RFID Smart Cabinets Market – Industry Trends & Overview

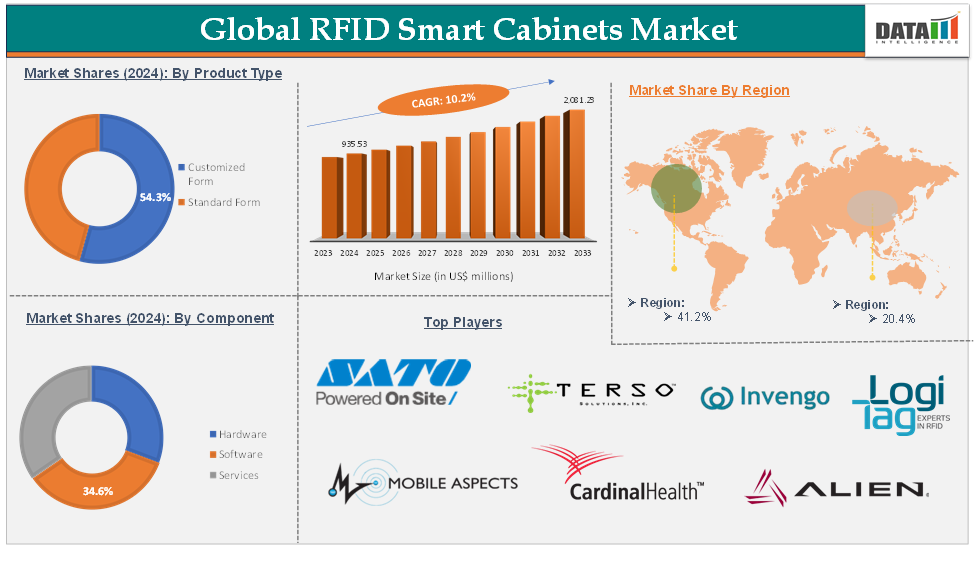

RFID Smart Cabinets Market reached US$ 935.53 Million in 2023 and is expected to reach US$ 2,081.23 Million by 2033, growing at a CAGR of 10.2% during the forecast period 2024-2033.

RFID smart cabinets are advanced storage solutions that utilize radio frequency identification (RFID) technology to improve inventory management. Each item stored in these cabinets is equipped with an RFID tag, which interacts with an integrated RFID reader within the cabinet. This arrangement facilitates real-time monitoring, streamlined inventory control, and improved security.

Drivers of the global RFID smart cabinets market include rising demand for efficient inventory management, the need for enhanced security, and access control. Opportunities in the market include expansion in emerging markets and integration with IoT and automation.

Key trends include the rapid adoption of RFID smart cabinets in hospitals and clinics for real-time tracking of medical supplies and integration with hospital information systems, which enhances inventory control and compliance.

Executive Summary

For more details on this report – Request for Sample

RFID Smart Cabinets Market Dynamics: Drivers

Increasing demand for efficient inventory management

RFID smart cabinets employ radio frequency identification (RFID) technology to automate the monitoring of items within them. Each item is affixed with an RFID tag that communicates with readers embedded in the cabinet. This automation removes the necessity for manual inventory counts and data entry, significantly decreasing human errors and labor costs associated with inventory management. Consequently, staff can focus on more strategic tasks instead of repetitive inventory checks.

RFID smart cabinets can provide real-time visibility into inventory levels and item locations. This functionality enables organizations to continuously monitor stock, ensuring they have accurate information about available items at any time. Such visibility helps prevent stockout instances where items are unavailable when needed and overstock situations, where excess inventory occupies valuable resources.

For instance, in October 2024, Avery Dennison opened a new, state-of-the-art RFID innovation facility in Querétaro, Mexico, marking its largest RFID site globally. This advanced plant is designed to serve both regional and global clients by manufacturing a wide range of RFID and digital ID solutions that enhance supply chain connectivity and transparency across industries such as apparel, food, healthcare, logistics, and retail. Moreover, the rising demand for IoT and smart technologies integration contributes to the global RFID smart cabinets market expansion.

RFID Smart Cabinets Market Dynamics: Restraints

High implementation cost

One of the primary challenges in adopting RFID smart cabinets is the significant upfront investment required. This encompasses expenses related to hardware, such as RFID tags and readers, as well as the costs associated with setting up infrastructure and integrating software. For smaller enterprises, these costs can be particularly daunting, potentially hindering overall market growth, especially in sectors that are sensitive to budget constraints.

The initial investment for RFID smart cabinets generally falls between $20,000 and $50,000 for smaller setups. This price range includes the acquisition of RFID tags, readers, and the necessary software for integration and operation. For medium-sized retail operations, the implementation costs can be significantly higher, typically ranging from $200,000 to $600,000. This variation reflects the need for more extensive infrastructure and potentially larger volumes of tagged items. Thus, the above factors could be limiting the global RFID smart cabinets market's potential growth.

RFID Smart Cabinets Market - Segment Analysis

The global RFID smart cabinets market is segmented based on product type, component, technology, deployment type, end-user, and region.

