Polypropylene Terpolymer Market Overview

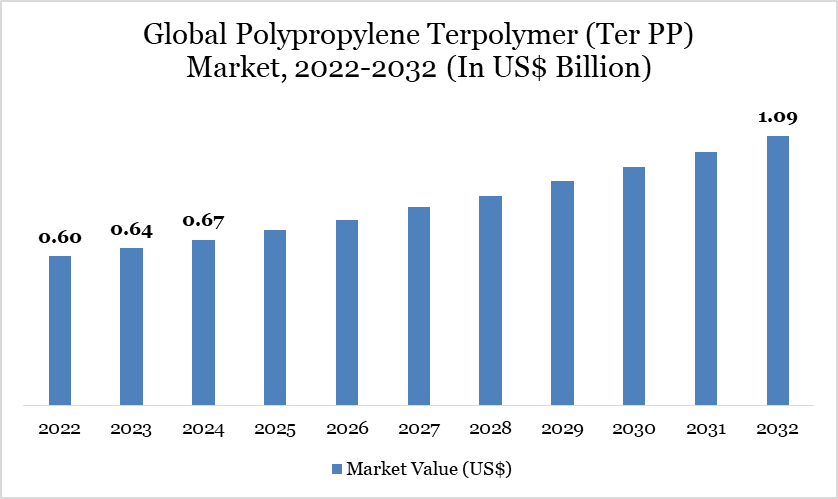

Global Polypropylene Terpolymer (Ter PP) Market reached US$ 0.67 billion in 2024 and is expected to reach US$ 1.09 billion by 2032, growing with a CAGR of 6.3% during the forecast period 2025-2032.

Ter PP is widely utilized across automotive, packaging, healthcare and construction industries due to its ability to provide a balance between impact resistance and transparency. Increased global industrialization and the shift toward lightweight, energy-efficient materials further amplify market demand. The growing emphasis on lightweight materials, particularly in the automotive and aerospace sectors, is a key trend driving the Ter PP market.

Governments globally are enforcing stringent regulations to reduce carbon emissions, prompting manufacturers to adopt lightweight materials. According to the US Department of Energy (DOE), using lightweight components like Ter PP in vehicle manufacturing offer great potential for increasing vehicle efficiency. A 10% reduction in vehicle weight can result in a 6%-8% fuel economy improvement. The adoption of Ter PP is further supported by its recyclability, aligning with global sustainability goals. The adoption of Ter PP is further supported by its recyclability, aligning with global sustainability goals.

Polypropylene Terpolymer (Ter PP) Market Trend

Advancements in packaging solutions is a key trend which is increasing the adoption of Ter PP, contributing significantly to market growth. Polypropylene Terpolymer (Ter PP) has been adopted by a growing number of packaging industries due to its properties, including exceptional clarity, flexibility and resistance to a variety of environmental factors. It is evident from these factors that Ter PP has the potential to develop novel applications in the fields of industrial, pharmaceutical and food packaging.

The recyclable property of Ter PP will be perceived as a competitive advantage in the market by consumers who are becoming more aware of sustainable packaging. Ter PP's significance for the cause is underscored by the fact that 81% of consumers in the UK were already requesting sustainable packaging in 2023.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Processing Technology | Injection Molding, Extrusion, Blow Molding, Thermoforming, Others |

| By Sealing Temperature | Below 105°C, 105°C -115°C, Above 115°C |

| By Form | Films and Sheets, Others |

| By End-User | Automotive Industry, Packaging Industry, Electrical and Electronics Industry, Building and Construction Industry, Healthcare Industry, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Polypropylene Terpolymer Market Dynamics

Growing Demand in Automotive Applications

The automotive industry has experienced an increase in fuel efficiency and a decrease in emissions as a result of the current trend toward lightweight materials. Polypropylene Terpolymer (Ter PP) is essential for the production of a variety of automobile components, including bumpers, consoles and interior trims, due to its exceptional thermal stability and high impact resistance. Light polymers can result in a 50% reduction in a vehicle's weight and a 35% increase in fuel efficiency.

