Premenstrual Syndrome Treatment Market Size & Industry Outlook

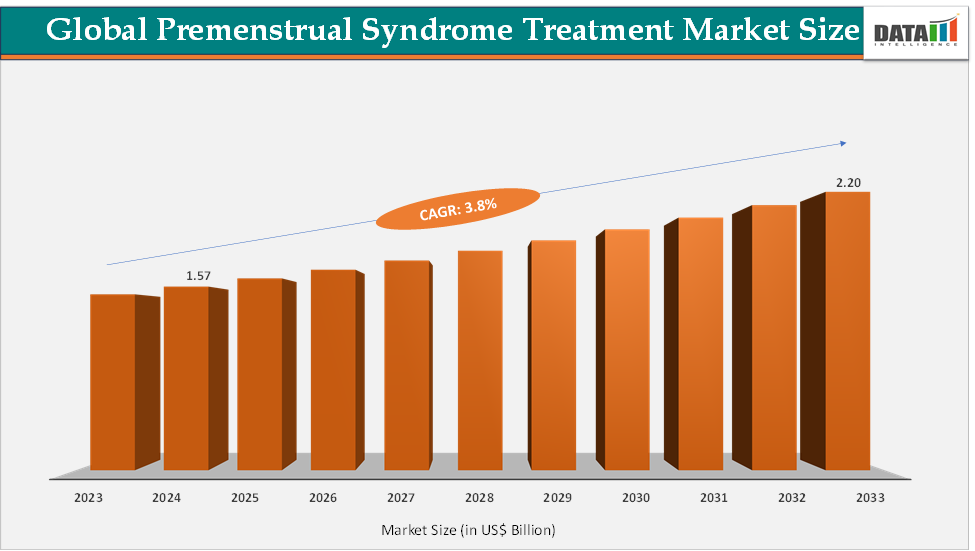

The global premenstrual syndrome treatment market size reached US$ 1.57 Billion in 2024 from US$ 1.52 Billion in 2023 and is expected to reach US$ 2.20 Billion by 2033, growing at a CAGR of 3.8% during the forecast period 2025-2033. The Premenstrual Syndrome (PMS) treatment market is experiencing steady momentum as growing awareness of women’s health and the rising demand for effective symptom management drive adoption of both prescription and over-the-counter solutions. While hormonal therapies, such as oral contraceptives and estrogen–progestin combinations, remain the most widely used treatment options, there is significant expansion in the use of non-hormonal approaches, including SSRIs, NSAIDs, and nutritional supplements, reflecting a shift toward personalized and accessible care.

The market is also being shaped by the rapid expansion of online pharmacies and telemedicine platforms, which make both prescription and OTC products more accessible to younger and tech-savvy consumers. At the same time, innovation in women’s health is accelerating, with companies like Bayer advancing non-hormonal agents such as elinzanetant in late-stage trials and Pfizer exploring SSRI variants tailored for PMS relief, signaling a strong pipeline for more targeted therapies. Collectively, these factors are broadening treatment choices, improving patient adherence, and reinforcing the market’s long-term growth trajectory.

Key Market Trends & Insights

Key trends in the PMS treatment market highlight a shift toward non-hormonal and natural therapies, as consumers increasingly prefer SSRIs, NSAIDs, and supplements like chasteberry, magnesium, and vitamin B6 over long-term hormonal use. The expansion of digital health and online pharmacies is reshaping access, particularly in emerging markets, with e-commerce and telemedicine platforms driving OTC sales and prescription adherence. These dynamics collectively reflect a market that is diversifying, digitalizing, and moving toward more patient-centric and accessible treatment solutions.

