Pressure Ulcer Devices Market Size & Industry Outlook

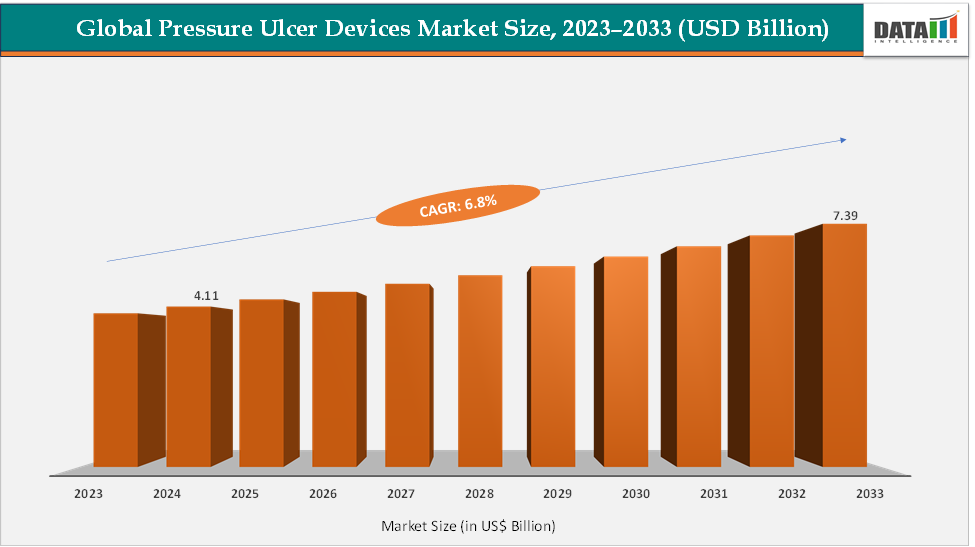

The global pressure ulcer devices market size reached US$ 4.11 Billion in 2024 from US$ 3.87 Billion in 2023 and is expected to reach US$ 7.39 Billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025-2033. The market is expanding primarily due to the growing geriatric population and rising incidence of immobility-related conditions, which increase the demand for advanced prevention and treatment solutions.

Hospitals and long-term care facilities are adopting dynamic support surfaces like Arjo’s Nimbus and Stryker’s IsoAir mattresses to reduce hospital-acquired pressure injuries and meet value-based care targets. Technological innovations, such as Hillrom’s Centrella Smart+ bed with integrated microclimate management, are gaining traction for their proven clinical benefits. The market further fuels the adoption by advanced dressings like Mölnlycke’s Mepilex Border and ConvaTec’s AQUACEL for both prevention and treatment. Together, these factors are driving sustained growth in the market.

Key Market Highlights

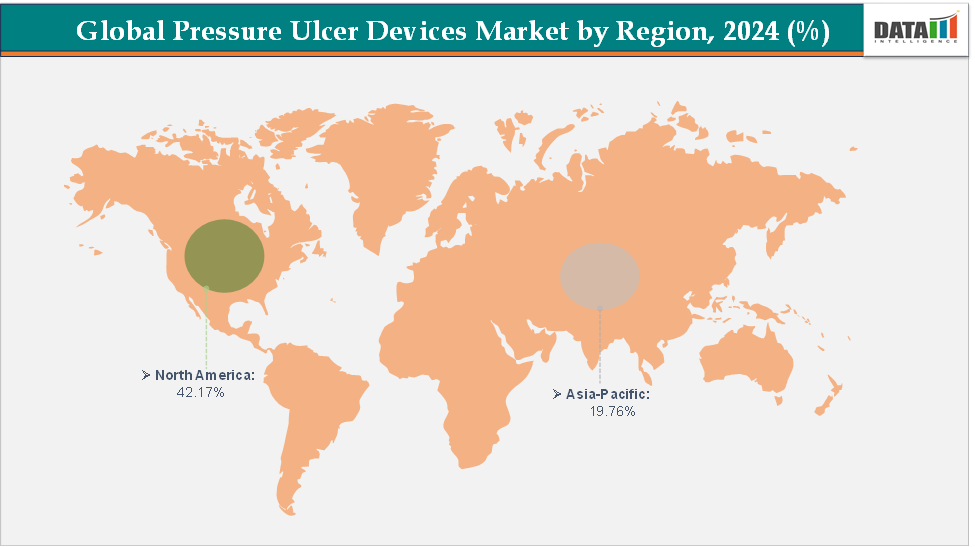

- North America dominates the pressure ulcer devices market with the largest revenue share of 42.17% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.7% over the forecast period.

