RegTech Market Size

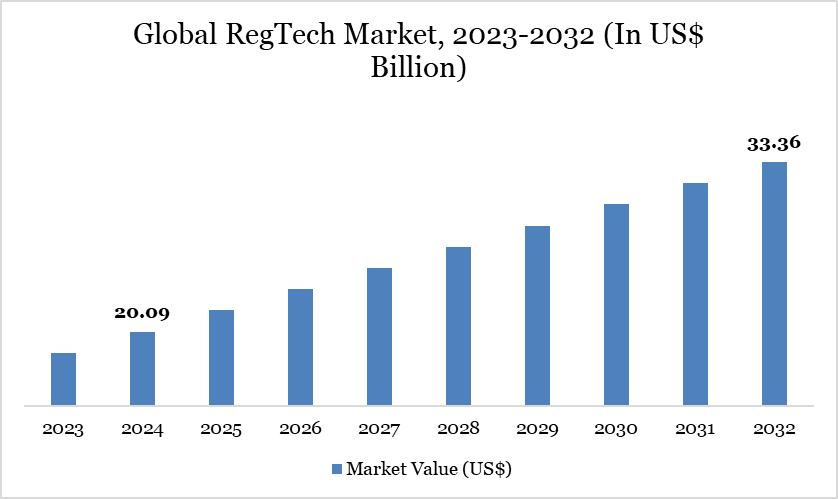

Global RegTech Market reached US$ 20.04 billion in 2024 and is expected to reach US$ 33.36 billion by 2032, growing with a CAGR of 6.75% during the forecast period 2025-2032.

The RegTech market is witnessing strong growth, driven by increasing regulatory complexity, rising financial crime risks, and the accelerating digital transformation of the financial sector. Financial institutions are under growing pressure to enhance compliance efficiency while reducing costs, leading to large-scale adoption of automated, cloud-native, and AI-powered regulatory solutions.

The surge in digital payments, open banking frameworks, and cross-border transactions is creating greater demand for scalable RegTech platforms that provide real-time monitoring, fraud detection, and automated reporting. Advanced technologies such as artificial intelligence, machine learning, blockchain, natural language processing, and robotic process automation (RPA) are playing a pivotal role in reshaping compliance, enabling predictive risk assessment, transparent audit trails, and faster regulatory change management.

Moreover, supportive government policies, stricter enforcement of anti-money laundering (AML) and know-your-customer (KYC) norms, and rising cybersecurity threats are further accelerating market adoption. While challenges such as high implementation costs and complex regional regulations remain, ongoing innovation and strategic partnerships between global players and fintech startups are expanding the reach of RegTech across both developed and emerging markets.

RegTech Market Trend

One major trend in the RegTech market is the shift from manual, siloed compliance processes to cloud-native and API-driven platforms that unify risk and compliance management. Financial institutions are increasingly adopting centralized compliance solutions that integrate fraud detection, AML monitoring, and regulatory reporting into a single digital framework. This shift reduces operational complexity, ensures real-time monitoring, and enables faster adaptation to evolving regulatory requirements, thereby transforming compliance into a strategic enabler rather than a cost burden.

Another key trend is the rise of AI- and ML-powered compliance automation, where advanced analytics and intelligent systems are driving innovation instead of traditional manual reviews. Leading players such as IBM, NICE Actimize, and Fenergo are setting benchmarks by offering AI-driven transaction monitoring, predictive risk modeling, and intelligent reporting systems. These solutions not only enhance detection accuracy and reduce false positives but also allow institutions to continuously update compliance capabilities through real-time insights. This trend is reshaping regulatory ecosystems into adaptive, data-driven platforms that improve transparency, efficiency, and trust.

