Global Procurement as a Service Market: Industry Outlook

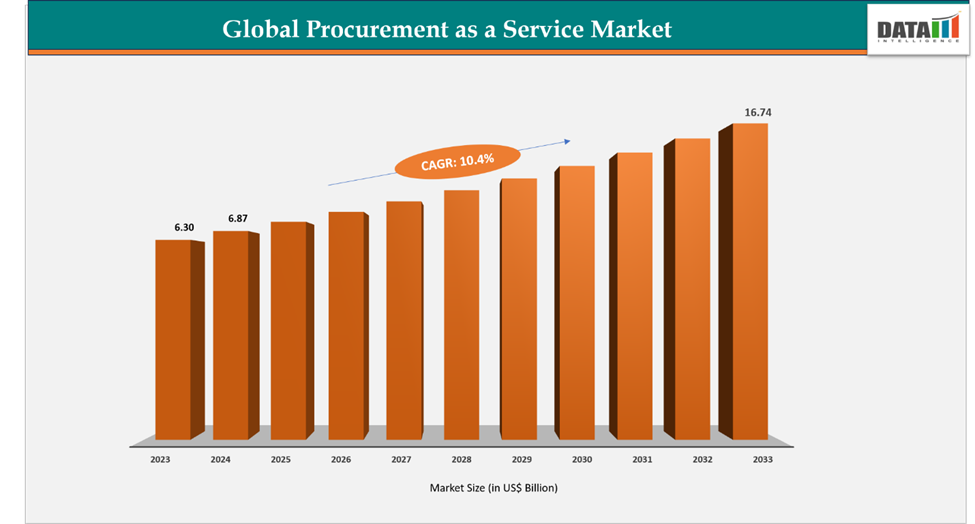

The global procurement as a service market reached US$6.30 billion in 2023, with a rise to US$6.87 billion in 2024, and is expected to reach US$16.74 billion by 2033, growing at a CAGR of 10.4% during the forecast period 2025–2033. The global Procurement as a Service market is witnessing steady expansion, driven by growing demand across industries including manufacturing, automotive, electronics, and healthcare. PaaS solutions are increasingly being adopted to streamline procurement processes, optimize supply chain operations, and achieve cost efficiencies. Growth is further fueled by technological advancements such as AI-driven predictive procurement, cloud-based platforms, and automation, alongside strategic collaborations, mergers, and acquisitions among procurement service providers.

The US leads the Procurement as a Service market, driven by adoption among large enterprises seeking enhanced procurement efficiency and cost optimization. For instance, Arkestro, the leading predictive procurement platform accelerating enterprise-scale procurement, announced a multi-year partnership with Valvoline Inc., a trusted leader in preventive automotive maintenance. Through this collaboration, Valvoline leveraged Arkestro's platform to improve speed, simplicity, and efficiency, achieving measurable cost reductions across both product and service categories. Supported by strong technological capabilities, robust enterprise adoption, and innovative platform providers, the US continues to dominate market growth.

Japan is emerging as a key market, focusing on expanding its procurement capabilities through strategic acquisitions and partnerships. In April 2024, Misumi Group announced its agreement to acquire Fictiv, a US-based provider of online parts procurement services, at an estimated total cost of US$350 million (approximately JPY 50.1 billion). Misumi plans to make Fictiv a wholly owned subsidiary via its US arm by June 2025, reflecting Japan’s strategic push to enhance global procurement capabilities. This acquisition underscores the country’s commitment to modernizing procurement operations and adopting advanced PaaS solutions for both domestic and international supply chains.

Key Market Trends & Insights

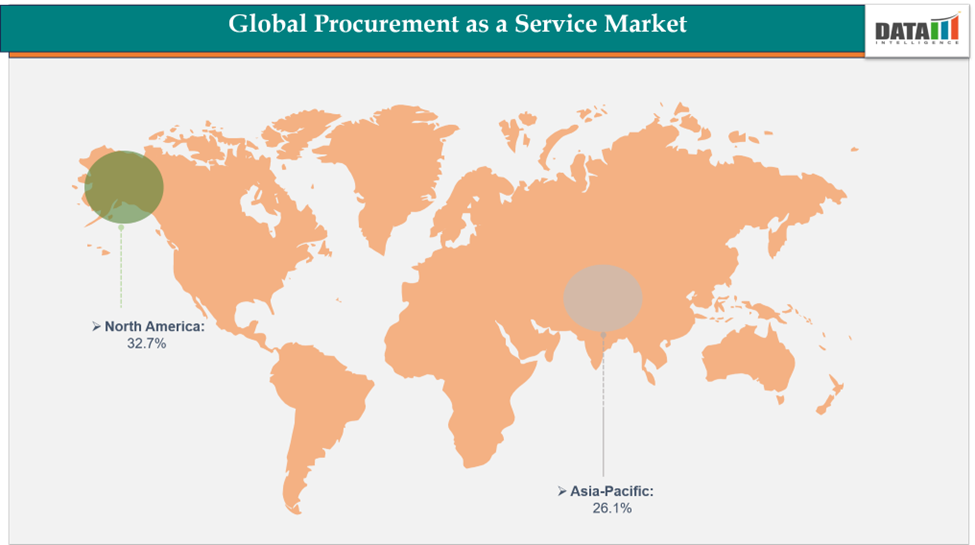

- North America accounted for approximately 32.7% of the global Procurement as a Service market in 2024 and is expected to retain its dominance throughout the forecast period. This leadership is supported by strong enterprise adoption, robust technological capabilities, and strategic investments in procurement transformation. For instance, The Hackett Group, Inc., a leading generative artificial intelligence (Gen AI) consultancy and executive advisory firm, released its 2025 Digital World Class Procurement research, highlighting how leading procurement organizations are navigating market volatility and redefining their role within enterprises. Initiatives such as these underscore North America’s continued focus on optimizing procurement processes and leveraging advanced PaaS platforms to drive efficiency and cost savings.

- Asia-Pacific is projected to be the fastest-growing region, driven by rising investments in digital procurement solutions, supply chain modernization, and automation. Japan, in particular, is strengthening its procurement capabilities through strategic acquisitions, such as its ongoing agreement in which Misumi Group is acquiring Fictiv, a US-based provider of online parts procurement services. This acquisition, valued at approximately USD 350 million (JPY 50.1 billion), is making Fictiv a wholly owned subsidiary via Misumi’s US arm by June 2025, reflecting the country’s commitment to continuously enhancing procurement efficiency and expanding global operational reach.

- The Strategic Sourcing segment remains the dominant product category due to its critical role in optimizing procurement workflows, supplier management, and cost control across industries. Its wide adoption across both enterprise and commercial sectors highlights its importance in driving technological innovation, operational efficiency, and enabling next-generation procurement capabilities.

Market Size & Forecast

- 2024 Market Size: US$6.87 Billion

- 2033 Projected Market Size: US$16.74 Billion

- CAGR (2025–2033): 10.4%

- North America: Largest market in 2024

- Asia-Pacific: Fastest-growing market

Market Dynamics

Driver: Strategic Partnerships and Acquisitions Boosting Global Capabilities

The global Procurement as a Service market is growing steadily as companies enhance their capabilities through strategic partnerships and acquisitions. Collaborations with specialized procurement and supply chain service providers are helping enterprises adopt advanced PaaS platforms more quickly, improve operational efficiency, and expand their global procurement reach.

For instance, in 2023, Accenture completed two acquisitions of firms specializing in reverse logistics and procurement services. These deals are enabling Accenture to expand its PaaS portfolio, offer comprehensive procurement solutions, and help enterprise clients achieve faster, more cost-effective, and resilient operations. Such strategic initiatives are reinforcing market growth and highlighting PaaS as a critical driver for global supply chain optimization.

Restraint: Limited SME Expertise in Adopting PaaS Solutions

Despite the increasing significance of procurement as a service, small and medium-sized enterprises (SMEs) face challenges due to limited expertise in implementing these platforms. Many SMEs find it difficult to integrate AI-powered tools, cloud-based systems, and predictive analytics into their procurement processes, which can slow adoption and reduce operational benefits.

For instance, several SMEs attempting to deploy PaaS solutions have encountered issues with platform configuration, employee training, and process optimization, emphasizing the need for simplified onboarding, intuitive interfaces, and professional support. Until these challenges are addressed, limited SME expertise is expected to remain a key barrier to broader market adoption.

