Polyvinyl Chloride Market Size

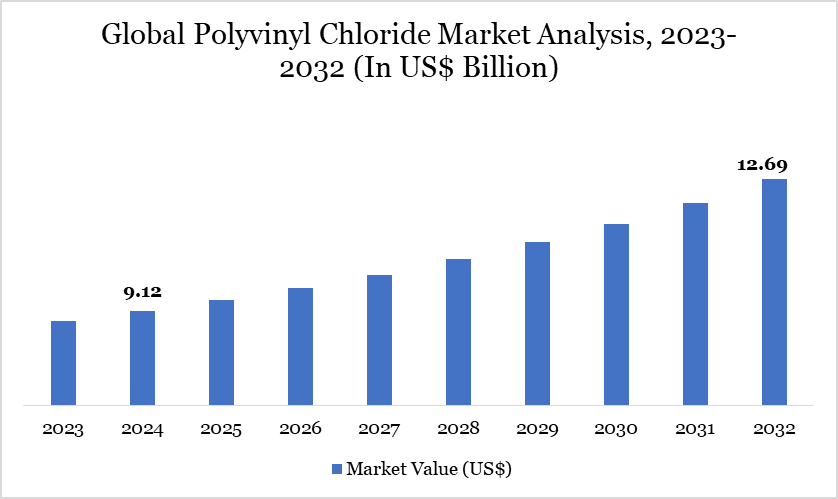

Polyvinyl Chloride Market size reached US$ 9.12 billion in 2024 and is expected to reach US$ 12.69 billion by 2032, growing with a CAGR of 4.22% during the forecast period 2025-2032.

The global polyvinyl chloride (PVC) market is set for significant expansion, propelled by substantial demand in various end-use sectors, including building, packaging and healthcare. As urbanization accelerates in growing economies such as India and Japan, the demand for economical, resilient and versatile materials has increased. The adaptability of PVC facilitates its widespread application in construction elements such as pipes, fittings, window frames and flooring.

In 2022, China became the foremost global user of PVC, a trend anticipated to continue due to its extensive infrastructure projects. The medical sector is increasingly demanding PVC-based products, including IV containers, tubing and blood bags, owing to the material's chemical resilience and flexibility.

The packaging sector substantially enhances market expansion by utilizing PVC's barrier characteristics and durability in the manufacture of bottles and blister packs. Ongoing advancements and sustainable alternatives, such as bio-based plasticizers, are favorably influencing the market forecast.

Polyvinyl Chloride Market Trend

The polyvinyl chloride market is seeing changing trends focused on technological innovations and sustainability. Manufacturers are diligently spending in research and development to launch high-performance PVC grades with superior physical and chemical qualities. This encompasses the creation of sophisticated additives that enhance PVC's versatility in industries such as automotive and electronics.

A significant trend is the rising utilization of bio-based plasticizers sourced from renewable materials, intended to mitigate environmental impact. The recyclability of PVC is being recognized as worldwide circular economy projects expand. In December 2023, INEOS introduced a new range of PVC products that exhibit a 37 percent reduction in carbon footprint compared to the European industry average, signifying a significant transition towards sustainable production techniques.

Moreover, the increasing demand for adaptable yet resilient materials in medical and packaging applications persists in fostering innovation. The tendency of substituting conventional materials such as metal and concrete with PVC in construction signifies its growing prevalence in urban development.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Product | Rigid, Flexible |

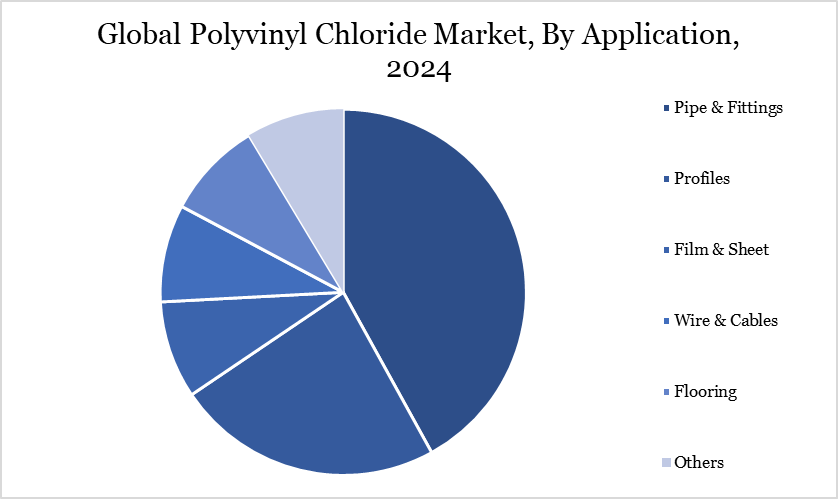

| By Application | Pipe & Fittings, Profiles, Film & Sheet, Wire & Cables, Flooring, Others |

| By End-user | Building & Construction, Packaging, Automotive, Electrical & Electronics, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Polyvinyl Chloride Market Dynamics

Infrastructure Expansion Propelling PVC Utilization in Construction

The primary factor propelling the PVC market is the rising demand from the building industry, particularly in developing nations. The cost-effectiveness, simplicity of installation and remarkable durability of PVC render it a favored substitute for traditional materials like wood and metal. The chemical resistance and durability of the material are crucial for constructing components such as pipes and fittings, which are fundamental to water supply and drainage systems.

The insulating characteristics of PVC render it suitable for electrical wiring, while its structural adaptability facilitates various construction applications. The increase in urbanization, especially in nations such as China and India, has resulted in intensified residential and commercial construction, therefore augmenting the utilization of PVC. In 2022, China constituted the predominant portion of PVC demand and due to continuous infrastructure development, it is anticipated to maintain its supremacy. These dynamics highlight the crucial significance of building in the future expansion of the PVC market.

Environmental Oversight and Hazardous Additives

The PVC market encounters substantial limitations owing to environmental and health apprehensions. The industrial method utilizes chlorine, potentially resulting in the release of toxic chemicals, including the carcinogen vinyl chloride. Toxic-Free Future revealed that thousands of pounds of vinyl chloride are emitted during PVC production in the United States, posing threats to public health and causing environmental damage.

The incorporation of chemicals such as plasticizers and stabilizers may lead to the leaching of compounds like phthalates and heavy metals into ecosystems. These issues have necessitated more stringent regulatory control and an increasing consumer antipathy to non-sustainable materials. The recycling of PVC entails technological and logistical difficulties, rendering it less advantageous than other recyclable polymers. These challenges are prompting manufacturers to implement sustainable practices and to create low-chlorine or chlorine-free PVC alternatives, while these transitions may impact production costs and market competitiveness.

Polyvinyl Chloride Market Segment Analysis

The global polyvinyl chloride market is segmented based on product, application, end-user and region.

Dominance of the Pipes and Fittings Segment Owing to durability and performance

The pipes and fittings sector is the predominant user of polyvinyl chloride, anticipated to sustain its supremacy during the projection period. The distinctive characteristics of PVC, including its resistance to corrosion, chemical inertness and limited biofilm formation, render it optimal for the conveyance of drinking water and subterranean piping systems. It also features a lifespan exceeding 100 years with markedly reduced failure rates compared to non-plastic alternatives, making it attractive for public and private sector infrastructure initiatives.

Due to continuous urbanization and the rising demand for resilient and economical plumbing solutions, PVC has emerged as the preferred material. The development of new water distribution and drainage systems in expanding cities, particularly in the Asia-Pacific region, has increased the demand for superior piping materials. Moreover, the lightweight characteristics of PVC facilitate transportation and installation, hence decreasing total project expenses. The widespread application in municipal water supply, sanitation and industrial fluid management highlights the sector's vital contribution to the expansion of the worldwide PVC market.

Polyvinyl Chloride Market Geographical Share

Infrastructure Expansion and Industrial Development Exerting Asia-Pacific’s Regional Supremacy

Asia-Pacific continues to be the most active and prominent in the worldwide PVC market, primarily driven by extensive urbanization, industrialization and infrastructural development. In 2022, China held the biggest market share and is anticipated to sustain its dominance during the forecast period. The nation's swift expansion in civil construction and industry has generated significant demand for PVC-based materials, especially in pipes, fittings and flooring.

India and Southeast Asian countries are enhancing this momentum through increased infrastructure investments and a growing middle class that bolsters development and housing demand. The region's elevated demand is also driven by the extensive utilization of PVC in manufacturing, electrical and packaging sectors.

Furthermore, local production capabilities are being augmented, exemplified in July 2023 by Chemplast Sanmar Ltd.'s declaration of a US$ 120 million investment to expand its specialty paste PVC facility in Cuddalore. The region's varied end-use landscape supports its dominant market position.

Sustainability Analysis

Sustainability is becoming a significant concern in the polyvinyl chloride industry, propelled by environmental restrictions and increasing customer demand for environmentally friendly materials. Recent advancements seek to diminish the ecological impact of PVC manufacturing. INEOS's 2023 introduction of a new PVC line, with 37 percent reduced carbon emissions relative to the European industry average, represents progress in this regard.

Bio-based plasticizers are progressively being utilized to substitute conventional additives, hence improving product sustainability. The recyclability of PVC presents potential, while logistical and contamination obstacles persist. Global initiatives are in progress to enhance recycling infrastructure and advocate for closed-loop solutions.

Regulatory bodies are promoting the diminishment of hazardous chemicals and the restriction of emissions in production, prompting corporations to invest in sustainable technologies. Sustainability solutions assist enterprises in adhering to stringent environmental regulations while also proving essential for sustaining competitiveness in a market increasingly oriented towards circular economy objectives.

Polyvinyl Chloride Market Major Players

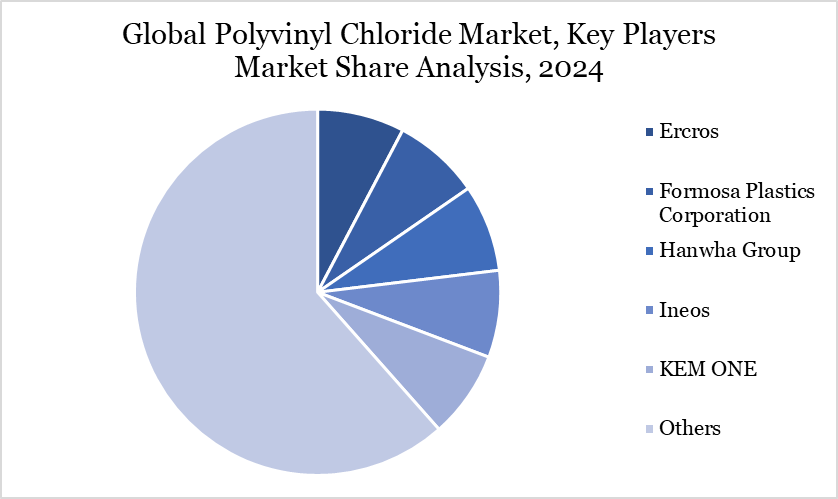

The major global players in the market include Ercros, Formosa Plastics Corporation, Hanwha Group, Ineos, KEM ONE, Occidental Petroleum Corporation orbia, Shin-Etsu Chemical Co., Ltd., Vynova and Westlake Corporation.

Key Developments

In July 2024, Formosa Plastics Corporation, announced the expansion of its PVC facility in Baton Rouge, Louisiana. This will substantially enhance the facility's capability, allowing for a more effective response to the growing demands of customers. The enhancement will facilitate the management of augmented production capacities and the supervision of peak demand periods efficiently.

In May 2024, Westlake Corporation declared its plan to establish a PVC-O pipe manufacturing facility at its site in Wichita Falls, Texas. The facility's expansion signifies a significant advancement in Westlake's commitment to growth, innovation and job creation in the region.

In April 2024, Delrin, a prominent industrial polymer firm, declared strategic agreements with Channel Prime Alliance and Entec. This alliance seeks to distribute all grades of Delrin goods to clients throughout North America.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies