Remote Monitoring Wearables Market Size

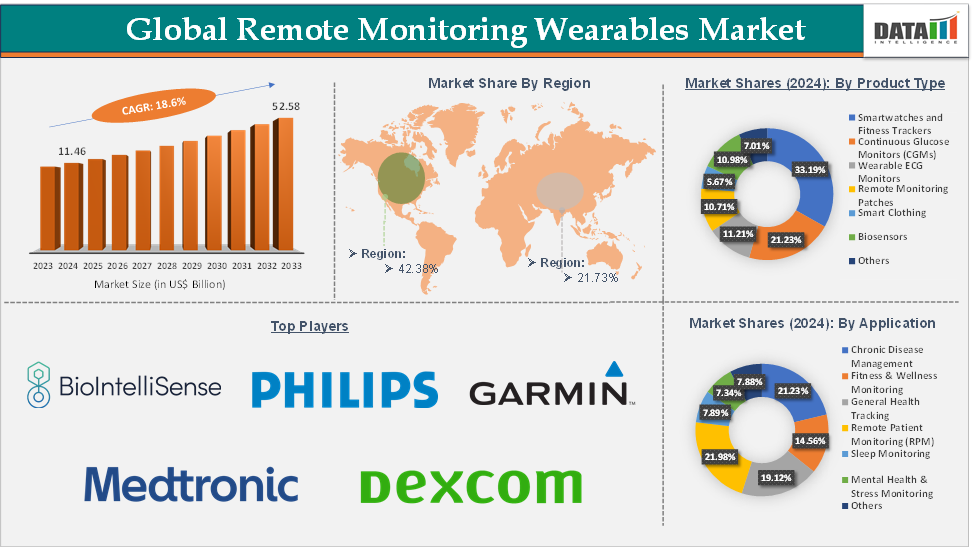

Remote Monitoring Wearables Market size reached US$ 23.26 Billion in 2024 and is expected to reach US$ 90.54 Billion by 2033, growing at a CAGR of 15.9% during the forecast period 2025-2033.

Remote Monitoring Wearables Market Overview

The remote monitoring wearables market is experiencing rapid growth, driven by technological advancements, increasing healthcare digitization, and rising consumer demand for proactive health management. These devices, which include smartwatches, fitness trackers, biosensors, and medical-grade wearables, allow real-time tracking of vital signs such as heart rate, blood pressure, oxygen saturation, glucose levels, and more. The COVID-19 pandemic significantly accelerated adoption, highlighting the value of remote patient monitoring in reducing hospital visits and managing chronic conditions from home.

Challenges include data privacy concerns, regulatory compliance, device accuracy, and integration with electronic health records (EHRs). However, ongoing R&D, favorable reimbursement policies, and partnerships between tech firms and healthcare providers are paving the way for sustained market expansion. Overall, remote monitoring wearables are poised to transform personalized healthcare delivery, enhance patient outcomes, and reduce system-wide costs, making them a critical component of the future digital health ecosystem.

Executive Summary

For more details on this report – Request for Sample

Remote Monitoring Wearables Market Dynamics: Drivers & Restraints

The rising prevalence of chronic diseases is significantly driving the remote monitoring wearables market growth

According to the World Health Organization, chronic diseases like diabetes, cardiovascular diseases, and respiratory disorders account for over 70% of global deaths. These conditions often require regular tracking of vital signs such as blood glucose, blood pressure, heart rate, and oxygen levels, which wearables can now monitor in real time. Continuous Glucose Monitors (CGMs) like the Abbott FreeStyle Libre and Dexcom G7 allow patients to track blood sugar levels 24/7. This reduces the need for finger-prick testing and enables timely intervention, critical for millions of diabetics globally.

Smartwatches like the Apple Watch Series 9 and Samsung Galaxy Watch come equipped with ECG and heart rate monitoring, helping detect arrhythmias such as atrial fibrillation (AFib) early. For patients with a history of heart disease, these tools offer peace of mind and allow healthcare providers to intervene before emergencies occur

Chronic respiratory illnesses like COPD and asthma are also rising. Wearables with SpO2 sensors (e.g., Fitbit Sense, Garmin watches) help track oxygen saturation. This became especially relevant during the COVID-19 pandemic, where oxygen monitoring at home was essential. Remote wearables allow remote patient monitoring (RPM), reducing unnecessary hospital visits and admissions for chronic patients.

The integration of remote monitoring wearables into chronic disease management enhances patient autonomy, improves clinical outcomes, and reduces the burden on healthcare systems. As chronic conditions become more prevalent, particularly among aging populations, demand for these wearables will continue to surge.