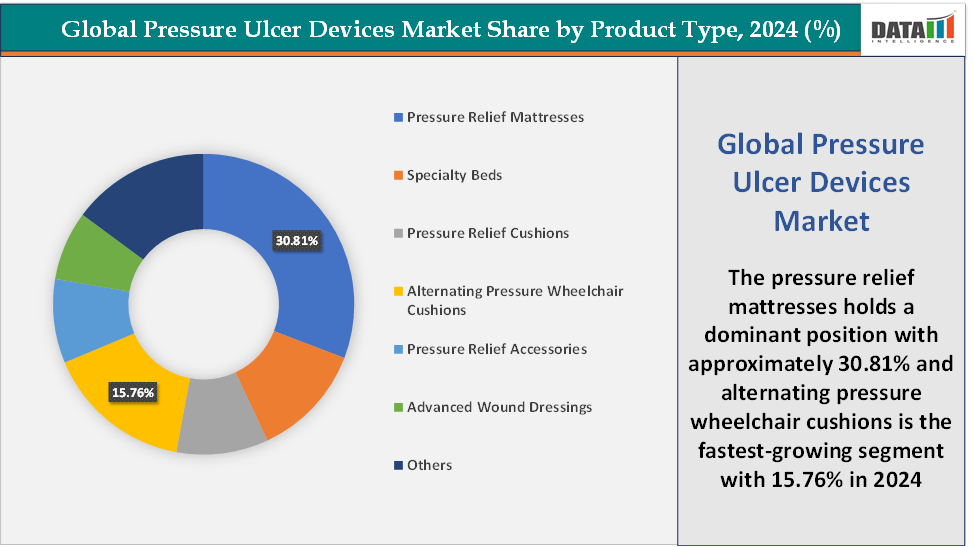

- Based on product type, the pressure relief mattresses segment led the market with the largest revenue share of 30.81% in 2024.

- The major market players in the pressure ulcer devices market are Stryker, Baxter (Hillrom), 3M, Arjo, Mölnlycke Health Care AB, Convatec Inc., Coloplast Group, and Smith+Nephew, among others

Market Dynamics

Drivers:The rising aging population and immobility are significantly driving the pressure ulcer devices market growth

The rising aging population and increasing rates of immobility are major factors significantly driving the growth of the pressure ulcer devices market. As populations around the world age, the prevalence of chronic conditions such as diabetes, cardiovascular disease, and post-surgical immobility rises, leaving a growing number of individuals at high risk for developing pressure ulcers.

For instance, according to the World Health Organization, by 2030, 1 in 6 people in the world will be aged 60 years or over. At this time, the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion. By 2050, the world’s population of people aged 60 years and older will double (2.1 billion). The number of persons aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million, highlighting a substantial expansion in the pool of patients requiring preventive and therapeutic interventions.

Pressure ulcers are particularly common among bedridden and wheelchair-bound patients, making effective support surfaces, dressings, and advanced wound therapies crucial in both hospitals and long-term care facilities. This demographic trend is reflected in market growth projections, driven largely by the demand from elderly and immobile populations. To address these clinical needs, manufacturers have developed a range of approved devices designed for prevention and treatment.

For instance, Arjo’s Auralis Plus offers a dynamic mattress system to redistribute pressure and prevent ulcer formation, Hillrom’s Centrella Smart+ Bed integrates advanced technology to monitor patient positioning and reduce pressure injury risk, and 3M’s V.A.C. Therapy NPWT system promotes healing of existing ulcers using negative pressure wound therapy. Additionally, Mölnlycke’s Mepilex Border dressings provide moisture management and protection for both preventive and therapeutic care. The combination of a growing elderly population, increased immobility, and rising awareness of the clinical and economic burden of pressure ulcers is therefore fueling the adoption of these advanced devices, making them a central driver of sustained market expansion globally.