Manufacturers are making substantial enhancements to their operations in order to mitigate environmental regulations and maintain the production of their products. The global move toward electric vehicles has bolstered the argument for lightweight materials, which are essential for enhancing battery performance and overall vehicle efficiency. In fact, the International Energy Agency observed that electric car sales in 2023 were 3.5 million higher than in 2022, resulting in a 35% year-over-year increase. This increase will stimulate development in the Ter PP market.

Fluctuating Raw Material Prices

The fluctuating cost of raw materials, particularly propylene, presents a significant challenge to the Polypropylene Terpolymer (Ter PP) market. Propylene prices are closely tied to crude oil prices, which are subject to volatility due to factors such as geopolitical tensions, production cuts and economic fluctuations. In 2023, crude oil prices surged by 15%, directly impacting the production costs of propylene and, consequently, Ter PP.

This price increase can strain manufacturers who rely on stable raw material costs to maintain profitability and competitive pricing. Additionally, supply chain disruptions, notably those stemming from the Russia-Ukraine war, have further exacerbated the volatility of raw material prices. High raw material costs can deter companies from adopting Ter PP, especially in price-sensitive markets where alternatives may be more economically viable.

Polypropylene Terpolymer Market Segment Analysis

The global Polypropylene Terpolymer (Ter PP) market is segmented based on offering, sealing temperature, form, end-user and region.

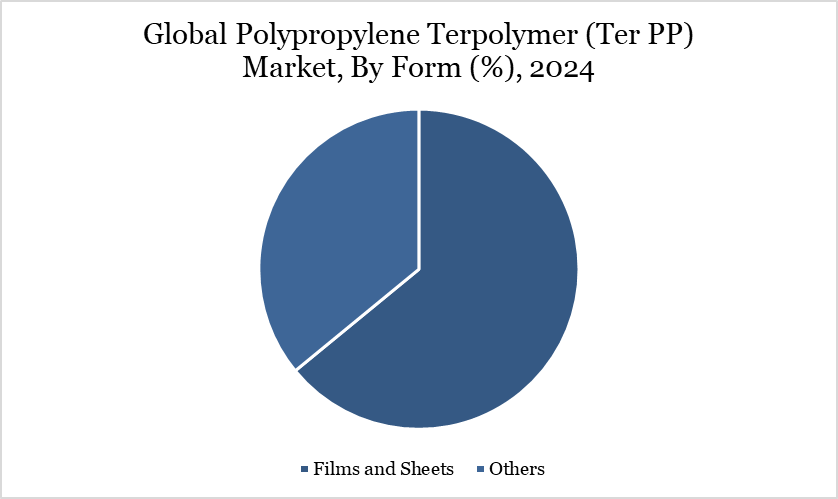

Superior Quality of Films and Sheets Drives the Segment Growth

Films and sheets is expected to hold about 62% of the global market valuing about US$ 0.42 billion in 2024. The segment of Ter PP is highly valued for its superior properties such as high clarity, rigidity, excellent impact resistance and good chemical resistance, making it ideal for a wide range of industries. Films and sheets made from Ter PP are increasingly used in packaging, especially for food and consumer goods, due to their durability and barrier properties. These materials offer an alternative to traditional plastic films, providing lightweight and cost-effective solutions.

Ter PP films and sheets are used in automotive and electronics industries for protective coatings and insulation. Their ability to be easily processed into various shapes and sizes enhances their versatility, driving demand across multiple sectors. The Polyolefin Company offers COSMOPLENE Terpolymer grades which are available in film form and cater to a wide range of film extrusion processing technologies. These grades are ideal for various applications such as food packaging, overwrapping, cigarette/tobacco packaging, lamination etc.

Polypropylene Terpolymer Market Geographical Share

Technological Advancements and Government Initiatives in Asia-Pacific

Asia-Pacific is expected to be the fastest growing region hold about 41% of the global market, valuing US$ 0.27 billion in 2024. The region's major Ter PP consumer is the packaging sector, driven by the rising need for both rigid and flexible packaging. The demand for strong and lightweight materials has increased due to the growth of e-commerce and consumer convenience preferences. In March 2023, Grace recently used UNIPOL PP technology and CONSISTA catalyst systems to successfully create advanced Ter PP grades in partnership with Yunnan YunTianHua Petrochemical Co., Ltd. (YTH).

The materials are intended for use in rigid and heat-seal packaging applications that serve the markets for household, medical and food products. Advanced polypropylene grades for exterior and interior components are being adopted at a rapid pace by China, the largest automotive manufacturer in the world. With the help of government initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, the Indian automobile industry is likewise moving toward lighter materials in order to achieve efficiency targets.

Sustainability Analysis

Polypropylene Terpolymer (Ter PP), like other polyolefins, is derived from fossil fuels primarily through the polymerization of propylene and other olefins. As such, its production contributes to carbon emissions and resource depletion. However, Ter PP's lightweight nature and durability enable manufacturers to use less material per product, reducing overall environmental footprint compared to heavier plastics or alternative materials. Moreover, the recyclability of Ter PP supports circular economy models, although global recycling rates remain suboptimal due to inadequate infrastructure and contamination issues.

Increasing global regulations on single-use plastics and carbon emissions are pushing the polymer industry to innovate. In response, several chemical companies are investing in bio-based or chemically recycled Ter PP variants to reduce environmental impact. Regulatory pressures, especially in the EU and North America, are accelerating demand for recycled-content plastics, with Ter PP being explored as a viable material for both mechanical and chemical recycling initiatives.

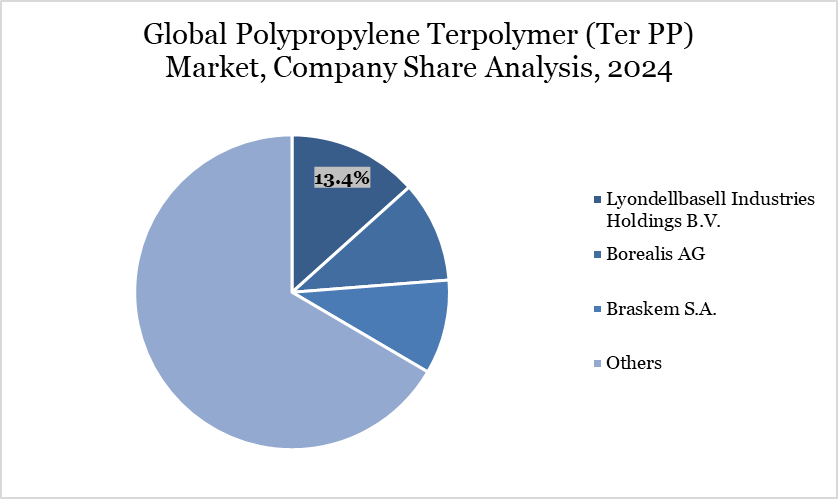

Polypropylene Terpolymer Market Major Players

The major global players in the market include Lyondellbasell Industries Holdings B.V., The Polyolefin Company (Singapore) Pte Ltd., Borealis AG, W. R. GRACE & CO., HMC Polymers Company Limited, INEOS Group Holdings S.A., Braskem S.A., Jam Polypropylene Co. (JPPC), Mitsui Chemicals, Inc. and Hanwha TotalEnergies Petrochemical Co., Ltd.

Key Developments

In May 2023, W.R. Grace & Co. is announced the successful production of advanced terpolymer polypropylene (PP) resin grades for heat seal and rigid packaging applications. This achievement was made possible through a collaboration with Yunnan YunTianHua Petrochemical Co., Ltd. (YTH), a UNIPOL PP technology licensee, utilizing Grace’s CONSISTA catalyst systems.