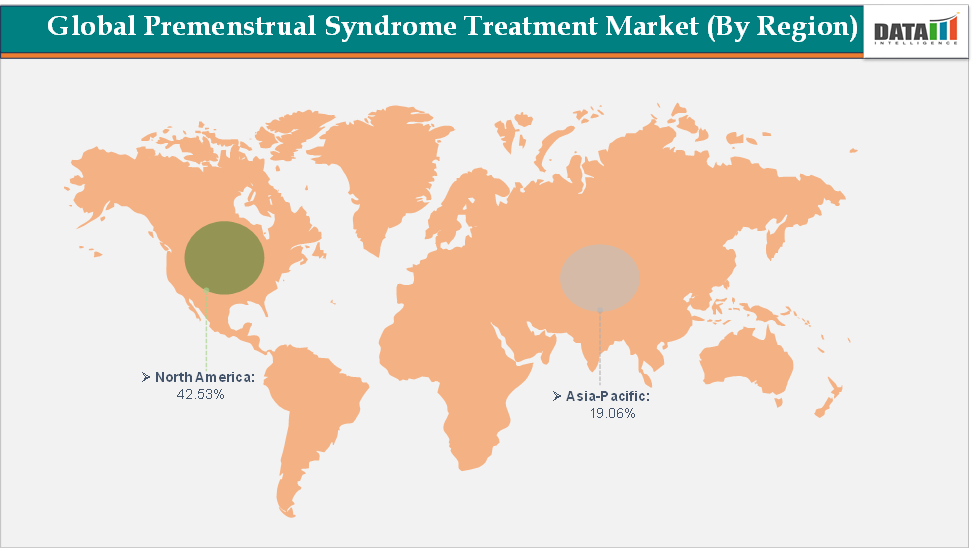

North America dominates the premenstrual syndrome treatment market with the largest revenue share of 42.53% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 3.7% over the forecast period.

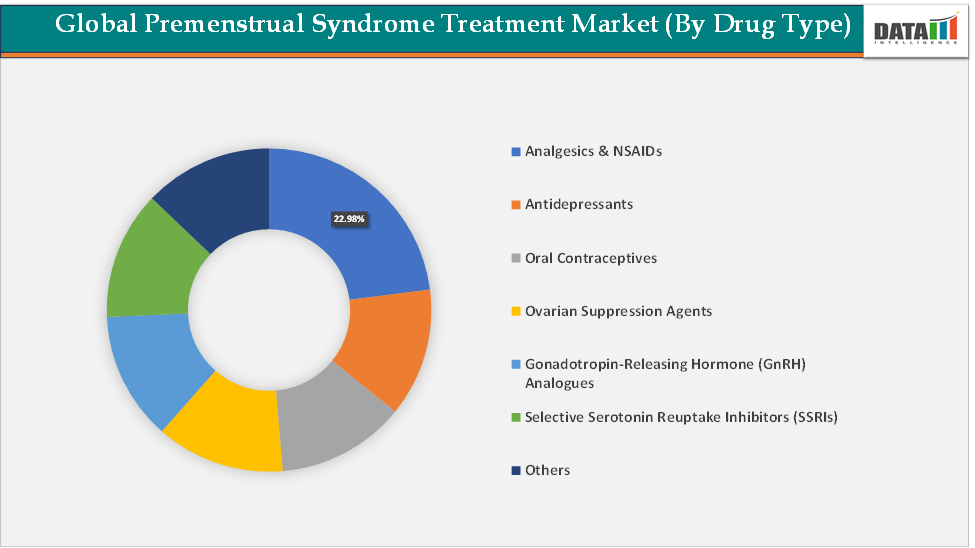

Based on application, the infectious diseases segment led the market with the largest revenue share of 22.98% in 2024.

The major market players in the premenstrual syndrome treatment market are Haleon Group, Bayer, Eli Lilly and Company, GSK, Lundbeck A/S, Pfizer Inc., AstraZeneca, Novartis International AG, and MetP Pharma AG, among others

Market Size & Forecast

2024 Market Size: US$ 1.57 Billion

2033 Projected Market Size: US$ 2.20 Billion

CAGR (2025–2033): 3.8%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

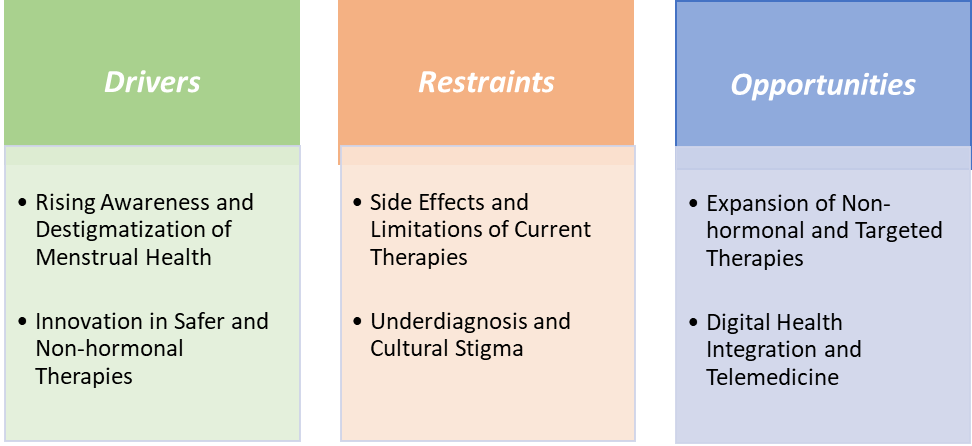

Drivers-Rising awareness and destigmatization of menstrual health are significantly driving the premenstrual syndrome treatment market growth