Lack of clinical validation & standardization is hampering the remote monitoring wearables market's growth

Lack of clinical validation and standardization is a significant barrier to the growth of the remote monitoring wearables market, primarily because it undermines trust, reliability, and integration into formal healthcare systems. Many popular wearables like Fitbit, Garmin, or Apple Watch are marketed for health tracking, but not all are clinically validated. For instance, while the Apple Watch ECG feature is FDA-cleared, not all models or features (e.g., blood oxygen monitoring) meet the same medical-grade standards. This creates variability in data accuracy, making it difficult for healthcare professionals to rely on these readings for diagnosis or treatment.

Different devices use varied algorithms and sensor technologies to measure the same vital signs (like heart rate or sleep). For instance, two wearables may show different heart rate variability readings for the same user under the same conditions. Without standardized protocols, clinicians can't compare or validate results across brands or systems, which limits their clinical adoption.

Remote Monitoring Wearables Market Segment Analysis

The global remote monitoring wearables market is segmented based on product type, application, end-user, and region.

The smartwatches and fitness trackers from the product type segment are expected to hold 40.4% of the market share in 2024 in the remote monitoring wearables market

The smartwatches and fitness trackers segment grew from US$ 6.99 billion in 2022 to US$ 7.91 billion in 2023, owing to rising adoption in the global market.

The smartwatches and fitness trackers segment is the dominant force in the remote monitoring wearables market, largely due to widespread consumer adoption, multi-functionality, and rapid technological innovation. As the adoption is rising, major market players are developing advanced smartwatches, which further boosting the segment growth.

For instance, in March 2025, Amazfit launched the Amazfit Bip 6 smartwatch. Featuring a vibrant 1.97-inch AMOLED display, advanced health and heart rate monitoring, AI-powered fitness programs, offline navigation, and comprehensive sleep tracking, the Bip 6 is designed to support everyday fitness enthusiasts at each stage of their health journey.

Additionally, in February 2025, OPPO unveiled its latest flagship smartwatch, the OPPO Watch X2. Built to redefine wearable tech, the OPPO Watch X2 combines comprehensive health and fitness monitoring capabilities, premium design, and exceptional battery life. Equipped with cutting-edge sensors, the Watch X2 enables ECG Analysis, blood oxygen tracking, and a revolutionary 60-second health checkup for a comprehensive wellness experience. It also offers up to 5 days of use in Smart Mode and 16 days in Power Saver Mode with the use of next-gen silicon-carbon battery technology.

Remote Monitoring Wearables Market Geographical Analysis

North America is expected to dominate the global remote monitoring wearables market with a 42.38% share in 2024

North America led the global remote monitoring wearables market in 2022 with a market size of US$ 7.29 billion and reached further to US$ 8.30 billion in 2023.

North America, especially the United States known as the hub of the major market players, Apple, Fitbit/Google, Garmin, and Medtronic, all have significant operations in the region. Their proximity to innovation hubs accelerates product development, clinical partnerships, and go-to-market execution, which drives the market growth in North America.

The U.S. spends more per capita on healthcare than any other country, enabling rapid adoption of advanced technologies. Hospitals and health systems readily invest in wearables to improve outcomes and reduce readmissions. Medicare and many private insurers in the U.S. have established reimbursement codes for remote patient monitoring, creating a clear financial pathway for providers to prescribe and monitor wearables.

North American consumers show very high smartphone and broadband adoption, essential for wearable connectivity. This underpins widespread use of devices like Apple Watch and Fitbit, which integrate seamlessly with mobile health (mHealth) apps. The FDA’s clear guidance on digital health devices and its Pre-certification Pilot Program have made it easier for U.S. companies to bring clinically validated wearables to market quickly, further reinforcing North America’s lead.

Remote Monitoring Wearables Market Top Companies

Top companies in the remote monitoring wearables market include MedioTek Health Systems, BioIntelliSense, Inc., Apple Inc., Koninklijke Philips N.V., Garmin Ltd., SAMSUNG, Biobeat, Qardio, Inc., Medtronic, and Dexcom, Inc., among others.

Market Scope

Metrics | Details | |

CAGR | 15.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Smartwatches and Fitness Trackers, Continuous Glucose Monitors (CGMs), Wearable ECG Monitors, Remote Monitoring Patches, Smart Clothing, Biosensors, and Others |

Application | Chronic Disease Management, Fitness & Wellness Monitoring, General Health Tracking, Remote Patient Monitoring (RPM), Sleep Monitoring, Mental Health & Stress Monitoring, and Others | |

End-User | Hospitals & Clinics, Home Care Settings, Fitness Centers & Sports Facilities, Geriatric Care Facilities, Research Institutes, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global remote monitoring wearables market report delivers a detailed analysis with 62 key tables, more than 63 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.