Market Scope

Metrics | Details |

By Component | Solutions, Services, |

By Deployment | On-precises, Cloud based |

By Enterprises Size | Large Enterprises, SME’s |

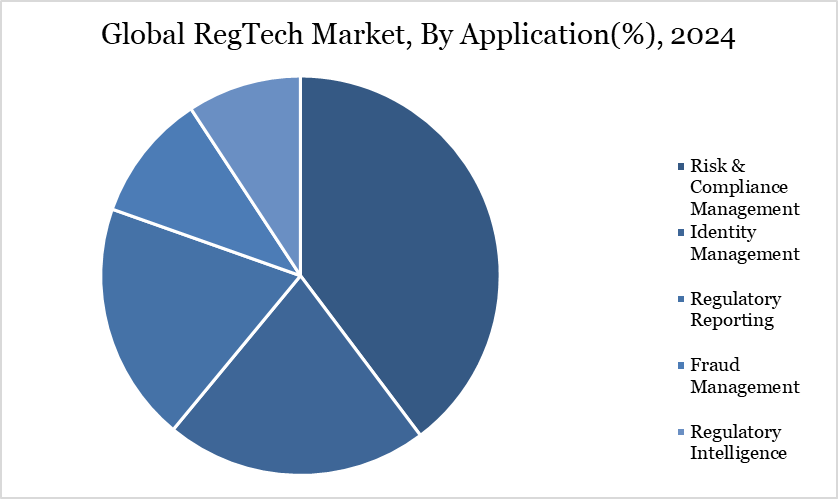

By Application | Risk & Compliance Management, Identity Management, Regulatory Reporting, Fraud Management, Regulatory Intelligence |

By Vertical | BFSI, Healthcare, Government, IT & Telecom, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising demand for advanced compliance and risk management solutions

The growing complexity of global regulatory frameworks and the surge in financial crimes are key drivers of the RegTech market, as financial institutions increasingly depend on advanced compliance technologies to achieve accuracy, transparency, and efficiency. AI- and ML-enabled tools are playing a central role in detecting fraudulent activities, strengthening AML monitoring, and streamlining real-time regulatory reporting. For example, IBM, NICE Actimize, and Fenergo are actively investing in next-generation platforms that combine cloud-native infrastructures, predictive analytics, and interactive dashboards to improve compliance outcomes.

Likewise, companies such as Thomson Reuters and Wolters Kluwer provide regulatory intelligence platforms designed to simplify policy interpretation, automate updates, and ensure cross-border compliance. Regulatory initiatives like GDPR in Europe, Dodd-Frank in the U.S., and PSD2 in the EU continue to accelerate adoption, while the rise in digital transactions worldwide amplifies demand for scalable solutions capable of handling high transaction volumes and complex global risk landscapes.

Cybersecurity challenges and regulatory complexities restraining growth

Persistent cybersecurity threats and intricate regulatory environments remain significant restraints on the RegTech market, as the adoption of AI-powered systems, open APIs, and cloud-native solutions increases exposure to data breaches, fraud attempts, and malicious cyberattacks. Several leading banks have recently faced ransomware and phishing incidents, highlighting the vulnerability of sensitive compliance and customer data.

Moreover, navigating region-specific regulations such as data localization requirements in India and China or stringent data privacy rules in Europe adds layers of cost and complexity to compliance operations. To address these challenges, institutions and vendors are compelled to adopt advanced encryption technologies, zero-trust security frameworks, and multi-layered monitoring systems. While critical for safeguarding systems, these additional investments often raise deployment costs and slow down adoption, creating near-term barriers to market growth.

Segment Analysis

The RegTech market is segmented based on component, deployment, enterprises size, application, vertical and region.

Rising Emphasis on Risk & Compliance Management Fuels RegTech Growth

The Risk & Compliance Management segment dominates the RegTech market, representing the largest share of adoption among financial institutions and regulators. Increasing demand for advanced fraud prevention, anti-money laundering (AML) surveillance, and automated reporting is driving banks and fintechs to embrace next-generation RegTech platforms.

Solutions such as AI-driven transaction monitoring, cloud-based compliance dashboards, and intelligent policy management systems are becoming mainstream. For instance, global leaders including IBM, NICE Actimize, and Fenergo are delivering cutting-edge compliance suites that set new standards for transparency and efficiency.