For more details on this report, Request for Sample

Segmentation Analysis

The global procurement as a service market is segmented based on component, enterprise size, end-user and region.

Component: The Strategic Sourcing segment represents an estimated 30% of the global procurement as a service market.

Strategic sourcing plays a vital role in the PaaS ecosystem, helping enterprises streamline procurement processes, manage suppliers efficiently, and achieve cost savings across industries such as consumer goods, retail, technology, and industrial sectors. Providers in this segment focus on delivering end-to-end solutions that leverage AI-driven insights, advanced analytics, and cloud-based platforms for real-time procurement optimization.

The segment’s growth is fueled by rising demand for efficient supplier management, operational scalability, and cost-effective sourcing solutions. For example, on Feb. 13, 2024, Accenture (NYSE: ACN) signed an agreement to acquire Insight Sourcing, a strategic sourcing and procurement service provider. This acquisition is expanding Accenture’s capabilities to serve private equity firms and companies in consumer goods, retail, technology, and industrial sectors, highlighting the increasing strategic importance of comprehensive sourcing services.

Looking forward, the Strategic Sourcing segment is expected to continue dominating the PaaS market, driven by the need for streamlined procurement, stronger supplier collaboration, and optimized costs. While integration challenges and skill gaps persist, ongoing advancements in AI, process automation, and analytics are anticipated to support sustained growth in the segment.

Geographical Analysis

The North America procurement as a service market was valued at 32.7% market share in 2024

The North America Procurement as a Service market held an estimated 32.7% of the global market share in 2024, remaining the largest regional contributor. The region’s growth is being driven by increasing adoption of cloud-based procurement platforms, innovative partnerships, and technology solutions designed to streamline public sector and enterprise sourcing processes.

For instance, Euna Solutions, a leading provider of cloud-based solutions for the public sector, is partnering with Pavilion, the leading search platform for cooperative contracts. Through this collaboration, Euna Procure, powered by Bonfire, is being integrated with the Pavilion platform to provide users with a seamless experience in finding, accessing, and sharing cooperative contracts, thereby accelerating procurement processes. Such initiatives highlight North America’s continued leadership in leveraging advanced PaaS solutions to enhance efficiency and operational performance

The Asia-Pacific procurement as a service market was valued at 26.1% market share in 2024

The Asia-Pacific procurement as a service market accounted for an estimated 26.1% of the global market share in 2024 and is emerging as the fastest-growing region. Growth is being propelled by investments in procurement consulting, digital transformation, and enterprise adoption of advanced sourcing platforms across multiple industries.

For instance, Bain & Company is expanding its presence in the region through the acquisition of ArcBlue, a leading procurement consulting firm in Asia-Pacific. This acquisition is enabling Bain to provide comprehensive procurement solutions, enhance operational efficiency, and strengthen enterprise sourcing practices. Supported by government-backed programs, rising adoption of innovative platforms, and regional expertise, the Asia-Pacific is rapidly increasing its share of the global PaaS market.

Competitive Landscape

The major players in the procurement as a service market include Accenture, GEP, IBM, Coupa, Genpact, WNS Procurement, Infosys Limited, Capgemini, Wipro, and HCL Technologies Limited.

Accenture: Accenture is a global professional services and consulting firm offering a wide range of solutions in strategy, consulting, digital, technology, and operations. In the Procurement as a Service market, Accenture provides end-to-end procurement and sourcing solutions, leveraging AI-driven platforms, advanced analytics, and cloud-based tools to optimize supply chains, reduce costs, and enhance operational efficiency. The company strengthens its PaaS capabilities through strategic acquisitions and partnerships, such as its 2024 acquisition of Insight Sourcing, enabling it to deliver comprehensive procurement services across industries, including consumer goods, retail, technology, and industrial sectors.

Market Scope

| Metrics | Details | |

| CAGR | 10.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Component | Strategic Sourcing, Procure-to-Pay (P2P), Contract Management, Supplier Management, Category Management, Spend Analysis & Reporting |

| Enterprise Size | SME's, Large Enterprises | |

| End-User | IT & Telecom, Manufacturing, Retail & E-commerce, Healthcare, BFSI, Government, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global procurement as a service market report delivers a detailed analysis with 62 key tables, more than 58 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.