The rising awareness and destigmatization of menstrual health are one of the most influential forces driving the growth of the market, as they directly impact diagnosis rates, patient demand, and treatment adoption. Historically, menstruation and related conditions like PMS and PMDD were rarely discussed openly due to cultural taboos, leading to underdiagnosis and self-management with home remedies. However, in recent years, global awareness campaigns by NGOs, governments, and healthcare organizations have helped normalize conversations around menstrual health.

For instance, initiatives like UNESCO’s menstrual hygiene education programs in Asia and Africa, as well as global campaigns like “Period Positive,” have increased knowledge of menstrual-related disorders and encouraged women to seek medical care. Social media has also played a pivotal role, platforms such as Instagram and TikTok have become channels where influencers, healthcare professionals, and advocacy groups spread information about PMS symptoms and available treatments, making the topic more mainstream. This cultural shift is translating into higher patient volumes seeking professional help and consequently expanding the market for prescription drugs like SSRIs and hormonal contraceptives, as well as OTC remedies such as NSAIDs and supplements.

Furthermore, employers and insurers are beginning to recognize PMS as a factor in workplace productivity and absenteeism, leading to its inclusion in wellness programs, a move that further drives treatment uptake. Collectively, these trends show how breaking the stigma and spreading awareness are not only empowering women to seek care but also creating a fertile environment for market expansion across clinical, consumer health, and digital health channels.

Restraints-Side effects and limitations of current therapies are hampering the growth of the premenstrual syndrome treatment market

The side effects and limitations of current therapies are major factors restraining the growth of the market, as they directly affect patient adherence, physician prescribing patterns, and overall market acceptance. Widely used SSRIs such as fluoxetine or sertraline are effective for mood-related PMS and PMDD symptoms but are often associated with side effects, including nausea, insomnia, sexual dysfunction, and weight gain. Many women discontinue these treatments prematurely, reducing long-term demand. Similarly, NSAIDs like ibuprofen and naproxen are first-line options for pain and cramping, but prolonged use carries risks of gastrointestinal bleeding, ulcers, and kidney damage, limiting their suitability for chronic monthly use.

Hormonal contraceptives, another cornerstone therapy, can cause adverse effects such as breakthrough bleeding, headaches, breast tenderness, and, in some cases, an elevated risk of cardiovascular issues, which makes some women reluctant to use them despite their efficacy. For severe cases treated with GnRH analogues, side effects like hot flashes, bone density loss, and high costs further restrict adoption to niche patient groups. In addition, many women perceive conventional medications as too aggressive for what they consider a “natural” monthly condition, prompting them to turn to herbal remedies or lifestyle adjustments instead of pharmacological therapies.

These concerns are compounded in emerging markets, where limited healthcare access and poor awareness of safe usage amplify fears about side effects. For pharmaceutical companies, this translates into slower market penetration, higher discontinuation rates, and greater pressure to develop safer, more tolerable alternatives. This restraint is precisely why non-hormonal innovations like Bayer’s elinzanetant and nutraceutical-based approaches are gaining traction, as they attempt to bridge the gap left by the limitations of existing options.

For more details on this report – Request for Sample

Premenstrual Syndrome Treatment Market, Segment Analysis

The global premenstrual syndrome treatment market is segmented based on drug type, indication, distribution channel, and region.

Drug Type-The analgesics & NSAIDs segment is dominating the premenstrual syndrome treatment market with a 22.98% share in 2024

The analgesics & NSAIDs segment is the dominant segment in the PMS treatment market, primarily due to its accessibility, affordability, and effectiveness in managing the most common physical symptoms of PMS, such as menstrual cramps, headaches, and joint pain. Most women experiencing mild-to-moderate PMS opt for over-the-counter solutions before seeking prescription therapies, making NSAIDs like ibuprofen, naproxen, and aspirin household staples. Products such as Midol, Advil, and Aleve are widely recognized and used globally, contributing significantly to market volume. The segment’s dominance is further reinforced by the rapid growth of OTC retail channels and e-commerce platforms, which allow easy, discreet access to these medications.