The rapid expansion of digital banking and open finance in markets like the US, UK, and Singapore is further amplifying the need for holistic compliance and risk management frameworks. Meanwhile, surging adoption of digital payments in India, Brazil, and Mexico is creating demand for scalable RegTech solutions capable of managing high transaction volumes and complex cross-border risks. Stricter regulations around AML, KYC, data protection, and real-time reporting are also accelerating adoption, compelling institutions to modernize legacy systems.

Geographical Penetration

North America Leads with AI-Powered Compliance, Cloud Integration, and Open Banking

North America is at the forefront of the RegTech market, driven by rapid adoption of advanced compliance solutions, strong regulatory oversight, and the presence of leading financial institutions alongside dynamic fintech players. The region leads in deploying AI-enabled fraud prevention, AML surveillance, and cloud-native compliance platforms, with major banks and technology providers investing heavily in building digital-first regulatory ecosystems.

Strict U.S. regulatory frameworks including Dodd-Frank, FINRA, and SEC requirements—are compelling financial institutions to implement automated systems for real-time reporting, risk assessment, and transaction monitoring. At the same time, the accelerating growth of open banking initiatives, digital payments, and fintech-driven innovation, supported by progressive policies, is fueling demand for secure, API-driven compliance tools.

Technology giants such as IBM, Microsoft, and Oracle play a pivotal role by delivering AI, blockchain, and cloud infrastructures that underpin the next generation of RegTech solutions. Meanwhile, Canada’s expanding fintech landscape and robust financial regulations, along with Mexico’s rapid shift toward digital banking, are further boosting adoption of agile and scalable compliance systems across the region.

Technological Analysis

Technological innovations are transforming the RegTech market by creating more intelligent, agile, and compliant financial ecosystems. The move from manual, fragmented compliance processes to cloud-based, API-enabled platforms is simplifying regulatory workflows and minimizing operational complexity. Increasing adoption of artificial intelligence (AI) and machine learning (ML) is driving advancements in fraud detection, anti-money laundering (AML) surveillance, and predictive risk modeling.

Blockchain and distributed ledger technologies are enhancing transparency and audit trails, while natural language processing (NLP) is streamlining regulatory change management by automating policy interpretation and compliance alignment. At the same time, real-time analytics and robotic process automation (RPA) are boosting accuracy, reducing human intervention, and enabling faster regulatory reporting. The integration of secure cloud environments and advanced cybersecurity solutions is further reinforcing data protection and compliance resilience.

Collectively, these technological breakthroughs are establishing RegTech as a cornerstone of modern compliance, shifting it from a regulatory obligation to a strategic enabler for financial institutions.

Competitive Landscape

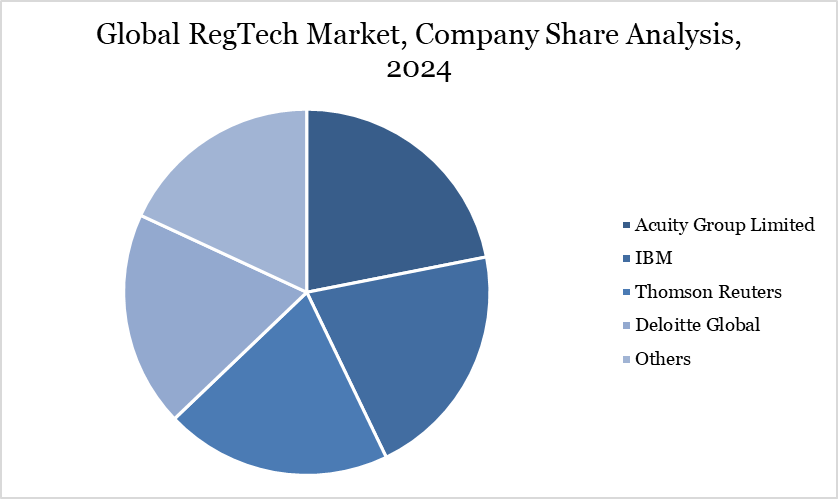

The major global players in the market include Acuity Group Limited, IBM, Thomson Reuters, Deloitte Global, Wolters Kluwer N.V., ACTICO GmbH, Fenergo , NICE Actimize, Chainalysis, London Stock Exchange plc and among others.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies