Plant-Based Ice Cream Market Size

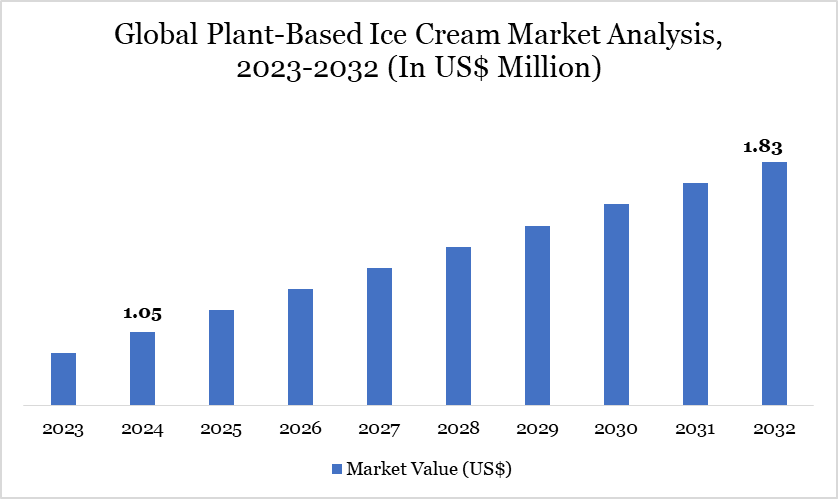

Plant-Based Ice Cream Market Size reached US$ 1.05 billion in 2024 and is expected to reach US$ 1.83 billion by 2032, growing with a CAGR of 7.21% during the forecast period 2025-2032.

The plant-based ice cream market is gaining momentum across North America, driven by increased consumer demand for dairy alternatives and government-backed sustainability goals. According to the USDA Economic Research Service, plant-based dairy alternatives have grown by over 50% in retail sales value between 2019 and 2023, with frozen desserts showing the highest year-over-year increase.

In 2023, the US Department of Health and Human Services emphasized dairy-free options in its Dietary Guidelines Advisory Committee updates, encouraging public institutions to offer non-dairy frozen desserts. The FDA has also provided updated draft guidance on labeling plant-based alternatives, enabling clearer market positioning and consumer awareness. Additionally, leading producers like Danone and Nestlé have reported double-digit growth in their plant-based ice cream segments, attributing success to cleaner labels and expanded flavor profiles.

Plant-Based Ice Cream Market Trend

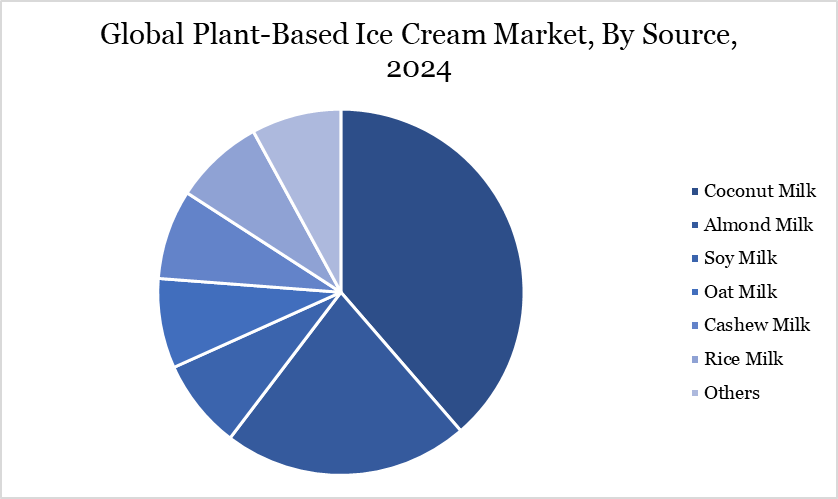

A distinct trend is the surge in oat- and coconut-based frozen desserts, replacing traditional almond or soy bases, driven by consumer taste preferences and sustainability. According to data submitted to the FDA in 2023, oat-based frozen treats increased by 25% in new product launches, with a notable share from major players like Oatly and Ben & Jerry’s. USDA-backed R&D funding is now supporting the development of pulse-based proteins for ice cream applications, indicating a growing push toward crop diversification.