Component:

The RFID tag segment is expected to hold 34.6% of the global RFID smart cabinets market in 2024

The RFID tags segment is pivotal for improving inventory management and operational efficiency across various industries. RFID tags are fundamental to RFID systems, enabling the identification and tracking of items stored in smart cabinets. Each tag includes a microprocessor that holds data about the item it is attached to, such as its identity and relevant details, which are transmitted to RFID readers through radio waves.

The use of RFID tags in smart cabinets facilitates real-time tracking of inventory levels and item locations. This capability enhances data accuracy compared to traditional inventory management methods, allowing businesses to maintain optimal stock levels, minimize waste, and improve operational efficiency.

The increasing trend of integrating RFID technology with Internet of Things (IoT) devices enhances the functionality of smart cabinets. This integration allows for seamless data collection and analysis, providing businesses with improved supply chain visibility and better decision-making capabilities.

Furthermore, key players in the industry's product launches would drive this segment's growth in the RFID smart cabinets market. For instance, in October 2024, Metalcraft, Inc. announced the launch of its latest innovation in RFID technology, the Long Range Universal RFID Tag.

This new product responds to customer demands for enhanced read range capabilities, offering an impressive 55-foot read range on metal surfaces, nearly double the performance of the company's current best-selling Universal RFID Asset Tag. These factors have solidified the segment's position in the global RFID smart cabinets market.

RFID Smart Cabinets Market – Geographical Analysis

North America is expected to hold 41.2% of the global RFID smart cabinets market in 2024

North America plays a crucial role in the global RFID smart cabinets market, holding a significant market share due to several compelling factors that contribute to its dominance. The region benefits from a robust technological infrastructure that facilitates the adoption of RFID technology.

Companies in North America are increasingly investing in RFID smart cabinets to enhance asset tracking and improve operational efficiency. This trend is especially pronounced in healthcare settings, where RFID smart cabinets significantly enhance medication dispensing accuracy and reduce errors.

The healthcare industry is a major driver of market growth in North America. The rising need for accurate inventory management and compliance with regulatory standards has prompted many healthcare facilities to adopt RFID solutions. Research shows that hospitals employing RFID technology have experienced inventory management efficiency improvements of up to 20%, further driving demand for smart cabinets.

There is a growing trend towards automation and data-driven decision-making within North America. Businesses are recognizing the advantages of RFID smart cabinets in streamlining operations, reducing manual errors, and enhancing overall productivity. This shift towards efficient inventory management systems is expected to persist, fueling market growth. Thus, the above factors are consolidating the region's position as a dominant force in the global RFID smart cabinets market.

Asia Pacific is expected to hold 20.4% of the global RFID smart cabinets market in 2024

The healthcare industry in Asia-Pacific is a primary driver for the adoption of RFID smart cabinets. Approximately 62% of healthcare facilities in the region are anticipated to implement these cabinets within the next two years to improve inventory accuracy and reduce costs. This trend highlights a growing awareness of the advantages that RFID technology can offer in managing medical supplies and ensuring patient safety.

Various government initiatives across Asia-Pacific countries are promoting technological advancements in healthcare and other sectors. Japan's "Society 5.0" initiative aims for widespread adoption of advanced technologies, including RFID systems, in large hospitals by 2026.

China's "Internet Plus Healthcare" program predicts a 28% annual growth in RFID installations. India's National Digital Health Mission is expected to drive a 45% increase in RFID-enabled devices. These initiatives significantly contribute to the deployment of RFID technology, enhancing market growth prospects.

Furthermore, key players in the industry product launching products that would drive this market growth. For instance, in August 2024, BCI (Bar Code India) launched an innovative IoT-based RFID reader named Dristi, which is set to transform the supply chain industry. This innovative device is designed to enhance operational efficiency and accuracy in various sectors, including manufacturing, distribution, transportation, and retail.

The Asian Development Bank forecasts that healthcare spending in the region will reach $2.4 trillion by 2030, with a substantial portion allocated for technological upgrades. This investment is likely to bolster demand for RFID smart cabinets as healthcare facilities seek better inventory management and operational efficiency. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global RFID smart cabinets market.

RFID Smart Cabinets Market - Major Players

The major global players in the RFID smart cabinets market include SATO Holdings Corporation, LogiTag, WaveMark (Cardinal Health), Terso Solutions, Inc., Mobile Aspects, Inc., Alien Technology, LLC., Invengo Information Technology Co., Ltd., Impinj, Inc., PALEX MEDICAL, S.A., and GAO Group, among others.

Key Developments

In October 2024, Schreiner MediPharm, a specialist in pharmaceutical packaging, introduced a new RFID label that features a digital first-opening indication and a unique construction designed to protect the integrated chip from mechanical stress. This innovation addresses critical needs in the healthcare sector, particularly in enhancing product safety and reducing medication errors through digitalization.

Market Scope

Metrics | Details | |

CAGR | 10.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2024-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Customized Form, Standard Form |

Component | Hardware, Software, Services | |

Technology | Ultra-High Frequency (UHF) RFID, High Frequency (HF) RFID: | |

Deployment Type | On-Premise, Cloud | |

End-User | Hospitals, Bio-Pharmaceutical Companies, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |