Revenue Cycle Management Market Size & Industry Outlook

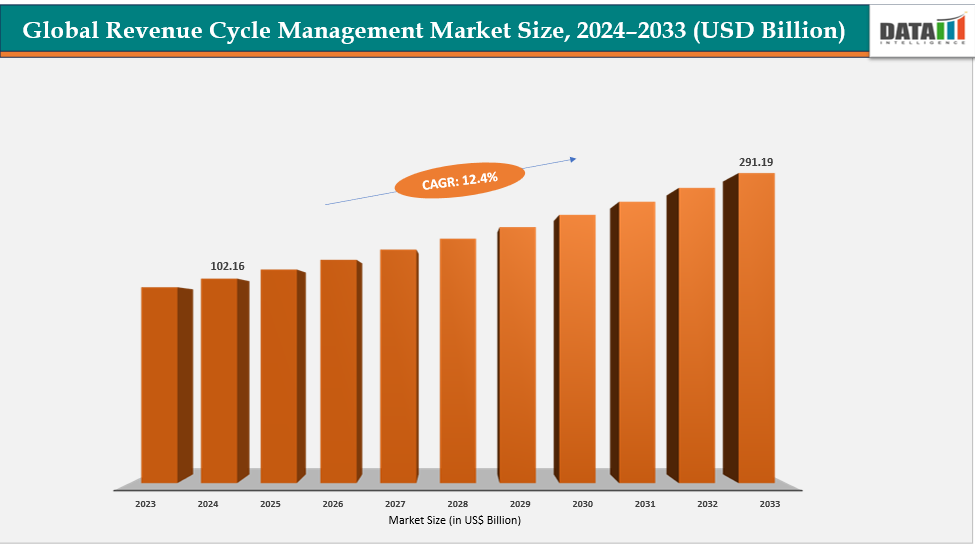

The global revenue cycle management market size reached US$ 102.16 billion in 2024 is expected to reach US$ 291.19 billion by 2033, growing at a CAGR of 12.4% during the forecast period 2025-2033. The market is primarily driven by the increasing complexity of healthcare billing and reimbursement processes, rising administrative costs, and the adoption of digital and AI-enabled solutions that streamline workflows, reduce errors, and accelerate revenue collection.

For instance, Healthcare providers continue to prioritize the patient experience to meet evolving consumer expectations. Approximately 68% of patients prefer online appointment scheduling, which helps streamline access to care and reduce administrative burdens. Clear and accurate billing is also highly valued, with 78% of patients seeking transparency in their financial interactions with providers. Moreover, 92% of patients who have a positive administrative experience are more likely to recommend their healthcare provider.

Key Highlights

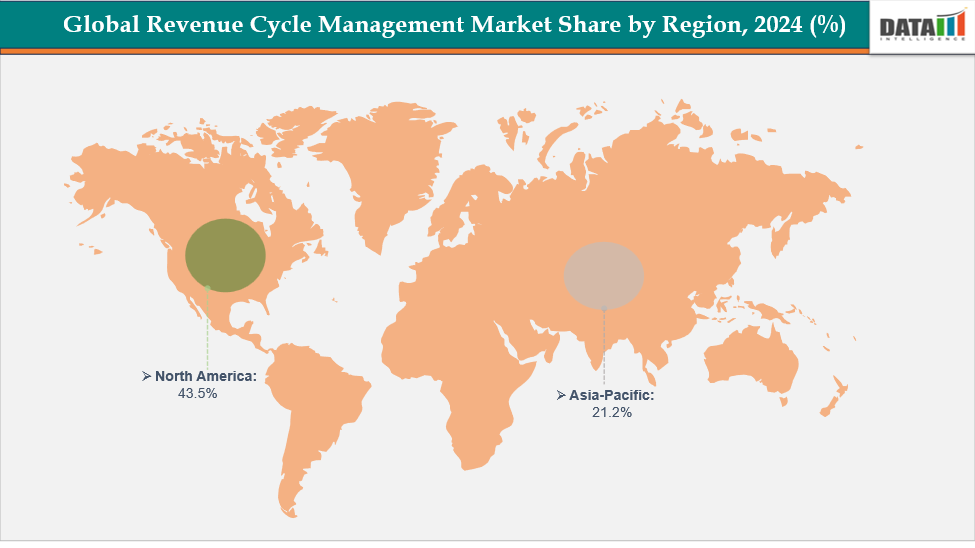

- North America dominates the revenue cycle management market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

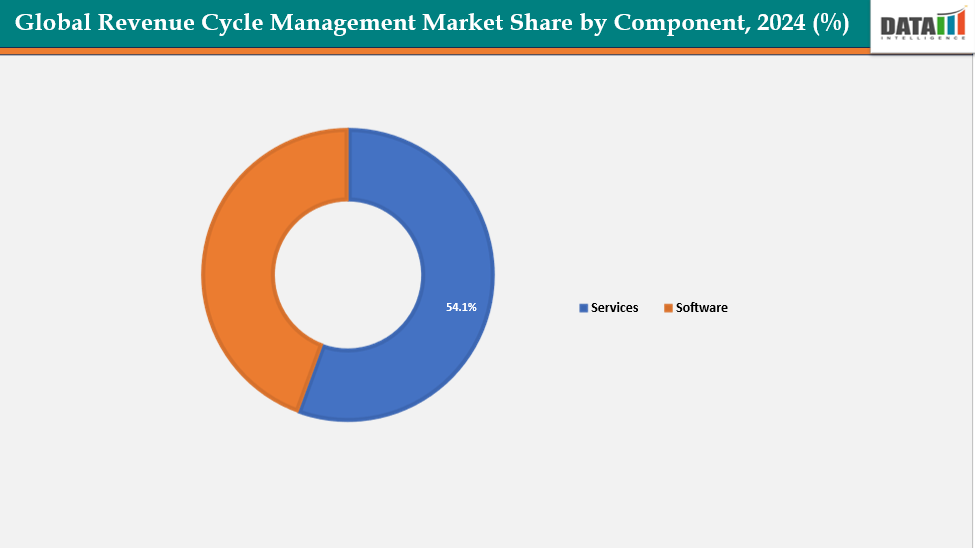

- Based on component, services segment led the market with the largest revenue share of 54.1% in 2024.

- The major market players in the revenue cycle management market includes Optum Inc (United Health Groups), Coronis Health, AdvancedMD, Inc, 3Gen Consulting, Plutus Health, e-Care India Pvt Ltd, Bellmedex, Antenahealth, eClinicalWorks, NXGN Management, LLC and among others.

Market Dynamics

Drivers:Growing demand for healthcare digitization and automated revenue cycle management is significantly driving the revenue cycle management market growth

The growing demand for healthcare digitization and automated revenue cycle management (RCM) is a major driver in the market, as providers increasingly seek solutions that seamlessly integrate electronic health records (EHRs), claims processing, and billing workflows into a unified digital ecosystem.

Automation reduces manual intervention, accelerates claim adjudication, and minimizes coding errors, enabling healthcare organizations to optimize resource allocation and improve cash flow.

For instance, in May 2025, Smarter Technologies, a leading automation and insights platform for healthcare efficiency, unveiled the industry’s first AI-powered revenue management platform, aimed at helping hospitals and health systems streamline administrative workflows and strengthen financial performance.

Moreover, digitized RCM platforms support real-time analytics and reporting, allowing organizations to identify bottlenecks, monitor financial outcomes, and ensure compliance with complex regulatory requirements.

This trend is particularly strong in regions with advanced healthcare IT adoption, such as North America and Europe, where providers are investing heavily in AI-enabled RCM systems to enhance operational efficiency and revenue predictability.

Restraints: Data security and patient privacy concerns are hampering the growth of the revenue cycle management market

Data security and patient-privacy concerns are a major challenge for the global Revenue Cycle Management (RCM) market because RCM systems aggregate highly sensitive personally identifiable health and billing information across multiple touchpoints—EHRs, insurance portals, payment gateways and third-party vendors—making them attractive targets for cyberattacks and accidental breaches. Regulatory complexity (HIPAA, GDPR and a patchwork of national privacy laws) raises compliance costs and increases the risk of heavy fines and reputational damage if controls are inadequate, while cloud migrations and API-driven interoperability expand the attack surface if encryption, access controls, vendor risk management and secure data-sharing protocols are not enforced.

For more details on this report – Request for Sample

Revenue Cycle Management Market, Segment Analysis

The global revenue cycle management market is segmented based on component, type, deployment mode, end user, and region.

Component: The services from component segment to dominate the revenue cycle management market with a 54.1% share in 2024

In the revenue cycle management (RCM) market, the services segment is vital for managing the entire revenue cycle, from patient pre-registration and eligibility verification to claims management and billing. By streamlining these processes, it reduces administrative burdens, minimizes errors, and enhances financial performance for healthcare providers.

The revenue cycle management (RCM) market services segment is fueled by the increasing complexity of healthcare billing and reimbursement processes, solution launches, the need for specialized service providers to handle front-end, middle-end, and back-end operations, and the need to reduce administrative burdens and minimize errors. Stringent regulatory requirements, such as HIPAA compliance, necessitate professional management of sensitive patient and financial data.

For instance, in October 2024, Patient Discovery Solutions, Inc., a prominent healthcare technology company, has announced the launch of its cutting-edge Revenue Cycle Management (RCM) solution, specifically designed to comply with CMS billing requirements for Social Determinants of Health (SDoH) assessments, Community Health Integration (CHI), and Principal Illness Navigation (PIN) services.