Additionally, the US Department of Energy reported a 12% reduction in greenhouse gas emissions associated with plant-based ice cream production compared to dairy-based products. This positions plant-based frozen desserts not only as a dietary choice but as a climate-conscious one.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Flavor | Chocolate, Vanilla, Strawberry, Mango, Others |

| By Source | Almond Milk, Soy Milk, Coconut Milk, Oat Milk, Cashew Milk, Rice Milk, Others |

| By Packaging Type | Tubs, Cups, Bar/sticks, Multi-Packs, Others |

| By Distribution Channel | Supermarkets/Hypermarkets, Specialty Stores, Online Channel, and Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Plant-Based Ice Cream Market Dynamics

The Increasing Vegan Population is Driving the Growth of the Global Plant-Based Ice Cream Market

The incidence of obesity-related disorders, such as diabetes, cardiovascular diseases, and others, has considerably increased in the last few years due to eating habits and sedentary lifestyles. According to the Organization for Economics Co Operations and Development (OECD), the prevalence rate of obesity in the US, Mexico, and England is estimated to reach 47%, 39%, and 35%, respectively, by 2030. Health-conscious people are shifting to vegan foods to maintain good health.

According to recent studies from Veganz Nutrition Study 2022, 30% of Americans are not only leaving meat off their plates but also seeking plant-based alternatives. Consumers are projected to become selective in their food habits to prevent severe health issues. Furthermore, growth in per-capita health expenditure, an increasing number of working women, and rapid urbanization enable consumers to buy healthy plant-based ice creams.

The High Cost of Plant-Based Ice Creams is Restraining the Market

Plant-based milk, such as soy, almond, cashew, and coconut milk, is costly compared to dairy milk. Moreover, the extraction cost of this milk is higher than animal milk. The milk is consumed mainly by fitness-conscious and vegan consumers. Thus, the high price of plant-based milk is raising the cost of vegan ice cream, due to which middle-class consumers may need help to spend n plant-based ice creams, which hampers the global plant-based ice cream market growth.

The availability of substitutes and the entry of new players cause additional challenges to the plant-based ice cream market. Complying with stringent regulations and varying standards worldwide, growing competition, inflation estimated to remain above the upper band during the short term in key nations, and fluctuating raw material prices are some plant-based ice cream market restraints over the forecast period.

Plant-Based Ice Cream Market Segment Analysis

The global plant-based ice cream market is segmented based on flavor, source, packaging type, distribution channel and region.

Coconut Milk Segment Driving Plant-Based Ice Cream Market

Low-fat coconut milk consists of a neutral base taste that can impart the flavour of ice cream. The demand for this milk is rising due to its health benefits. It is rich in vitamins C & E. It is well known for its antioxidant properties and also for weight loss. It is a critical source of potassium, magnesium and phosphorus, helping prevent cardiac diseases and strengthening the immune system. Thus, fitness-conscious & health-conscious consumers prefer coconut milk ice cream, significantly contributing to market growth.

The large market share of this segment is attributed to factors such as the increasing number of lactose-intolerant people, the growing ethical concerns amongst consumers about animal abuse in modern dairy farming practices, and the nutritional benefits offered by plant-based dairy products. According to NIH, approximately 65 % of humans cannot digest lactose after infancy. Lactose intolerance in adulthood is most prevalent in people, affecting more than 90% of adults in some communities.

Plant-Based Ice Cream Market Geographical Share

Demand for Plant-Based Ice Cream in North America

The demand for plant-based ice cream in North America is rising sharply, fueled by shifting consumer preferences toward dairy-free, allergen-friendly, and sustainable products. According to the US Department of Agriculture (USDA), per capita fluid milk consumption declined by over 40% since 1975, reflecting a broader shift to plant-based alternatives.

Simultaneously, the US Food and Drug Administration (FDA) has expanded labeling guidance to support transparency for plant-based products, boosting consumer trust. The Canadian Food Inspection Agency (CFIA) is also revising compositional standards to accommodate non-dairy frozen desserts better. Government-backed health campaigns promoting low-cholesterol and lactose-free diets further support market growth.

In 2023, the USDA awarded over US$10 million in grants for innovation in plant-based food processing, indirectly supporting ice cream manufacturers. State-level programs in California and New York are offering incentives for sustainable food innovation, including plant-based dairy alternatives. Together, these developments are fostering an ecosystem where plant-based ice cream demand continues to grow across retail and food service sectors.

Sustainability Analysis

The sustainability of the market is reinforced by its significantly lower environmental footprint compared to traditional dairy ice cream. According to the Food and Agriculture Organization (FAO), dairy livestock accounts for over 4% of global greenhouse gas emissions. Non-dairy alternatives such as oat, almond, and soy bases require significantly less water, land, and energy. For instance, the US Geological Survey (USGS) reports that almond milk uses approximately 80% less water than cow’s milk per liter of production. This shift is aligned with growing governmental pressures to reduce emissions from the food sector.

Further, consumer preference is increasingly shaped by sustainability labelling and government initiatives promoting plant-based alternatives. The USDA, under its Climate-Smart Agriculture initiative, encourages innovation in plant-based food systems to reduce agricultural emissions. Companies like Oatly Group AB report a 49% lower carbon footprint for their frozen dessert products compared to dairy equivalents. These factors suggest strong alignment between environmental policies and market demand, positioning the plant-based ice cream industry for long-term growth and resilience.

Plant-Based Ice Cream Market Major Players

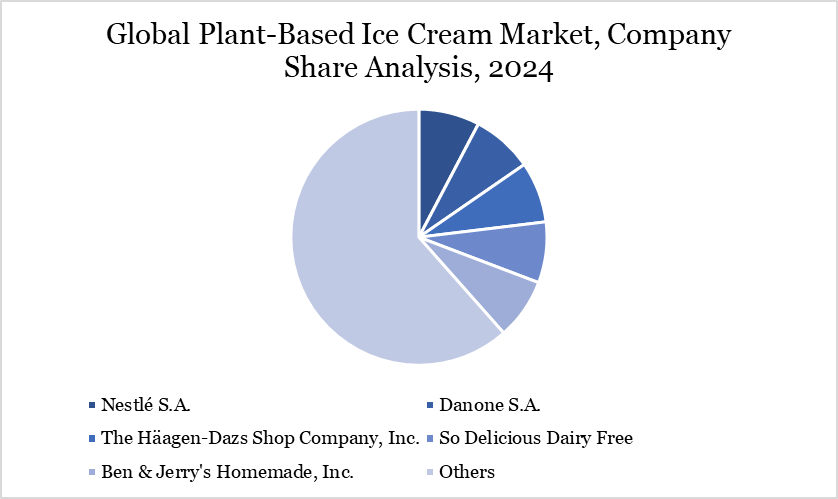

The major global players in the market include Nestlé S.A., Danone S.A., The Häagen-Dazs Shop Company, Inc., So Delicious Dairy Free, Ben & Jerry's Homemade, Inc., Oatly Group AB, Tofutti Brands, Inc., NadaMoo!, Eclipse Foods, Inc., and The Hain Celestial Group, Inc.

Key Developments

In June 2024, McDonald’s announced the launch of a new dairy-free ice cream-style frozen dessert. The Vegan Scoop is available in two flavors, Choco and Strawberry, and both have been certified as vegan by The Vegetarian Society. The product has been described as “smooth and creamy,” and it costs US$ 1.79 for a tub.

In January 2022, American ice cream company Cold Stone Creamery has teamed up with Danone North America, a food and beverage company known for its plant-based products, to launch its first-ever vegan ice cream.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies