrome (SBS) drug market due to its targeted mechanism of action, proven clinical efficacy, and increasing regulatory approvals. GLP-2 (glucagon-like peptide-2) analogs enhance intestinal absorption by promoting mucosal growth and improving fluid and nutrient uptake, reducing the dependence on parenteral nutrition.

Teduglutide (marketed as Gattex in the U.S. and Revestive in Europe), the first GLP-2 analog approved by the FDA and EMA, has shown significant improvements in patients' nutritional autonomy and quality of life, driving strong adoption. Moreover, the segment is gaining momentum from a robust pipeline of next-generation GLP-2 analogs. For instance, Apraglutide by Ironwood Pharmaceuticals (formerly VectivBio) demonstrated positive Phase III results in 2024, showing a substantial reduction in weekly parenteral support volumes.

Similarly, Glepaglutide, developed by Zealand Pharma, is under regulatory review following Phase III trials, with additional studies planned after receiving a Complete Response Letter from the FDA in late 2024. These agents offer longer half-lives and more convenient dosing schedules, which are likely to further increase patient adherence and physician preference. As these advanced GLP-2 analogs enter the market, this drug class is well-positioned to remain the cornerstone of SBS pharmacological therapy.

Short Bowel Syndrome Market, Geographical Analysis

North America is expected to dominate the global short bowel syndrome market with a 40.3% share in 2024

Notable therapeutic advancements, such as the widespread use of GLP‑2 analogs like teduglutide, and active clinical trials for next-generation treatments, further cement North America’s leadership in the SBS market. With over 70% global market share as of 2023, the region is well-positioned to maintain its dominance in the coming years.

Asia-Pacific is growing at the fastest pace in the short bowel syndrome market, holding 19.6% of the market share

Asia-Pacific is expected to emerge as the fastest-growing region in the short bowel syndrome (SBS) market, propelled by rising healthcare investments, growing awareness of rare gastrointestinal disorders, and improving access to specialized care. Countries such as China, India, Japan, and South Korea are witnessing a steady increase in SBS-related hospitalizations, primarily due to higher survival rates of premature infants and rising cases of conditions like Crohn’s disease and bowel ischemia.

The Asia-Pacific region's evolving healthcare landscape and rising demand for advanced gastrointestinal treatments position it as a key area of opportunity in the global SBS market.

Short Bowel Syndrome Market Competitive Landscape

Top companies in the short bowel syndrome market include Takeda Pharmaceutical Company Limited, OxThera, and Nutricia North America, among others.

Short Bowel Syndrome Market, Key Developments

In April 2025, Ironwood Pharmaceuticals announced that the FDA had requested a confirmatory Phase 3 trial for apraglutide in patients with short bowel syndrome with intestinal failure (SBS-IF) reliant on parenteral support. While continuing development, the company has engaged Goldman Sachs to explore strategic options aimed at maximizing shareholder value.

In January 2025, Ironwood Pharmaceuticals announced a renewed strategic focus on advancing apraglutide for short bowel syndrome (SBS) patients dependent on parenteral support. As part of this shift, the company will reduce its workforce by about 50% to better align resources and support long-term growth.

Short Bowel Syndrome Market Scope

Metrics | Details | |

CAGR | 19.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Class | GLP-2 Analogs, Growth Hormones, Glutamine, Others |

Route of Administration | Medications & Supplements, Enteral Nutrition, Parenteral, Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global short bowel syndrome market report delivers a detailed analysis with 40+ key tables, more than 45+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.