Overall, the services segment continues to play a pivotal role in enhancing operational efficiency, ensuring regulatory compliance, and driving revenue optimization for healthcare organizations across the globe.

Type: The integrated RCM segment is estimated to have a 54.1% of the revenue cycle management market share in 2024

The integrated Revenue Cycle Management (RCM) segment plays a pivotal role in the global RCM market by combining all key functions of the revenue cycle—patient registration, eligibility verification, coding, billing, claims submission, payment posting, denial management, and analytics—into a single, unified platform. This holistic approach improves data accuracy, reduces duplication of efforts, and streamlines workflows across front-, middle- and back-end operations. Integrated RCM solutions also enable better interoperability with electronic health records (EHRs) and payer systems, allowing providers and payers to track the entire patient financial journey in real time.

As healthcare organizations face mounting pressure to cut administrative costs, enhance reimbursement rates, and comply with evolving regulatory standards, integrated RCM systems stand out for delivering higher automation, improved patient experience, faster claim turnaround, and more actionable insights compared with standalone or fragmented solutions.

Geographical Analysis

North America dominates the global revenue cycle management market with a 43.5% in 2024

In North America, the revenue cycle management (RCM) market is primarily driven by a combination of advanced healthcare infrastructure, novel platform launches, regulatory requirements, technological adoption, and evolving care models. The region’s well-established healthcare system, with widespread use of Electronic Health Records (EHRs) and other digital tools, enables more efficient management of revenue cycles.

For instance, in February 2025, Infinx Healthcare, a frontrunner in AI-driven revenue cycle management solutions, has launched its Revenue Cycle Agent Platform and Document Capture AI Agent Platform. These innovative platforms blend Generative AI (GenAI), automation, and human expertise to optimize financial performance and streamline revenue cycle operations.

Moreover, the integration of technologies like Artificial Intelligence (AI), Robotic Process Automation (RPA), and predictive analytics enhances accuracy, reduces errors, and accelerates reimbursement processes. The shift from fee-for-service to value-based care models further encourages adoption of integrated RCM systems capable of managing complex payment structures.

Additionally, rising healthcare expenditures have increased the need for streamlined billing, coding, and claims management, making RCM solutions essential for reducing administrative burdens and improving financial performance. Collectively, these factors make North America a key growth driver in the global RCM market.

Europe is the second region after North America which is expected to dominate the global revenue cycle management market with a 34.5% in 2024

The European RCM market is driven by continent-wide digital health strategies, cross-border care initiatives, and strict GDPR compliance, which push providers to adopt secure, integrated billing and claims platforms. Rising healthcare costs, an increasing volume of outpatient procedures, and a growing focus on value-based care models also create demand for automated revenue cycle solutions to reduce administrative burden and improve reimbursement accuracy.

Germany’s market is boosted by government funding programs such as the Hospital Future Act (KHZG), which support the digitization of hospital administration and billing. A mandatory health insurance system with complex reimbursement pathways, combined with a push to cut administrative costs, drives hospitals and clinics to implement advanced, compliant RCM systems that improve efficiency and transparency.

The Asia Pacific region is the fastest-growing region in the global revenue cycle management market, with a CAGR of 8.1% in 2024

Across Asia, expanding healthcare infrastructure, rising patient volumes, and the adoption of health IT as part of national e-health initiatives are fueling demand for RCM solutions. Rapid growth of private hospitals, increased medical tourism, and the shift toward cashless insurance claim processing further strengthen the need for automated billing, coding, and claims management platforms.

Japan’s market is driven by an aging population that significantly increases healthcare utilization and cost pressures. Frequent government fee-schedule revisions and universal health coverage make precise coding and claims handling essential. Hospitals face administrative staff shortages, prompting them to invest in automation and cloud-based RCM systems, while policy incentives encourage integration of EHRs with financial workflows.

Competitive Landscape

Top companies in the revenue cycle management market include Optum Inc (United Health Groups), Coronis Health, AdvancedMD, Inc, 3Gen Consulting, Plutus Health, e-Care India Pvt Ltd, Bellmedex, Antenahealth, eClinicalWorks, NXGN Management, LLC and among others.

Optum:- Optum plays a significant role in the global revenue cycle management (RCM) market as one of the largest end-to-end service and technology providers. The company delivers integrated RCM solutions covering patient access, medical coding, billing, claims management, payment integrity, and analytics for hospitals, physician groups, and payers. Leveraging its scale, proprietary data assets, and advanced automation/AI tools, Optum helps clients reduce administrative costs, shorten revenue cycles, and improve reimbursement accuracy.

Market Scope

| Metrics | Details | |

| CAGR | 12.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Component | Services, Software |

| Type | Integrated RCM, Standalone RCM | |

| Deployment Mode | On‑Premises, Cloud‑Based | |

| End User | Hospitals, Physician Offices / Clinics, Diagnostics, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global revenue cycle management market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare IT-related reports, please click here