Restraints: Limited clinical validation for emerging technologies is hampering the growth of the market

The growth of the pressure ulcer devices market is being hampered by the limited clinical validation of emerging technologies, which creates uncertainty among healthcare providers regarding their effectiveness and cost-efficiency. Many of the newest innovations, such as sensor-enabled mattresses, smart overlays, and hybrid dynamic support surfaces, promise real-time monitoring, pressure mapping, and personalized care, but there is a lack of large-scale, peer-reviewed clinical studies demonstrating their superiority over traditional devices. This scarcity of robust clinical data makes hospitals and long-term care facilities hesitant to replace established systems with these novel solutions, particularly given the high upfront costs of advanced mattresses or NPWT-integrated beds.

Even though promising products such as Hillrom’s Centrella Smart+ Bed and ConvaTec’s Avelle NPWT system offer innovative prevention and treatment features, their uptake is constrained by the need for validated trials to prove efficacy and cost-effectiveness. This gap between technological innovation and evidence-based clinical adoption highlights a key restraint in the market, where cautious decision-making by healthcare institutions slows the commercialization and widespread deployment of cutting-edge pressure ulcer management solutions.

For more details on this report – Request for Sample

Segment Analysis

The global pressure ulcer devices market is segmented based on product type, stage, end-user, and region.

Product Type: The pressure relief mattresses segment is dominating the pressure ulcer devices market with a 30.81% share in 2024

The pressure relief mattresses segment is currently dominant in the pressure ulcer devices market, driven by their extensive application across hospital, long-term care, and home care settings, where they serve as a primary preventive measure against pressure ulcers in patients with limited mobility. These mattresses are designed to redistribute pressure, enhance patient comfort, and reduce the incidence of skin breakdown, making them an essential tool in both clinical and home-based care.

Advanced products like the PURAP Pressure Relief Mattress System utilize proprietary 3-layer fluid-based flotation technology, which has been clinically tested at Stanford University Hospital to deliver exceptionally low peak pressures, outperforming many standard alternating air-loss mattresses. Similarly, the Drive Medical Med-Aire Plus Alternating Pressure and Low Air Loss Mattress System offers alternating pressure cycles combined with low air loss, ensuring effective prevention and treatment of pressure ulcers while maintaining patient comfort and skin integrity.

The effectiveness of these products, along with increasing awareness of the clinical and economic burden of pressure ulcers, has led healthcare providers to prioritize investment in high-quality support surfaces. As a result, the pressure relief mattress segment not only maintains a strong market presence but also continues to attract rapid adoption due to its proven clinical benefits and versatility, reinforcing its position as a cornerstone of pressure ulcer management strategies worldwide.

The alternating pressure wheelchair cushions segment is the fastest-growing in the pressure ulcer devices market, with a 15.76% share in 2024

The alternating pressure wheelchair cushion segment is currently the fastest-growing category in the pressure ulcer devices market, driven by the increasing number of individuals with mobility impairments and growing awareness of pressure ulcer prevention. Patients who rely on wheelchairs, particularly the elderly and those with spinal cord injuries, stroke, or multiple sclerosis, spend prolonged periods seated, which significantly increases their risk of developing pressure ulcers. This has created a surge in demand for innovative seating solutions that can redistribute pressure and enhance comfort.

Products like the MobiCushion, featuring rechargeable batteries and low air loss technology, and the Vive Health Alternating Seat Cushion, suitable for both wheelchairs and office chairs, exemplify advancements in this segment. These cushions use alternating air cells to redistribute pressure, improve blood circulation, and minimize tissue deformation, making them highly effective for both prevention and management of pressure injuries. Technological innovations, including hybrid materials and sensor-enabled designs, further enhance their functionality and patient compliance.

The expansion is fueled not only by technological improvements but also by an increased focus on home healthcare and outpatient care, where patients require portable, easy-to-use solutions. As healthcare providers and caregivers increasingly prioritize patient comfort, mobility, and preventive care, alternating pressure wheelchair cushions are becoming essential devices, driving robust adoption and establishing this segment as the fastest-growing within the pressure ulcer devices market.

Geographical Analysis

North America is expected to dominate the global pressure ulcer devices market with a 42.17% in 2024

North America is the dominant region in the global pressure ulcer devices market, primarily due to its advanced healthcare infrastructure, high prevalence of chronic conditions, and significant investments in medical technology. This leadership is reinforced by a robust regulatory environment, strong healthcare expenditure, and widespread adoption of technologically advanced medical devices.

US Pressure Ulcer Devices Market Trends

The presence of leading manufacturers and innovators in the US has accelerated the introduction of FDA-approved solutions that address both prevention and treatment of pressure ulcers. For instance, Prelivia, a neurostimulation device that enhances blood circulation to reduce the risk of pressure injuries in bedridden or wheelchair-bound patients, and the SEM Scanner, a wireless handheld device that detects early-stage tissue damage, enabling timely clinical intervention before visible ulcers develop.