Additionally, NSAIDs offer a fast-acting solution for pain relief without the hormonal side effects associated with oral contraceptives or the psychiatric effects of SSRIs, making them the preferred first-line treatment for a large proportion of women. This high volume usage ensures that analgesics & NSAIDs hold the largest share by user base, even though revenue per patient may be lower compared to prescription therapies. Furthermore, companies continue to innovate within this segment by offering combination products, such as Midol Complete, which pairs NSAIDs with caffeine or vitamins to enhance efficacy, further strengthening market leadership. Overall, the segment’s widespread acceptance, OTC availability, and effectiveness for the majority of PMS sufferers solidify its dominant position in the market.

Geographical Analysis

North America is expected to dominate the global premenstrual syndrome treatment market with a 42.53% in 2024

The North America region dominates the global market due to a combination of high awareness, advanced healthcare infrastructure, and widespread accessibility of both prescription and over-the-counter (OTC) treatments. The region benefits from strong public health initiatives and educational campaigns that have destigmatized menstrual health, encouraging more women to seek treatment for PMS and PMDD. The United States, in particular, leads in the adoption of innovative therapies, supported by regulatory frameworks that facilitate faster approvals and reimbursement for prescription medications. Widely used products such as SSRIs (fluoxetine, sertraline), NSAIDs (ibuprofen, naproxen), and oral contraceptives (Yasmin, Loestrin) are easily available through pharmacies and online platforms, which strengthens patient access and adherence.

OTC brands like Midol, Advil, and Aleve are household names, driving high-volume usage among women with mild-to-moderate PMS symptoms. North America also benefits from a mature digital health ecosystem, with telemedicine platforms enabling remote consultations and home delivery of prescription therapies, making care more convenient, especially for working women and younger demographics. Pharmaceutical companies such as Bayer, Pfizer, Eli Lilly, and other emerging players are actively investing in research and development in this region, introducing novel treatments like Bayer’s non-hormonal elinzanetant and exploring SSRIs tailored for PMDD, which strengthens the pipeline and attracts early adoption.

The Asia Pacific region is the fastest-growing region in the global premenstrual syndrome treatment market in 2024

The Asia-Pacific region is the fastest-growing market for PMS treatments due to rising awareness of women’s health, increasing healthcare access, and a growing acceptance of both prescription and over-the-counter (OTC) therapies. Countries such as India, China, Japan, and South Korea are witnessing a cultural shift toward openly discussing menstrual health, supported by government initiatives, NGO campaigns, and digital health education platforms that encourage women to seek treatment for PMS and PMDD. The large population base, combined with increasing urbanization and disposable income, has expanded access to healthcare facilities, pharmacies, and e-commerce channels, making both NSAIDs and SSRIs more readily available.

Widely used products in the region include NSAIDs like ibuprofen and naproxen (brands such as Advil and Combiflam), SSRIs like fluoxetine and sertraline, and oral contraceptives like Yasmin and Marvelon. OTC nutraceuticals and herbal remedies, including magnesium, vitamin B6, calcium, and chasteberry-based supplements, are also rapidly gaining popularity among health-conscious consumers seeking natural alternatives. The rise of telemedicine and online pharmacy platforms has further accelerated adoption, allowing women in semi-urban and rural areas to access consultation and treatment discreetly.

Pharmaceutical companies are increasingly targeting the Asia-Pacific for product launches and clinical trials due to lower regulatory barriers and the large, untreated population. Additionally, younger demographics, particularly millennials and Gen Z, are more receptive to wellness-focused approaches, digital apps for menstrual tracking, and subscription-based delivery of PMS management products. The combination of increasing awareness, evolving consumer behavior, rising healthcare expenditure, and expanding digital access positions the Asia-Pacific as a high-growth region.

Competitive Landscape

Top companies in the premenstrual syndrome treatment market include Haleon Group, Bayer, Eli Lilly and Company, GSK, Lundbeck A/S, Pfizer Inc, AstraZeneca, Novartis International AG, and MetP Pharma AG , among others.

Market Scope

Metrics | Details | |

CAGR | 3.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Type | Analgesics & NSAIDs, Antidepressants, Oral Contraceptives, Ovarian Suppression Agents, Gonadotropin-Releasing Hormone (GnRH) Analogues, Selective Serotonin Reuptake Inhibitors (SSRIs), and Others |

Indication | Mild-to-Moderate PMS and Severe PMS | |

Distribution Channel | Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global premenstrual syndrome treatment market report delivers a detailed analysis with 59 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here