Additionally, devices like the Topical Oxygen Chamber for Extremities (TOCE) provide humidified oxygen therapy to aid in the healing of chronic skin ulcers. The strong focus on research and development, combined with a high incidence of conditions such as immobility, diabetes, and obesity that increase pressure ulcer risk, has driven widespread adoption of these advanced devices in hospitals, long-term care facilities, and home care settings.

Novel product launches also further boosting the market growth in the US. For instance, in September 2025, Smith+Nephew launched the CENTRIO Platelet-Rich-Plasma (PRP) System, a biodynamic hematogel derived from a patient’s own platelets and plasma that, once applied, may assist the natural healing process by maintaining a moist wound environment. CENTRIO PRP System can help manage chronic exuding wounds, including pressure ulcers.

The Asia Pacific region is the fastest-growing region in the global pressure ulcer devices market, with a CAGR of 6.7% in 2024

The Asia Pacific (APAC) region is currently the fastest-growing market for pressure ulcer devices, driven by a combination of demographic shifts, technological innovation, and growing awareness of pressure ulcer prevention and treatment. A major factor behind this rapid growth is the aging population in countries such as China, Japan, and India, which has led to an increased prevalence of chronic conditions like diabetes, vascular diseases, and immobility, all of which heighten the risk of pressure ulcers.

Technological advancements have also significantly contributed to market expansion, with innovations such as negative pressure wound therapy (NPWT) systems, advanced dressings, and sensor-integrated support surfaces improving both prevention and treatment outcomes. Notable approved products in the region include 3M’s V.A.C. Therapy NPWT system, PICO sNPWT system, and RENASYS tNPWT, which have demonstrated clinical efficacy in promoting wound healing and preventing pressure injuries. The rising prevalence of immobility, coupled with expanding home healthcare services, has created a growing demand for portable and easy-to-use devices such as alternating pressure cushions and dynamic support surfaces. Altogether, the combination of an aging population, rising disease burden, technological innovation, and increasing healthcare infrastructure positions APAC as a rapidly evolving and highly dynamic market.

Europe Pressure Ulcer Devices Market Trends

The European pressure ulcer devices market is witnessing substantial growth, driven by a combination of demographic trends, healthcare advancements, and increasing awareness of pressure ulcer prevention and management. A major factor fueling this expansion is Europe’s aging population, with over 20% of the population aged 65 or older, leading to higher incidences of chronic conditions such as diabetes, vascular diseases, and immobility, all of which significantly increase the risk of developing pressure ulcers.

Technological advancements in wound care, including negative pressure wound therapy (NPWT) systems, bioengineered dressings, and advanced foam and gel support surfaces, have improved treatment efficacy and patient outcomes, driving adoption across hospitals, long-term care facilities, and home healthcare settings. Countries such as Germany, France, and the United Kingdom lead the regional market due to their well-established healthcare infrastructure, supportive reimbursement policies, novel product launches, and initiatives promoting the use of advanced wound care and pressure ulcer prevention technologies.

For instance, in May 2025, A “transformative” pressure care solution, called Tidewave, which gently and continuously moves the user in harmony with their support surface, is now available in the UK. Tidewave is a pressure care mattress that automatically turns patients prone to pressure ulcers. According to medtech company Tidewave Medical, the developer of Tidewave, it is the world’s first continuous movement system. Tidewave can both prevent and heal pressure ulcers, including complex stage 4 pressure ulcers. The mattress further enhances patient comfort and dignity with quiet, automated operation.

Competitive Landscape

Top companies in the pressure ulcer devices market include Stryker, Baxter (Hillrom), 3M, Arjo, Mölnlycke Health Care AB, Convatec Inc., Coloplast Group, and Smith+Nephew, among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Pressure Relief Mattresses, Specialty Beds, Pressure Relief Cushions, Alternating Pressure Wheelchair Cushions, Pressure Relief Accessories, Advanced Wound Dressings, and Others |

| Stage | Stage I, Stage II, Stage III, and Stage IV | |

| End-User | Hospitals, Specialty Clinics, Homecare Settings, Nursing Homes, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global pressure ulcer devices market report delivers a detailed analysis with 56 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here